June 2020

With India’s energy consumption poised to grow at almost 5% annually over the next decade, its refineries are systemically important. Clarissa Dann talks to the leadership team at the Mumbai headquarters of Nayara Energy about realising potential – 20 million metric tonnes per year of it and growing

When Indian Prime Minister Narendra Modi and Russian President Vladimir Putin took their strategic partnership to a new level in October 2016, during the eighth BRICS summit in Goa, it produced 16 signed agreements across multiple sectors.

One was for the Russian energy giant Rosneft Oil Company and Kesani Enterprises Company Ltd (a consortium comprising commodities trader Trafigura and private investment group United Capital Partners) to acquire India’s second-largest private sector refinery, which was owned by what used to be called Essar Oil Limited and is now Nayara Energy.1

When flow met Anup Vikal, Nayara Energy’s CFO, at the company’s headquarters in Mumbai, he talked through the ensuing due diligence process and the deal, concluded on 18 August 2017 for US$12.9bn. Jewels in Essar’s asset crown included the 20 million metric tonnes per annum (MTPA) Vadinar refinery and the Vadinar Port in Gujarat. This infrastructure had formed the country’s second-largest private oil refinery, producing ca. 8% of domestic refining output, India’s largest network of private petrol pumps (5,700 and rising) and a 1,010 megawatts electric multi-fuel power plant. In May 2018, the company was renamed Nayara Energy – combining the Hindi word ‘naya’ (new) and the English word ‘era’.2

To ensure expertise and a balanced shareholding representation, Vikal says, “we constituted a new board and robust governance structure. And to ensure we are an independent board-managed company, there were four seats for Rosneft and four for the Kesani representatives.” One Kesani seat went to the Executive Chair, Tony Fountain, who has 34 years of experience working with BP and Reliance Industries, India’s largest conglomerate. “Tony brought a unique perspective and helped us kickstart our journey towards optimised and efficient crude slate. He had ambitious asset development plans, with a strong focus on safety, sustainability and social responsibility,” Vikal reflects. The board was balanced further with the recruitment of well-known strong independents such as Deepak Kapoor, former Chair of PwC India, and Naina Lal Kidwai, former Country Head of HSBC India.

Energy demand dynamics

450m MTPA

“The global oil market is experiencing renewed uncertainty and volatility due to complex geopolitical and macroeconomic factors,” stated Nayara Energy CEO B. Anand in the company’s 2018−19 annual report, aptly entitled Realizing Potential. Fast-growing developing economies such as India have, in turn, fuelled energy demand. According to the International Energy Agency (IEA), India is the world’s third-largest consumer of oil, the fourth-largest oil refiner and a net exporter of refined products. “The rate of growth of India’s oil consumption is expected to surpass that of the People’s Republic of China in the mid-2020s, making India a very attractive market for refinery investment,” notes the IEA.3

So it is an understatement that Nayara Energy is systemically important. India’s Minister for Petroleum and Natural Gas, Dharmendra Pradhan, has commented that the country’s energy consumption is projected to grow at 4.2% per annum until 2035.4 This will require almost doubling its existing hydrocarbon refining capacity to meet fuel demand. Speaking in July 2019 at the Council on Energy, Environment and Water’s Energy Horizons 2019 conference in New Delhi, Pradhan said: “In India, we have current domestic refining capacity of 250 million MTPA. Recent studies have pointed out that, even with an aggressive electric vehicle roll-out plan, India would need 450 million MTPA of refining capacity.” This steady growth augurs well for Nayara Energy’s high-complexity refinery.

Vadinar Oil Terminal, Gujarat

By March 2019, the Indian oil industry saw overall year-on-year growth of 2.7% in the consumption of petroleum products, prompted by sales of passenger vehicles, two-wheelers and commercial vehicles. Diesel oil accounted for around 40% of total petroleum production, followed by gasoline. Bitumen consumption grew 8.7% over the same period, reflecting the government’s push to improve road networks; India builds around 40 kilometres of highways per day and the IEA forecasts that the country will, by 2040, have eight times more passenger cars and four times more commercial vehicles than in 2017. To improve air quality, India is moving to Bharat Stage VI (BS VI) emission standards from April 2020, which, in addition to low-emission vehicles, require high-quality, cleaner gasoline and gasoil – something Nayara Energy is already positioned to deliver.

