28 January 2025

Japanese pharma company Takeda embarked on its in-house banking journey as early as 2008. Assistant Treasurer, Fiona Foley and Treasury Operations Lead for EMEA and Canada, Andreas Schollenberger tell flow’s Desirée Buchholz why the team’s attention is now turning to Asia-Pacific – and how on-behalf-of structures are a big lever for efficiency

MINUTES min read

Being among the front runners is nothing new for Takeda: it was back in 1781 that Chobei Takeda set up a business selling traditional Japanese and Chinese medicines in Doshomachi, Osaka, the centre of the medicine trade in Japan. His small shop bought these from wholesalers, then divided them into smaller batches and sold them on to local merchants and doctors. This business laid the foundation of the present-day Takeda Pharmaceutical Company Limited, headquartered in Tokyo.1

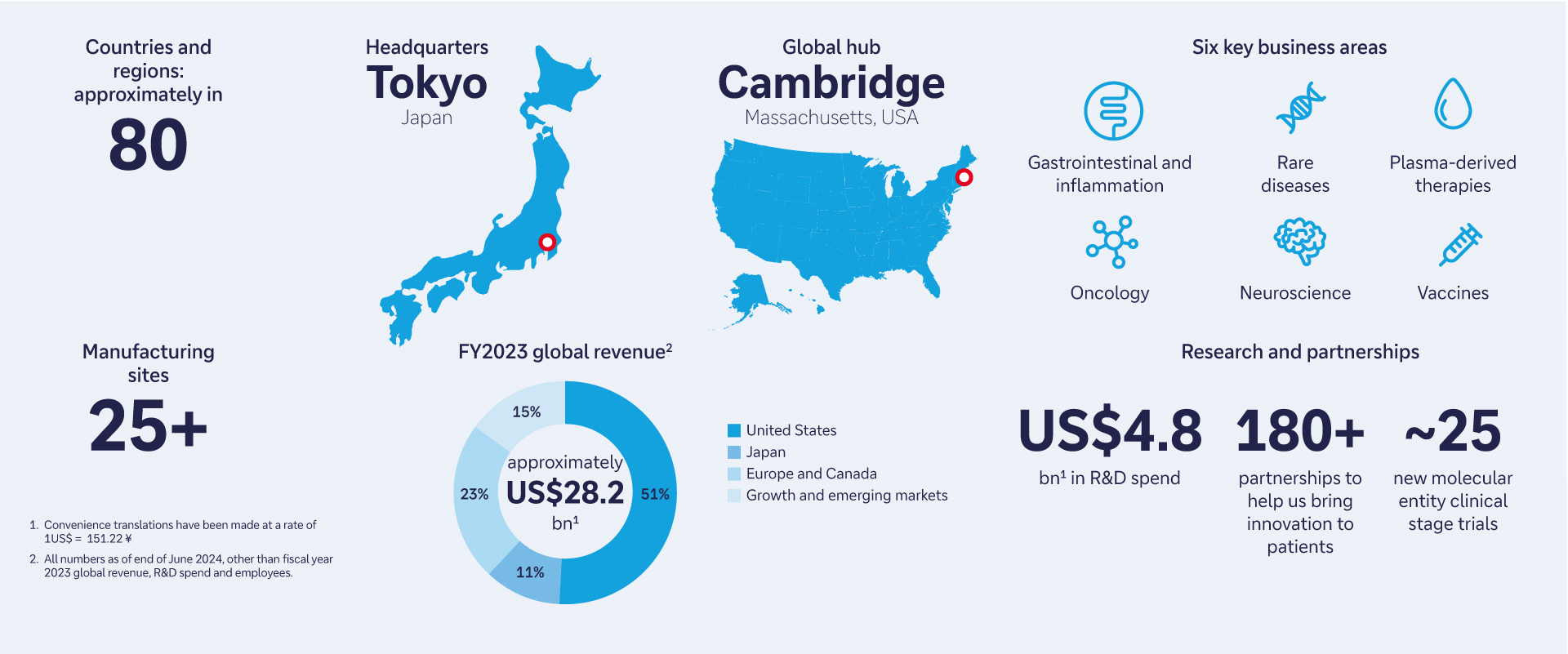

Now, nearly 250 years later, Takeda has grown into a US$28.2bn company, ranking among the 15 largest pharma players by turnover globally.2 With approximately 50,000 employees across 80 countries and regions, the company operates in six business areas: oncology, rare diseases, neuroscience, gastroenterology, plasma-derived therapies, and vaccines. In FY2023, more than half of its revenues (51%) came from the US, 23% from Europe and Canada, 11% from Japan, and 15% from growing and emerging markets in Asia-Pacific and Latin America (see Figure 1).3

Within treasury, Takeda has been an early adopter of new approaches. As early as 2008 the company recognised the value of centralisation and automation and began to set up an in-house bank (IHB). At the time, this concept was mostly confined to European multinationals and only a few companies in APAC had investigated IHBs.4 This flow case study explores the drivers and how Takeda aims to take its IHB to the next level.

