20 January 2021

Are corporate treasurers unhappy with the level of support they receive from banks? Can we expect trade to bounce back in the next 12 months? flow reports on these and other pressing issues featured at TXF’s Global Trade 2020 virtual conference

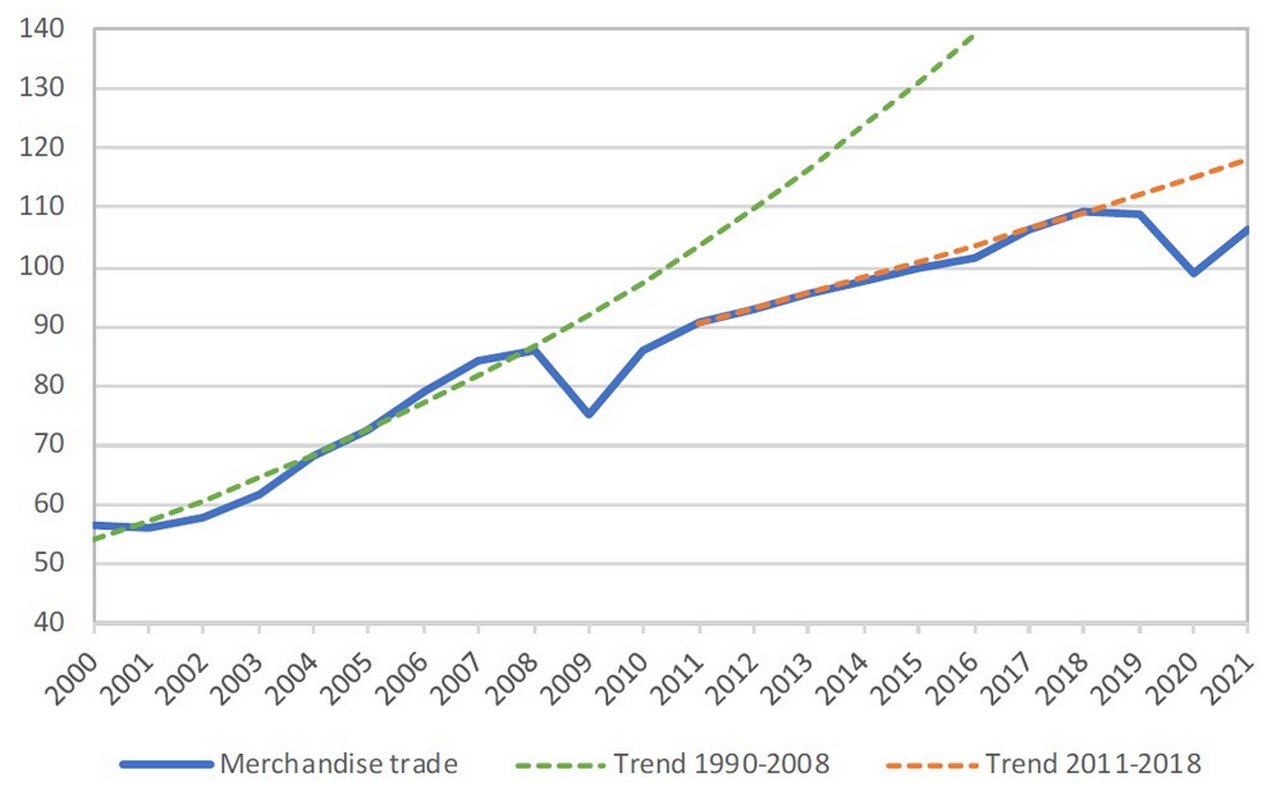

When the Covid-19 pandemic broke out in early 2020, few were prepared for the year that was to follow. For trade finance, the disruption created by the virus led to a 9.2% year-on-year contraction in the volume of world merchandise trade, according to the World Trade Organization (WTO)1. Supply chain and commodity market disruption, along with the wider economic fallout from the pandemic – and not forgetting existing trade wars and tariff disputes – have wrecked the steady growth trajectory established after the 2008 financial crisis (see Figure 1).