New beginning

Once the acquisition was completed, Nayara Energy’s next challenge, Vikal explains, was to shake off its debt-ridden Essar legacy and stamp the new organisation’s identity on the market with a brand embedded in a matrix of key values: Energetic, Xtraordinary, Courageous, Ethical, Lead (EXCEL). The values, explains Shweta Munjal, Vice-President of Brand and Corporate Communications, “keep curiosity, innovation and energy at the heart of everything we do”.

According to Vikal, the balance sheet had “substantial challenges”; old dues of US$3.5bn to be settled straightaway and a current and non-current liability profile that required alignment with the asset profile. Much of the US$5bn debt portfolio was held by Indian public sector banks and was expensive. Additionally, financial and operational controls needed improvement, along with the required focus on corporate social responsibility. “We refinanced our entire debt more than twice over and raised US$11bn in the past 18 to 24 months. This saved around US$170m per annum of interest costs, and converted short-term liabilities into long-term debt,” says Vikal.

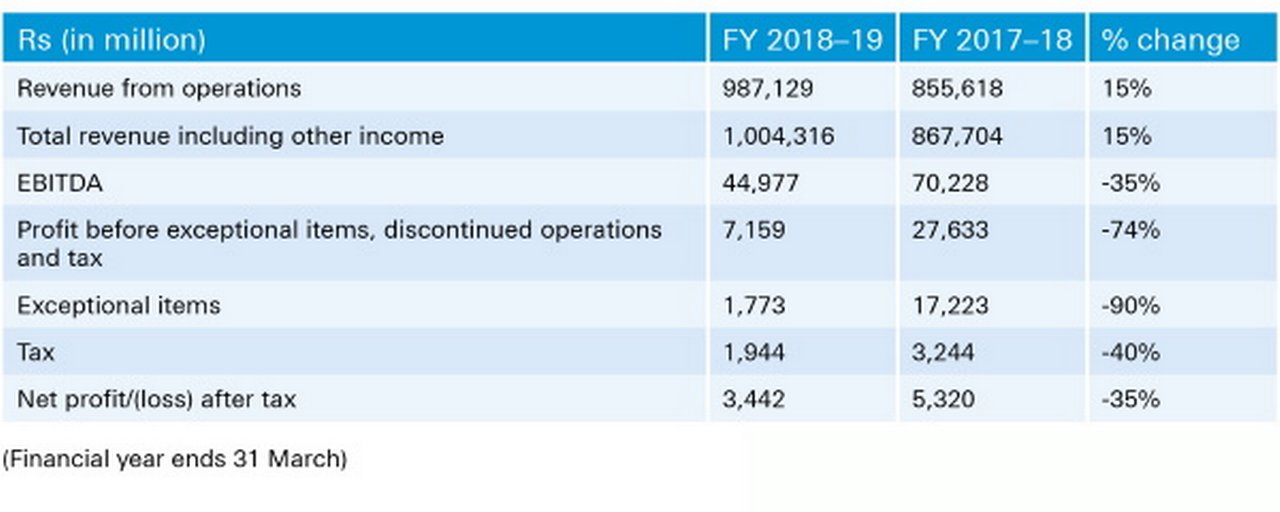

The first full post-acquisition results, for the financial year that ended 31 March 2019, saw revenues of around US$13.7bn and year-on-year growth of 15% – the bottom line reflecting the investment made into the new business.

Legacy accounting and treasury systems were migrated to a new enterprise resource planning system, SAP HANA, enabling checking of end-of-day positions in real time. Both Fountain’s industry experience and Anand’s business and operational perspective were “invaluable”, and saw the overhaul of strategic operations, while initiating Nayara Energy’s corporate social responsibility (CSR) journey, says Vikal.

