18 October 2023

The global economy has now reached a “decisive moment” Chief Economist David Folkerts-Landau writes in the latest House View from Deutsche Bank Research. flow’s Desirée Buchholz summarises the three key risks the team has identified – and explores what could be a new source of growth

MINUTES min read

For years it has seemed as though the global economy is moving from one crisis to the next: as growth was still recovering from the Covid-19 pandemic, the Russia/Ukraine crisis hit. In parallel, the geopolitical tensions between the two largest global economies – the US and China – intensified and inflation reached levels last seen 40 years ago. Consequently, central banks pursued their most aggressive tightening cycle in a generation.

Now, the main central banks “have likely reached their respective terminal rates,” writes David Folkerts-Landau, Chief Economist of Deutsche Bank writes in his foreword to A cloudy mountain top, the October House View from Deutsche Bank Research. “In turn, markets experienced one of the sharpest rises for long-dated borrowing costs in decades, and yields have broken out of the bull-market trend that had been ongoing since the 1980s.” According to Folkerts-Landau, the “months ahead will prove critical” for the future development of the global economy and its markets.

In summary, Deutsche Bank Research’s team has identified three key risks for:

- renewed inflationary pressures;

- stagnation; and

- elevated geopolitical risks.

Key risk 1: renewed inflationary pressures

Although there has been good progress on fighting inflation in the US and parts of Europe, the team expects inflation to remain “firmly above target in both the US and Europe”. In the euro area, wages, administered prices and oil prices could drive inflation higher in 2024.

Brent crude oil price exceeded the US$90 per barrel (bbl) level in September. While prices have since come down slightly, supply tightening by large oil producing states is expected to provide price support. Saudi Arabia and Russia recently announced that they will continue voluntary output cuts to year end to maintain current pricing.1

“We are in desperate need of a new source of growth”

Moreover, data from the Climate Prediction Center and the US National Weather Service, shows that there is now a 71% chance that this year’s El Niño disruption will be a strong one. Historically, this climate pattern in the Pacific Ocean that can affect weather worldwide, is “correlated with higher inflation as a result of higher commodity prices”, the team points out.

Key risk 2: stagnation and recession in developed economies

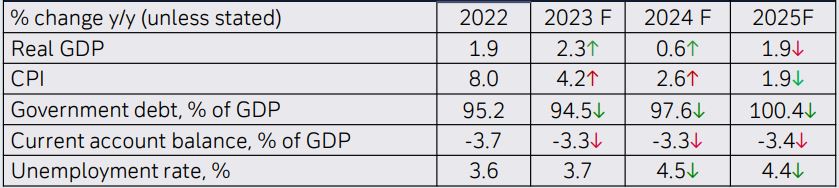

The second risk for the global economy that the team identifies is that no G7 country – namely Canada, France, Germany, Italy, Japan, the UK and the US – is expected to see GDP growth above 0.8% in 2024. For the US, Deutsche Bank Research anticipates a mild recession beginning in Q1 2024, with annual growth forecast to slip next year to 0.6% from 2.3% in 2023 (see Figure 1). Yet, the team points out that America’s labour market has remained fairly strong and “if it were to stabilise over the coming months, a soft landing could become our base case”.

