June 2019

Much has been said about North Sea oil having had its heyday. But just because the oil majors are withdrawing, that doesn’t mean there is no extraction. Clarissa Dann looks at how reserve-based lending is supporting the smaller independent oil producers that are thriving in the region

In May 2017, after 40 years at sea, the 44-metre tall, 24,000-tonne Brent Delta oil platform was brought ashore in one piece to ABLE Seaton Port in Hartlepool, where 97% of the material is destined for recycling.1

As the North Sea hydrocarbon era turns 50, with the first oil discoveries made in 1969, there are more headlines about decommissioning (and an entire new industry of service providers dedicated to this) than exploration and production (E&P). But North Sea E&P is by no means

a sunset industry.

The North Sea industry body Oil & Gas UK estimates that, while 43 billion barrels have already been extracted, there are at least 12 billion more recoverable barrels of oil equivalent (boe) still out there.

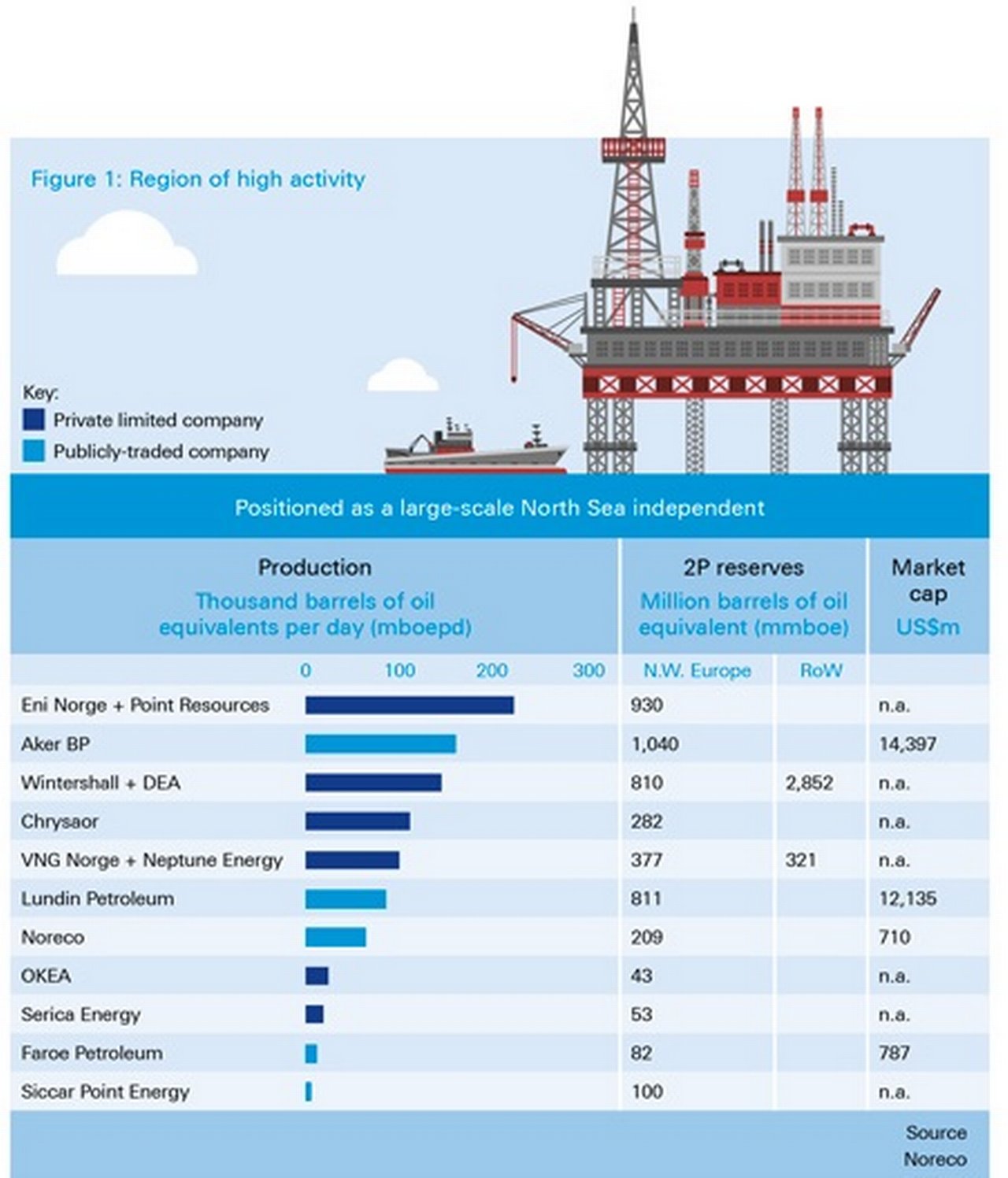

As oil majors invest elsewhere and giant European utility companies retrench from hydrocarbon extraction, there has been a growing appetite from a new breed of agile, independent oil E&P entities acquiring competitive assets, and eagerness to reach once inaccessible or undiscovered reserves.

This article takes a closer look at how the technique of reserve-based lending has, alongside private equity (PE), changed the face of oil production in the North Sea. It also takes a closer look at some recent transactions as examples.