Figure 1: World merchandise trade volume, 2000−2021

Source: World Trade Organisation

Yet, there’s light at the end of tunnel. Progress on Covid-19 vaccines and some surprisingly strong GDP bounce-backs provided some end-of-year cheer, as well as hope for the year ahead – the momentum of which has accelerated in the opening weeks of 2021.2

In addition, confidence is returning. A McKinsey Global Survey on economic sentiment revealed that 63% of participant executives believe economic conditions in their respective countries will be better in six months from now, while 61% predict global conditions will improve in the months ahead. Encouragingly, respondents were the most confident they’ve been in the past three years of expecting the world’s economic growth rate to increase.3

This optimism was equally visible during the TXF Global Trade conference held on 8 December 2020, where delegates from around the globe gathered virtually to discuss the implications of this unprecedented year and the consequences it will have for trade finance in the longer term.

"Global value chain recovery has been strong in intermediate goods, passenger vehicles and electronics"

Trade resilience

Marc Auboin, Counsellor for Trade and Finance at the WTO, opened the conference. Looking back on the year, he split its story into two very different perspectives. 2020 represented a perfect storm for trade finance, a combination of policy developments – border closures and export restrictions – and the ongoing impacts of the health and ensuing economic crises. Yet, the year also represented one of resilience for the industry, as well as one of innovation in enabling business and trade to continue despite the crisis.

Trade in goods recovered strongly following the end of national lockdowns. At the end of Q2, the year-on-year fall in trade was limited to 10%, which was followed by a strong recovery in Q3. That said, Q4 looks set for weaker output as the second wave of the pandemic impacts demand.

In contrast to the 2008-09 financial crisis, where trade collapsed “across the board” according to Auboin, activity was sustained this year by trade of Covid-19 protective equipment and medicine, and the distribution of consumer goods via ecommerce, among other areas of resilience. He added that analysis indicated global value chain recovery has been “strong in intermediate goods, passenger vehicles and electronics”.

“When you compare with 2008−09, we do have world trade flows that are resisting better than GDP,” Auboin explained. “Despite people not moving – arrivals at international airports have gone down 90% – we do have goods moving.” However, he added that services trade was in poor shape. “By the end of the summer, services exports had fallen by over 20% year-on-year (travel and tourism).

“One may argue,” reflected Auboin, “that restrictive measures added to an increase in trade restructure measures post-Global Financial Crisis. According to the WTO, trade restrictive measures altogether had impacted 10% of trade. However trade facilitating/liberalising measures impacted an even greater amount of trade.” This is because “trade tends to grow structurally faster in trade liberalising sectors, than in trade restrictive ones.”

Throughout the conference many delegates struck an upbeat tone, including Daniel Schmand, Head of Trade Finance and Lending at Deutsche Bank. Earlier in the month, while commenting on the WTO forecasts, he explained that “Since the news that a Covid-19 vaccine might be broadly available in the New Year, our global trade finance outlook has improved. We expect trade finance activity to return to pre-crisis levels around the middle of next year. Given the broad correlation of global trade and GDP growth, this is very encouraging.”4

"Will there be a pick up: yes, there’s no other way out"

Cautious optimism

The changing face of supply chains was a theme picked up in a panel session moderated by Jonathan Bell, Editor-in-Chief and Director of TXF. This also looked at how at how digitalisation and ESG priorities are reshaping the way trade finance is delivered. Joining Schmand on the panel were Valeria Sica, Global Head of Trade Product Development, Treasury and Trade Solutions at Citi; Michael Spiegel, Global Head of Trade at Standard Chartered; and Soraya Ahmed, EMEA Trade Head at JP Morgan.

“Will there be a pick up: yes, there’s no other way out,” said Schmand. However, the path ahead will be complex. “Measures implemented by governments – which I believe were the right ones – may have created so-called zombie companies,” he added. “We need to wait, however, until the government programmes are finished. If everything goes smoothly I suspect we may see a stronger pick up in trade than others may be expecting, but there certain dependencies for this to happen.”

