08 August 2024

Growing shareholder value and delivering medicines where they are needed most is a tightrope that AstraZeneca has walked for a while. flow’s Clarissa Dann catches up with Andy Barnett, the Anglo-Swedish group’s Head of Investor Relations, about what it takes to maintain investor loyalty over the long term

MINUTES min read

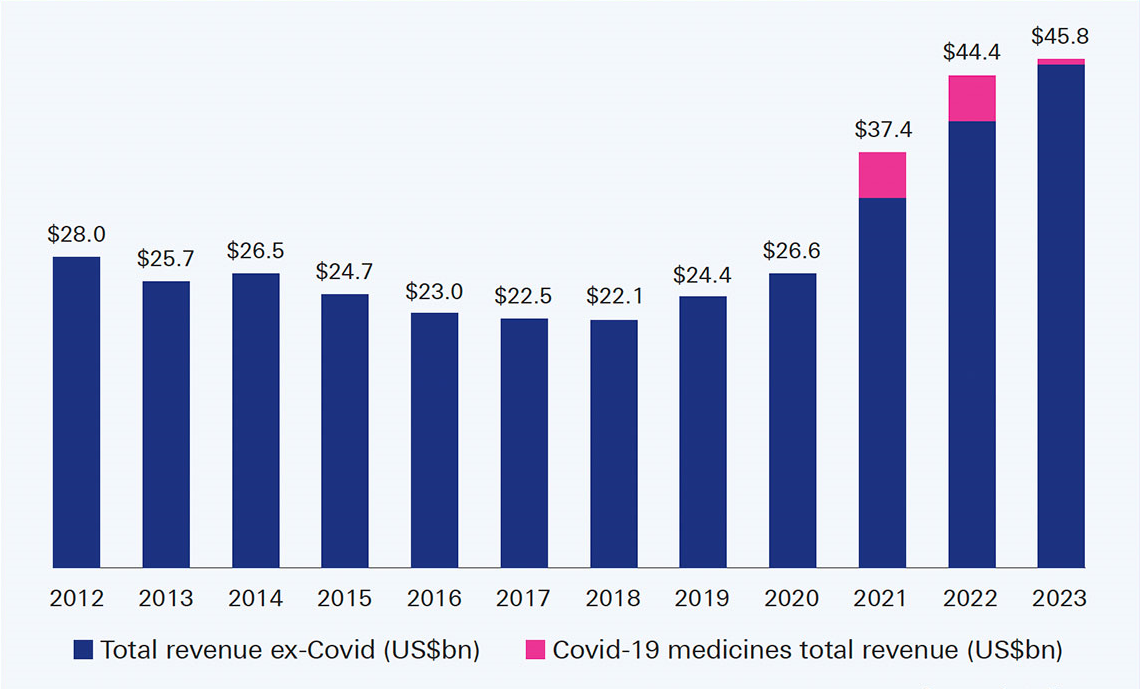

When AstraZeneca held its first Investor Day since 2014 at its headquarters in Cambridge on 21 May 2024, CEO Sir Pascal Soriot confirmed that the global pharmaceutical company had hit its target set 10 years ago – of generating annual revenues greater than US$45bn by 2023. But this is not a company to sit on its laurels. “Now we have a new ambition to deliver US$80bn in total revenue by 2030, with sustained growth thereafter,” Soriot told investors. The company, he added, “is on track to deliver mid-30s% core operating margin by 2026”. (see Figure 1)

He explained how the company would do this through its core therapy areas of Oncology, Biopharmaceuticals (including Cardiovascular, Renal and Metabolism, and Respiratory and Immunology) and Rare Disease, as well as the launch of 20 new medicines by the end of the decade.

Figure 1: Delivered on ambition to achieve > US$45bn total revenue by 2023

While AstraZeneca has been more widely associated with vaccines during the Covid-19 pandemic, this is not, as Head of Investor Relations (IR) Andy Barnett says, its core business – and did not grow the bottom line. “We mostly did this because we wanted to try and help and it was almost entirely done on a not-for-profit basis – most of our vaccines were delivered to emerging markets,” he adds. “It was a time when we all had to roll up our sleeves and the overall learning point from that period was an identification of what timelines could be squeezed and what could not.” The experience also reinforced that, “partnership was key, as it was fundamental to building out a global vaccine manufacturing network that did not previously exist”. Indeed, continues Barnett, “we managed to achieve this in record time. We also built strong relationships with key stakeholders along the way.”

These learnings have been taken into the company’s wider strategy of balancing innovation and market access while improving access to therapies and patient health in lower middle-income countries – and helping drive long-term sustainable growth in the process. While the company has invested in emerging markets for some time, “these markets are an increasing feature of where the growth in our business is coming from,” says Barnett. Emerging markets are now delivering strong income growth for the company – accounting for 29% of total revenue (as of Q1 2024).

