7 December 2023

With elections looming in many key economies next year, and a hawkish year from central banks in the face of inflation, how is the 2024 economic landscape shaping up? Drawing on insights from Deutsche Bank Research flow reports on a delicate balance between recession and growth – with regional nuances

MINUTES min read

The year ahead will see the US edge into mild recession during H1 while the eurozone languishes in a period of stagflation already underway. But longer term, artificial intelligence (AI) promises to ride to the rescue and offers brighter prospects for global economic growth.

This is the basic message from Deutsche Bank Research’s 27 November 2023 Economics World Outlook publication, 2024 Outlook: The Race Against Time which, noted newswire CNBC, offers “a considerably bleaker prognosis than market consensus”.1 Yet rather than being unduly pessimistic the bank’s senior analysts, Jim Reid, Head of Global Economics and Thematic Research and David Folkerts-Landau, Group Chief Economist Global Head of Research, have a knack of calling it correctly.

As flow noted in Inflation genie drivers and Inflation: where next? early in 2021 both sounded an alarm that central banks were too sanguine about the risk of resurgent inflation at “uncomfortable levels”. And as Fortune magazine commented the day the Deutsche Bank Research was published, “In April 2022, with the Ukraine war in its early stages and inflation raging near a four-decade high, Deutsche Bank became the first major investment bank to predict a US recession …Folkerts-Landau argued the rise of inflation would ultimately force the Federal Reserve to rapidly hike interest rates – ‘to err on the side of doing too much’ – sparking a ‘mild’ recession by late 2023 or early 2024.”2

The authors reference these earlier warnings in the report. “Over the last two to three-years we’ve had a fairly consistent macro narrative, viewing this as a classic policy-led boom-bust cycle that would culminate in a US recession towards the end of 2023. We think our narrative still holds,” they write.

“Monetary policy famously operates with lags which are highly uncertain in their timing and impact. A US recession before this point would have been early historically relative to the start of the hiking cycle.”

A race against time

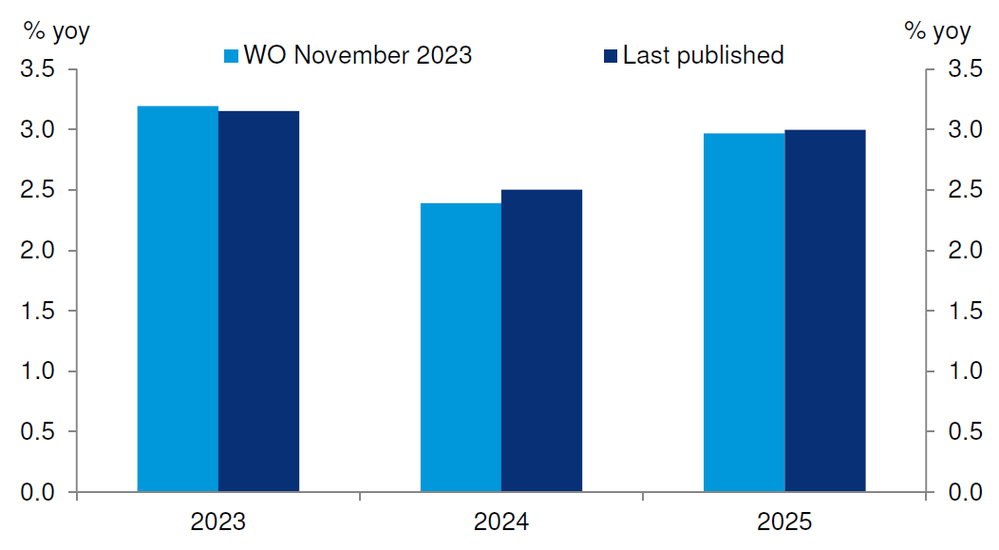

Figure 1: Deutsche Bank World Real GDP growth forecasts

Source: Deutsche Bank

In October, the International Monetary Fund (IMF) forecast that global economic growth would slow from 3.5% in 2022 to 3.0% this year and 2.9% in 2024, well below the historical average of 3.8% for the years 2000 to 2019. The IMF expects the US to achieve growth of only 1.5% next year, against 2.1% in both 2022 and 2023 while the eurozone falls from 3.3% in 2022 to only 0.7% this year before edging back to 1.2% in 2024.

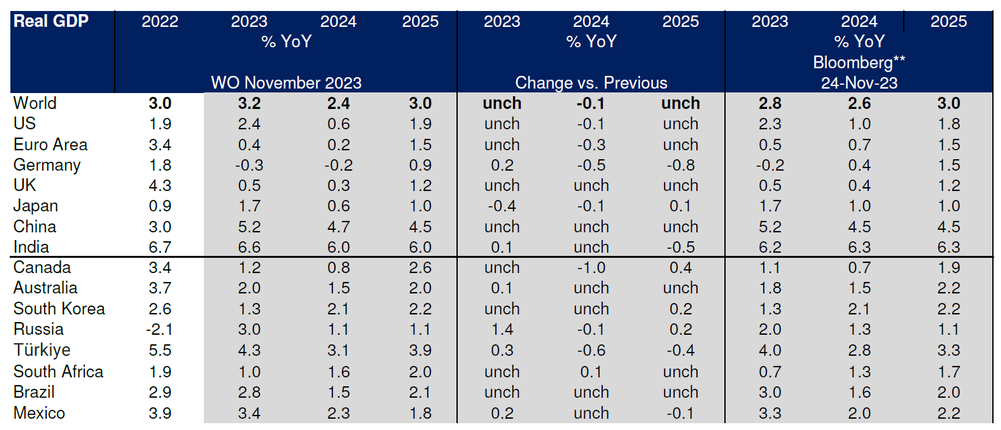

Less upbeat are Deutsche Bank’s analysts, who expect a bigger fall for global economic growth, from 3.2% in 2023 to only 2.4% next year “with 2.5% seen as the upper bound of being deemed to be in a global recession.” Even this slower pace of global growth depends on major contributions from the biggest emerging markets (EMs), with India forecast to grow by 6.0% and China by 4.7%.

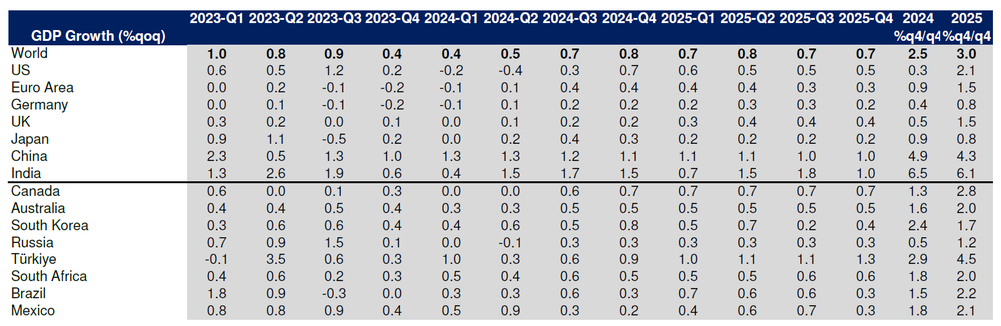

By contrast “the lag of policy” identified by Reid and Folkerts-Landau will, they believe, trigger a mild US recession in H1 2024, cut next year’s GDP to only 0.6% from this year’s estimated 2.4% and see the Federal Reserve respond with 175 basis points (bps) interest rate cuts from the current 5.25-5.50% range. Its northern neighbour, Canada, performing only slightly better with 0.8% growth, still surpasses projections for every other G7 economy. “Although that is still positive and the profile improves through the year, it means the major economies will be more vulnerable to a shock as they work through the lag of this most aggressive hiking cycle for at least four decades.”

