20 September 2023

Japan might be a relative latecomer in journeying towards a cashless society, but it has made swift progress in just five years, as a Deutsche Bank Research paper reports

MINUTES min read

Cash is no longer king in Japan as the usage of coins drops sharply, reported the Financial Times on 10 July.1 Evidencing the change of direction, it pointed out in April that the World Expo 2025, to be held in the city of Osaka, will be the first world’s fair to be entirely cashless. Ahead of the event a dedicated blockchain-enabled Expo Digital Wallet is being developed that visitors will use to make contactless payments via smartphone both inside and outside the venue and also after the event.

“Visitors to the next World Expo should expect to see no cash changing hands in restaurants and shops at the exhibition site, as the government of Prime Minister Fumio Kishida plans to make the Expo a cashless world’s fair for the first time in the event’s history,” reported Nikkei Asia.2 “With as many as 28 million visitors expected, the Expo will be a huge cashless society experiment.”

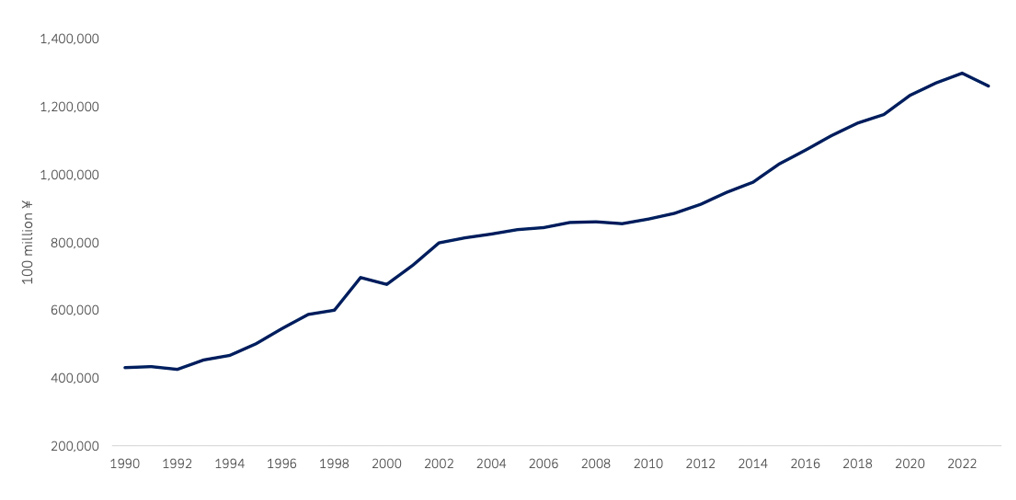

While countries such as Sweden have been steadily moving towards an entirely cashless society for more than 15 years, Japan’s own journey is still in its early stages. As Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace note in their 6 September white paper, Japan’s journey to a cashless society, – the latest report in the Future of Payments series – cash has long reigned in Japan and over the period 1995 to 2022 cash in circulation grew from under 10% of GDP to 23%.

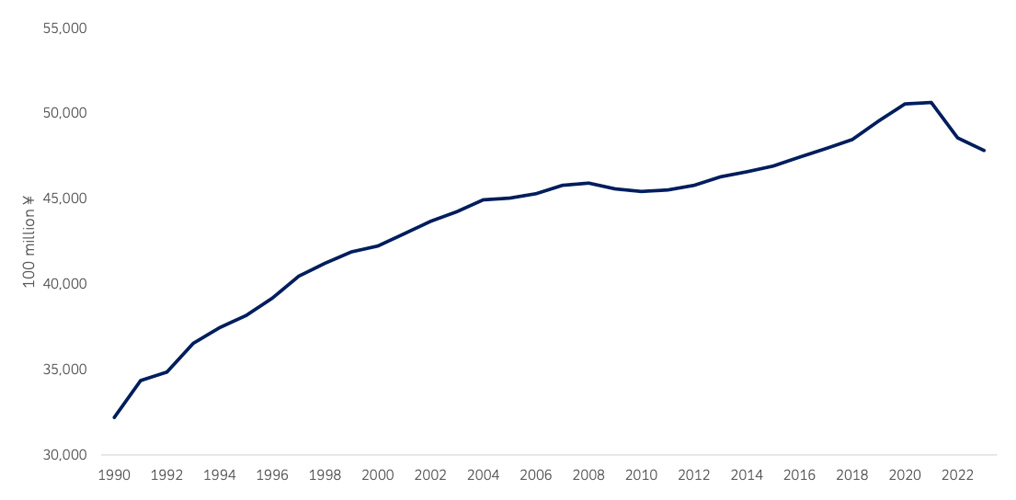

But recent data suggests that, like Germany where the ‘cash is king’ mantra was also traditionally held, a transition away from cash has begun in Japan. Cash in circulation declined in the first half of 2023, while coins in circulation have been declining for six consecutive quarters.

Efforts to promote a cashless society in Japan go back a little further as Kimberley Long noted in ‘Japan seeks to shake off cash’, her August 2021 article for The Banker.3 “The Japanese government attempted to push the use of cashless transactions in 2019, setting the target of having 40% of transactions being made via credit cards, debit cards or e-money in time for Expo 2025 Osaka, and with the future aim of reaching 80% of all transactions,” explained the article.

