11 June 2025

Following the Polish Presidency of the Council of the European Union for the first half of 2025, flow reports on the country’s meteoric economic growth over the past three decades, its attractiveness to investors, and its diversified merchandise and services trade position

MINUTES min read

Since its transformation into a market economy in 1989, Poland has emerged as an exporting beacon of Central Europe. Sharing a border with seven countries – including Germany, Russia and Ukraine – and several major seaports along its Baltic Sea coastline, it is highly integrated into global supply chains, with its strong distribution networks making it one of the most popular destinations in Europe for foreign direct investment (FDI).

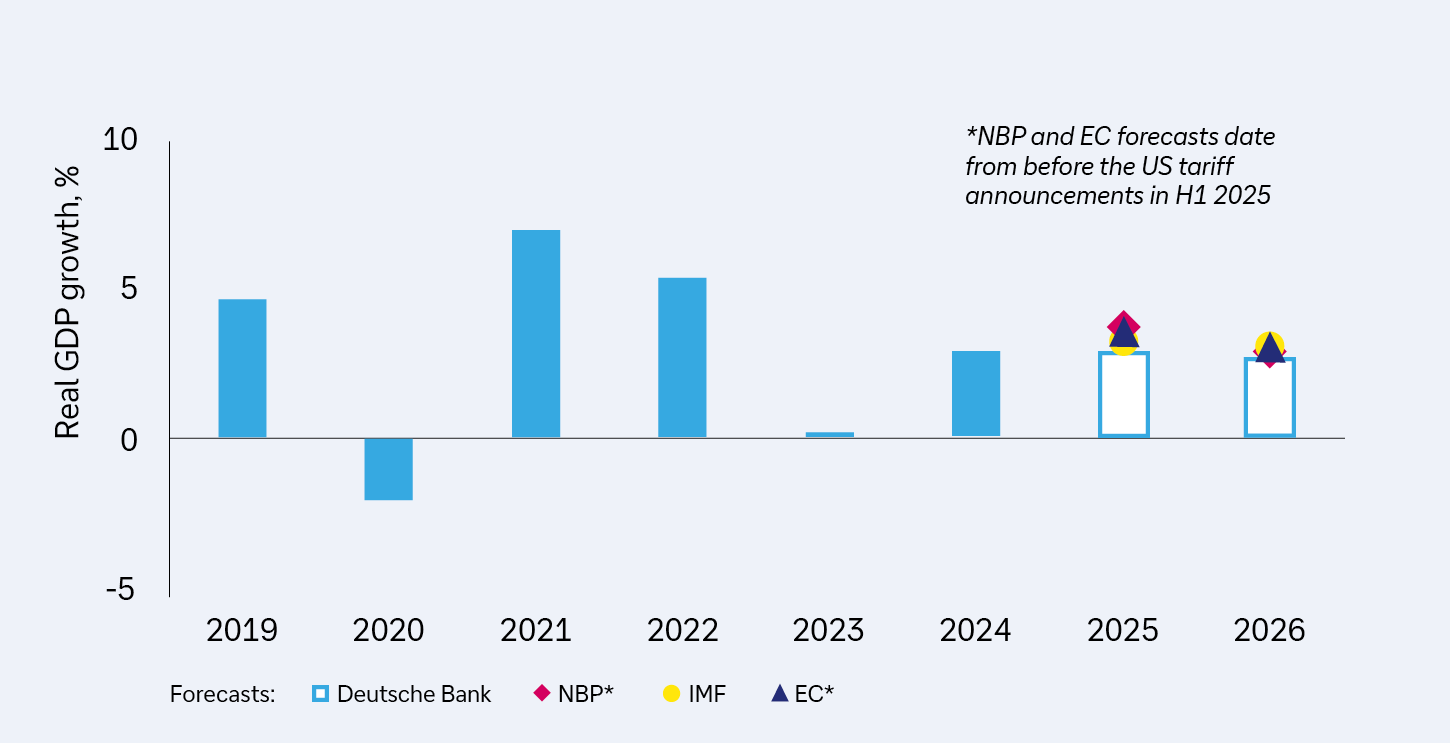

Now a parliamentary republic with a population of more than 38 million, Poland is the sixth-largest economy in the EU, with GDP of US$908bn and 2.9% GDP growth recorded in 2024 (see Figure 1).

Figure 1: Poland’s GDP growth

Source: Deutsche Bank Research

Having joined the EU on 1 May 2004, Poland has experienced dynamic economic growth, bringing its level of development significantly closer to the EU average, and has positioned itself as an ideal base for companies looking to establish themselves in Europe, enabling efficient trade and logistics across the continent. Private consumption is the key driver of the Polish economy, supported by wage growth, falling inflation and increased social transfers. Investments, both public and private, also contribute to this growth, including those implemented under the National Recovery and Resilience Plan.1 Long-term challenges for Poland include a shrinking working-age population, relatively low innovation in the economy, and the need for green and digital transformation. The effective use of EU funds and increased spending on research and development remain very important.

CEO Tomasz Kowalski heads Deutsche Bank Polska, and makes the point that the Polish Presidency of the Council of the European Union (Poland holds the office for the first six months of 2025) is “taking steps to strengthen the competitiveness of the EU economy, focusing on integration of the internal market, simplification of regulation and support for geopolitical stability in the region”. He adds, “The Polish Presidency has constantly emphasised the importance of – and fought for – support for Ukraine. Accordingly, the topic of Ukraine is on the agenda of every Economic and Financial Affairs Council meeting.” Poland has significant trading ties with Ukraine and is its second largest trading partner after China.

Investor attraction

Poland offers an open and investor-friendly environment with a fast, transparent and fully digitalised company registration process that is also accessible to non-residents. Competitive corporate tax rates, research and development incentives, the IP Box regime (a tax regime where profits from innovative activities are taxed at reduced rates) and preferential conditions for startups enhance its attractiveness, while special economic zones provide additional tax exemptions.

The Polish banking sector, adds Kowalski, “remains one of the foundations of the country’s economic stability and is one of the most technologically advanced in Europe; recognised for its innovation and adoption of cutting-edge technologies”. It is also the second most popular destination for companies to establish service centres, behind only India.