Long-term prepayments

Prepayment, a popular technique in the oil industry, was an important element of the overall capital structure strategy. Nayara Energy’s innovative approach took it to a whole new level with a long-term structure, backed by a consortium of international banks, never previously attempted in this part of the world. Deutsche Bank was mandated by Nayara Energy’s two offtakers, BP and Trafigura, as the sole coordinating mandated lead arranger (MLA) for a four-year US$750m facility. The transaction, signed in April 2019, was structured into two tranches of US$375m each, backed by separate commercial contracts and prepayment agreements between Nayara Energy and the respective buyers. This in turn was supported by back-to-back offtake contracts with the two offtakers. The deployment of a special purpose vehicle in the structuring provides the flexibility to change the offtakers if needed. Anand hailed the deal as “truly a benchmark transaction and yet another milestone in our journey towards achieving financial excellence”.

Seasoned commodity finance structurers Christian Muchery, Charles Leung and Bernhard Koppold of Deutsche Bank, who led the bank’s MLA team, noted that “to get a structure like this across the finishing line, you need the support of many stakeholders,” and praised Nayara Energy’s team for their patience and “answering all our questions”.

Nayara Energy’s Head of Finance Strategy and Projects, Vineet Srivastava, explains that the main challenges included working with 15 sets of stakeholders while they got comfortable with the Nayara brand – most were dealing with the company for the first time – and the aftermath of Iran crude supplies being halted following the reimposition of US sanctions. “Iran was a preferred supplier because it extended us 90 days’ credit for the crude – the norm being 30 days,” he says. “Once this flexibility had gone, we had to fill the working capital hole.” And this was at a time when the company was still in the process of optimising its capital structure and balance sheet considerations.

Figure 1: Financial performance snapshot

Source: Nayara Energy annual report 2018–19

Asset development

Quite apart from the company’s network of 5,700 regional fuel stations which, explains Vikal, deliver “a great margin”, the refinery site at Vadinar was long overdue a turnaround. With a capacity of 20 million MTPA, it is India’s second-largest single location refinery and among the world’s most complex.

Complexity is measured by comparing the secondary conversion capacity of a petroleum refinery with the primary distillation capacity. The indicator, known as the Nelson Complexity Index (NCI), reflects both the investment intensity and the refinery’s potential value addition. The higher the index number, the greater the cost of the refinery and the higher the value of its products. The Nayara Energy refinery has an NCI of 11.8 – among the world’s highest. It is capable of processing some of the toughest crudes while also producing high-quality Euro IV and Euro VI grade products. The refinery has been providing higher-quality BS IV compliant fuels to international standards for the past 12 months.

"India is a very attractive market for refinery investment"

“To ensure business sustainability and asset reliability, in 2018 we scheduled a 33-day major turnaround,” says Vikal. This was subsequently undertaken in 30.5 days, 2.5 days ahead of schedule, with no lost time from injuries. Key activities addressed during this process included maintenance and inspection of all processing units, utilities, products and intermediates tankage, the crude oil tank, the jetty and the single point mooring system. Once the project was completed, the refinery’s capacity to intake higher total acid number and high-sulphur crude increased, enabling Nayara Energy to produce cleaner products with very low sulphur levels. “We took the opportunity to make improvements in reliability, efficiency and other structural changes to the refinery so we could ship low-sulphur cargoes compliant with IMO 2020 and BS VI to our retail outlets and customers,” Vikal explains.

Since January 2020, ships must use marine fuel with a sulphur content not exceeding 0.5% by mass, and it is unclear whether the global refining sector will be able to produce enough low-sulphur marine fuels to meet demand. At any rate, Nayara Energy has ensured it is ready to produce it.

“We have a unique opportunity to leverage on the existing integrated infrastructure of land, port, power and storage and we are well positioned to harness the demand/ supply gap and build on the momentum. But we are very mindful of our commitment to maintain a healthy balance sheet and meet the deleveraging targets we have set,” says Vikal, adding that the tax breaks to enter this industry were welcome, given the focus on keeping leverage low and reducing debt.

On 18 January 2019, Nayara Energy signed two memorandums of understanding (MoUs) with the Government of Gujarat, committing investment of US$850m towards Phase 1 of an expansion plan for the new refinery and petrochemical units, contributing towards developing Devbhumi Dwarka district as a petrochemical hub in India.