Figure 1: Outlook for the US economy

Source: Deutsche Bank Research, October House View

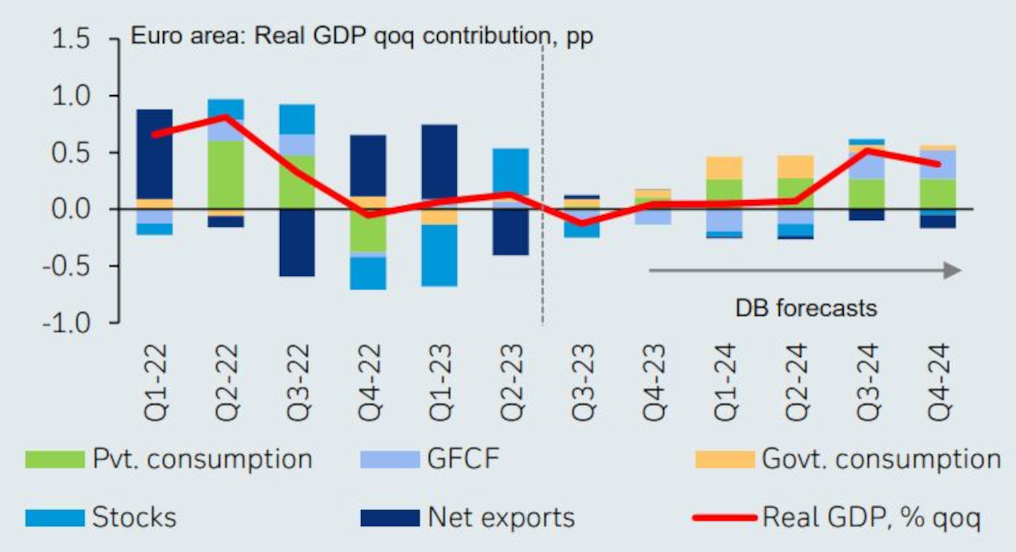

For the euro area, the team expects that an outright recession will likely be avoided – given that declining inflation will lift real income and monetary tightening will have its maximum impact in the second half of 2023. However, current GDP stagnation is anticipated to continue until mid-2024 (see Figure 2).

Figure 2: Euro area growth will remain in stagnation

Source: Deutsche Bank Research, October House View

Turning to emerging markets, there are mixed signals. While the team sees evidence that China’s economic growth bottomed out in July with important macro fundamentals like industrial production, investment, retail sales and trade all recording significant improvement, it still forecasts annual growth to slow from 5.1% in 2023 to 4.7% in 2024. For India, GDP growth is expected to slow from 6.5% in 2023 to 6% in 2024.

Key risk 3: geopolitical tensions

The third key risk for the global economy identified by DB Research’s analysts is ongoing geopolitical tensions: most prominently the friction between the US and China has intensified in recent months. The team highlights three events:

- China’s ban – announced in May – on purchases of semiconductors from US firm Micron2;

- China’s export ban from 1 August on gallium and germanium, two critical materials which are for example used to produce semiconductor wafers, integrated circuits, light-emitting diodes, electric vehicles and solar cells3

- the announced discovery in September of a seven nanometre (nm) 5G-enabled chip in the latest Huawei phone, putting the efficacy of US sanctions into question4.

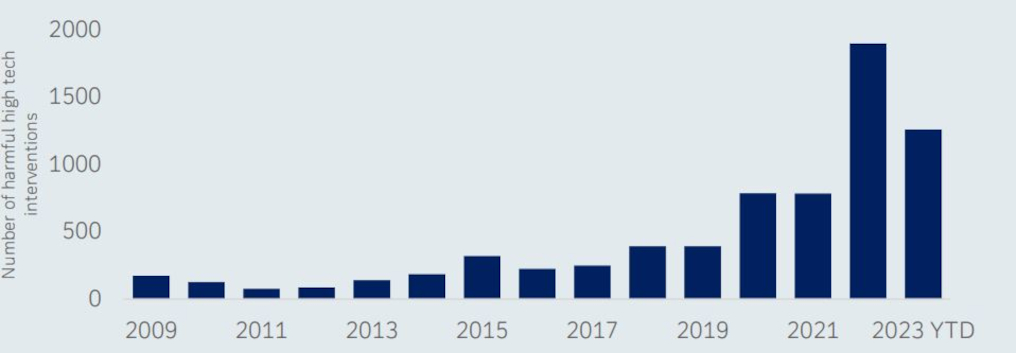

On the back of this, adds the team “we continue to expect the US-China strategic competition to intensify with limited immediate signs of a near term tangible improvement in the relationship”. In the wake of technological decoupling between the US and China, the number of harmful trade interventions has increased significantly over the past couple of years (see Figure 3).5

Moreover, there remains a risk of escalation of conflict in Israel, with the potential for an extended conflict, the team stresses.