Trade and exports

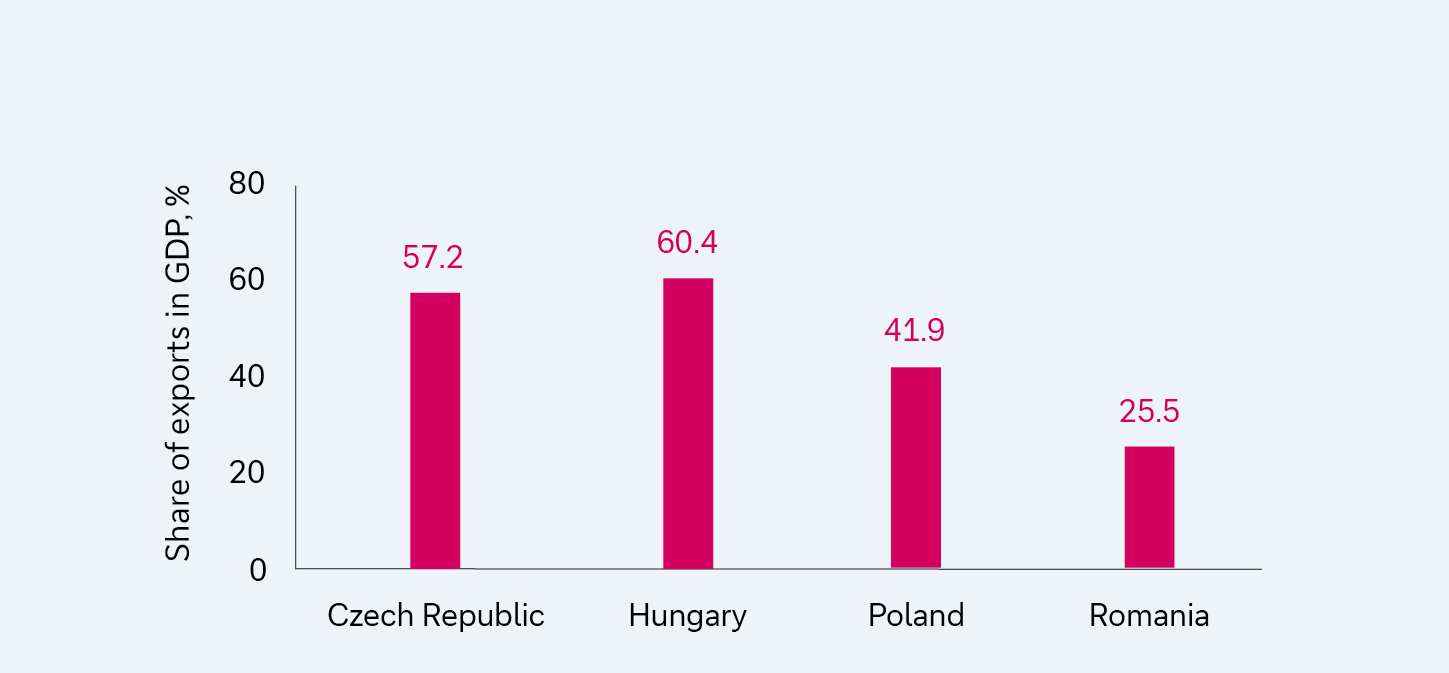

While Poland’s direct exposure to US trade is limited, given the low share of direct exports to the US, it remains a relatively open economy with high exposure to global trade in general. This, say Deutsche Bank Research analysts Twisha Roy and Christian Wietoska in their Insight CEEMEA reports, makes it particularly vulnerable to a trade shock from a global tariff war. They reflect, “The magnitude and scope of tariffs globally have exceeded most expectations and represent a significant shock to global trade”. The smaller, open economies of the CE3, whose GDP is heavily dependent on exports (more so in the Czech Republic and Hungary) “will be left particularly vulnerable to the global trade shock that is unfolding”.

However, they point out that Poland has a more diversified economy and a lower exposure to the auto sector in its export basket, and lower beta to European growth, which provides some resilience. Figure 2 compares the share of Poland’s exports in GDP (a measure of exposure to global trade shock) compared with that of the Czech Republic, Hungary and Romania.

Figure 2: Share of Poland’s exports in GDP compared with the Czech Republic, Hungary and Romania

Source: Deutsche Bank Research

In recent years, Polish-German cooperation has developed dynamically, covering key areas of the economy, energy, innovation and infrastructure. Germany remains Poland’s largest trading partner, accounting for approximately 25% of the country’s trade, and at 16% of FDI (2023) is the country’s largest European investor.

“I believe globalisation is now entering a new phase – its scope is being redefined”

Innovation and strength

Magdalena Rogalska, Head of Corporate Bank and Deputy CEO at Deutsche Bank Polska, notes that the country is “witnessing rapid growth in modern payment services, including instant transfers such as Express Elixir (interbank clearing system) and BLIK (payments network), open banking systems aligned with PSD2, as well as innovative tools for automating bulk and cross-border settlements”.

Regarding the current climate of geopolitical uncertainty she adds, “I believe globalisation is now entering a new phase – its scope is being redefined. To maintain a high level of resilience, economic stability, and security, countries must become stronger and more self-sufficient. Achieving this requires a robust and stable banking system.”

Kowalski develops Rogalska’s point on financial stability: “As part of a strong European financial group, we have great potential both in Poland and abroad in terms of financing innovation, which is known to drive growth. A strong European banking sector also ensures financial stability and adequate risk management.” Part of this innovation drive can be seen in the increasing emphasis Deutsche Bank Polska places on financing renewable energy and sustainability projects. He says, “We are supporting the energy transition, reducing emissions and helping our clients achieve their targets in this area”.

A recent example of this was the bank’s mandated lead arranger role in the non-recourse 25-year project financing for Polska Grupa Energetyczna (PGE), Poland’s largest energy company, and Danish renewables company Ørsted.2