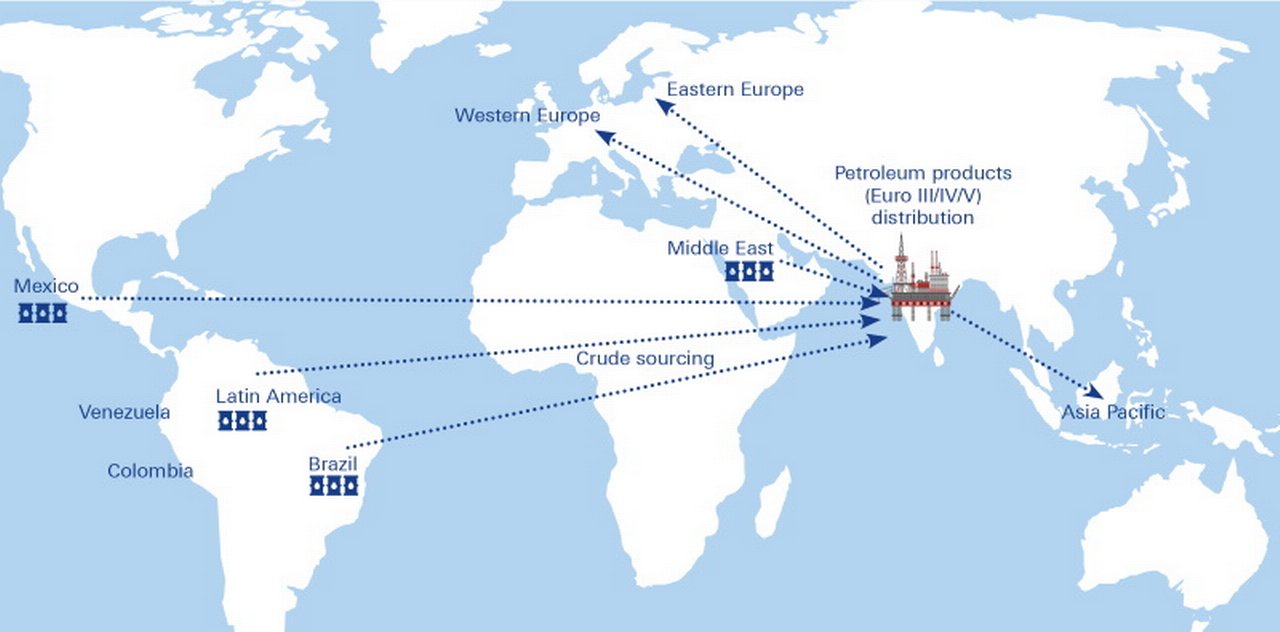

Figure 2: How a strategic location enables wide geographic reach

Another significant investment was a depot at Wardha in Maharashtra. Strategically positioned in central India, the depot is equipped with a vapour recovery system driven by hybrid technology, and a 300 kilovolt- amperes solar power plant generating 450,000 kilowatts of power a year. “The addition of Wardha is in line with our commitment to create world-class assets in a sustainable manner,” says Anand. “This, being our first rail-fed depot, will be an important step towards enhancing our supply infrastructure in the region.”

Location and reach

India’s dependency on oil imports is, notes the IEA, expected to continue increasing. “With an oil import bill of around 4% of GDP today, and 65% of imports coming from the Middle East through the Strait of Hormuz, the Indian economy is, and will become even more, exposed to risks of supply disruptions, geopolitical uncertainties and the volatility of oil prices,” says the agency.

However, Nayara Energy is confident of its supply sources and has strong relationships with national oil companies. Although Rosneft and Trafigura are shareholders, they receive no special treatment when sourcing crude or supplying products. “We don’t do guaranteed deals with shareholders. Each crude and product deal has its own transparent evolution process, where shareholders’ entities are also treated at par with other bidders,” notes Vikal. Srivastava confirms that the pool of crude suppliers mainly consists of global oil majors, large traders and state-owned companies. This ensures the company gets the optimum pricing. Procurement employs a mix of open credit and short-term trade finance such as letters of credit, he adds.

