5 December 2024

flow reflects on the seismic changes in the economic world order over the past 12 months, drawing on insights from the Deutsche Bank Research latest Outlook. The focus around inflation and rate cutting remains, centred on the scale of potential US tariffs following the decisive Republican victory on 5 November

MINUTES min read

A year ago, in flow’s ‘Outlook for 2024 – the race against time’, a US recession loomed, growth elsewhere was all but stagnant, and the battle with inflation raged on. The findings were drawn from the end-of-year Deutsche Bank Research report by Jim Reid, Global Head of Macro Research, and David Folkerts-Landau, Group Chief Economist.

Twelve months and after 50 general elections globally, added to a more dovish stance from key central banks, the world looks rather different. By the third quarter of 2024, the US Federal Reserve had expressed greater confidence that “inflation is moving sustainably towards 2%” and made its first interest cut since 2020, some three months after the ECB had led the way.

The financial and geopolitical world then changed dramatically overnight on 5 November with Donald Trump’s election victory and the Republican sweep in Congress, wrote Reid and Folkerts-Landau in their latest World Outlook, Navigating Trump 2.025, published on 25 November 2024. In their view, this does suggest an outlook far from “business as usual” but one that opens up a “wider range of outcomes for the global economy and financial markets”. These range from a potentially “much more positive US outlook on the one hand, to a much more negative European outlook on the other”.

Their base case for 2025 is “stronger US growth and inflation and a higher Fed terminal rate than previously expected with the opposite conditions for Europe”. This outlook is driven by the assumption of modest US tax cuts, a strong deregulation push, and more supportive financial conditions. On trade they are assuming a 10 percentage point (pp) increase in the tariff rate on imports from China during H1, rising up a further 10pp in H2) and an equalisation of tariff rates on motor vehicles with Europe. Their forecast also assumes a 5% universal baseline tariff, though that is more likely to be implemented late 2025/early 2026.

“Our base case for 2025 is stronger US growth and inflation ... than previously expected with the opposite conditions for Europe”

This article shares key takeaways in their global macroeconomic outlook for 2025 drawing on country analysis from the respective Deutsche Bank Research economics teams.

US

While there is no doubt that the Republican sweep of the 2024 US election promises to bring “transformative changes to the policy landscape”, details about the exact timing and parameters around the policies “are highly uncertain”. Reid and Folkerts-Landau expect shifts in fiscal and trade policy will “provide crosscurrents to the growth outlook (a theme of the flow article, Trump trade – back to the future).