The uncertainty and heightened risk brought about by the pandemic has led to some stakeholders reducing their exposure to many countries. The process, known as de-risking, has been growing since the 2008-09 financial crisis and mostly affects small and medium-sized enterprises (SME). Writing in the H1 2020 issue of flow, Auboin noted how “Before the global financial crisis, there were around a million correspondent banking lines in place. However, post-crisis, one in five has disappeared, leaving 800,000, with most of the relationships that were terminated affecting developing countries; particularly the poorest.”5

Given the role that SMEs play within the wider global economy, adequate market access is paramount for the health of the economy, as well as the continued growth of the trade finance industry. A recent International Chamber of Commerce (ICC) memo on the topic, “Priming Trade Finance to Safeguard SMEs and Power a Resilient Recovery from Covid-19”, indicated that, prior to the pandemic, over half of trade finance requests by SMEs were rejected, compared to just 7% for multinational companies.6 There is a clear business case for proactive interventions, the report stated, as well as the need for coordinated action to enable cross-border trade and provide genuine relief to businesses and workers.

Innovation and digitalisation

“I see massive room for trade finance and the role it has to play,” said J.P. Morgan’s Soraya Ahmed.

“What’s been a big surprise is how resilient the whole industry has been – with the trade wars and Covid. It’s been a learning process for all of us, and the clients have been able to adapt,” added Citi’s Valeria Sica.

The push towards digital processes and solutions was inevitable once remote working became the norm. “What we saw was […] how challenging it was to continue with paper,” added Sica. Very quickly, digital signatures had to come into play. “We had to make a lot of changes internally. We had client requests to send documents to their home addresses.”

The pandemic also gave banks the impetus to hasten the transformation within their businesses, as well as modernising their client offerings. “It also helped us internally to drive more into the digital world,” said Sica. “Some things that were seeing internal pushback became a necessity.”

Looking at the potential for digitalisation beyond the current crisis, new trends include the growing “asset-as-a-service” model. Schmand forecast how, in a world where sensors can provide a wealth of information regarding a piece of equipment, “Know your Device” will become increasingly important, with financing decisions stemming directly from the data collected at the source. “This is where our true investments are going,” he said. “I strongly believe that we’ll have a completely new way of interacting – with completely different data, treasury and credit models going forward.”

Standard Chartered’s Michael Spiegel reminded the audience that in the journey towards digitalisation, there remains a long road ahead. Most respondents to a recent CGI-BAFT survey indicated that the majority of their business remains traditional trade finance, and they continue to expect traditional trade finance to form the greater part of their portfolio in five years’ time. 7

It isn’t just a case of developing the right technology, explained Spiegel. Standardisation and legislation are also required to make digitalisation a workable reality. “One thing is to agree on an electronic bill of lading,” he said. “It needs to be enforceable. Let’s wait and see if it gets enacted in legislation across the world.”

Standardisation is a priority agreed Oswald Kuyler, ICC’s Managing Director of the Digital Standards Initiative, who presented an update on his group’s work.

Integrating sustainability

The ESG space is another area where significant progress has been made. Growing interest in the topic has led to the development of bank taxonomies and frameworks, such as Deutsche Bank’s own criteria for ESG financing.8 Speaking at the time of the announcement, Deutsche Bank CEO Christian Sewing elaborated on the importance of the new framework: “This Sustainable Finance Framework is one precondition for enabling us to become a trailblazer in this area in the financial sector. It helps us provide our clients with the clarity they need and the guidance they require regarding ESG financing and ESG financial products – including their own transformation to a sustainable business model.” 9

Focusing on the development of ESG within trade finance, J.P. Morgan’s Ahmed noted that “We do have the possibilities for clients: we can provide e-invoicing, yield enhancement, term extensions etc. We have plugins that provide third party compliance with ESG goals and can be monitored. There is no need for clients to build out new systems, this can be achieved by the plugins that the latest front-ends are providing in this space.”

Importantly, the focus on ESG is not coming from the banks. The clients are demanding it. “We are noticing this as a trend in all the RFPs we are getting from our clients – there are ESG-related questions,” said Sica.

“For us, the strongest demand we see is on S[ocial],” noted Schmand. “We have never financed more medical equipment than in the last 12 months.” Working collaboratively with clients and staff internally to understand and integrate the ESG and sustainability agenda into the Bank’s strategy and product offering will be an important focus for Deutsche Bank going forward. “For me, that’s a mega trend for the next decade,” he added.