Figure 1: Takeda in numbers

Source: Takeda

How M&A shaped treasury at Takeda

As is typical for the pharma industry, M&A activity has contributed much to Takeda’s growth over recent years: In 2011, the company bought Switzerland’s Nycomed, helping to expand its business in Europe and emerging markets.5 Eight years later, Takeda landed another major deal by acquiring Irish-based Shire for US$62bn, which was one of the largest deals ever in pharma history.6

These two acquisitions also significantly shaped Takeda’s treasury set-up. The team now operates out of three locations in Tokyo (Takeda headquarters), Zurich (where Nycomed was based) and Dublin (where Shire was based), explains Fiona Foley, former Head of Treasury Operations and Assistant Treasurer at Shire who now holds these roles at Takeda. “In treasury, we follow a three-pillar approach that is linked to activities, but is also reflected in the regions,” she tells flow. This comprises:

- Capital markets team: responsible for all new funding activities, managing the debt portfolio and rating agency relationships, based in Tokyo;

- Financial risk team: managing all financial risks, such as FX, interest rate, credit and counterparty risks, as well as trade finance and bank guarantees, based in Zurich; and

- Treasury operations team: looking after global cash management, intercompany liquidity, cash pooling and centralisation, cash forecasting and investments, based in all three regions.

Next to these three pillars, the pharma company has a treasury solutions team based in Łódź, Poland and Tokyo which supports the middle and back-office activities.

“The treasury operations team is the largest pillar comprising 13 out of the overall 21 treasury specialists at Takeda,” Foley adds. In addition to global cash management, the team is also responsible for treasury projects and spearheaded the implementation of the treasury management system (TMS) by Kyriba, which was introduced shortly after the Shire acquisition.

Takeda's implementation of Kyriba Treasury was done in a modular manner over three years, with the first phase focusing on standardised bank connectivity and increased cash visibility. The second phase focused on the instrument modules to integrate investments, risk management (FX, interest rate and counterparty risk) and manage the debt portfolio and capital market activity. Payments were then implemented as final phase.

Evolution of Takeda’s in-house bank

With its centralisation efforts dating back to 2008, the company did not need to start from scratch. “Our IHB journey began with a bank tender for our European cash management,” recalls Andreas Schollenberger, Treasury Operations Lead for EMEA and Canada at Takeda. Deutsche Bank won the business for southern and mid-Europe, thanks to its “well-established technical capabilities and transparent fees”, he continues: “Deutsche Bank has been a trusted partner for us ever since.” Cash management for the Nordics was awarded to Nordea.

Following the bank tender, Takeda began to introduce its IHB structure in a four-step approach:

- Phase 1 encompassed the incorporation of deposits and liabilities into Takeda’s SAP enterprise resource planning system (ERP), enabling intercompany (IC) payments to be performed internally rather than via external bank transfers – that was much more cost efficient. This also included IC invoice netting, FX exposure consolidation and the implementation of a cash pool structure.

- In Phase 2, Payments-on-behalf-of (POBO) was introduced for selected local entities and Collections-on-behalf-of (COBO) via SEPA direct debit for a very limited set of entities.

- Phase 3 was centred on consolidation of US and Japan regions into the one IHB (including POBO) and by doing so eliminating inefficiencies in the current design and enabling greater automation.

- Phase 4 will extend IHB/POBO capabilities to countries and entities not previously in scope as well as broadening the use of COBO for current and future participating entities.

“Today, just over 100 entities globally participate in our in-house bank”

In terms of regions, Takeda launched its IHB in Europe – with a Swiss entity as “owner” and European entities as participants. There was a separate IHB for US and one in Japan. “In the past, these three regions were technically disconnected in SAP,” recalls Foley. “But now at the start of 2025 we have almost completed the integration of these into one IHB for Takeda to allow for more straight-through-processing and less manual work.”

