26 July 2023

In the Q3 Asia Corporate Newsletter, Deutsche Bank Research analysts examine the impact of China’s slowing growth and what this means for corporates and their risk management around currency hedging and supply chain diversification

MINUTES min read

The implications of China’s economic slowdown underpin much of the Q3 analysis in the Deutsche Bank Research Asia Corporate Newsletter (July 2023).

In search of stimuli

Mallika Sachdeva and Joey Chung, together with the Asia strategy team, look back at the trajectory of China’s growth over the last few years, and note that Covid-19 lockdowns and a property market downturn have combined to slow down the economy versus trend growth. The world’s second largest economy expanded by 3% in 2022, which is anaemic by the country’s previous standards. Added to that, their industrial production rose by only 3.6% against 9.6% in 2021. The data for Q2 2023, released earlier this month, showed that the economy expanded by only 0.8% between April and June, against the Q1 rate of 2.2%. “The post-reopening momentum in China has slowed down, given a weak recovery in the labour market, still high precautionary savings, a keenness to de-lever, a lack of private sector confidence, and the absence of tailwinds from global demand,” says Sameer Goel, Global Head of Emerging Markets and APAC Research.

“An improvement in growth appears to rest on the intent and ability of policymakers to deliver on a stimulus package, which we think needs to be fiscally led, to act as a ‘circuit breaker’ on sentiment. Policymakers likely recognise the trade-offs involved – given a poor starting point on debt – between supporting growth versus risking a financial re-levering and moral hazard. The risk therefore is that the ‘red line’ on growth might be lower from here, with a downward trend becoming self-fulfilling”.

He continues, “It is becoming tough to separate the near-term concerns from longer term challenges to China’s growth such as demographics, technology access, access to capital markets, and shifts in supply chains and investment trends.”

The Q3 Asia Corporate Newsletter though also notes some of the silver linings to the China outlook, with signs of improving labour demand (reflected in average weekly hours rising), a broad-based increase in property prices and sales, and low inflation – China edged nearer deflation with a rate of 0% in June – proving “a longer runway for monetary policy to stay stimulative”.

FX hedging and China correlations

The Deutsche Bank Research team has been highlighting since early 2022 the importance of declining hedging costs as a growing consideration for Asian corporates’ FX hedging, given that the region’s central banks have been tightening monetary policy at a slower pace than the US Federal Reserve.

More than a year later they find that “corporates indeed appear to be taking advantage of lower hedging costs in lower yielding currencies in Asia”, hedging the US dollar (USD) most against the Taiwan dollar (TWD), Thai baht (THB) and South Korean won (KRW) rather than higher carry currencies including the Indonesian rupiah (IDR), Indian rupee (INR) and Philippine peso (PHP).

“We think most of Asia will likely follow the Fed in cutting rates next year”

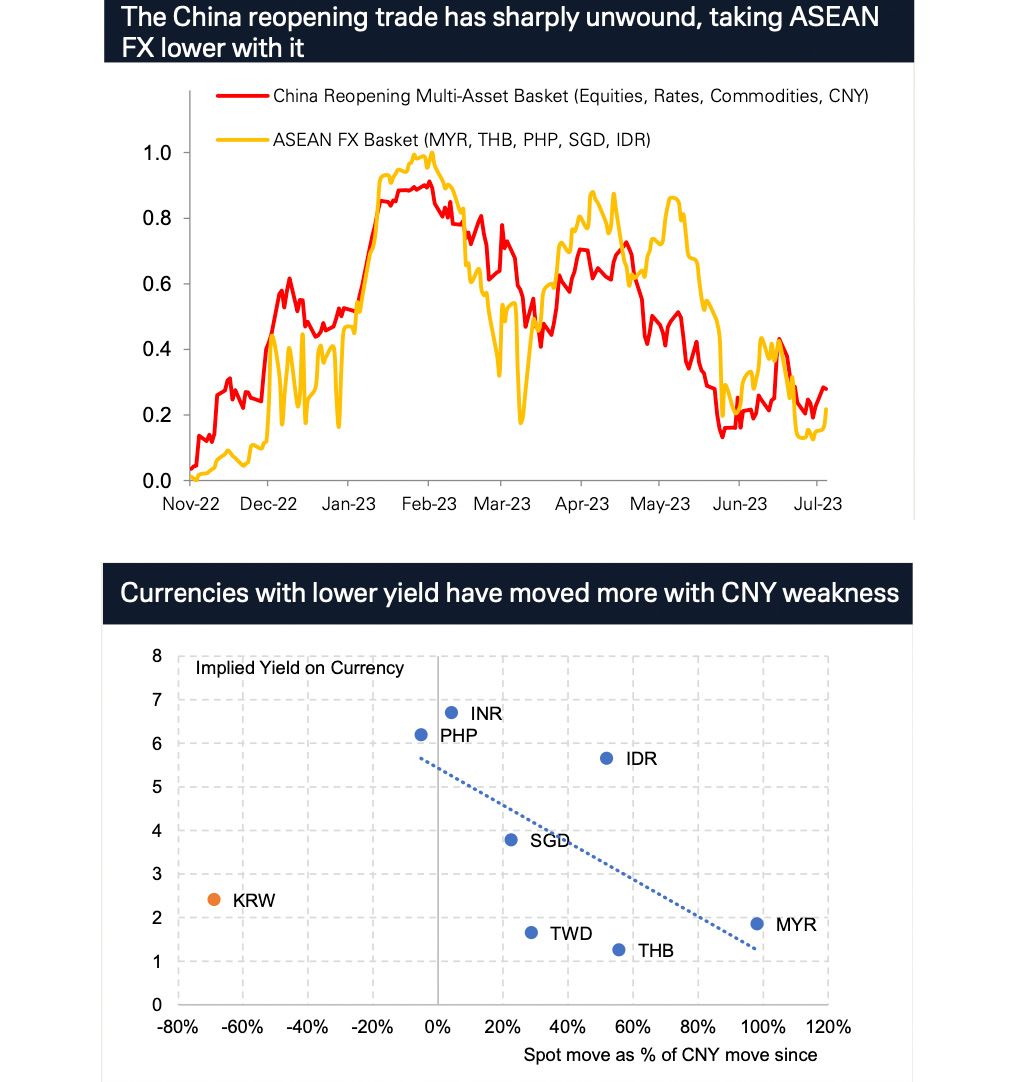

From a broader FX perspective, the team notes that the Association of Southeast Asian Nations (ASEAN) currencies have been the most correlated in the region to the China basket, following the rally and unwind very closely over the past 18 months (see Figure 1). “This makes sense, given the growing and dominant economic linkages between China and the ASEAN countries. We also note that currencies with lower yield moved more with CNY weakness,” they reflect.

Figure 1: Linkage of ASEAN currencies with China’s economic performance

Sources: Deutsche Bank, Bloomberg Finance LP, CEIC

With Asia’s rate tightening having been less dramatic than that of North America, Europe and Australia, the market still expects some further tightening from central banks like in Thailand and Malaysia. “However, with inflation either already within target or on a declining trend for most economies, and the US expected to enter a recession in Q4 2023, we think most of Asia will likely follow the Fed in cutting rates next year,” the team comments.

By mid-2024, they predict that local financing costs will be lower, with the Philippines and South Korea tipped to be the first to begin easing. “High frequency growth indicators show that both economies are slowing, current and expected end-of-year real rates are positive, and they have the most room to cut rates,” they note.

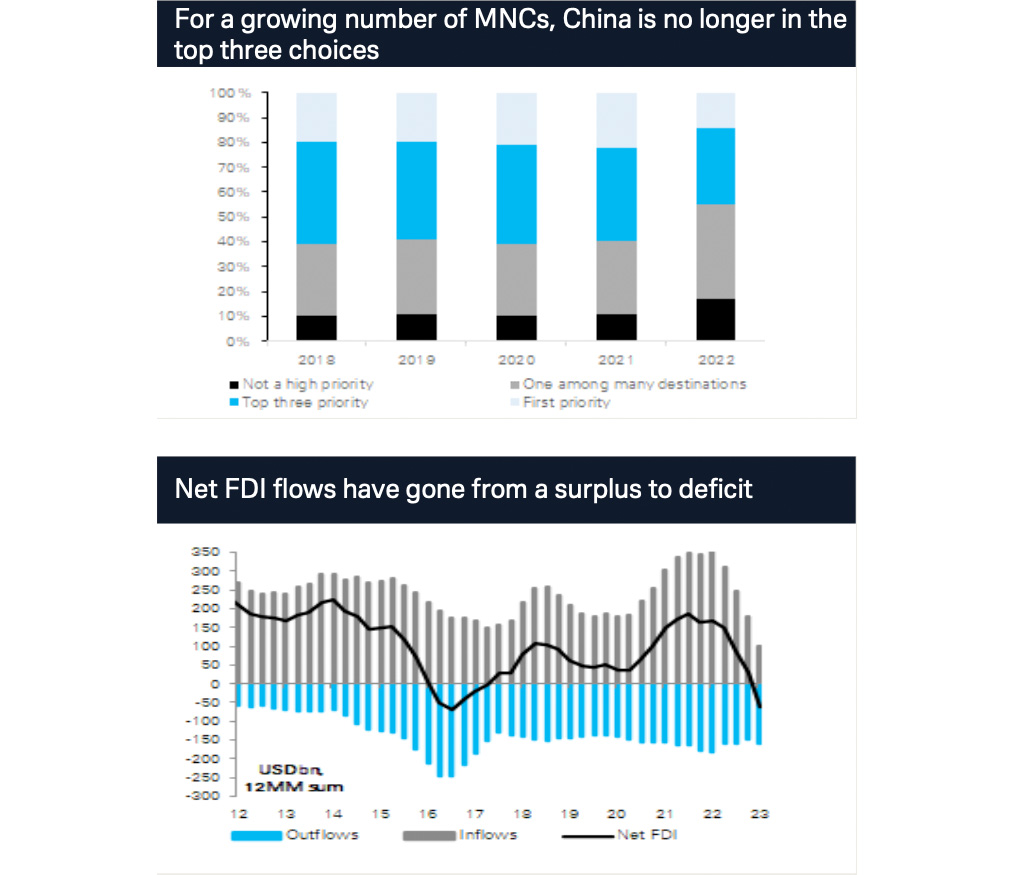

Figure 2: Reduced FDI into China

Source: Deutsche Bank, Bloomberg Finance LP, CEIC BIS

The team observes that the growing political tension between China and developed nations have already seen many multinational corporations (MNCs) not only reduce their investment in the country but ask their onshore subsidiaries to be more financially independent. Deutsche Bank Research Analyst Perry Kojodjojo identifies three major drivers of the trend in the Asia Corporate Newsletter:

- Onshore subsidiaries have often been profitable and built-up savings. This means that parent companies prefer that that they use growing cash holdings onshore more proactively and reduce their financial dependence on their parent.

- A more proactive use of onshore funds will both reduce the need for hedging FX exposure and offer better returns.

- Cheaper financing, as the divergence in monetary policy cycles between the US/Europe and China has caused onshore financing to become cheaper than offshore swapped financing.

Issuance of so-called ‘panda bonds’ issuance has increased, encouraged by updated regulation that now permits the proceeds to also be used offshore. He also forecasts that the ongoing fall in foreign direct investment (FDI) inflows will not only result in a widening deficit but also see the renminbi (RMB) “losing one of its more stable inflows, making the currency more vulnerable to market conditions”.

