28 January 2025

How could leading Asian economies respond to a more protectionist US trade policy? And what does this imply for corporates in the region? flow’s Desirée Buchholz summarises insights from Deutsche Bank Research Asia specialists

MINUTES min read

2025 is the Year of the Wood Snake in the Chinese zodiac – and snakes are associated with wisdom, calmness, transformation and creativity. “All these traits should be much in demand to navigate the potential volatility in financial markets ahead with Trump 2.0 set to reshape the macro and geopolitical landscape in the US and elsewhere”, write Sameer Goel, Global Head of Emerging Markets & APAC Research, Deutsche Bank Research and Perry Kojodjojo, Asia Macro Strategist, Deutsche Bank Research in their Asia Corporate Newsletter Q1 2025: Welcome Year of the Snake.

The team expects that 2025 in Asia will – at least initially – mainly be driven by preparing for the impact of tariffs that the new Trump administration is anticipated to introduce. According to the Deutsche Bank Research experts, Asia is more exposed to a protectionist US trade policy than other regions for three reasons:

- Several countries in the region have big bilateral trade surpluses with the US;

- Their economies are closely interlinked with China, “which is arguably most at risk of a more ‘strategic’ rather than just ‘transactional’ application of tariffs”; and

- Tariffs are expected to strengthen the US dollar, and many Asian countries have low real rate buffers to deal with a stronger dollar and higher core rates.

This article summarises the key takeaways from the report. It examines the instruments Asian policymakers have available to mitigate the impact of tariffs. It follows a detailed review of the US trade deficit – in particular in relation to China – as discussed in Trump trade – back to the future? and the outlook for the global economy summarised in No trade, no gain?.

Two options for China’s currency policy

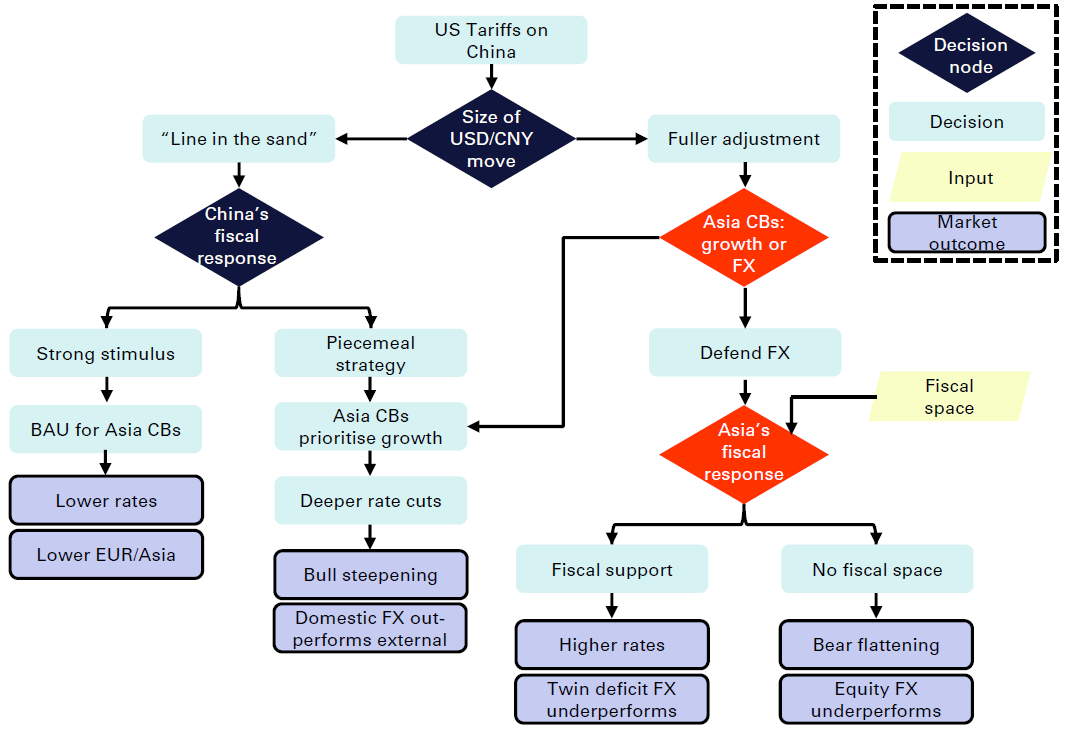

According to Deutsche Bank Asia Strategy Team, the fallout from tariffs can be contextualised as an ‘algorithm’, with the following key decision nodes for Asian economies:

- China’s currency policy choices;

- China’s fiscal response;

- Asian policy preferences between growth and financial/FX stability; and

- the region’s fiscal space/constraints.

Figure 1: The tariff algorithm for Asian economies

Source: Deutsche Bank, Bloomberg Finance LP

Looking in detail at the first node – the scale of the renminbi (RMB) movement – the report explains the two options China’s policymakers can choose from:

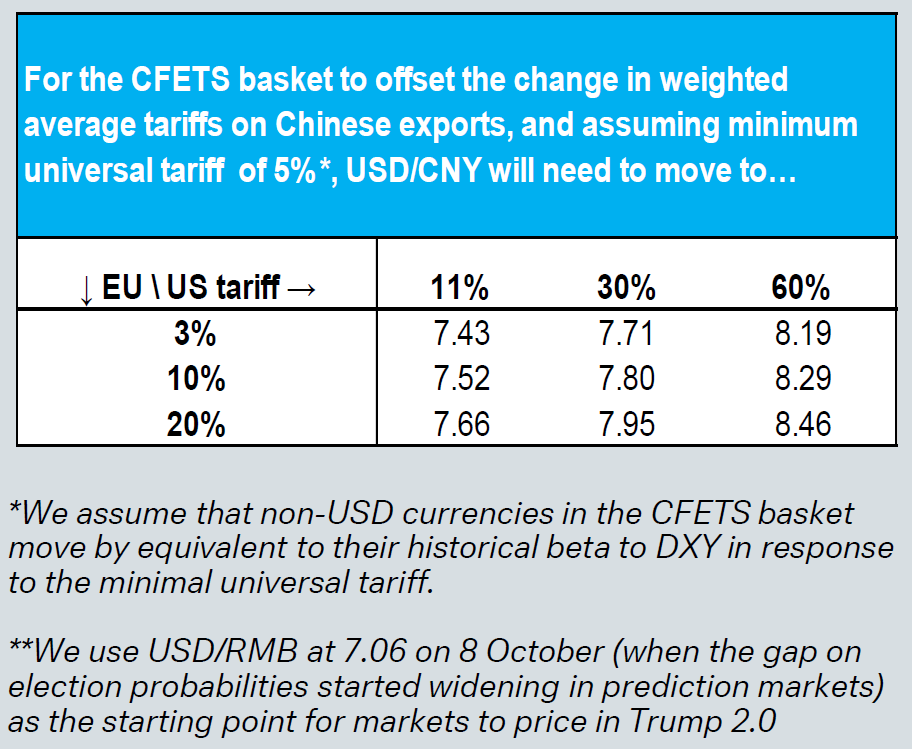

Option 1. Allow for the RMB to fully adjust to the introduction of US tariffs on imports from China. This approach would see a weakening of the RMB by the equivalent trade-weighted index (TWI) amount and therefore minimise the impact on China’s export market share. Figure 2 outlines what the various tariff scenarios would mean for the dollar/yuan (US$/CNY) exchange rate. These results should be thought of more as boundary conditions, with the caveat that potential second round effects from fears of ‘competitive devaluation’ could stretch these boundaries, especially on currencies with greater ‘export similarity’ with China.

Figure 2: Scenarios for the US$/CNY in a full adjustment decision

Source: Deutsche Bank, Bloomberg Finance LP

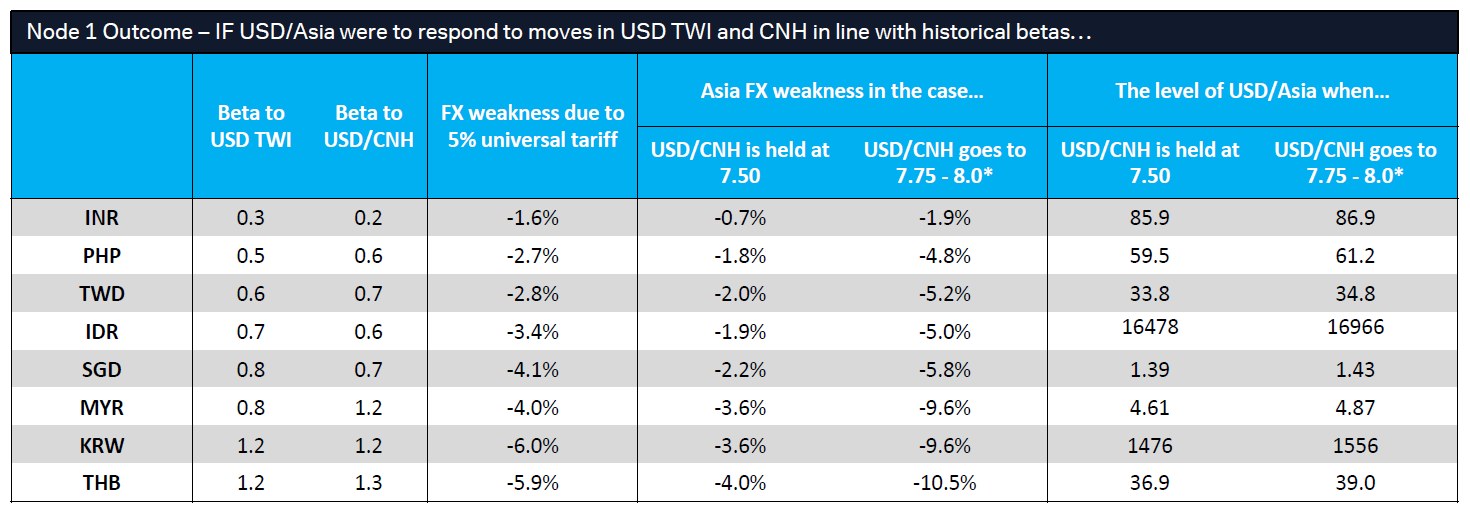

Option 2. Alternatively, China’s policymakers could decide to limit the depreciation of the RMB (“draw a line in the sand” as the authors describe it) to avoid the risk of capital outflows and financial instability. In any case, China's decision will have significant repercussions for the rest of Asia. “The choices China make on FX will impact the pressure on rest of Asia. The pressure on Asian currencies should reflect both (1) a universal minimum tariff; and (2) Asia’s economic and financial exposure to China,” the team writes.

Figure 3: Potential moves in US$/Asian currencies

Source: Deutsche Bank, Bloomberg Finance LP *we use the mid-point for illustration

What will China’s fiscal response look like?

Turning to the second decision node of the tariff algorithm, the report discusses options and anticipated impact of China’s fiscal response. As described in the China Macro: 2025 Outlook Stimulus vs. headwinds, Deutsche Bank Research economists project an increase in the fiscal deficit from 3% to 4% of GDP in 2025, anticipating a 2.7 percentage point (ppt) boost to nominal GDP growth.

“A larger-than-expected fiscal stimulus package could ease depreciation pressure on Asian currencies, potentially creating room for more aggressive interest rate cuts”, Goel and Kojodjojo state. “Conversely, a smaller-than-expected fiscal package could necessitate deeper rate cuts in the region, likely leading to a bull-steepening of the rates curve.”

