January 2020

When damage to the Siri platform in the Danish North Sea put Noreco at a crisis point, its turnaround plan included the opportunity to acquire new Danish assets from oil major Shell. But how could the company raise the financing? Clarissa Dann reports on how a seven-year reserve-based lending solution positioned this remarkable Norwegian oil producer for growth in a two-year journey of revival

In the flow article, ‘Sunset to sunrise’, we saw how reserve-based lending (RBL) helps smaller independent oil producers grow their businesses through to investment grade status and the very different approaches taken by the UK and Norway took to oil sector governance in the North Sea Basin.

In addition, the article explained how oil majors are now investing elsewhere and giant European utility companies retrenching from hydrocarbon extraction. This has stimulated a growing appetite from a new breed of agile, independent oil E&P entities acquiring competitive assets, and eagerness to reach once-inaccessible or undiscovered reserves.

An example of how this secured borrowing base structure where funds are lent against the future cash flows of the business can now also be seen in the phoenix-like rise of Norwegian Energy Company ASA (Noreco) as it prepares to make a transformational acquisition from Shell of their upstream assets on the Danish Continental Shelf (DCS).

From shutdown to new dawn

Established in 2005, Noreco had, up until 2014, a mixture of production, development and exploration assets and, at its peak, produced around 15,000 barrel of oil equivalent per day (boepd). However, a production shutdown on the Danish North Sea-located Siri platform in August 2009 when inspections revealed cracks in a water buffer tank brought the company to crisis point. Attempts to claim the US$470m of damage from a group of 20 insurance companies were ultimately unsuccessful after an Eastern High Court ruling in 2018 – a legal battle that had gone on for almost a decade.

A combination of high production costs, a falling oil price and an over-leveraged, sub-optimal capital structure added to Noreco’s challenges. The company exited the majority of its asset portfolio and brought in a new board and management team headed by renowned investor Riulf Rustad. Together with Danish corporate turnaround expert Lars Purlund, Rustad set in motion an extraordinary repositioning of Noreco. Opportunities lay in unused tax allowances in Denmark from investments on the DCS, and an acquisition from Shell.

Deutsche Bank was contacted by Purlund in 2016, and the bank’s Structured Commodity Trade Finance (SCTF) team could see the revival potential. Thus began a 24-month-long partnership, with Deutsche Bank as the first bank on board, that led up to the conclusion of the RBL and acquisition. Few believed that Noreco could execute this kind of transaction and the detailed deal announcement in October 2018 was completely unexpected by the market.

New capital structure

Funding expansion takes a certain amount of agility at this critical part of the company’s development and on 31 July 2019 Noreco announced that through a wholly owned subsidiary, it had completed its acquisition of 100% of the shares in Shell Olie- og Gasudvinding Danmark B.V.

This meant agreeing a new financing and capital structure, which involved a private placement of US$352m ordinary shares, the issuance of a convertible bond of up to US$160m and a US$40m partially underwritten subsequent offering. Additional debt capital was raised through a new seven-year reserve-based lending facility of up to US$900m, with a sub-limit of US$100m for letters of credit.

Deutsche Bank was mandated, together with Bank of Montreal and Natixis to structure and underwrite the RBL.

Not only was the deal a landmark in terms of its scale, but it put in place, at a pivotal juncture for Noreco, a complete new capital structure – one that enabled Noreco to become the second largest oil and gas producer in Denmark, as well as establishing it as a considerable independent E&P company in the North Sea. It also revitalised the Noreco name, which had hitherto remained closely associated with the Siri platform failed exploration, and over-leverage. Following the acquisition from Shell, Noreco now has a 36.8% interest in the Danish Underground Consortium (DUC), a joint venture with 15 producing fields and related infrastructure. It has also increased its interest in the Lulita field from 10% to 28.4%.