Sea of plenty

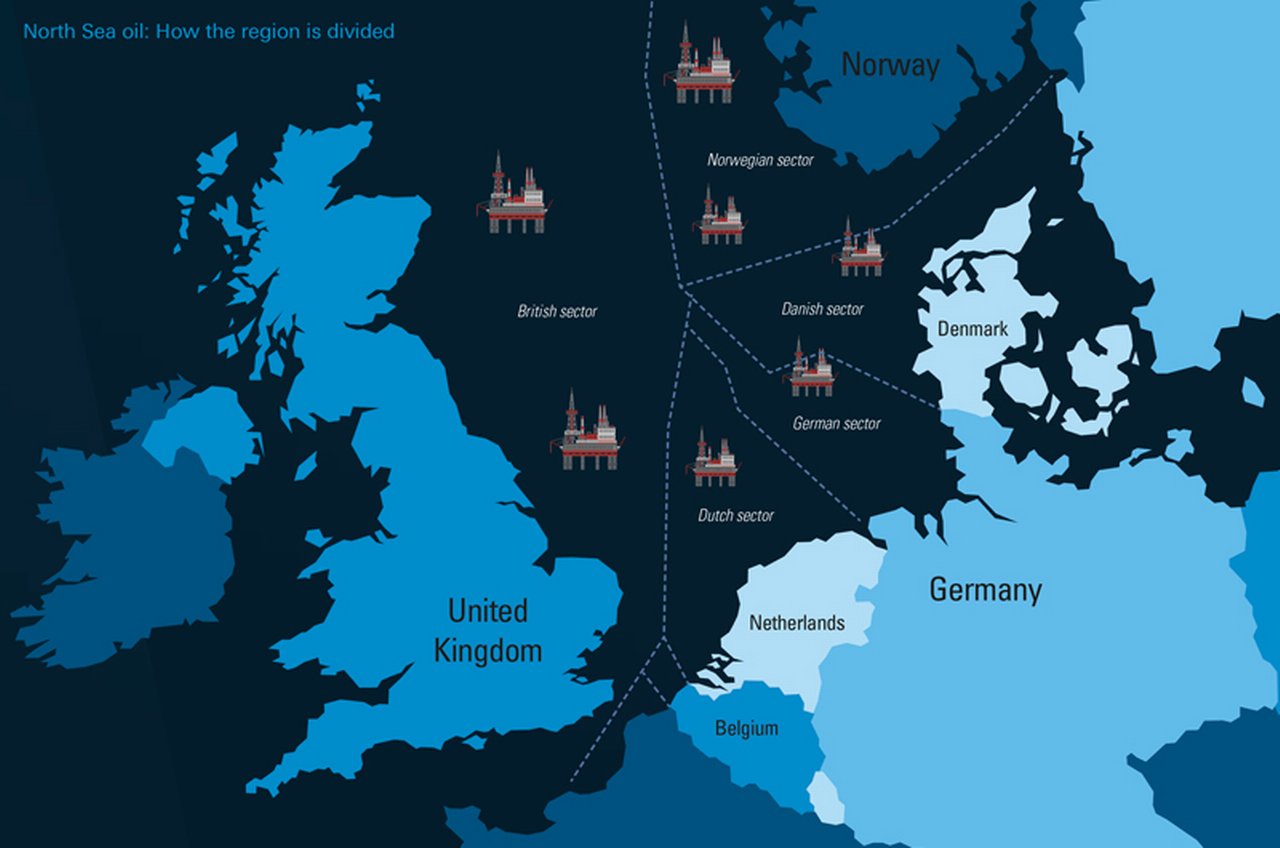

The continental shelves of the UK, Norway, Denmark, the Netherlands and Germany make up the petroleum region of the North Sea, with the UK and Norwegian shelves dominating the group and accounting for more than 90% of the reserves.

"Since 2016 we have seen a huge stream of M&A activity reshaping the sector"

With the North Sea Basin split down the middle between them, the UK and Norway have had a very different approach to oil sector governance since the sector took off in the 1960s. The UK completed the privatisation of British Petroleum (BP) in 1987, after which point its government had no direct equity participation in the North Sea. With a fully private upstream sector, taxation was, observed the Natural Resource Governance Institute in 2015, “the only channel of government revenues from hydrocarbons”.

Norway took a different approach, notes the Institute, with more than 50% of production coming through Statoil (now Equinor, of which the state owns a majority) and state ownership of assets via the State’s Direct Financial Interest, held through Petoro (which is wholly owned by the state).2

Norway generated more than double the revenues the UK did from each barrel it produced and in 2017, Norway’s sovereign wealth fund – currently the largest in the world and backed by its oil reserves – hit US$1trn in value for the first time.

43

Since 2008, Norway has also fostered a new cycle of investments on the ‘mature’ Continental Shelf through a tailored fiscal framework, resulting in multiple world-class commercial discoveries by independent players, and reviving Norwegian hydrocarbon production for a few more decades.

12

Unsurprisingly, a number of political debates have been circling about the cost/benefits of high-taxation-high-national-wealth versus low-taxation-private-sector-controlled approaches to what has been done with the North Sea revenues during the past half-century.

