02 July 2021

As inflation moves upwards, central banks continue to assert that the increase is transitory. Yet a return to “uncomfortable levels” is a very real prospect as the US economy undergoes its biggest shift of direction in four decades and others follow its lead, reports flow’s Graham Buck

"US macro policy and, indeed, the very role of government in the economy, is undergoing its biggest shift in direction in 40 years”

On 10 June, the US Bureau of Labor Statistics announced that in May American consumer prices rose at an annual rate of 5%1, the highest figure since August 2008 and up from 4.2% for April and 1.4% in January 2021.

The main contributory factors cited were a 7.3% increase from April to May in the cost of used cars and trucks, pushing the year-on-year rate to 29.7%. That reflected the global shortage of semiconductors, limiting car production and boosting the market for second-hand models. Energy prices were 28.5% higher than in May 2020; the cost of gasoline rising 56% and largely reflecting the temporary demand slump that occurred during the first weeks of the Covid-19 pandemic.

However, according to recent reports2 US consumers can also expect price hikes from companies such as Coca-Cola, PepsiCo, Procter & Gamble, Kimberly-Clarke and General Mills, which are paying more for raw materials and may employ tactics such as reducing product size rather than price rises.

As flow reported in Inflation genie drivers, many regard the Federal Reserve under Chairman Jerome Powell as too relaxed about the risk of post-pandemic economic recovery releasing the brake on inflation. However, an announcement on 16 June3 by the Fed’s Open Markets Committee (FOMC) took markets by surprise. Officials, who in March had indicated they expected US inflation to edge above the targeted 2% level to reach 2.4%, now concede that 3.4% is a more likely figure but maintain that the rise reflects “transitory factors” caused by “greater than anticipated” supply chain bottlenecks.

The Fed’s guidance on interest rates has also changed since March, when no rise in the benchmark interest rate – currently 0% to 0.25% – was projected before 2024. Officials now indicate that two rate hikes could be brought forward to 2023.

Across the Atlantic, Germany’s inflation rate is also rising. The consumer price index for May was up 2.4% year-on-year, the highest figure for October 2018. In its monthly report released 21 May, the Bundesbank reported4 that “in the coming months, the rate of inflation should initially continue to rise slowly” and “could temporarily reach 4%” once an earlier reduction in value added tax ends.

The Bank of England (BoE)5 was similarly relaxed on 24 June when the UK CPI for May moved back above its 2% target to hit 2.1%. Its statement noted that “financial market measures of inflation expectations suggest that the near-term strength in inflation is expected to be transitory” and members of its monetary policy committee (MPC) expect UK inflation to rise above 3% “for a temporary period”.

However, Andy Haldane6, the BoE’s Chief Economist was a dissenting voice. Of the MPC’s nine members, he alone voted at the June meeting for tapering its quantitative easing (QE) programme and warned that upward pressure on energy costs and wage rates caused by key worker shortages could push UK inflation significantly above 3%.

End of an era

While short-lived and modest upticks in inflation might appear to be a price worth paying for enabling economies to repair the damage inflicted by the pandemic, a Deutsche Bank Research white paper suggests bigger, longer-lasting increases. The title of the 7 June publication, What’s in the tails? Inflation: The defining macro story of this decade, shows that its authors fear “uncomfortable levels” of inflation are a very real prospect in the 2020s.7

“US macro policy and, indeed, the very role of government in the economy, is undergoing its biggest shift in direction in 40 years,” write Deutsche Bank’s Chief Economist and Global Head of Research, David Folkerts-Landau, Global Head of Economic Research Peter Hooper and Head of Thematic Research Jim Reid.

The most immediate manifestation of this shift “is that the fear of inflation, and of rising levels of government debt, that shaped a generation of policymakers is receding,” they add. “Replacing it is the perspective that economic policy should now concentrate on broader social goals.

“Such goals are as necessary as they are admirable. They include greater social support for minority groups, greater equality in income, wealth, education, medical care, and more broad-based economic opportunity and inclusion. They should be front and centre of the policies of any government in these times.”

An increased focus on these priorities extends beyond the ongoing expansionary response to the pandemic to policymakers’ other long-term objectives such as combating climate change, tightening the social safety net and efforts to more evenly balance economic and political power between the corporate sector, labour and the consumer.

But the trio stress that central bankers must still prioritise keeping inflation under control despite shifting priorities. A significantly higher rate will make these social goals either harder or impossible to achieve, due to the social costs and greatly expanded debt servicing obligations.

What’s behind the shift?

The aftermath of the 2008 financial crisis paved the way for the current shift in policy, the report suggests. Concerns centred on high and rising levels of sovereign debt and “market fears of peripheral Eurozone countries led governments to pre-emptively move towards fiscal consolidation before bond market vigilantes could force them”.

The resulting austerity worsened as banks and consumers attempted to repair their balance sheets. So low interest rates and asset purchases continued, as economies stagnated and inflation stayed subdued.

Even before Covid-19, this orthodoxy was increasingly questioned. Inequality and lacklustre growth fuelled voter support for populist parties and unconventional leaders. As low inflation continued – although interest rates were also low – economists grew more relaxed about the levels of debt that countries could sustain.

Folkerts-Landau and colleagues say that the pandemic has accelerated this shift in thinking. “Sovereign debt has risen to levels unimaginable a decade ago with large industrial countries exceeding red-line levels of 100% of GDP. Yet, there is little serious concern about debt sustainability on the horizon from investors, governments or international institutions,” they observe.

“Similarly on inflation, the vast majority of central bankers and economists believe any rise in prices away from the historically-low levels of the last decade will be transitory. It is assumed that base line effects, one-offs, and structural forces will continue to suppress prices”.

The end result is that inflation and debt sustainability – two of the biggest constraints on macroeconomic policy – are increasingly seen as no longer binding. In turn, removing them has opened the door to new goals for macro policy, which extend way beyond simply stabilising output across the business cycle.

Fiscal injections are now “off the charts”, just as the Fed’s modus operandi has shifted to tolerate higher inflation, the team points out. And where the US leads, others tend to follow. Even in Germany, known for its reliable fiscal discipline “there is growing support for to reform the constitutional debt brake in order to permit more deficit spending. And although in aggregate the EU’s fiscal stimulus has been more limited than that seen in the US, the arrival of the €750bn Recovery Fund financed by collective borrowing potentially opens the way for further such packages in response to future crises”.

So an unprecedented “coordinated expansionary fiscal and monetary policy” is set to continue in major economies as output moves above potential. Even if some inflation does prove transitory and ebbs away “we believe price growth will regain significant momentum as the economy overheats in 2022,” warns Folkerts-Landau’s team.

The Fed having recently adopted its new inflation averaging framework, they fear it will be too slow to dampen rising inflation pressures effectively, The delay will mean greater disruption of economic and financial activity than would be otherwise be the case when it does finally act. The outcome could be a major recession and “a chain of financial distress around the world, particularly in emerging markets”.

The Covid-19 response

Covid-19, trigger for the most severe economic shock since the Great Depression, has seen US policymakers keen to avoid the mistakes of 2008, when the quantity of US stimulus was insufficient and recovery was needlessly slow. This time around, the sum total of legislated stimulus packages “so far has totalled well in excess of US$5 trillion or more than 25% of GDP, not counting the infrastructure packages in the pipeline.

“The US federal deficit is likely to come in at 14−15% (over US$3trn) of GDP in both 2020 and 2021 and come to rest in the mid-to-high single digit range in the years thereafter. In totality, this is well in excess of the 10% deficit in 2009 (US$1.8trn in 2020 dollars)”.

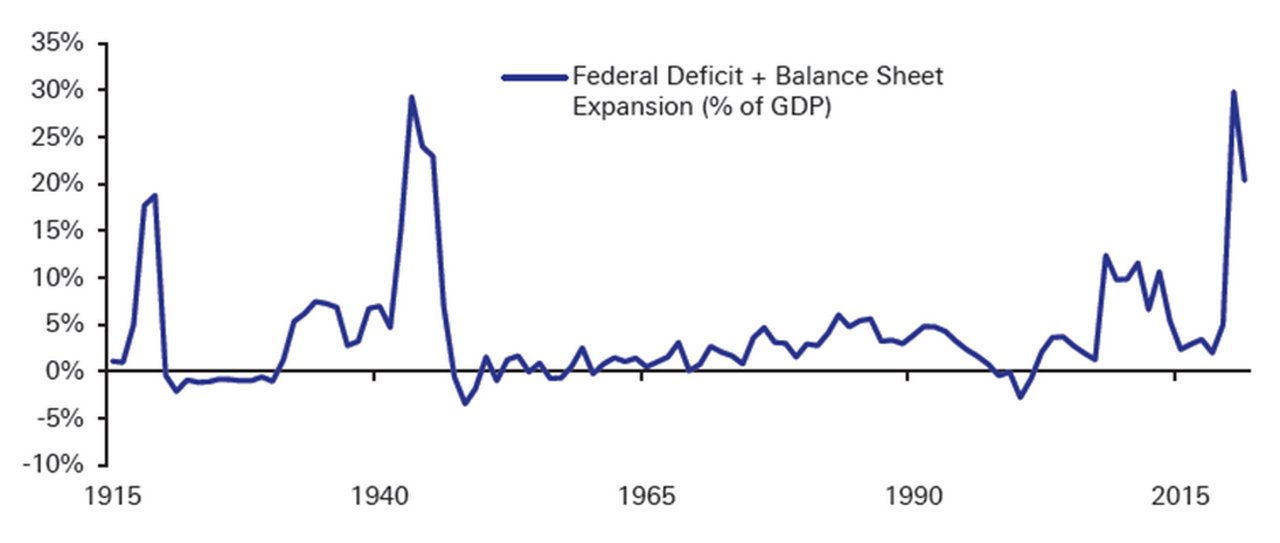

Figure 1: US fiscal and monetary policy has only been as coordinated during World War II

Source: GFD, Deutsche Bank

As summarised in Figure 1, the current fiscal stimulus compares more to that of the World War Two era, when US deficits ranged from 15% to 30% for four years and annual inflation rose to 8.4% in 1946, 14.6% in 1947 and 7.7% in 1948 – after which the economy normalised and pent-up demand was released.

Longer-term forces

The report’s authors warn that after years of very low inflation expectations, the world is ill-prepared for a dramatic shift. “That is especially the case as many asset prices today rely on the monetary policy support of low rates and abundant liquidity that has been a hallmark of the post-2008 world”.

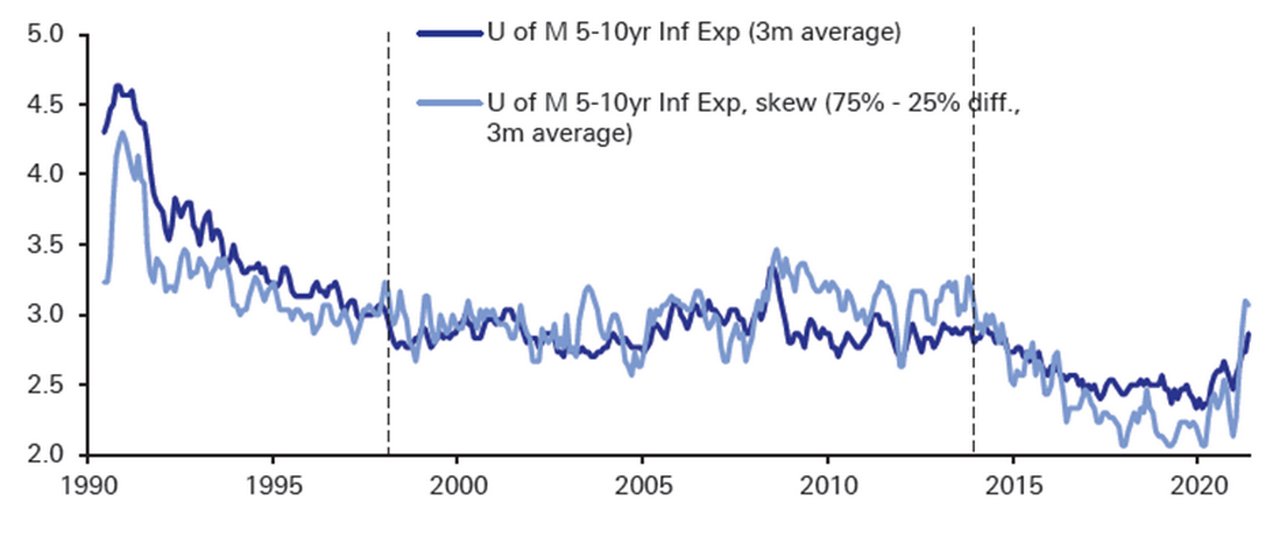

Many sources of rising prices now filtering through might appear transitory, but could feed into expectations – as in the 1970s. “The risk then, is that even if they are only embedded for a few months they may be difficult to contain, especially with stimulus so high”. Figure 2 illustrates how market expectations of higher inflation are already rising.

Figure 2: A jump in inflation expectations

Source: University of Michigan, Deutsche Bank

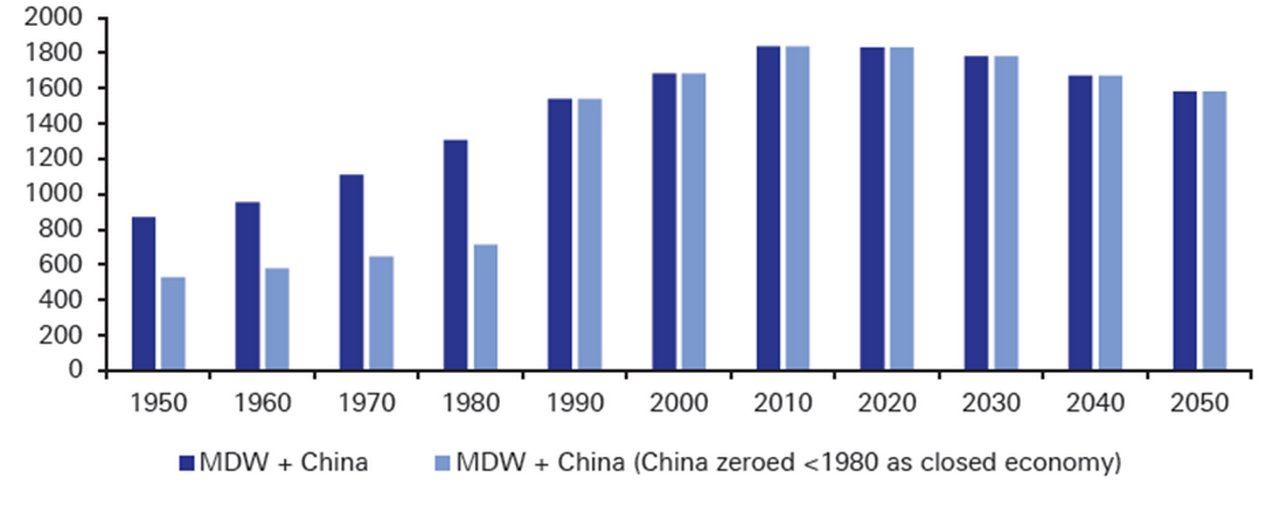

Several longer-term and structural forces fuel those expectations. Since Deng Xiaoping initiated its ‘open door’ policy in 1978, the integration of China and other emerging markets into the global economy has seen the absorption of hundreds of millions of low-wage workers – applying downward pressure on wages and prices in the developed world.

That integration process has now matured. In the years ahead the size of the working-age individuals is set to decline both in absolute terms and relative to the overall population, both in advanced economies and in China. A scarcity of workers will pressure wages upwards (as flow reported in Back to work? the trend is already underway) and, in turn, the prices of goods and services.

Figure 3: The working age population in the more developed world and China

Source: United Nations, Haver Analytics, Deutsche Bank

Waning globalisation could also contribute to lifting inflation. While global trade more than doubled over 50 years as a share of GDP, from 27% in 1970 to 60% in 2019, the upwards growth trend stalled in the 2010s as the political climate moved steadily towards protectionism.

Covid-19 has placed global supply chains under fresh scrutiny, with countries and corporates keen to ensure the resilience of key inputs as geopolitical tensions rise. This could, in turn, lead to a bias for investment in home production, especially in critical sectors such as PPE, drug manufacturing, and semiconductors. But higher production costs will likely result, to be borne by consumers.

And with the 2020s set to be marked by major climate and sustainability investment, the report’s authors anticipate a negative supply shock that prompts wide-scale fiscal spending to reengineer greener economies. “It seems likely that policymakers will increasingly try to price externalities which will increase business costs and ultimately lead to inflation as they are passed on to consumers,” they conclude.

Germany’s big spending

"This “low interest rate/high public debt” equilibrium is fragile, as it crucially hinges on a continuation of low inflation"

“Inspired by the new US fiscal regime to go big, the German election campaign is witnessing an overbidding competition with regard to public investment,” commented Deutsche Bank Senior Economist Sebastian Becker in his 21 June white paper Focus Germany – The return of big government spending: Will this time be really different?

While he supports higher investment in areas such as digitisation, Becker warns that “the current zeitgeist of seeing large-scale deficit financed investment as deus ex machina for all of societies’ problems is shortsighted”. Unless such policies are gradual and balanced, they risk repeating the mistakes of the 1970s; the era of stagflation.

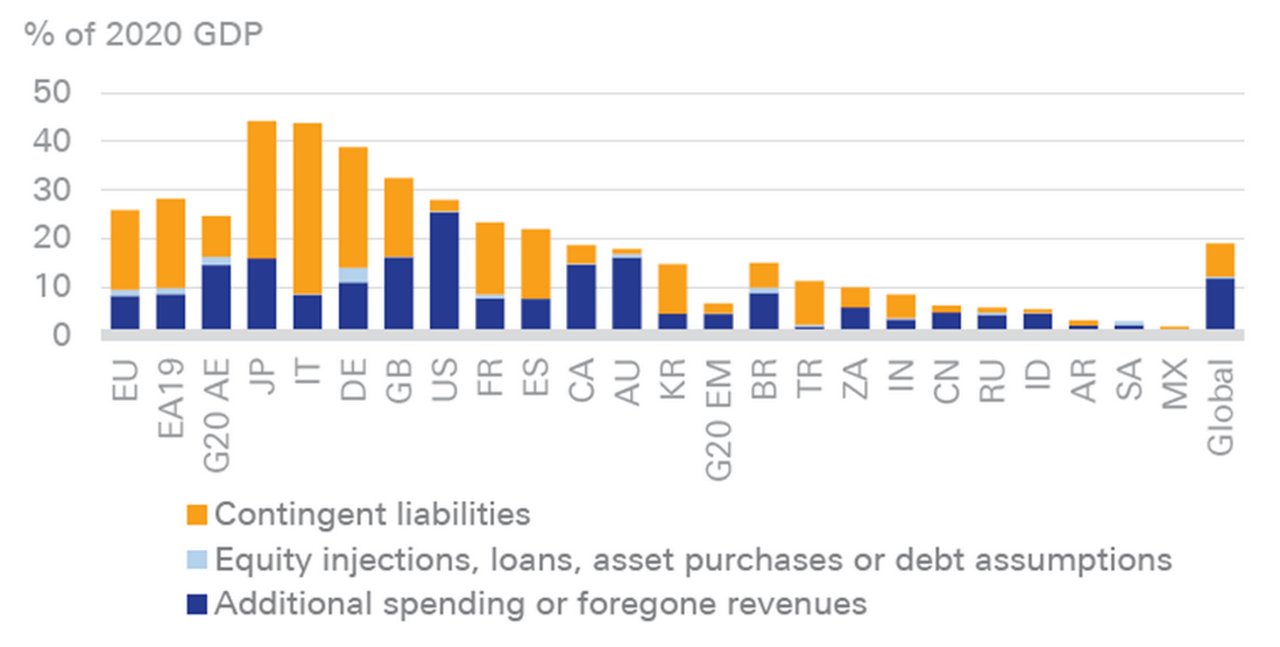

Reviewing total fiscal support worldwide since the pandemic began, the International Monetary Fund estimated (in April 2021) that it has risen to nearly US$16trn (values since January 2020), or no less than 19% of world GDP in 2020. This fiscal support comprises around US$9.9trn (11.7% of GDP) in additional spending and/or foregone revenue as well as US$6.1trn (7.2% of GDP) in liquidity support (e.g. for public equity injections, loans, asset purchases, debt assumptions, and/or state guarantees).