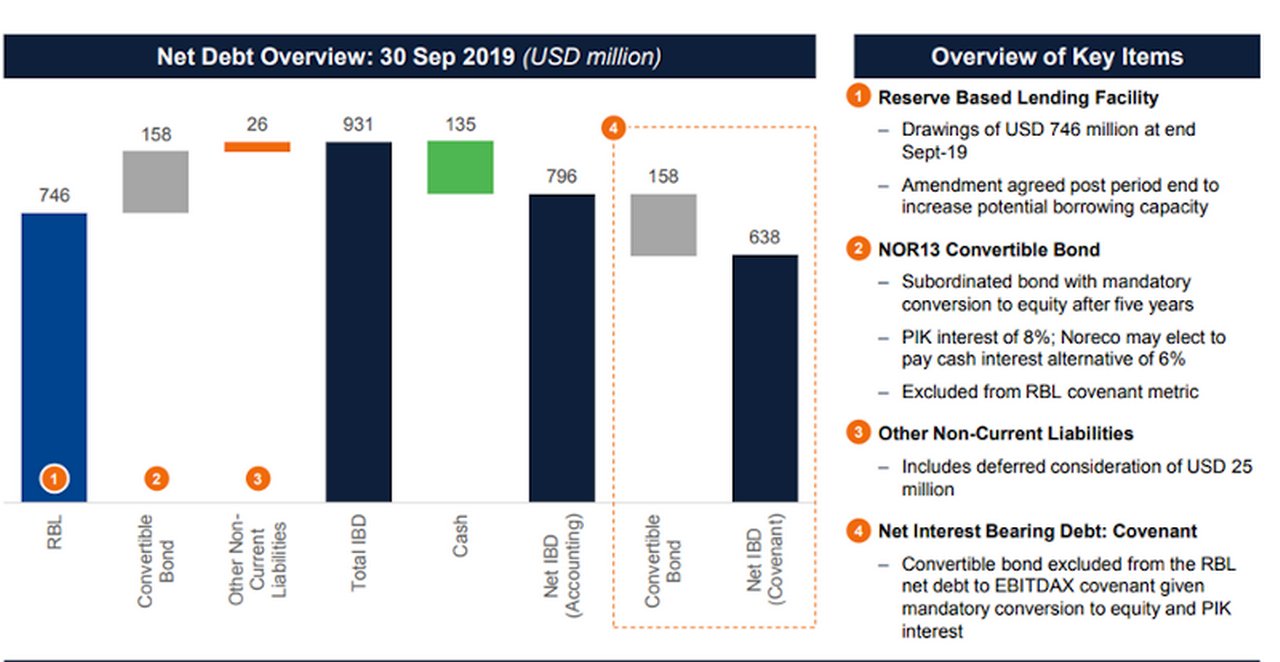

By 30 September 2019, US$746m of the facility had been drawn down with an additional US$100m outstanding in respect of a letter of credit. Subsequent to closing of the transaction, an amendment was also agreed to increase the potential borrowing capacity. On page 17 of the company’s Q3 Financial Review, the significance of the RBL can be seen when compared with other elements of the company’s sources of finance.

Figure 1: Capital structure overview 30 September 2019

Source: www.noreco.com

"The journey continues, the RBL will support the company’s growth in the years to come"

Lars Purlund added, “Noreco constantly works to protect and enhance the value of our assets, while having an entrepreneurial approach to drive the sustainable energy transition. We believe that this can be done in ways that are both profitable and sustainable.” He continued, “DUC has the opportunity to take a leading position in the green transition sweeping through the oil and gas industry and Denmark can be the first continental shelf with a fully electrified production.”

“We are particularly proud to have contributed to the revival of Noreco. The journey continues, the RBL will support the company’s growth in the years to come,” reflects Yann Ropers, Deutsche Bank’s Head of London for SCTF and RBL specialist.

Purlund concluded, “There is little doubt, that Deutsche Bank was instrumental in getting the transaction over the finish line. The structure was atypical due to a number of moving parts, and these parts did not really stop moving before a couple of days prior to close. Our strong relationship with the banking group lead by Deutsche Bank, and the company’s shareholders made us able to adjust and adapt on a dynamic basis so that Noreco was ultimately successful in closing this transformative transaction”

For a business that seemed to be nearing a precipice a decade ago, this is an inspirational example of how sheer grit in combination with a creative and innovative banking group can work miracles.

Note: Images are of the Tyra rig in the Danish North Sea, courtesy of Noreco

Riulf Rustad

Executive Chair of the Noreco Board

Lars Purlund

Director of the Noreco Board

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending

Beyond the invoice Beyond the invoice

Supply chain finance is growing at 20% a year, with around US$2tn in payables available for financing. But how can this be made safer and more sustainable – and accessible to SMEs? flow reports on key themes at BCR’s 4th Supply Chain Finance Summit in Amsterdam

Trade finance and lending

Journey into simplicity Journey into simplicity

How will India’s meet its US$5trn GDP target in the next five years? And what role will financiers, government reform and technology have in making this happen? Clarissa Dann reports on GTR’s one-day conference in Mumbai

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments