September 2019

Were it not for China’s economic reforms, Ma Zhi Qing would still be running a farm. Today he leads a multi-billion-dollar petrochemical corporate. Clarissa Dann visited the team to hear more about the role prepayment finance is playing in Shandong Qingyuan’s growth story

In 1981, three years after China decided to open its doors and put in place the economic reforms that were the vision of former premier Deng Xiaoping,1 a young farmer from Linzi in Shandong province had another vision.

One would be forgiven for thinking it could have been a dream of an international football career. After all, Cuju – a game played in ancient China by kicking a ball around that is widely held to be the progenitor of today’s game of football – started life 2,000 years ago in the very same province.

Ma Zhi Qing ran a 240-strong grain farming people’s cooperative, and at 22 years old was already a highly experienced manager. But he saw opportunities to develop a business with national and international impact. “Our agricultural businesses needed better logistics, so I invested my savings in my very first tractor,” reflects Ma. “By 1983, I had tripled my business and had three tractors, so I decided to invest again – but this time in my first truck, so that I could get into construction transportation logistics.”

I meet Ma, now the founder and president of one of China’s largest independent oil refineries, along with members of his senior team, at their industrial premises in Zibo, a three-hour high-speed train journey south from Beijing. He is justifiably proud of the recent installation of new refining machinery and we take a tour of the entire works, complete with the health and safety-approved hard hat and jacket. This includes a visit to the ‘engine room’ where every part of the factory is visible from a central hub of screens, ensuring that any disturbance to the journey of crude through to refined oil is tackled with no downtime. His team explain how some processes have a mirror set of equipment so production can be continuous while one set rests.

This article tells the story of how pre-delivery finance positioned what was one of a number of Shandong-based independent refineries to move to a new phase of organic growth.

Foundations

By 1985, Ma had been moving limestone in his trucks for the highway construction industry as rural tracks became country roads. At this point, his role in this transformation graduated from quite literally the underground upwards when the opportunity to transport the bitumen that forms the macadam on the road surface in an oil tanker presented itself. An oil tanker was acquired, and then another and another, and when the fleet had grown to more than 12 tankers and trucks by 1994, they started to manufacture bitumen themselves. This involved buying heavy oil (the final residue in the refining process) from the local state-owned refinery. However, Ma always took a particular interest in the special oil that was used to lubricate the machinery.

Fast-forward to 1997, when Ma further invested and expanded the bitumen capacity, upscaling the technology from its basic beginnings to move the quality output from country road-standard bitumen to that required for motorways. Key to all of this expansion, says Ma, was the company’s close cooperation with its supplier of crude: Shandong-headquartered Qilu Petrochemical, part of state-owned Sinopec. Qingyuan Group was launched in 1998 and capacity had hit 80,000 tonnes a year by 1999.

A range of finished base oils

Oiling the wheels

An important by-product of bitumen is wax oil, or base oil. This is bought by lubricant manufacturers such as Kunlun Lubricant (part of PetroChina), which adds a small amount of additive to develop different lubricants that find their way into most aspects of modern living – motor oil, cosmetics, printing equipment, pharmaceuticals, and foodstuffs and food wrappings being just a few examples. The proportions are around 99% base oil and 1% additive. However, the American Petroleum Institute (API) set the international standard in 1993, categorising the oils into five groups according to refining method, viscosity, proportion of saturates and sulphur content.

Qingyuan had registered its first branded base oil product in 1999, entitled ‘Qingyuan’, but while it was suitable for local tractors, it needed to be at least API-I standard for this new product line to have a chance of expansion beyond the farm vehicle market. Ma reflects: “We looked at what products were required to lubricate the tractors and step by step we developed our special oil.”

By 2005, Qingyuan had repositioned itself as a major base oil producer and was focusing on continual quality improvements and increased capacity. The product mix now includes other refined products such as diesel, gasoline, residual oil and hydrogenated naphtha. “To stay ahead of the game is to continue extending our value chain. We wanted to be innovative and go into downstream industries with our latest technologies and products,” says Ma.