"We refinanced our entire debt more than twice over and saved ourselves around US$170m per annum in interest costs"

Another factor is the variation in what types of crude are available. A complex refinery such as Nayara Energy needs uninterrupted access to heavy/sour crude (containing higher levels of sulphur) as well as high-quality low-sulphur sweet crude oil, in order to operate at capacity. Sour crude oil, needed for the production of diesel, marine fuels and bitumen, had been imported from Iran and Venezuela. At one stage, 40% of Nayara Energy’s crude came from Iran, but once that source was shut off by sanctions, more supplies were sourced from alternative suppliers in Latin America and Canada. The lighter, sweeter crude – sourced mainly from the US – is commonly used for processing into gasoline and kerosene.

Corporate social responsibility

Vikal’s other job – and his particular passion – is overseeing the company’s CSR strategy. “Performance and sustainable development have been central pillars of our growth journey. We see the 15 villages in and around our refinery as key stakeholders,” he explains.

In other words, the company’s land acquisition immediately turned it into a resident of the villages – which, between them, have around 50,000 people who make a living there. “We are part of the family,” he smiles. While Gujarat is a prosperous region, nutrition is often poor, and wealth is concentrated in the top ca. 1% of the population.

“Our attempt has been to drive inclusive growth and we are therefore partnering with the community through various sustainable development projects to improve people’s quality of life,” says Vikal. “Tobacco addiction and unhealthy food habits are a real problem.”

The solution, he suggests, is to work with the region’s women. “When women get more money in their hands, they use it for the purposes of nutrition and their social standing increases.” Micro-enterprises facilitated and supported by Nayara Energy empower the community’s women to make financial decisions for their households. For example, the stitching centre in Vadinar has transformed into a fully fledged garment manufacturing enterprise.

Nayara Energy supports micro-enterprises that empower the women of the Gujarat region

The company has invested in local community programmes to improve health and sanitation (including the installation of public toilets), to support villagers – particularly women – in earning their livelihood, and to double farmers’ incomes through climate-smart agriculture techniques, effective livestock management and water resource management. There’s also a special focus on education and skill development; absence from school is addressed, and students are trained on programmes to prepare them for the workforce.

Nayara Energy also signed a MoU with the Gujarat government to make the Devbhumi Dwarka district malnutrition-free. Together with the Indian Institute of Public Health, Gujarat’s capital city Gandhinagar, and health solutions developer JSI India, it is implementing Project Tushti to strengthen nutrition indicators in the district’s 249 villages.

Realising potential

The combination of a corporate turnaround story, a transformational landmark deal, and bringing nutrition and skills to Gujarati villagers demonstrates that this company has already realised many of the potential benefits that were mere aspirations when the Indian and Russian leaders signed the MoU in 2016.

But, like all good businesses, Nayara Energy does not rest on its laurels and has applied to the environment ministry to add a single point mooring facility at Vadinar Port to handle additional crude deliveries, increasing capacity to 46 million MTPA. The estimated total cost of the expansion is around US$20bn and the investment aims to serve India’s growing demand for petroleum products.

And, in line with India’s progress towards meeting Goal Seven (delivering energy access) of the United Nations Sustainable Development Goals while reducing emissions, Nayara has led the way in producing BS VI and IMO 2020 compliant clean fuels for the past 18 months – while certain other providers are still talking about it. “We have been doing our bit,” Srivastava concludes.

Sources

1 See https://bit.ly/338BVxa at nayaraenergy.com

2 See https://bit.ly/3cRBGuH at business-standard.com

3 See https://bit.ly/3bjkNec at iea.org

4 See https://bit.ly/3aKjHVm at thehindubusinessline.com

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

MultiSafepay and “Request to Pay”: open banking comes of age MultiSafepay and “Request to Pay”: open banking comes of age

The implementation of Europe’s second Payment Services Directive (PSD2) has unlocked a number of new open banking solutions, such as Request to Pay (RtP).

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments

Trade finance and lending

RCEP launches after eight years’ gestation RCEP launches after eight years’ gestation

Fifteen Asia-Pacific economies sign up to the Regional Comprehensive Economic Partnership (RCEP) Agreement in a move back towards multilateral trade and tariff reduction. flow's Clarissa Dann summarises what this means for trade