Following a flow interview with Barnett in May 2024, this article provides an update to the case study published four years ago (see flow, H1 2020).1

Relentlessly curious

Barnett stepped into his global role as Head of IR in June 2022, having held franchise head roles at AstraZeneca since arriving from Roche in 2019. As an expatriate Canadian growing up in Dubai, Barnett studied at British schools in the Middle East before returning to Canada to finish his education, where he read biochemistry at McGill University in Montreal. The career path leading from biochemistry, via various business roles in pharma to IR, might not seem an obvious one, but his relentless curiosity got the better of him. “I was interested straightaway because it was something I hadn’t done before, and I could see it as being central to how the company organises itself and ommunicates,” he reflects.

“Emerging markets are an increasing feature of where the growth in our business is coming from”

On the investor side, while I had managed businesses, I didn’t have a finance background – so there was quite a bit I had to learn. On the other hand, I came to realise many investors didn’t only need that from me. Most put greater emphasis on wanting to understand the business strategy, the R&D pipeline and the potential value of our medicines, which I was able to help with straight away.”

Communicating with investors

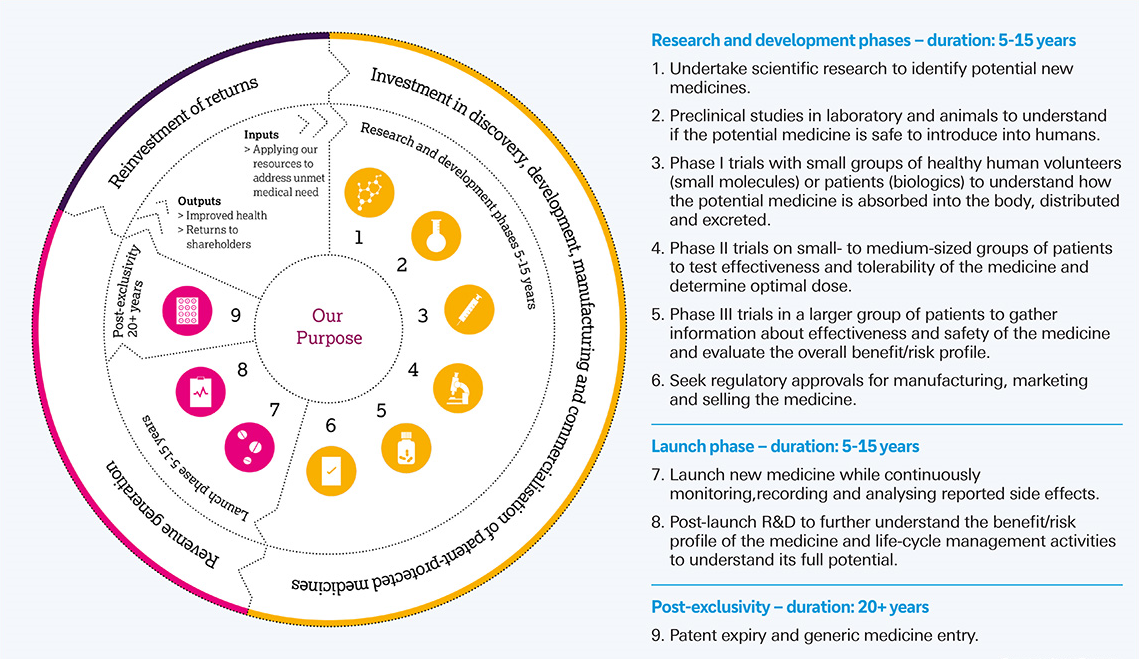

A visit to the company’s investor relations page2 provides a practical guide to the pharma business model and what investors need to understand in terms of how long it takes for initial research and development investment to result in an approved, safe medicine (see Figure 2). Given the length of the investor journey, the specific risk profile of the pharmaceutical industry, the competitive landscape and the potential for artificial intelligence (AI) to support with research and development, there is no shortage of investor touchpoints in need of the right sort of communication.

Communicating the revenue opportunity to investors is a key part of the job for Barnett and team, with an active schedule of interactions through various conferences. “I hear often that our business is complex, and I view it as our job to communicate the nuances of the sector, and the particular growth profile we have, to investors,” he says. Stakeholders are interested in the risk profile of a company – and the more this can be diversified through different therapy areas and geographies, the more attractive the investment can become. It is not, for example, uncommon for one region to experience pricing pressures or unhelpful changes in regulation that can impact a business for a period, while at the same time other regions are thriving.

AstraZeneca has five strategic research and development hubs located in Cambridge, UK; Gothenburg, Sweden; Shanghai, China; Gaithersburg, Maryland (USA); and Boston, Massachusetts (USA).

To effectively manage communication with existing investors and build relationships with new ones, the IR team provides on-the-ground support across these geographies. “This helps us manage tight time zones and ensure we are being responsive to investor questions,” says Barnett.

Internally, the IR team also works closely with several teams to develop clear and precise external communications for investors. “The first is our global financial reporting team, which makes sure that we are complying with all necessary reporting standards and that the statements we make are fully justified based on their observations. These efforts are supported and supplemented by the input from our auditors, who do at least two deep dives every year on our reporting.”