Figure 2: Deutsche: Bank GDP forecasts and changes from previous published numbers with consensus included

Source: Bloomberg Finance LP, Deutsche Bank

For the eurozone, they see 2024 GDP growth at a meagre 0.2%. “The Euro Area is on course for nearly two years of stagnation by mid-2024 when the recovery slowly starts,” they warn and the European Central Bank (ECB), which in September hiked its deposit rate to 4% – the highest since the euro’s launch in 1999 – “will likely cut 100bps from June to year-end (YE) 2024.” On 17 November, just before Folkerts-Landau and Reid published their research, Germany’s 2024 growth was downgraded around half a percent to -0.2% following a Constitutional Court ruling on the country’s so-called “debt brake”.

“Non-linearity risk that can turn a mild downturn into a deeper recession remains high”

Referencing the report’s title, the authors write “The race against time narrative refers to the fact that funding has dried up or tightened considerably over the last couple of years for various parts of economies as rates have risen. Can lending standards loosen, and can yields fall, quickly enough to avoid a funding accident that could see contagion? Non-linearity risk that can turn a mild downturn into a deeper recession remains high.”

A soft landing?

Since the report appeared, estimated US economic growth for Q3 2023 was revised upwards on 30 November by the US Bureau of Economic Analysis3 from an already impressive 4.9% to 5.2%, encouraging the view from many analysts that the Federal Reserve can achieve its target of a “soft landing” in 2024 as inflation continues to slow but recession is averted.

Reid and Folkerts-Landau are less convinced. As they observe, “We only saw what is likely to be the last Fed hike in the cycle in July (ECB in September), likely closing out the most aggressive tightening of policy in several decades and made more so when you include the quantitative tightening (QT) still continuing in the background.”

The continue, “In the US, the most recent jobs report showed the highest unemployment rate since January 2022, credit card delinquencies are at 12-year highs, and high yield defaults are comfortably off the lows. At the outer edges of the economy there is obvious stress that is likely to spread in 2024 with rates at these levels.” Deutsche Bank Research US Chief Economist Matt Luzzetti, who also anticipates a mild US recession in Q1 and Q2, expects the unemployment rate to peak at 4.6% by Q3 “which will encourage the Fed to start cutting rates from June 2024” and this cycle to extend into 2025.

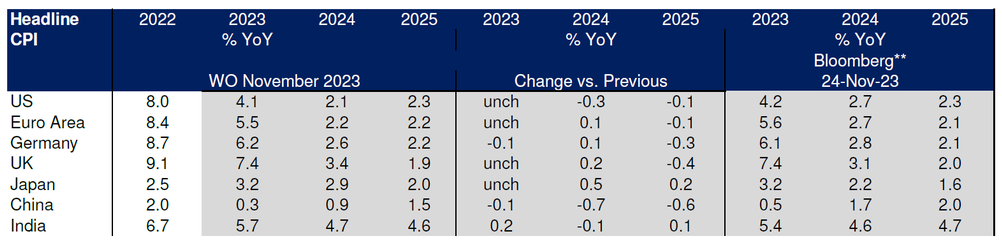

US inflation, which hit a post-pandemic peak of 9.1% in mid-2022, is steadily approaching the Fed’s 2% target as the year-end nears and, on a more positive note, the report states “the team are encouraged by 2023’s progress on inflation that has occurred alongside a steady loosening in labour market conditions. So, they would acknowledge the upside risks if this trend continues. In addition, US fiscal policy has been easier than expected. This may be one reason why the US is feeling less drag from the monetary tightening to date.”

Figure 3: Deutsche Bank: CPI forecasts and changes from previous published numbers with consensus included

Source: Bloomberg Finance LP, Deutsche Bank

In the Euro Area, the outlook is clouded by the economic woes of Germany, the region’s biggest economy. Mark Wall, Deutsche Bank’s Chief Economist, Europe “believes we are currently in a mild recession in H2 2023 that will stretch into the start of 2024, but the reality is that Euro Area growth has stagnated since Q3 2022 and looks set to do so until mid-way through 2024. So that will mean we will have had nearly two years of near zero growth by then even if there hasn’t been a major slump lower,” the report states.