Diversifying supply chains into ASEAN

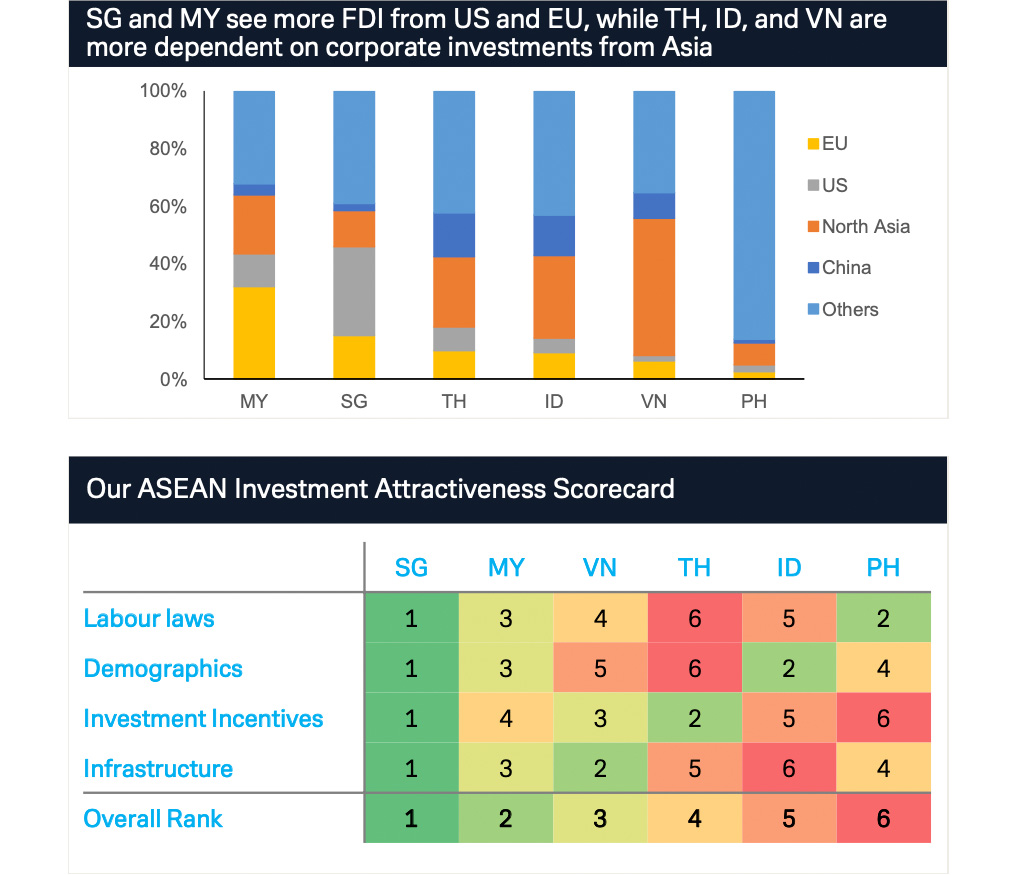

Within ASEAN, the team notes “an interesting diversity across countries in terms of where individual strengths and investment attractiveness comes from” and recommend diversification of supply chains into ASEAN where it makes sense. They have developed a scorecard to assess the relative strengths of different ASEAN economies, using drivers from labour laws, to demographics, investment incentives, and infrastructure. Here is a summary of the findings:

- Singapore scores the best on all parameters, but high costs limit FDI to capital-intensive and high-skilled sectors. Singapore can function well as a place for regional headquarters and to test-bed innovative solutions, rather than capture broader fundamental shifts in supply chains out of China.

- Malaysia also scores relatively well across the categories. Corporates looking for a well-developed economy to build manufacturing facilities in a moderately-skilled sector, with relatively low costs could find it an attractive destination.

- Corporates can leverage on Vietnam, Indonesia and Thailand’s large working populations and invest in low- to moderately-skilled manufacturing sectors there. Country-specific industry strengths include textiles and electronics for Vietnam, auto manufacturing for Thailand, and natural resources for Indonesia.

- The advantage for Philippines is its recent liberalisation of FDI rules, high English proficiency, and low costs, which could lead to increased investment in the future.

Figure 3: Supply chains and ASEAN economies

Source: Deutsche Bank, Bloomberg Finance LP, CEIC

Lower commodity prices

Potential good news for the region is the likelihood that lower commodity prices – led by oil – will drive disinflation and help towards building better external balances. The team expects Brent prices in Q3 2023 to be stable at around US$74/bbl while “lower prices in the commodity complex more broadly also benefit commodity importing economies on their external balances”. However, slowing demand for oil in the world’s two largest economies could be offset by Opec imposing further supply cuts.

Commodity-driven disinflation has already benefited the Philippines and Thailand in particular. “Commodities have been the biggest drivers of inflation in these markets, contributing 5.2% and 6.9% to Thailand and Philippines’ peak inflation respectively. Unsurprisingly, these markets are where the fall in commodity prices have driven the sharpest decline in overall CPI.”

Asia’s largest net commodity importers, South Korea and Taiwan, are the main beneficiaries with improving trade balances “with Korea benefitting the most from commodity-driven import compression”. Conversely, commodity exporters Malaysia and Indonesia are experiencing decreasing trade surpluses from lower prices, with commodity exports for both falling by around 0.35% of GDP in the first half of the year.

Prudent balance sheet management

The Asia Corporate Newsletter also argues that market concerns of a potential Asia credit crunch, following the failure of three major US banks and the collapse of Credit Suisse in March 2023, are unlikely to play out – due in part to the region’s more prudent approach to balance sheet management.

“Asia has not faced deposit outflow pressure, which started the domino effect in the US,” says Deutsche Bank Research Analyst Bryant Xu. “Indeed, all Asian markets have seen positive bank deposit year-on-year growth. There should thus be less urgency for Asian banks to slow credit growth dramatically from a balance sheet point of view.”

Deutsche Bank Research report referenced:

Asia Corporate Newsletter – Q3 2023: A patchwork of hedges by Mallika Sachdeva, Sameer Goel, Perry Kojodjojo, Bryant Xu, Tim Baker and Joey Chung (July 2023)