Figure 3: Development of harmful trade interventions

Source: Deutsche Bank, World Trade Alert *The high-tech classification combines the high and medium high technology classifications from the OECD's Technology Intensity Classification.

Can AI transform economies for the better?

On the back of these developments, where can future economic impetus come from? “We are in desperate need of a new source of growth given the weak cyclical outlook, declining demographics, and sluggish productivity growth of the last decade,” reflects Folkerts-Landau. He suggests that artificial intelligence (AI) could be the solution that lifts productivity to new levels and boosts growth “significantly in the years to 2030”.

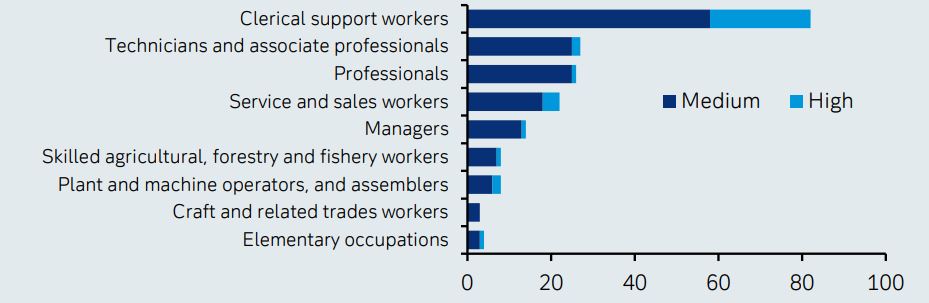

The reason why he is “incredibly enthusiastic about the potential of generative AI to transform our economies” is that AI is not only likely to augment white-collar work, but also clerical support tasks (see Figure 4). This will foster economic development, as – in the past – productivity enhancing technologies have led to long term gains in real wages that, in turn, could foster higher consumption and investment.6

DB Research expects the benefits of AI to materialise from 2024 and to 2030. The fact that AI applications are approaching commercial use is underlined by the number of AI-related IPOs and M&A deals, which has increased every quarter in 2023 to reach 75 transactions in Q3.

Figure 4: How AI will change the labour market?

Source: International Labour Organisation (ILO), Deutsche Bank

In short, as Folkerts-Landau put it, “We have now reached a decisive moment for the economy and markets.”

Deutsche Bank Research report referenced

The House View: A cloudy mountain-top, by Jim Reid, Marion Laboure and Cassidy Ainsworth Grace (with introduction by David Folkerts-Landau), Deutsche Bank Research, 10 October 2023

Sources

1 See reuters.com

2 See nytimes.com

3 See globalpolicywatch.com

4 See bloomberg.com

5 See How the great decoupling impacts global trade at flow.db.com

6 See AI in motion: Tracking the smart money’s journey at flow.db.com

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

TRADE FINANCE, MACRO AND MARKETS, SUSTAINABLE FINANCE

How the great decoupling impacts global trade How the great decoupling impacts global trade

Globalisation is not coming to an end, but a rethink is overdue, Deutsche Bank’s Markus Müller and Marion Laboure argue. flow summarises their thoughts on three acute challenges for global trade: interdependence, technology, and sustainability

Trade finance and lending, Macro and markets

Rare earths – a powerful attraction Rare earths – a powerful attraction

China has dominated the production of rare earth metals – the vital inputs in the clean energy transition as well as military equipment. But this could be all set to change as Western economies seek greater control of their supply chains and to reduce their dependence on rivals, explains Deutsche Bank’s Marion Laboure

TECHNOLOGY, MACRO AND MARKETS {icon-book}

AI in motion: Tracking the smart money’s journey AI in motion: Tracking the smart money’s journey

Deutsche Bank Senior Strategist Marion Laboure takes a closer look at the explosion in artificial intelligence (AI) commercial applications by examining patent growth areas