Figure 4: Fiscal measures in response to the Covid-19 pandemic

*since January 2020.

Source: IMF Fiscal Monitor (April 2010), IMF WEO, Deutsche Bank Research

The lion’s share comes from the G20 economies (US$8.5trn or 14.6% of GDP), led by the US (US$5.3trn or 25½% of GDP), followed by the UK (16.2% of GDP), Australia (16.1%) and Japan (15.9%). Further proposed investment programmes could push the US figure even higher to more than US$9trn or over 40% of 2020 GDP.

As governments have opened the “fiscal floodgates” in response to the pandemic, debt ratios have reached new post-war highs in many economies, comments Becker. Although bold fiscal reaction was perhaps inevitable, the trend towards ever higher fiscal deficits and public debt levels is worrying.

“Economic reform fatigue and generally loose fiscal policies in the pre-pandemic era are taking vengeance now in many major economies,” he adds. “Indeed, fiscal deficits and government debt ratios have become ever larger crisis after crisis and the fiscal situation seems to be clearly unsustainable in many high debt economies”. With fiscal buffers largely depleted since early 2020 and a danger that the next crisis will arrive sooner rather than later, “sovereigns seem to have no other option than to consolidate public finances and restore fiscal sustainability after the pandemic has been overcome”.

With their growth prospects weak, restoring debt sustainability seems “a Herculean task” for high debt countries, suggests Becker, but even fiscally prudent countries like Germany face severe fiscal challenges as their populations age. To meet these challenges, governments need to channel more fiscal resources into high productivity spending areas while pursuing essential structural reforms to keep social spending dynamics under control and strengthen people’s incentives to keep working.

“If spent wisely, investment-driven deficits could be conducive to debt sustainability for moderately indebted countries – allowing them to grow out of debt by boosting productivity/economic growth,” he concludes. “By now, record high debt has only remained manageable because of the structural decline in interest rates and de facto debt monetisation by central banks.

“This “low interest rate/high public debt” equilibrium is fragile, as it crucially hinges on a continuation of low inflation. But should inflation rise more strongly and central banks fail to react, things could ultimately spiral out of control. Conversely, slamming on the brakes through rising interest rates and bond spreads could lead to major budget crises, triggering painful downturns over the fiscal adjustment process”. Clearly the insouciance still displayed by the main central banks on the outlook for inflation is becoming less convincing.

Deutsche Bank Research reports referenced

(Both reports are open access and can be downloaded in full)

What’s in the tails? Inflation: The defining macro story of this decade by David Folkerts-Landau, Peter Hooper and Jim Reid (7 June)

Focus Germany: The return of big government spending: Will this time be really different? by Sebastian Becker (21 June)

Just published is UK Economic Notes: Inflation outlook – a little less transitory, a little more persistent by Sanjay Raja (1 July)

Sources

1 See https://bit.ly/2SI8Wj6 at theguardian.com/

2 See https://cnb.cx/3h7S2Uw at cnbc.com/

3 See https://nbcnews.to/3w74vfg at nbcnews.com

4 See https://politi.co/3HzFOhm at politico.eu

5 See https://bbc.in/361sEJo at bbc.com

6 See https://bit.ly/3Ap2T3Y at theguardian.com

7 See flow’s Covid-19 and inflation (May 2020) where Reid highlights bail-out debt history

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS

Inflation genie drivers Inflation genie drivers

Once post-Covid economic growth accelerates, will inflation spiral out of control? flow’s Graham Buck examines current measures and past performances for indicators

Macro and markets, Dossier Covid-19

Back to work? Back to work?

While anti-Covid vaccine rollouts have helped some regions lift coronavirus restrictions, limited access to labour could also limit economic recovery. flow’s Graham Buck and Clarissa Dann review sectors at risk and what this means for employers and governments

TRADE FINANCE, MACRO AND MARKETS

Greening the supercycle Greening the supercycle

Are we heading for another commodities supercycle? One could be forgiven for thinking this was just around the corner given some of the bounce-backs in prices, but ESG priorities and liquidity shortfalls bring different nuances, flow’s Clarissa Dann reports