Key achievements so far

“Today, just over 100 entities globally participate in our in-house bank”, explains Schollenberger. This not only includes Europe, US and Japan as already mentioned but also Canada, Mexico, Australia, New Zealand, and most recently Singapore – but more on this later. “With 87 entities we do POBO and six are on COBO.” 90% of intercompany payments are now managed via the IHB and approximately 92% of global cash is centralised into Treasury entities. After the Shire acquisition, Takeda held more than 1,000 bank accounts globally – a figure which the treasury team managed to cut to less than half that number thanks to the integration of the Shire entities and inclusion in the IHB where possible.

“With our IHB structure, treasury has greater visibility and access to cash around the group”

The benefits are clear: “With our IHB structure, treasury has greater visibility and access to cash around the group – which is particularly critical with rising interest rates where strategic use of all available cash is key. We have also seen a significant reduction in international bank fees and transaction costs after the introduction of the IHB with better controls and centralised risk mitigation”, says Foley. The service level agreement (SLA) signed by each entity onboarded also covers cross-border intercompany lending and borrowing.

Moreover, FX exposure management is easier to identify and manage and there are advantages from a governance and compliance point of view, given that central treasury is now in control of payments and liquidity – rather than the local entities. “If you just look at the time we spend working through treasury related topics with entities that are part of the IHB and those that are not, the business case quickly becomes clear,” she adds.

While undertaking such a prestigious and time-consuming project abroad may seem unusual at first sight, it is fairly typical for Asia-headquartered companies to start IHB structures in Europe. This is because many markets in APAC have tax requirements, capital controls and other regulations in place that prevent a free flow of cash and payments cross-border.

“We conduct a thorough legal and tax due diligence to evaluate whether an entity can participate in an IHB run out of Zurich,” says Schollenberger. Takeda has local operations in 13 countries and regions in APAC, but in many – including for example Thailand, Vietnam, Indonesia – the “reality is that we are restricted to add them to our IHB,” adds Foley. “If things were to change, we would like to onboard more entities. This not only applies to APAC but also to Latin America and the Middle East.”

Extending the IHB to Singapore

As briefly mentioned above, Takeda’s latest IHB venture includes Singapore, which is one of the company’s main Asian hubs. In 2015, the pharma firm has established its regional headquarters for growth and emerging markets (GEM) there. Singapore also hosts Takeda’s only biologics drug substance manufacturing facility in Asia. It supplies several markets globally including countries in the European Union (EU), the US and Japan.7 Hence, many cross-border intercompany payments take place between Singapore and Takeda’s global entities – which creates a big lever for the IHB.

The IHB project in Singapore kicked off in mid-2023, recalls Schollenberger: “We already had three of the four entities in Singapore on the IHB but only for cash investments. Payments were still managed locally, and we wanted to streamline those too.” That’s why the company opened a central Singapore dollar (SGD) account at Deutsche Bank Singapore designated to execute SGD payments on-behalf-of all local entities.