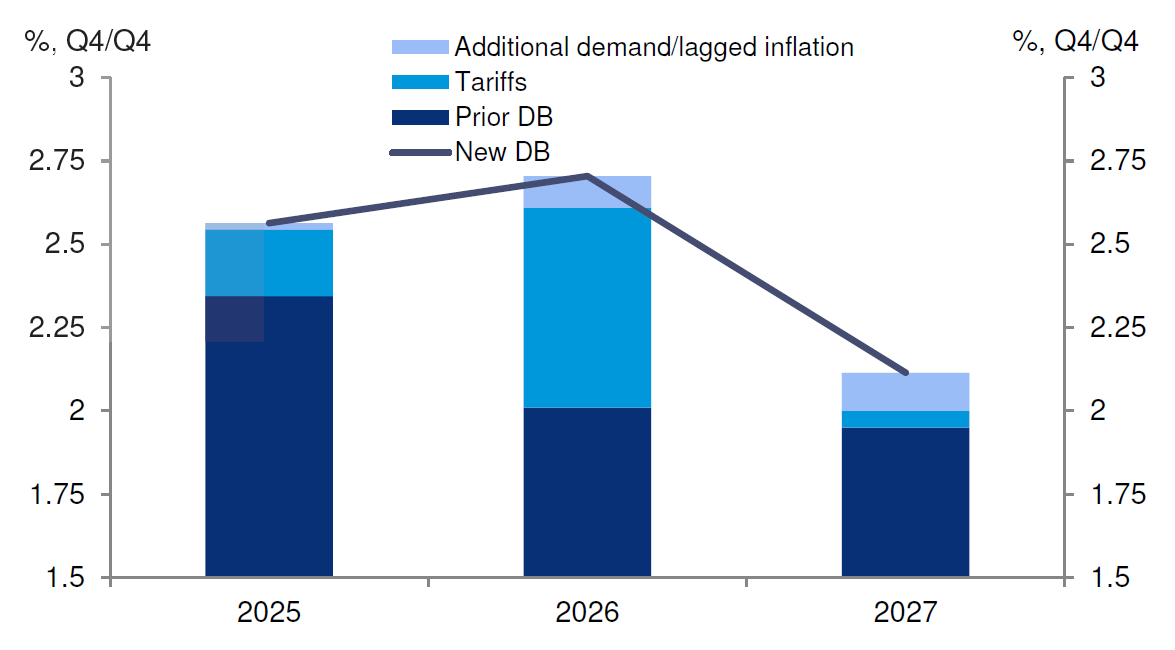

Figure 1: Inflation forecast revision mostly due to tariffs

Source : BEA, Haver Analytics, Deutsche Bank

The most likely scenario, notes the US Deutsche Bank Research economics team is that modest tax cuts, a strong deregulation push, and more supportive financial conditions “will produce faster growth in 2025” under the new administration – the rate now estimated at 2.5% for 2025 (Q4/Q4) rather than their previous forecast of 2.2%. But after 2025, the adverse effects from the trade war and the anticipation of a more restrictive monetary policy setting have trimmed their growth estimates. “This policy mix will stall progress on inflation, with core PCE expected to remain at or above 2.5% over the next two years, leading the Fed to undertake an extended pause,” they explain.

Euro Area

Overall European economic picture

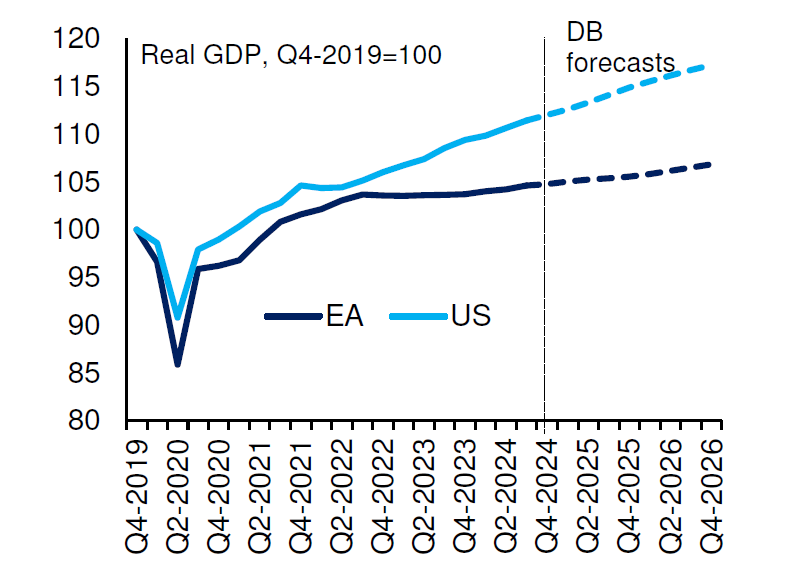

Figure 2: US-EU GDP divergence is set to grow in 2025

Source : Deutsche Bank, BEA, Eurostat, Haver Analytics LP

While the US star has been in the ascendant, a clear gap has emerged in the relative performance of European economies since the onset in 2022 of the Russia/Ukraine conflict and resulting energy shock, notes Deutsche Bank’s European Research team. In their view, the policy stance of the incoming US Administration is “likely to reinforce this gap in 2025”.

While growth was positive in 2024 – “an improvement after the stagnation of 2022–23” – the real income-driven consumption recovery was, reflect the team, “slow to materialise”. They explain that “growth has been largely export-led, and as such vulnerable to external shocks like US tariffs”. But the monetary policy doves look here to stay, and they add, “inflation has been declining more rapidly in recent months and the ECB is at least on course to removing policy restriction by mid-2025”.

“Structurally, there is a significant and growing challenge,” continues the team. The world is changing. More frictional geopolitics is exposing the vulnerability of the EU’s trade-based economic model,” continue the team, and US tariffs look set to reinforce this.

Germany

With Germans going to the polls in February 2025, the team anticipates that policy responses from the Euro Area’s largest member “are unlikely to be felt until 2026...leaving policy accommodation likely resting on the ECB’s shoulders in 2025”. The team point out that the Germany economy is likely to finish 2024 with a slight contraction “for the second year in a row”. This is, they add, “not so much a cyclical recession as a structural stagnation that started well before the pandemic”. As for 2025 they anticipate 0.5% annual growth with a meaningful recovery on hold until 2026. This will “require more expansionary fiscal policy and effective supply side reforms under the next government,” notes the team.

UK

The UK Autumn Budget on 30 October saw “historic spending increases and a historic increase in investment” but large increases in taxation “will hit private demand”. In short, “higher taxation, higher inflation, lower employment, and lower wage growth will result in a smaller real disposable income growth uplift than previously anticipated, and likely crowding out some business investment plans”. Inflation, which in October rebounded from 1.7% to 2.3% is predicted to rise to 2.9% in 2025, “given administrative tax changes, the national living wage (NLW) hike, and the pass-through of higher employer national insurance contributions (NICs)”, before returning to the 2% target in 2026.