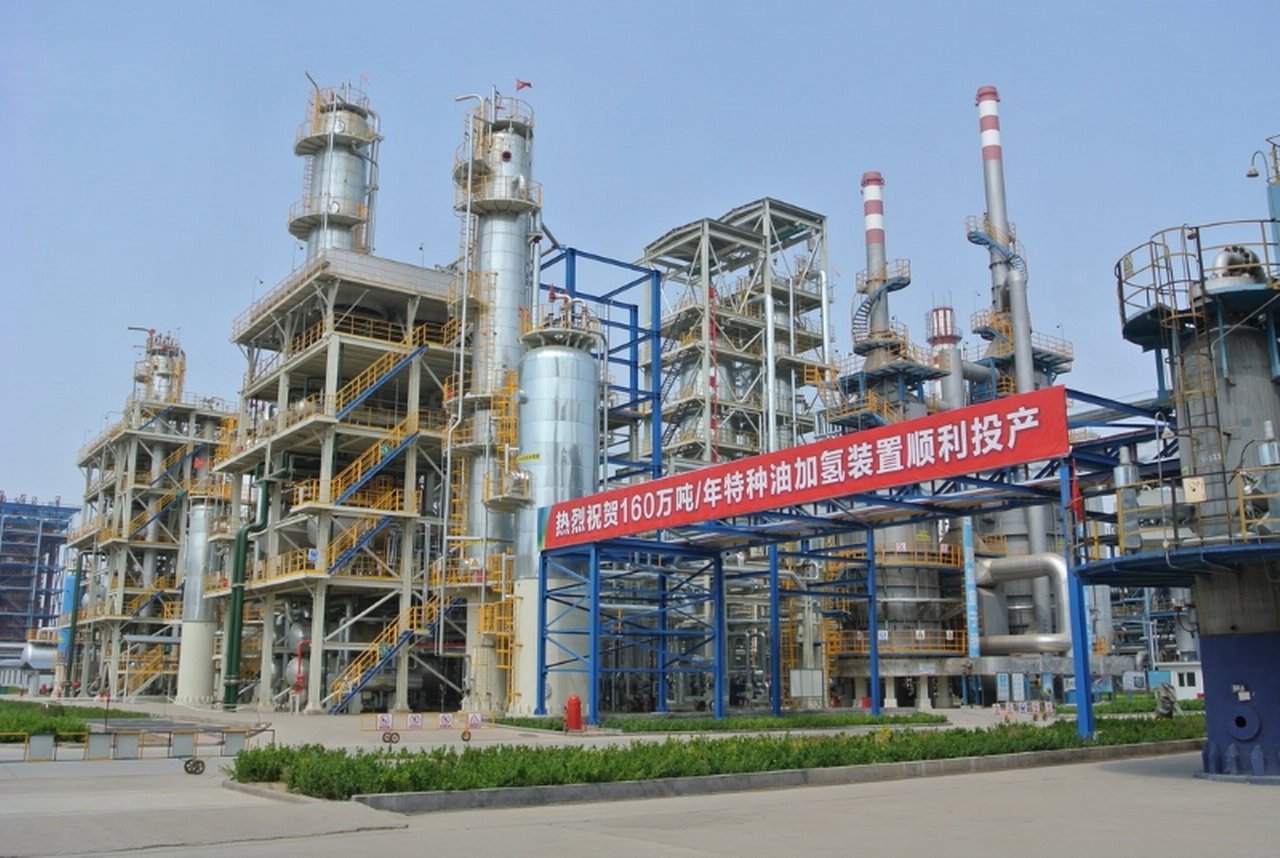

Qingyuan's 1.6 million-tonne hydrogenation facility

Today the group is the largest privately owned producer of base oil in China, with a processing capacity of 8.6 million tonnes per annum (mtpa) and a production capacity of 1.9mtpa of API-I, API-II and API-III base oil types. It now accounts for around 35% of China’s overall capacity of high-quality API-II and API-III base oils.

Certified with the ISO 9001 quality label, Qingyuan is one of 27 API-certified companies in China. In addition, it has moved further up the value chain with its own sales of finished lubricating oil, transformer oil, other specialist oil products and aviation kerosene. In 2016, the group became the only domestic producer of white oil, the highest-quality base oil, which is widely used in pharmaceutical and medicinal applications, cosmetics and food industries. Starting with a white oil production capacity of 0.1mtpa, Qingyuan has gradually ramped it up to the current 1.0mtpa, with plans to double that to 2.0mtpa by the end of 2020.

Left to right: Liu Juan, Jiao Chong, Ma Zhi Qing, Chen Chun Xia, Cao Yong Gang

International trade environment

Although a huge amount had been achieved in three decades, Ma was keen to widen the gene pool when it came to sourcing crude imports, to include global oil majors. The Chinese authorities had been granting crude oil import licences to independent (i.e. non-state-owned) refineries such as Qingyuan – known ironically in the industry as ‘teapots’ because of their small size in comparison with state-owned enterprises – since 2016.

By the end of that year, around 19 independent oil refineries had import quotas of almost 1.5 million barrels per day (mbpd) – more than the net imports of some European countries. Qingyuan’s total crude oil import quota for 2019 is 7.04mt.