Commenting in Petroleum Economist on 8 December 2018, Dan Slater of oil and gas brokerage Arden made the point that “while part of the PE rationale was to invest near the bottom of the oil price cycle and profit as this has recovered”, the involvement of some firms in exploration, appraisal and development activities “implies a willingness to continue investing even when prices had climbed substantially higher”.3

What is reserve-based lending?

Originally structured and designed for medium-sized oil and gas producers – first in the US but also in the North Sea – reserve-based lending (RBL) is a senior secured borrowing base structure where funds are lent against the future cash flow of the assets.

The oil and gas reserves of the borrower are reviewed at agreed intervals (often depending on the size of the client) and the size of the facility and the tenor is based upon the value of the oil and gas reserves, with repayment secured on the proceeds from the oil and gas sales. The agreed value is known as the borrowing base and is based on the following factors:

- Proven and probable reserves in accordance with the independent expert findings;

- A conservative approach to future pricing of oil and gas over the loan period;

- Capital expenditure and investment in the field by the borrower; and

- Assumptions made on the borrower’s operating costs.

Yann Ropers, a former petroleum engineer, and now Deutsche Bank’s Head of London for Structured Commodity Trade Finance and RBL specialist, says: “This is a brilliant tool for us as a lender to get close to our clients at an early stage of their development, and accompany them through the whole stage of their growth through to investment grade status, where they can then access the capital markets.” The bank has a history of cross-client management between the structured commodity trade finance and investment banking teams.

Growth in RBL lending

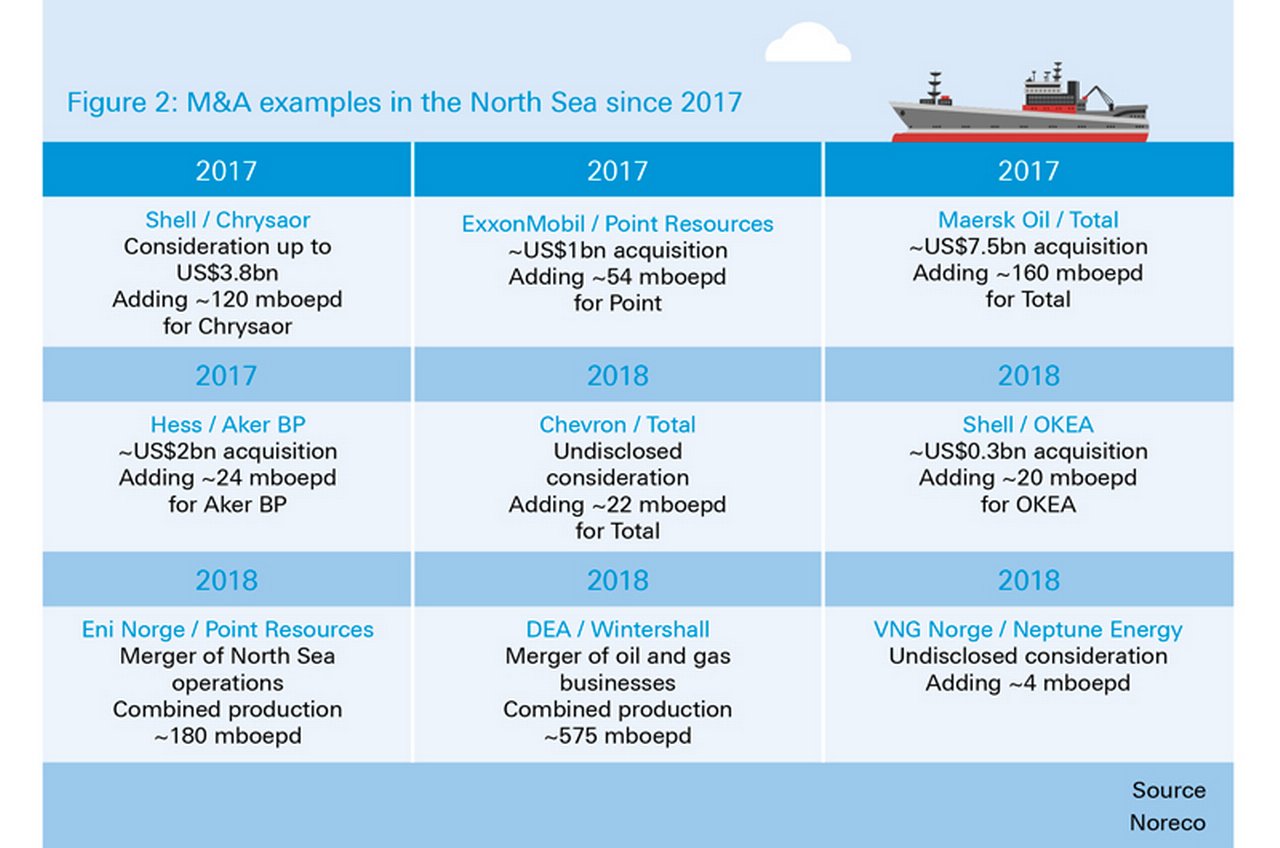

Ropers had been concerned that enthusiasm might wane during the oil crisis of 2014–16, but he notes that this was unfounded. “The private equity market is very interested in oil and gas and always on the lookout for keenly priced assets. Since 2016 we have seen a huge stream of mergers and acquisitions (M&A) activity reshaping the sector, and each transaction has created a new client or RBL financing opportunity.”

While oil majors don’t need structured commodity trade finance, as their investment grade status provides access to inexpensive unsecured capital market financing, the smaller new players, says Ropers, “need RBLs to grow and maintain operations”. Deutsche Bank has supported a number of independent North Sea producers using the RBL technique as they moved through their growth phases:

Lundin Petroleum

Sweden’s Lundin Petroleum, which focuses on operations in Norway and has a strategy of organic growth, enjoyed what President and CEO Alex Schneiter called “a standout year across all areas of our business”, with EBITDA of US$1.9bn and a record high free cash flow of US$663m for the full year 2018, ending 31 December.

The company’s jewel in the crown is its giant Johan Sverdrup field, now 85% complete and less than a year away from start-up. It is a highly capital-hungry asset, and the Swedish producer tapped the RBL market three times between 2014 and 2016, the largest deal being the seven-year US$5bn RBL signed with a syndicate of 11 banks, including Deutsche Bank.4

Vår Energi

Now the largest independent E&P company operating on the Norwegian Continental Shelf after oil majors and Equinor, Vår Energi was formed when energy company Eni Norge and private equity investor Point Resources AS merged into the renamed Vår Energi AS.

In advance of the M&A deal closure on 10 December 2018, Vår Energi raised a six-year senior RBL facility of US$3bn to finance the future growth of the new entity. The repayment schedule is back-ended with a four-year grace period, followed by two annual repayments of 25% and a 50% bullet at maturity. The facility also includes a US$200m letter of credit sublimit. During 2018, production was around 180,000 barrels of oil equivalent per day (kboepd), coming from 17 producing fields and four development fields, all located in Norway. The company has said it plans to grow daily production to 250kboepd over the next five years.

"Vår Energi represents a new beginning on the Norwegian Continental Shelf"

Neptune Energy

Neptune Energy is another example of a PE-backed company that has acquired assets in the North Sea from a European utility giant or oil major. A joint venture formed by The Carlyle Group, CVC Capital Partners and China Investment Corporation, Neptune acquired the oil and gas assets of ENGIE, the French utility company, on 15 February 2018. These are located mainly in Western Europe (Norway, Germany, the Netherlands and the UK) and to a lesser extent in Indonesia.

After completing the acquisition of the ENGIE assets, Neptune now controls a diversified portfolio of oil and gas upstream assets with a very strong operational track record. The acquisition was transformational for the company, as it is now producing around 160,000bbl/d (barrels per day), and the seven-year RBL signed on 15 February 2018 was instrumental in completing it. Deutsche Bank acted as a coordinating mandated lead arranger and underwriter with 10 other banks.

L1 Energy

London-based L1 Energy, an investment fund created by former shareholders of TNK-BP, is part of the investment vehicle LetterOne Group. With an acquisition strategy (rather than organic development like Lundin), L1 Energy acquired DEA AG in March 2015 from German utility company RWE AG.

In March 2015, Deutsche Bank co-led and co-underwrote a seven-year US$2.3bn RBL facility to help finance the acquisition with a security and covenant package that includes pledges over the operating company’s shares and revenues accounts. The borrowing base used to determine the size of the facility included assets in Germany, Norway and Egypt.

Having used the RBL to get to that first stage of growth, three years later, LetterOne announced its intention to merge its oil and gas businesses with BASF to create Wintershall DEA.5

LetterOne stated that the new entity “will be the largest independent European E&P company” and the combined proven reserves of almost 22 billion boe estimated at the end of 2017 puts the reserves to production ratio of the combined businesses at 10 years.Outlook for RBLs

With a buoyant demand in the RBL space and a track record of successful deals with growing independent E&P corporates, Ropers is confident he will be doing a lot more lending here. The oil majors might be decommissioning, but the supply and demand continues – just with different participants.

Sources

1 See https://bit.ly/2TzVkVy at shell.co.uk

2 See https://bit.ly/2OQVXDT at resourcegovernance.org

3 See https://bit.ly/2NNMKgq at petroleum-economist.com

4 See tagmydeals.com

5 See https://bit.ly/2H7LoMW at letterone.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending, flow case studies

Sustainable latex from Cameroon Sustainable latex from Cameroon

Allegations related to environmental and social issues in Halcyon Agri’s Cameroon rubber plantations attracted headlines until they were addressed through its Corrie MacColl subsidiary. flow´s Clarissa Dann reports on how sustainable finance helps the firm set

Trade finance and lending {icon-book}

A new era for Indian energy A new era for Indian energy

With India’s energy consumption poised to grow at almost 5% annually over the next decade, Clarissa Dann talks to the leadership team at Nayara Energy about realising the potential of its systemically important oil refineries

TRADE FINANCE, EXPORT FINANCE {icon-book}

Building healthcare Building healthcare

Well before the advent of Covid-19, plans were under way for better healthcare infrastructure in Côte d’Ivoire to support GDP growth momentum. flow reports on a project to build hospitals and additional facilities in the towns of Aboisso and Adzopé