Asia

Japan

Over the next two years, according to the report, the team see “a domestically driven recovery in the Japanese economy, fueled by wage growth exceeding inflation”. Based on currently available information, they believe “uncertainties surrounding overseas economies will not materially impact Japan”. Inflation, excluding the effects of government stimulus packages, should remain around 2%. In this context, the team anticipates a Bank of Japan (BoJ) policy rate hike to at least 1% in fiscal year 2025 (i.e., by Q1 2026). But this is not guaranteed – “The uncertain political landscape, both domestically and internationally, could influence BoJ monetary policy,” they add.

China

China's growth has improved following the implementation of expansionary macroeconomic policies, notes the China team.

While the property market downturn, now in its fifth year, shows tentative signs of lifting with sales rebounding sharply in the past two months in both new and secondary home markets; the large inventory of unsold housing continues to depress prices. The China team notes that “while uncertainties remain very high, we think the most likely outcome is a ‘muddle through’ scenario for 2025, with prices continuing to fall, albeit at a slower pace, and new home sales rising modestly, thanks to improved housing affordability and government policy support, including through downpayment and mortgage rate cuts, housing inventory purchases, and urban renewal projects”.

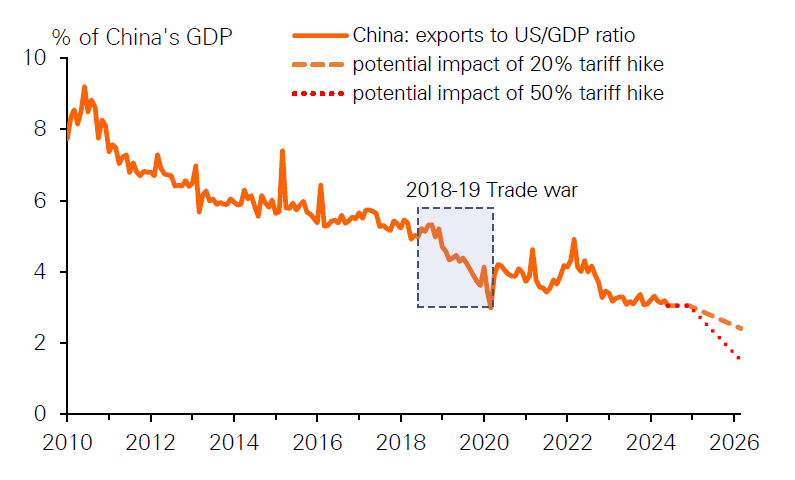

Figure 3: How a trade war could impact China’s GDP

Source : Deutsche Bank Research, IMF

The China outlook highlights the risk of renewed US-China trade tensions under the second Trump administration. “Our baseline projection assumes phased US tariff hikes on Chinese goods: 10% in the first half of 2025 and another 10% in the second half. This gradual approach aims to minimise disruptions to US growth and inflation.” However, the team points out that the negative impact on China is estimated at “no more than 0.5% of GDP because exports to the US only account for 3% of China’s GDP now”, and the impact of tariff hikes “will be mitigated by exchange rate adjustments and trade reorientation to non-US markets”. But should a severe trade war unfold with the US hiking tariffs of 50% on China and 10–20% on the rest of the world, the team warns, “China’s growth could fall to around 4% in 2026”.

India

The beacon of global growth in recent years has been India and although growth is slowing, the Deutsche Bank Research economists still believe it will be at 6.5% in 2025 and 2026, “which would necessitate some monetary policy support, particularly against the backdrop of sustained fiscal consolidation”. The team are forecasting a reduction in CPI inflation to average 4.1% in 2025 vs. 4.9% in 2024 and 5.7% in 2023.

Based on this growth-inflation mix, “we now expect one 25 basis points (bps) repo rate cut in Feb 2025, followed by another 25bps cut in April 2025. With July to September 2024 real GDP growth surprising sharply to the downside (5.4%yoy actual vs. Bloomberg consensus estimate of 6.5%yoy), they think a front-loaded rate cutting cycle is warranted to stabilise growth in the 6.5-7.0% range. The cumulative effective rate cut could be higher at 75bps, as the Reserve Bank of India allows short-term rates to possibly drift 25bps below the repo rate at some stage in 2025”.

The report notes that during 2024, in terms of bilateral trade, China (US$118.4bn) surpassed the US (US$118.3bn) marginally in terms of bilateral trade to become the largest trading partner of India – China and the US are India’s two largest trading partners, and the US is India’s biggest export partner with a 17.7% share in total exports. “Increased tariffs on India’s exports under Trump 2.0 could slow down the exports momentum and prove to be a drag on growth,” notes the report.

Deutsche Bank Research report referenced

World Outlook: Navigating Trump 2.025 by Jim Reid, Head of Global Economics and Thematic Research, and David Folkerts-Landau, Group Chief Economist and Global Head of Research, Deutsche Bank Research (25 November 2024)

Country contributors quoted: Matthew Luzzetti and Team (US;) Mark Wall and Team (Euro Area); Robin Winkler and Team (Germany); Sanjay Raja (UK); Kentaro Koyama (Japan); China Yi Xiong (China); and Kaushik Da (India)