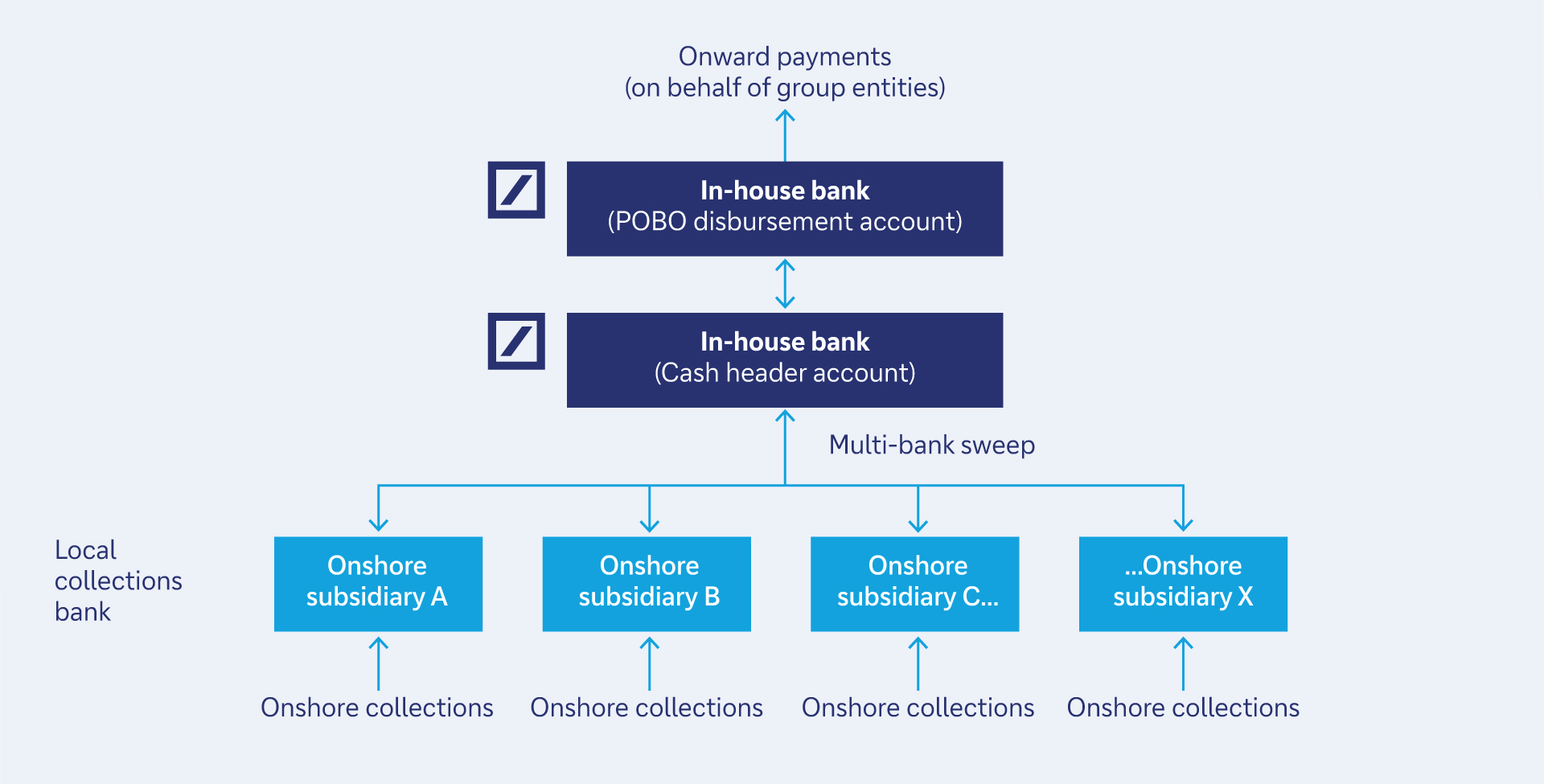

These payments are funded through an automated multi-bank sweep arrangement from Takeda’s existing local collections bank to the central Deutsche Bank SGD account. It builds on a two-way target balance and is accompanied by intraday and overdraft facilities to ensure smooth payment processing throughout the day (see Figure 2).

Figure 2: IHB workflow in Singapore

Source: Deutsche Bank

But why did Takeda not opt to move all accounts to one bank and close the others? This would allow for even more efficiency and a faster implementation, given that it would not have been necessary to coordinate the process with two banks. “You need to explain and demonstrate the benefits of an IHB to the local entities. It can be complex when there is a significant volume of activity on local accounts which would be impacted,” explains Foley. “This is why we went for the quick win, which meant getting the connection to the IHB up and running without causing any disruption for the local team. We will now look to streamline further over time.”

The new POBO structure in Singapore went live in December 2024 – and while Schollenberger feels it was challenging to incorporate third-party bank accounts in the set-up managed by Deutsche Bank, he mentions that “little to no documentation was required for applicable affiliates participating in the SGD POBO set-up, which also allows the structure to be quickly scaled/replicated for new entities in future”.

Asked what Takeda’s treasury function might look like in another five to 10 years, Foley admits that this is not a timeframe she plans in. “In the fast-paced pharma industry with all the activities on the M&A front, plans can change overnight.” Yet, looking at the priorities for 2025 and 2026, she points out a few things: the roll out of POBO for Japan, leveraging increasing standardisation of payment formats to centralise POBO further and continued focus on integrating fraud protection to the payment process and the broader adoption of COBO globally.

“COBO is the one area in IHB that we still don’t leverage as much because its introduction would involve more time and work for the local finance teams; for example, when it comes to communicating changes to customers,” she reflects. The five countries in which Takeda’s IHB collects money on behalf of its subsidiaries are all in the Single Euro Payments Area (SEPA) where cross-border collections are comparatively easy due to a harmonised set of rules. Yet, COBO allows for further cash centralisation – and will therefore definitely be on Takeda treasury’s agenda going forward.

Sources

1 See takeda.com

2 See fiercepharma.com

3 See assets-dam.takeda.com

4 See theglobaltreasurer.com

5 See reuters.com

6 See takeda.com

7 See tbcdn.talentbrew.com