Chinese product supplies had surged, leading to an increase in exports to other Asian markets.2 But this could not last, and a period of market consolidation followed once the teapots had expanded to compete with state-owned groups. A battle for market share between independent and state-owned companies unfolded, complicated by a slowing demand for refined products in a climate of excess capacity. As the Financial Times put it in 2017: “The goal for the surviving independent refineries is to put pressure on state-owned companies to become more efficient without creating an existential threat to their dominance.”3

"Were it not for the opening up of the Chinese economy, we would not be here now"

Access to dollars

To take advantage of the crude import licence quotas, the group needed to settle crude purchases in US dollars, explains Finance Director Chen Chun Xia. In addition, rising oil prices and increased working capital requirements meant that facilities from Chinese banks alone were no longer enough. “The refining business relies on availability of funding and it is a capital-intensive business,” she notes.

Qingyuan Group first tapped the onshore USD market in early 2016

With a good track record of API-II and API-III quality base oil production behind it, together with Qingyuan Group’s additional revenue streams such as plastics, and overall financial stability (profits were continuously reinvested in the plant and machinery), the group was now attractive to international lenders.

A tightening of China’s currency outflow regulations from the State Administration of Foreign Exchange as part of Beijing’s move to boost currency and protect FX reserves in 2016 made offshore financing an attractive option for corporates seeking deeper dollar liquidity. “Qingyuan Group first tapped the onshore USD market in early 2016 and then the more liquid offshore USD market via the US$650m facility in June 2017,” recalls Frank Wu, Deutsche Bank’s Head of Structured Commodity Trade Finance Asia Pacific. Since then, the refinery has been steadily moving its funding from onshore to offshore.

Quingyuan plant control room

Jiun Ching (HK) Holding (JCHK), an affiliated trading arm of the group, went on to sign three pre-delivery finance loans in 2018 – two for US$250m and a third for US$430m – for the purchase of crude oil from Trafigura and BP for onward sale to Shandong Qingyuan. Attracting a seven-bank syndicate of mandated lead arrangers comprising ABN AMRO, Commonwealth Bank of Australia, Deutsche Bank, First Abu Dhabi Bank, ING, Sumitomo Mitsui Banking Corporation and Westpac, this was self-liquidating debt.

1.9mtpa

The loan proceeds are disbursed to JCHK and used for crude oil purchases from the crude suppliers under a supply contract. JCHK then on-sells the crude to Qingyuan under a feedstock purchase contract. By acting as the co-borrower, Qingyuan plays the de facto guarantor role.

The facility relies on the performance of Qingyuan under the off-take contract; in other words, the ability to produce and deliver base oil to its distributor partner, CNOOC. It has a one-year tenor matching that of the facility and specifies the minimum value of base oil deliveries based on the debt service coverage ratio of 135%.

The three pre-delivery financing facilities, all closed in 2018, collectively went on to win a TXF Best Overall Commodities Finance Deal of the Year 2018 award, and Ma brought his team to Amsterdam to celebrate their success. Talking to Trade Finance TV shortly before the presentation, Ma reflected: “It took 38 years to get from my farm to where we are now. Were it not for the opening up of the Chinese economy, we would not be here now – I would still be on the farm. But we made it, and I could realise my dream of building an international business.”4

Western eyes

I ask Ma and his team about their export plans. Thus far, Chinese demand for base oil-related products has outstripped capacity. However, the existing relationships with oil majors and commodity traders, and now international banks, have paved the way for developing Qingyuan’s export client bases. “I believe the market will continue to be open to us and the reform of the Chinese economy will continue,” he says.

Ma adds: “As a privately owned enterprise we were granted crude oil import licences that enabled us to source crude oil from international traders. With the support from international banks we have grown and reinvested our profits. We do believe this trend will continue and we will continue to work with international banks.”

And there is no shortage of banks happy to be part of this winning team.

Key Facts

Shandong Qingyuan

- Founded: 1998

- Located: Qilu Chemical Industrial Zone, Zibo City, Shandong, PRC

- Industry: Petrochemicals, base oil

- Revenues: RMB35.2bn (2018)

- Profits: RMB1.2bn (2018)

- Number of employees: 2,500

Sources

1 See https://bbc.in/2YbSdWb at news.bbc.co.uk

2 The Rise of China’s Independent Refineries, by Erica Downs, Columbia SIPA Center on Global Energy Policy, September 2017

3 See https://on.ft.com/2eLG4yT at ft.com

4 See https://bit.ly/2ySsPXf at tradefinancetv.net

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

TRADE FINANCE, MACRO AND MARKETS

Covid-19 and commodities Covid-19 and commodities

Covid-19 has shaken up the world’s commodities sector although price volatility is no stranger to its participants. Reduced demand has seen falling prices, lack of investment, and logistics log jams. Clarissa Dann reviews the fundamentals

Trade finance and lending {icon-book}

Market makeover Market makeover

Thanks to some transformational lending, Ghana’s Kumasi Market is undergoing a makeover that is set to transform the Ashanti economy and all it touches. flow tells the story of a project involving three governments, a Brazilian contractor and Deutsche Bank’s Structured Trade & Export Finance team

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments