27 October 2023

In the Q4 Asia Corporate Newsletter, Deutsche Bank Research analysts look at the multiple headwinds impacting the outlook for Asian markets – and provide hedging guidance for corporates with local exposure in Asia, in particular to the Chinese Renminbi

The year thus far has been marked by multiple expected headwinds for developed economies, including a run down in excess household savings, tightening credit conditions and slowing income growth, plus some unexpected ones, such as higher energy prices. The economies have proven relatively resilient to all of this though, and which has raised the likelihood of avoiding a deep correction. Deutsche Bank Research now expects a mild recession in the US and stagnation in Europe.1

What does this mean for Asia? In the Q4 Asia Corporate Newsletter, Editors Sameer Goel and Perry Kojodjojo, together with the Asia strategy team talk about multiple headwinds, including commodity prices and term premia in global curves, but also some rays of hope, including tentative signs of a peak in the global policy rate hiking cycle and a trough in China's business cycle. The team offers recommendations on the likelihood that the US dollar remains strong against a weak renminbi (RMB) in the near term and the risk that interest rates will stay higher for longer than previously forecast.

Past the low point?

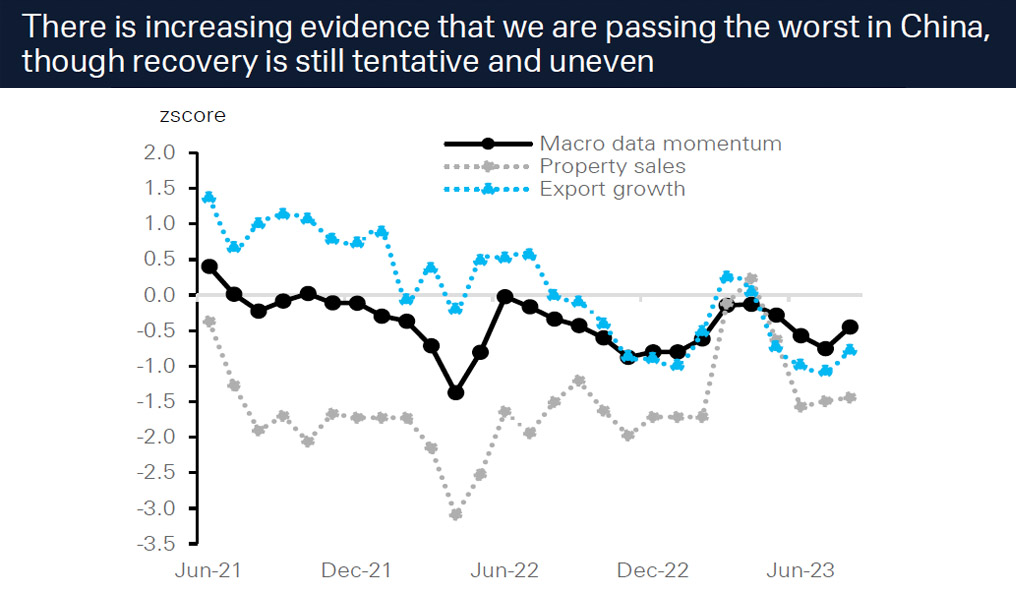

The good news is that there is evidence that China’s economy could be past the worst (see Figure 1). Macro aggregates such as credit, industrial production (IP), investment and retail sales; and from high frequency indicators like car sales, steel inventory and electricity consumption all suggest that it is bottoming out. The team has marked up its forecast for China’s Q3 growth to 4.6%, and for full year 2023 growth to 5.1%. Hindering a stronger revival are a still underperforming private sector and sluggish property sales responding only slowly to policy measures.

“China’s cyclical challenges are compounded by structural headwinds from global de-risking, slowing urbanisation, worsening demographics and the overhang of debt”

Figure 1: China poised for recovery?

Source: Deutsche Bank, Haver Analytics, Wind

China’s 5% growth target “is seen by most as ‘line in the sand’, but will need more policy effort,” they add. The People’s Bank of China will need to do “part of the legwork” to help in pushing the economy out of deflation zone, particularly as short-term business cycle challenges “are being made worse by the more medium-term headwinds including global de-risking, slowing urbanisation, worsening demographics and the overhang of debt.”

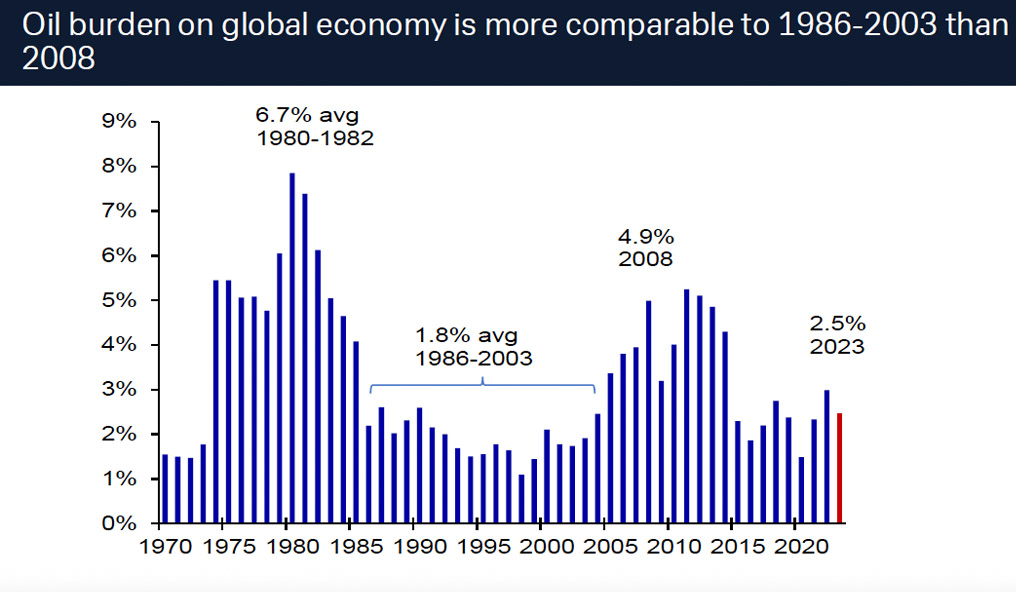

Oil is relatively cheap

Oil might not currently appear cheap, but the team observes that prices this year will likely be 39% below the 2008 average in real terms. Over the same period world energy efficiency in real GDP terms has improved by 17% on a primary energy basis, and 24% on a strictly oil basis, as oil has shrunk from 35% to 32% of the energy mix. Consequently, the burden of oil consumption will be 2.5% of global output this year against 4.9% in 2008, which should mitigate the impact of oil prices on amplifying any cyclical slowing imposed by tighter monetary policy.

Figure 2: Oil is less expensive than in 2008

Source: Deutsche Bank, Haver, Bloomberg Finance LP

What might upset this forecast is the OPEC+ coalition’s recent greater assertiveness in setting production policy. Since President Biden’s overtures to Saudi Arabia in July 2022 and a brief rise last month, OPEC+ production has fallen by two million barrels per day (mmb/d) with the US Strategic Petroleum Reserve’s (SPR) ability to respond to supply disruptions reduced by record withdrawals in response to the Ukraine war. A likely scenario is a fundamental deficit keeping prices above US$90 per barrel (bbl) in Q4, while in 2024 “we expect US and Latin America supply growth to satisfy a large proportion of weaker demand growth”.

The team notes that higher oil prices tend to be (rather counter intuitively) positively correlated with Asian FX over long cycles, which is “more a reflection of both being driven by demand pull reflation expectations. In a supply shock driven push to oil prices, it is more useful to focus on the divergence within the region, and pockets of potential vulnerability”.

Korea and Thailand, the team argues, are the economies most vulnerable to higher energy prices on the back of high pass through to domestic inflation and large fuel trade deficits as a percentage of GDP, while Philippines and India have the least buffer from non-energy current account balances.

Net commodity exporters Malaysia and Indonesia are the region’s only members that stand to gain from higher oil prices. Both economies have also heavily subsidised retail fuel prices which have remained unchanged since July, and hence the impact to inflation is significantly more measured compared to elsewhere. The impact to Singapore would appear the most neutral.

To ease or to stick?

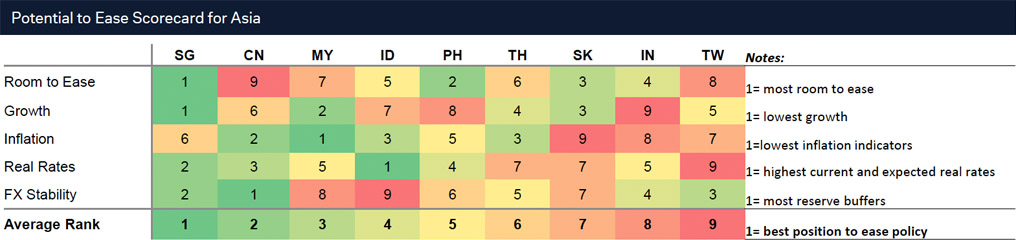

With developed markets now expected to keep their interest rates higher for longer and the US dollar strong, the team also expect to see Asian central banks push back the timing and possibly magnitude of policy easing in 2024. Countries such as the Philippines and Korea which have hiked rates aggressively have the best case to ease but must contend with rebounding inflation. FX stability will play major role in the decision to cut rates, as the US currency continues to appreciate.

Figure 3: DB Research’s Potential to ease scorecard

Source: Deutsche Bank, Bloomberg Finance LP, Haver Analytics

The case for policy easing is judged strongest in Singapore. “High frequency growth indicators show that the economy is slowing, current and expected end-of-year real rates are positive, the Monetary Authority of Singapore (MAS) has possibly over tightened, and FX stability is high,” the team comments.

“Taiwan, India and Korea have the tallest hurdles in the near term, with inflation having rebounded to above target range, pushing real rates down. Bank of India (RBI) needs to see supply side inflation correct; Bank of Korea (BOK) has to get comfortable with household credit growth. Malaysia and Thailand rank towards the middle but will likely be driven more by idiosyncratic factors in their decision whether to ease.

“Expected subsidy rationalisation in Malaysia and large fiscal stimulus in Thailand will keep both central banks relatively worried. Indonesia has among the best inflation/real rates profile but is back of the pack on FX passthrough concerns.”

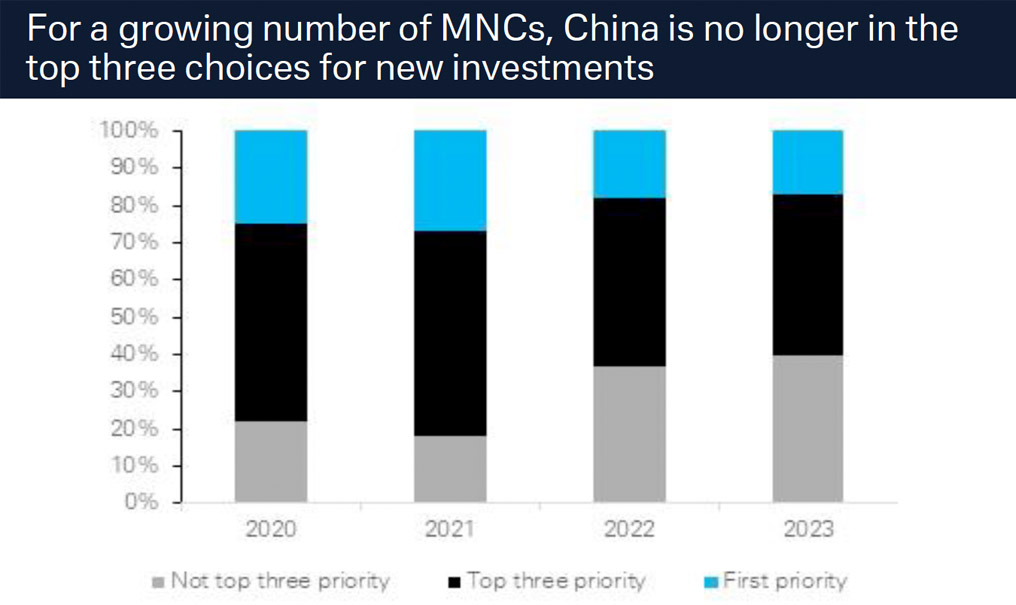

MNCs cooler towards China

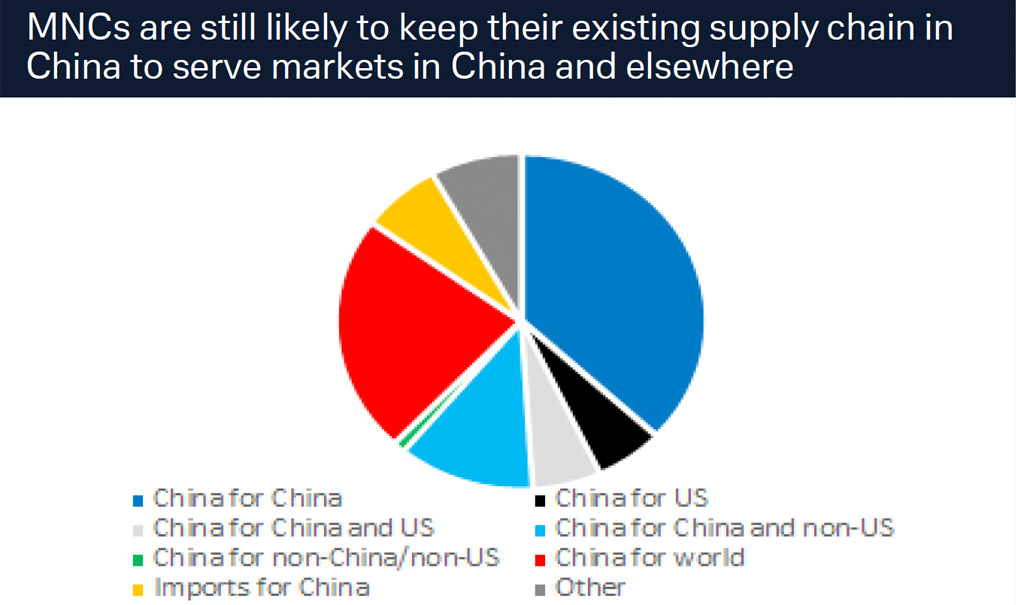

The Q4 Newsletter has further unwelcome news for China, noting that multinational corporations (MNCs) no longer cite it as their top investment destination although they are keen to retain existing supply chains.

Figure 4: MNC attitudes towards investment in China have cooled

Source: Deutsche Bank, American Chamber of Commerce Shanghai

The latest American Chamber of Commerce report2 finds that despite the reopening of China’s borders and the commitment from the government to open up its market to foreign investors, only 52% of companies are optimistic about the business outlook in China for the next five years versus 78% in 2021 and only 17% reported that China was their number one investment destination globally from 27% before. Seventy percent of respondents blamed uncertainty about US-China tensions, 49% cited slowing growth, and 48% expressed concern over the lack of clarity on China’s commercial policies.

In this latest survey, 40% of respondents stated they have redirected or plan to redirect investment originally planned for China, 6 percentage points (ppts) more than 2022 and much higher than pre-Covid or at the height of the trade war in 2019 (26%). The top destinations cited were ASEAN (57%), followed by the US (30%) and Mexico (29%) as near-shoring and friend-shoring trends continue. At 23%, Europe bested the Indian subcontinent (22%) for the first time.

However, MNCs still want to keep their existing supply chains in China, with 37% of those surveyed still producing or sourcing goods and services in China for the China market. For another 23% their Chinese operations will remain part of their global supply chains.

Indonesia as electric vehicle hub

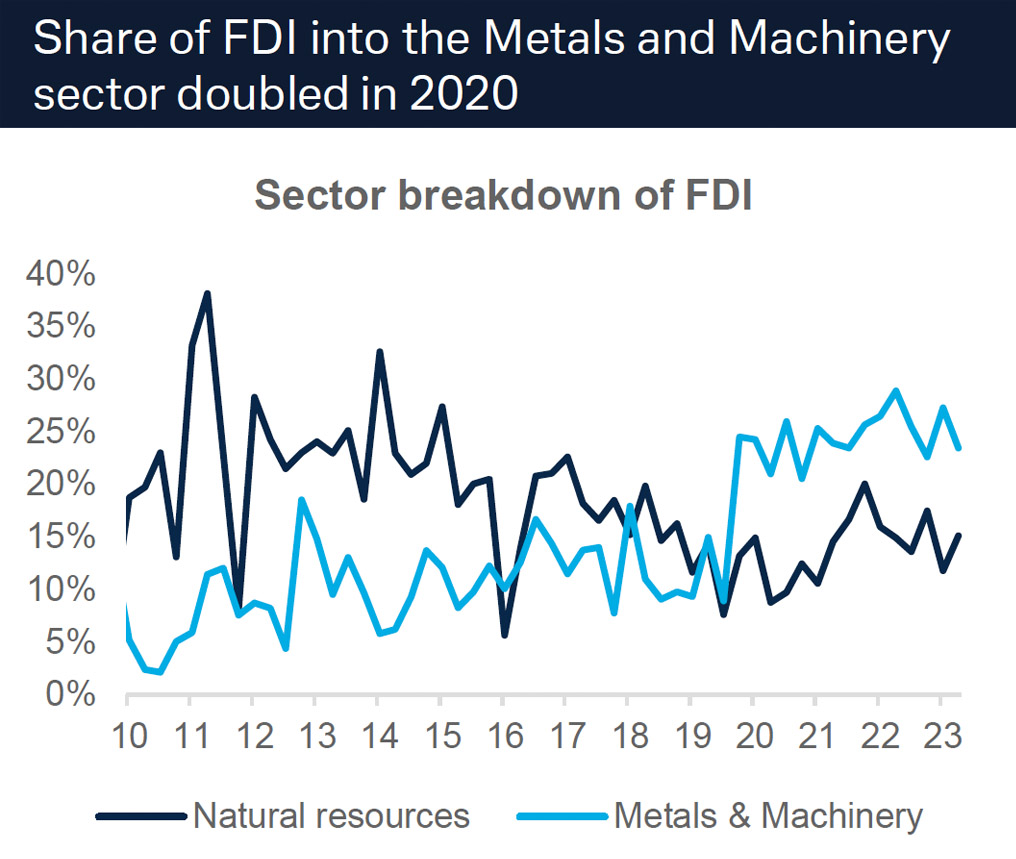

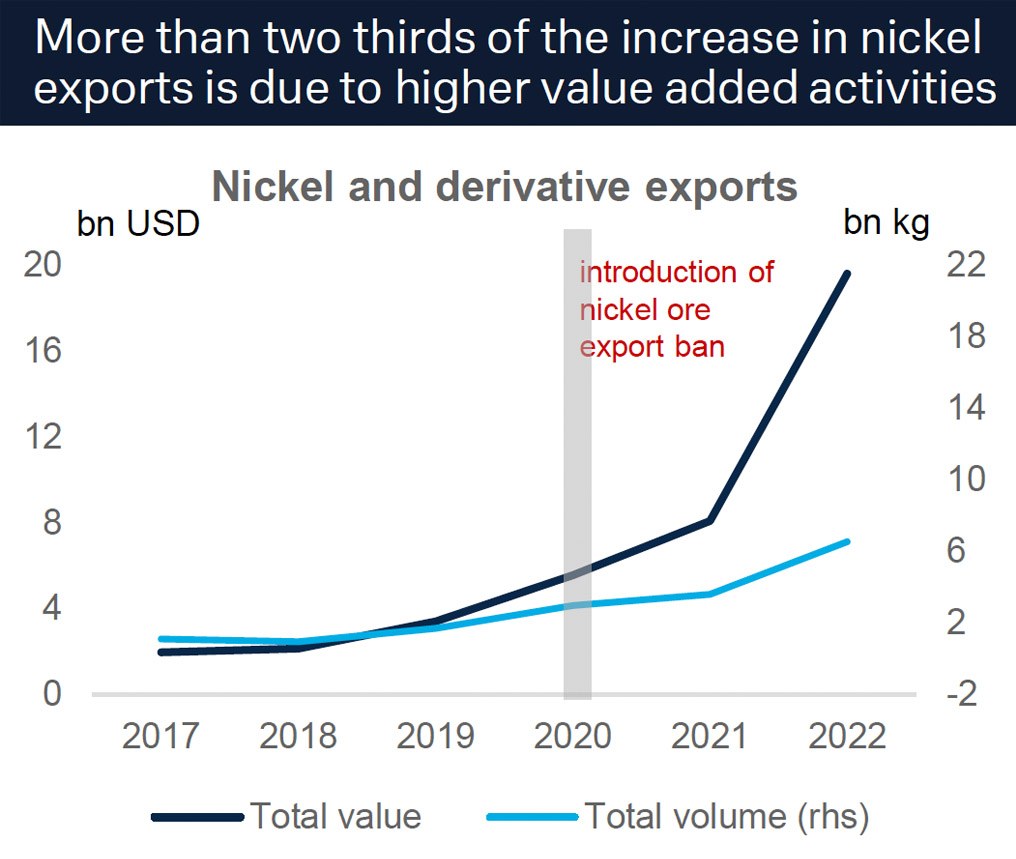

The Deutsche Bank Research team also examines Indonesia’s aspirations to become central to electric vehicle (EV) production. Southeast Asia’s largest economy imposed a nickel ore export ban in 2020 and saw strong FDI (foreign direct investment (inflow) in the same year, as North Asian manufacturers built plants onshore to process raw materials into higher value-added products. As the world’s largest producer of nickel, Indonesia aims to be a production hub for EV batteries, for which the transition metal is a main component.

Figure 5: Indonesia’s credentials as an EV hub

Sources: Deutsche Bank, CEIC, Bank Indonesia, IMF, World Bank

Indonesia’s current account has reaped the rewards, with the export value of nickel and its derivatives surging by 5.7 times since 2019. Less than one third of the increase is attributed to higher global commodity prices, with the rest likely coming from higher value-add from smelting activities. The value add of nickel derivative products are estimated to be x11.4 for nickel sulfate, x19.4 for nickel precursor, x37.5 for cathodes, and x67.7 for EV battery cells.