On top of this, the executive team, comprising CEO Sir Pascal Soriot and CFO Aradhana Sarin, are intimately involved in and engaged with the process. “They are very interested in two things: helping to make sure that they play a key part in working with investors so that they understand the business well, and at the same time collecting insights and understanding from the market about the company strategy. And they really do put a lot of time into doing that,” Barnett adds.

He confirms that the top 30 shareholders hold around 50% of the shares, with the profile having been ‘largely stable’. “This probably tells you that our investors have confidence in not just the nearterm trajectory but the longer term,” and “there is excitement about the pipeline opportunities,” he adds. The share price has grown from £30 around 10 years ago to more than £120 on the London Stock Exchange at the time of writing.

Future-proofing results

At the Investor Day event, the new strategy was set out in three stages, “today, tomorrow and the day after”. The first stage refers to the company delivering commercial performance from its existing portfolio of medicines and upcoming launches this year and in 2025. Over the next 18 months AstraZeneca anticipates more than 40 phase three or late-stage study read outs, which will be important catalysts for the company’s future growth.

"Our investors have confidence In not just the near-term trajectory but the longer term"

The second stage is about delivering on the late-stage programme of studies for new medicines and extensions for existing medicines until 2030. During the ‘Delivering Shareholder Value’ presentation at the Investor Day, CFO Sarin explained, “Many of our medicines – for example in respiratory – are still very early into their lifecycle and have 10-plus more years to go. So, in our current portfolio there’s the existing medicines with the existing indications, and there’s existing medicines with lifecycle management opportunities.”

The final stage is where AstraZeneca is investing in transformative new technologies and platforms with potential to shape the future of medicine. For example, it is looking to further enhance how it already uses AI in research and development to better transform the understanding of disease biology, driving earlier diagnosis and helping to create the next generation of medicines.

“We’re trying to think strategically along these lines because in our industry there’s a long lead time,” Barnett explains. “You’re making strategic bets on new technologies and platforms that you think have the potential to make a big difference, but you’re doing it quite far out.

“So, you often find that where pharmaceutical companies do well or don’t do well is not a result of their near-term effects. It’s often a result of the decisions they’ve taken many years ago, so they’re now seeing the results of those decisions pay off or not.”

As it continues to grow across all therapy areas, AstraZeneca also announced that it will continue to decouple its carbon emissions from its increase in revenue. By 2026 the company will be carbon zero for Scope 1 and 2 emissions, and by 2030 will have halved its Scope 3 emissions on the way to science-based net zero by 2045, at the latest.3

American depositary receipts

In September 2020, AstraZeneca transferred the listing of its American Depositary Receipts (ADRs) from the New York Stock Exchange to the Nasdaq Global Select Market, with the aim of broadening its shareholder base and becoming more easily accessible. ADRs are dollar-denominated equity instruments that represent ownership of certain equity securities (the ‘underlying shares’) that are issued and traded in a company’s home market(s).

“We wanted to be in the NASDAQ 100 because we were among companies that were highly active and with whom we shared similar characteristics,” says Barnett. It has taken a few years to tease out the impact of this listing because not only did AstraZeneca make the move during the pandemic, but the company also completed the Alexion Pharmaceuticals acquisition shortly afterwards – deepening its Rare Diseases portfolio in the US.4 Barnett confirms that AstraZeneca sees the programme as “attractive to our US shareholders” and that it remains a company priority to increase the US shareholder base.

"The AstraZeneca IR team... expertly navigated the company’s transformation”

Deutsche Bank is the depositary bank for AstraZeneca’s ADR programme, which was first established in 1999 following the merger of Astra AB and Zeneca Group PLC. The ADR programme has achieved industry recognition by winning the ‘Best Depositary Receipt Programme’ award from EMEA Finance in 2020 and 2021.

The bank supports the company with ensuring that cross-border ADR activity is conducted seamlessly, the processing of dividend payments or other entitlements occurs on a timely basis, complex corporate actions are executed efficiently and the AGM proxy process for ADR holders is coordinated. In addition, the IR advisory team provides useful support on targeting investors, help with navigating the financial markets and the provision of insights on trends, all of which is viewed as an important part of the dialogue, says Barnett.

“The AstraZeneca IR team led by Andy Barnett expertly navigated the company’s transformation into a science-based biopharmaceutical leader,” reflects Daniel Clark, Global Head of Depositary Receipts and Head of Trust and Agency Services, APAC, at Deutsche Bank. “Their focus on keeping investors and analysts fully updated on business progress and the pipeline of new medicines has been exemplary in terms of investor relations best practice and translating into equity market receptivity.”

He concludes, “The AstraZeneca – Deutsche Bank ADR partnership demonstrates our effectiveness to complement the company’s ambition to grow and broaden the US investor base, whilst executing one of the largest M&A transactions using ADRs as an acquisition currency in 2021.”

Figure 2: Summary of the medicine business model

Source: AstraZeneca

Sources

1 See "The personal touch" at flow.db.com

2 See astrazeneca.com

3 See astrazeneca.com

4 See astrazeneca.com