The EU’s level of GDP is estimated as €500bn below its pre-pandemic trend by mid-2024, which explains Europe’s poor business sentiment, although growth should finally resume in H2. But with core inflation forecast at 2.1% in 2025, still slightly above the ECB’s 2% target, rate setters will be “relatively cautious in cutting rates. Our team currently sees the first ECB cut in June and 100bps in total in 2024 with a further 100bps in 2025”.

Looking to Asia

Figure 4: Deutsche Bank quarterly real GDP growth forecasts for key economies

Source: Deutsche Bank

Growth prospects for the world’s third-biggest economy are similarly conservative, with the team agreeing that Japan’s central bank will abandon its yield curve control (YCC) policy as early as January 2024 and growth expected at around 0.5% “attributable mainly to faster wage growth and the continuation of an accommodative monetary policy framework.” Core inflation excluding energy should drop below 2% by H2 but bottom out in the upper 1% range.

China, which post- pandemic has increasingly marched “to a different drum” has seen this year’s disappointing economic data “met by much stronger macro and administrative support in H2” with the benefits likely to emerge in 2024. The Chinese government is likely to seek a growth target at “above 4.5%” but this depends on support being maintained. “Assuming such support arises, our team sees China’s CPI inflation rebounding to 0.9% in 2024, from 0.3% in 2023.”

“The Indian economy will double in size by the end of the decade”

This leaves India as again the star performer in 2024 “even if the lag of monetary policy and a global slowdown leads to a dip from an expected +6.6% YoY in 2023 to +6.0%.” The April/May election is key and underpins “our economists’ prediction that the Indian economy will double in size by the end of the decade” against an estimated 20% expansion for the European economy over the same period.

Technology

Aside from the number crunching, the report also considers the potential impact of two other factors – artificial intelligence (AI) and geopolitical risk. The team notes that technology notably helped to prop up equity markets in 2023 “and longer term the prospect of a material bump in productivity via AI is an enticing prospect”. This, they explain, could potentially boost US productivity well above 3% by the end of the decade.

While 2024 is probably too early for the full force of the technology to be unlocked, the performance of the so-called “Magnificent Seven” tech stocks has helped ease financial conditions in the past 12 months and offered a degree of support for growth. “So can this continue in 2024?” the report asks. “That would be an upside risk to our forecasts. The scale of the medium-term productivity story is one that we will explore in greater depth in 2024 as it could be crucial to our longer-term assumptions on all things macro.”

Geopolitical risk

Geopolitical risk has resurfaced in recent years and the authors warn “the potential hotspots are increasing with interlinkages that could see them build into something that markets would find less easy to shake off”.

The report reflects that this could be more of a multi-year trend rather than building towards a specific 2024 turning point event. However, the peace dividend that has been operating for the last few decades “is fraying at the edges” and goes on to explain that the macroeconomic effects already emerging include:

- A changing pattern of global foreign direct investment (FDI) flows; and

- The growing popularity of ‘near-shoring’ as reflected in rising inflows into locations such as Poland, Romania and Mexico; and

- The ‘China plus one’ strategy explaining similar trends into Vietnam.

2024 will also be a year of elections including – but not only in – Taiwan, India, Europe (European Parliament), the UK and US. As the authors note: “One thing that is guaranteed to create massive market headlines is the US election. As it stands, its set to be a fraught polarised campaign. By the summer of 2024 this could be the biggest story in financial markets with potentially huge market and policy implications.”

At the time of writing, the team see the US election as most likely “a replay of the contest between Presidents Biden and Trump” with a “highly uncertain outcome” and the potential for a split Congress when the number of seats in play for each party is factored in. “We would suspect that either presidential candidate would push for more fiscal measures, Biden via spending increases on social items and Trump on extending the 2017 tax cuts. We anticipate both candidates would also continue to pursue recent strategies towards China. However, they will draw sharp distinctions on other key policy issues such as support for Ukraine and Israel, trade partnerships, immigration, environmental and domestic social issues,” they conclude.

It's going to be an interesting 2024.

Deutsche Bank Research report referenced

2024 Outlook: The Race Against Time... by Jim Reid, Head of Global Economics &Thematic Research and David Folkerts-Landau, Group Chief Economist Global Head of Research, Deutsche Bank