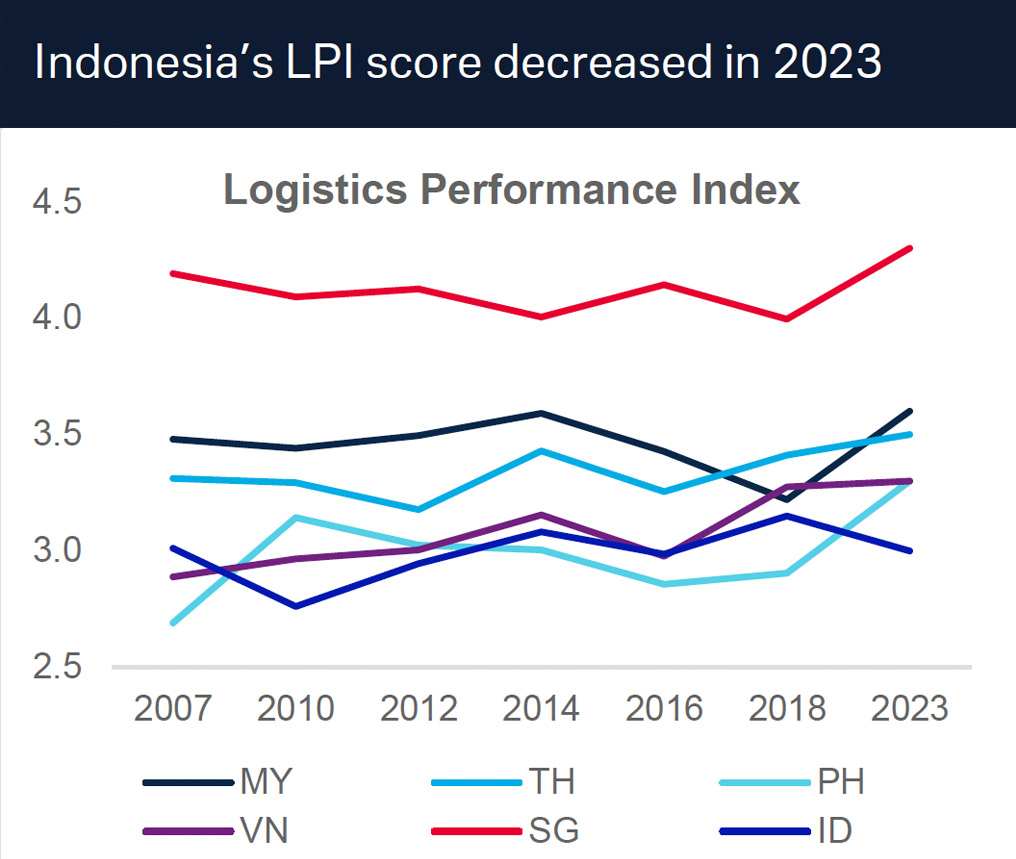

Reforms such as the 2020 Omnibus law streamlined business regulations, added nickel processing into its “priority sectors” for foreign investment, and made labour laws more attractive for corporates. However, realising Indonesia’s EV aspirations is increasingly contingent on whether it can improve its infrastructure and develop comprehensive supply chains. The World Bank’s 2023 Logistics Performance Score (LPI) ranks Indonesia last in trade logistics performance in ASEAN, and it was the only country in the region to not improve from its 2018 score.

Deutsche Bank Research report referenced:

Asia Corporate Newsletter – Q4 2023: Multiple Headwinds by Sameer Goel, Perry Kojodjojo, Bryant Xu, Joey Chung, Tim Baker, Michael Hsueh, Liam Fitzpatrick and Mallika Sachdeva (October 2023)

Sameer Goel

Asia macro strategist, Deutsche Bank Research

Perry Kojodjojo

Asia macro strategist, Deutsche Bank Research

Bryant Xu

Asia macro strategist, Deutsche Bank Research

Joey Chung

Analyst, Deutsche Bank Research

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Dossier ASEAN, Macro and markets

Navigating China’s slowdown Navigating China’s slowdown

In the Q3 Asia Corporate Newsletter, Deutsche Bank Research analysts examine the impact of China’s slowing growth and what this means for corporates and their risk management around currency hedging and supply chain diversification

Trade finance and lending, Macro and markets

Rare earths – a powerful attraction Rare earths – a powerful attraction

China has dominated the production of rare earth metals – the vital inputs in the clean energy transition as well as military equipment. But this could be all set to change as Western economies seek greater control of their supply chains and to reduce their dependence on rivals, explains Deutsche Bank’s Marion Laboure

CASH MANAGEMENT, MACRO AND MARKETS

Japan joins the journey to a cashless society Japan joins the journey to a cashless society

Japan might be a relative latecomer to journey towards a cashless society, but it has made swift progress in just five years, as a Deutsche Bank Research paper reports