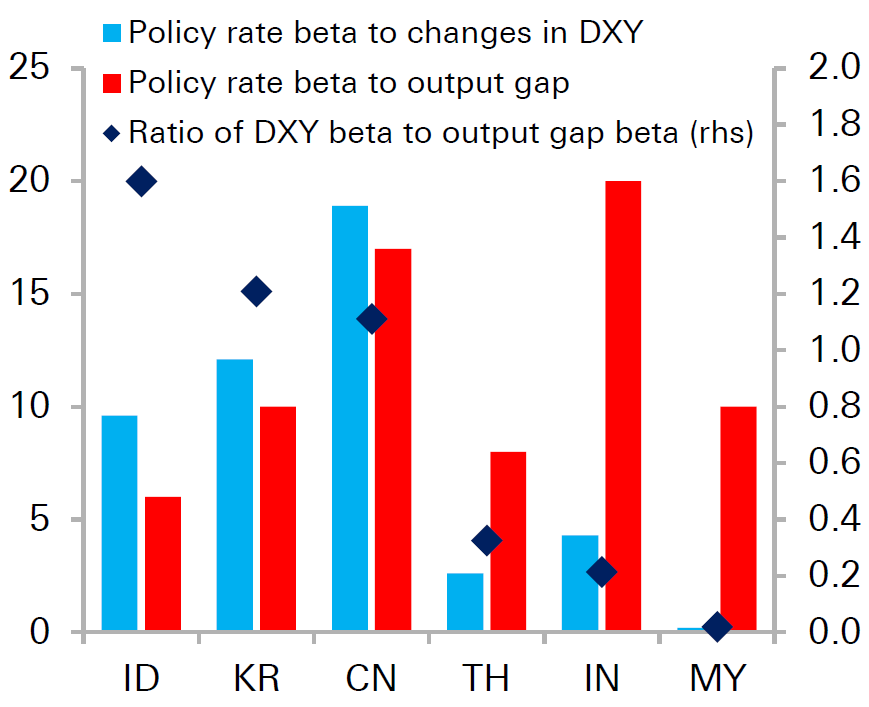

“Central banks in Indonesia, Korea and China tend to focus more on FX over output gaps”

The impact that US tariffs will have on Asian economies also depends on whether governments and central banks in the region prioritise GDP growth (by increasing fiscal spending or cutting interest rates to compensate for the negative impact of tariffs on their exports) or if they choose to defend FX stability (by doing the opposite) – which is the third decision node. “Central banks in Indonesia, Korea and China tend to focus more on FX over output gaps,” the authors note.

Pivotal moment for Vietnam

In general, the more reliant countries are on global trade and the more intertwined their business cycles are with the US and China, the stronger the growth headwinds and the larger the pressure on FX will be – and the balance between growth and FX becomes more difficult. According to data from McKinsey, Vietnam and – to a lesser extent – Malaysia, the Philippines, and Thailand have become “connectors” between the US and China and therefore more exposed to global trade and potential US tariffs. In the case of Vietnam, the value of imports from China doubled from 2017 to 2023 —an addition of US$50 bn—and its exports to the United States increased by US$60 bn.1

The Deutsche Bank Research report echoes this premise that while China is “in the eye of the tariff ‘storm’”, 2025 could also prove pivotal for Vietnam. According to the data, the country benefitted significantly after 2017 from the first round of tariffs introduced between the US and China – in particular in the electronics and consumer markets. On the one hand, China now accounts for roughly 30% of Vietnam’s foreign direct investment (FDI) inflow. On the other hand, approximately 40% of all ASEAN exports to North America now originate in Vietnam. “Given Vietnam's trade surplus with the US is the third largest, it is more vulnerable to the threat of possible tariffs from the incoming US administration,” Kojodjojo writes.

Ultimately, the question of whether Asian economies will support growth or defend FX also depends on their fiscal space, which determines to what extend they are able or willing to increase public spending – the fourth decision node in the tariff algorithm. “Most of Asia has sufficient degrees of freedom here,” the team writes. “Philippines, Korea, India and Malaysia are the furthest away, but the latter three have favourable demand-supply dynamics, which should allow for fiscal expansion.”

Figure 4: Room for fiscal spending in Asia

Source: Deutsche Bank, CEIC, Bloomberg Finance LP

Deutsche Bank Research report referenced

Asia Corporate Newsletter Q1 2025: Welcome Year of the Snake by Sameer Goel, Perry Kojodjojo, Vaninder Singh, Bryant Xu, Joey Chung, Jalaj Singh, Lachlan Dynan, Michael Hsueh, Liam Fitzpatrick and Hazel Lai