That ambitious target might still be some way off, but four years on, Japan has made “significant headway” in its transition to a cashless economy, note Laboure and Ainsworth-Grace. Japanese currency in circulation fell 2.9% between the end of 2022 and Q2 2023. The number of Japanese coins in circulation fell 5.5% from its peak in 2021, declining for six consecutive quarters to Q2 2023.

The trend is mirrored in other developed economies. Since its peak in Q4 2021, UK currency in circulation has fallen 1.4% and in the EU cash in circulation declined 0.6% in the last quarter.

Figure 1: Japanese currency in circulation (100 million yen)

Source: Deutsche Bank, Haver Analytics. Note: 2023 data takes Q2 2023 data only

Figure 2: Japanese coins in circulation (100 million yen)

Source: Deutsche Bank, Haver Analytics. Note: 2023 data takes Q2 2023 data only

Blame it on Covid?

As with many developed economies, the acceleration in Japan’s cashless payments transition owes much to Covid-19, but the authors identify three other major contributing factors: new banking fees on cash deposits; the rise of cashless payment technologies; and post-pandemic increases in inflation and interest rates.

“An almost zero interest rate on deposits in Japan has meant consumers are indifferent to holding their money as cash or depositing it with a bank”

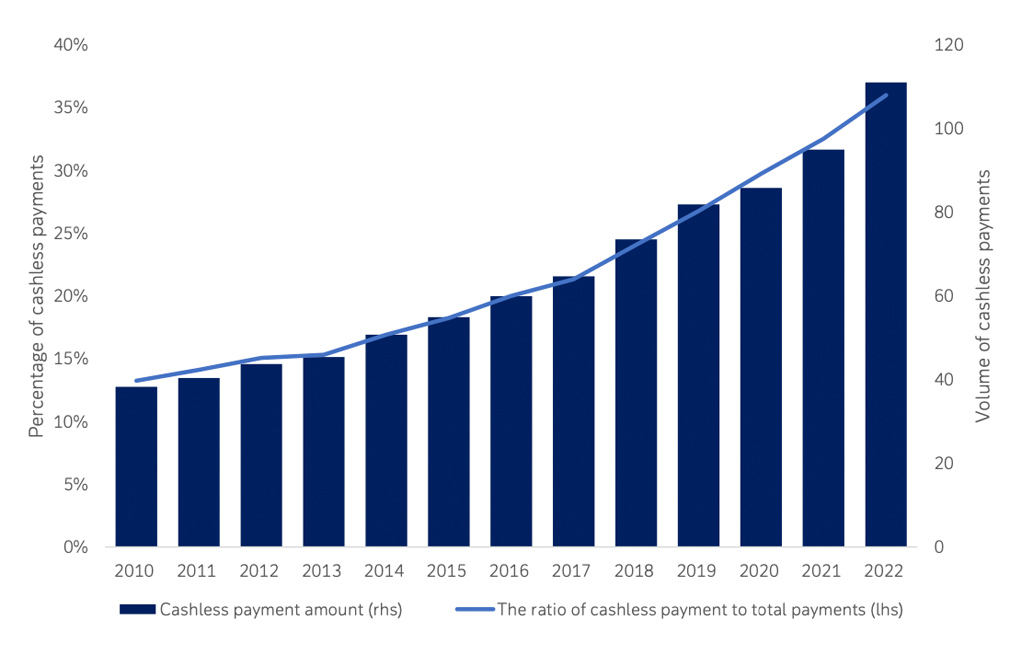

The pandemic forced consumers worldwide to either reduce or stop using cash and switch instead to contactless, digital payments or even to shopping online – often for the first time. In Europe, the number of online transactions nearly tripled from 6% in 2019 to 17% in 2022 as cash usage fell sharply over the three years from 72% to 59%. The same trend was evident in Japan, where the volume of cashless payments increased 36% from 2019 to 2022.

Piggy banks are a less obvious victim of Japan’s move away from cash. Traditionally, Japanese parents set aside 500 yen (¥) coins – about US$3.40 – from their change for their children’s piggy banks, which were deposited in the bank once several coins had accumulated. However, in October 2021 Japan’s retail banks announced that they would begin imposing charges of up to ¥1,100 on customers depositing a large number of coins at bank counters and ATMs.

Fees were calculated based on the number of coins deposited, leading to an infamous incident at Japan Post Bank in 2022, when a deposit of ¥1,000 in ¥10 yen coins incurred a ¥550 fee. Deposits of the smallest denominations coins could even incur fees exceeding the deposited amount. The high charges sparked a cultural shift by making the tradition impractical and has driven down coinage in circulation by 5.5% since 2021.

The ‘Cashless Vision’

Meanwhile, cashless payment technology in Japan has made electronic transactions convenient and accessible. E-money debuted back in November 2001 with the launch of Suica, a prepaid rechargeable contactless smart card for use on the train network. It was subsequently popularised by the launches of digital payment platforms such as Pasmo – used for transportation, vending machines and in stores – and PayPal, which have made electronic transactions more accessible and reduced fees.