Mixed opinions

Biofuel tanks at Alfa Laval (source: Alfa Laval)

Another keynote session of the conference comprised a series of discussions between Katharine Morton, Head of Trade, Treasury and Risk at TXF, and several corporate treasurers. Speaking on their experience over the past 12 months, one of the questions asked of each panellist was whether their company had received adequate support from its banks throughout the pandemic.

“No, we are not getting the support we need from banks,” stated Henrik Welch, Vice President and Group Treasurer at Swedish engineering group Alfa Laval. “It’s to our advantage that we are BBB+ rated with a stable outlook from Standard & Poor's. In that sense, we have a very strong balance sheet and very strong bank line support from our banks. […] But when you talk about trade finance in the more normal fashion, you would look at it in the way of ‘how can you actually have banks supporting you, taking some risks on your customers’, for example. And here, there is a clear ‘no’ from our side. We do not see as strong a support there as I would have wanted.”

In contrast, Michael Crawford, Senior Corporate Treasury Manager at US tile supplier The Mosaic Company found that banks went “over and above” for his company during the crisis. “Although they were very stressed as we put cash in their coffers, we’ve been able to pay off the additional debt we took-on earlier in the year, and [the banks] really went out of their way to make sure they could continue to serve us.”

The panellists also discussed the status of their supply chain finance (SCF) programmes, and the important need to communicate, both with banks and also with suppliers and partners along the supply chain.

Anthony Buchanan, Treasurer at Asahi Breweries Europe recounted how his company proceeded once the crisis kicked off. “Obviously you focus on the team first, and the work-from-home support. Then, from a treasury perspective it’s [all about] cash, whether that’s drawing on facilities or having excess cash, which we were lucky to have following a strong year [in 2019]. Then you look at the supplier and customer base – we look at the SCF programme that’s been in place for a few years, making sure the discounting is available to everyone that needs it.”

Supporting all the supply chain was also a priority. “In some key areas we were looking at sustainability for the smaller suppliers, which usually wouldn’t happen,” added Buchanan. “We have been running a pilot on that, providing them with another means of discounting at our cost of debt. If it’s successful we’ll look into rolling this out to the whole group.”

Thanks to growing demand in the wake of the crisis, support for SCF programmes was one of the key pillars of Deutsche Bank’s support strategy over the past year. Read more about it in the flow article: Redefining the supply chain finance landscape.

The development of SCF programmes further down the supply chain was another focus of the conference, with various sessions and discussions examining the future role that multi-tier, or distributed SCF, could play. Included in this was the growing use of trade receivables financing and inventory financing, among others.

Towards 2021

The conference stayed true to its ambitions, as Dan Sheriff, Managing Director of TXF explained in his closing remarks. “We didn’t want this event to represent a closing of 2020. This event is really to kick-off the opening of 2021.”

TXF Global Trade 2020 took place virtually on December 8-10 2020

Sources

1 See https://bit.ly/2KrOzCr at wto.org

2 See Covid-19: Will vaccines deliver “normality”? at flow.db.com

3 See https://mck.co/3sHmsAK at mckinsey.com

4 See https://bit.ly/2M1U6QE at db.com

5 See Call for capacity at flow.db.com

6 See https://bit.ly/3oXfYeI at iccwbo.org

7 See https://bit.ly/39N801c at cgi.com

8 See https://bit.ly/3oYtajb at db.com

9 See https://bit.ly/3qw6Vla at db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending

Why trade gets paid Why trade gets paid

In light of recent restructurings and regulatory developments, the title of this article is perhaps more optimistic than the result may be. However, some guidance as to how to approach the issues in receivables financings may help to improve the position of the debt holder.

TRADE FINANCE, MACRO AND MARKETS

Covid-19 and commodities Covid-19 and commodities

Covid-19 has shaken up the world’s commodities sector although price volatility is no stranger to its participants. Reduced demand has seen falling prices, lack of investment, and logistics log jams. Clarissa Dann reviews the fundamentals

Trade finance and lending

After the perfect storm After the perfect storm

flow reports on how a seven-year reserve-based lending solution positioned oil producer Noreco for growth in a two-year turnaround journey