As digital payment platforms become mainstream, Japan’s government has responded by embedding their use in the country’s payment infrastructure. In April 2018, the Ministry of Economy, Trade and Industry proposed the ‘Cashless Vision’, which aims to increase cashless to 40% of all transactions by 2025 and ultimately to 80%. Last September, the government announced a system for paying salaries digitally and since April 2023 Japanese companies have been able to make payments directly to payment provider accounts via smartphone payment apps and other means, instead of to a traditional bank account.

Figure 3: Total cashless payments in Japan

Source: Deutsche Bank, Ministry of Economy, Trade and Industry

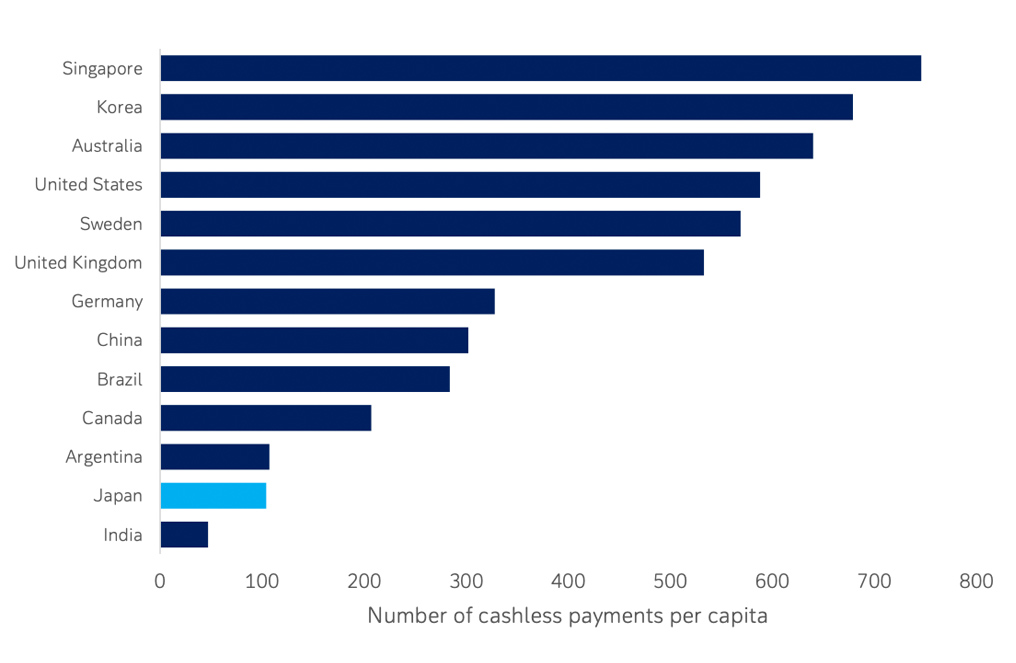

Figure 4: Average number of cashless payments per capita (2021)

Source: Deutsche Bank, Deutsche Bank, Bank for International Settlements

Quick response (QR) code payments entered the market in 2018, when telecom company NTT DoCoMo introduced its QR code-based mobile payment service. Banks followed its lead a year later. In March 2023, Japanese payment startup Netstars announced a partnership with Vietnam’s Military Commercial Joint Stock Bank to facilitate payments using QR codes at the Tokyo Dome City mall. The value of QR code payments rose from near zero in 2018 to ¥7.9trn in 2022, with nearly 50% growth in 2021–22 alone.

These two trends saw the cashless payment ratio increase from 13% in 2010 to 36% by 2022, equivalent to ¥111trn. Although impressive, Japan still lags behind South Korea, China and Singapore, which had respective percentages of 94%, 83% and 60% in 2020.

Higher inflation and interest rates

The BoJ has kept interest rates close to zero, in contrast to successive hikes since early 2022 from the world’s other central banks. The resulting meagre rate on deposits has made Japanese consumers indifferent to holding their money as cash or depositing it with a bank. However, Japan’s core inflation is now rising, having exceeded the BoJ’s 2% target for 16 months. Bank Governor Kazuo Ueda has now indicated that the era of zero rates is nearing an end, suggesting that depositing funds may become more attractive and currency in circulation will likely drop further.

Laboure and Ainsworth-Grace believe that cash usage will continue to decline in both Japan and in Europe, where cash payments for goods and services have already fallen from 72% in 2019 to 59% in 2022. In the US, the share of cash as a payment instrument has also slipped, from 31% in 2016 to 18% in 2022.

“As we reach the peak of the hiking cycle of most major developed central banks, this trend will likely continue, as holding cash looks less and less attractive relative to deposits,” they conclude. “The fall in cash’s popularity, and the increasing demand for digital payment alternatives will likely drive the development and adoption of central bank digital currencies (CBDCs).”

Deutsche Bank Research report referenced:

Future Payments: Japan’s journey to a cashless society by Marion Laboure and Cassidy Ainsworth-Grace (6 September 2023)