28 June 2023

Slower economic growth and rising interest rates have accelerated transition from cash to digital payments. flow reviews the latest recent Deutsche Bank Research report on the future of payments along with the move to digital wallets and IDs

MINUTES min read

In May 2023, India’s central bank announced that the 2,000-rupee (INR) (US$24 /£20) banknote is being withdrawn from circulation and will cease to be legal tender. The notes had only a short life, introduced by the Reserve Bank of India (RBI) in late 2016 as INR500 and INR1,000 notes were abruptly removed but no new INR2,000 notes have been printed since 2019.1

As The Times reported on 23 May “it feels like Diwali across India as stores selling gold, diamonds and luxury brands are swamped by shoppers. But the frenzy is not for a festival, it is because millions of Indians are desperate to get rid of their stashes of INR2,000 notes, before they cease to become legal tender at the end of September.” While withdrawing higher value banknotes falls short of full demonetisation, it accelerates India’s move towards a cashless society.

The news tallies with forecasts by Deutsche Bank Research analysts Marion Laboure, Nooshin Nejati and Cassidy Ainsworth-Grace in the third of the white papers for the series The Future of Payments. In Bye-bye cash, hello digital payments, they write that the “structural shift from cash to digital payments is expected to continue in 2023 with further evolution of digital IDs and digital wallets. Amid a macro slowdown, we expect financial solutions offered by non-financial firms, such as embedded financing, to play a major role in the further adoption of digital payments.”

As reported by flow in ‘Digital assets – from exuberance to utility’ and ‘Digital currencies: the ultimate soft power’, previous papers considered the rise of cryptocurrencies and the development of a central banks’ digital payment alternative, the central bank digital currencies (CBDCs). This latest instalment examines the transition from cash to digital payments.

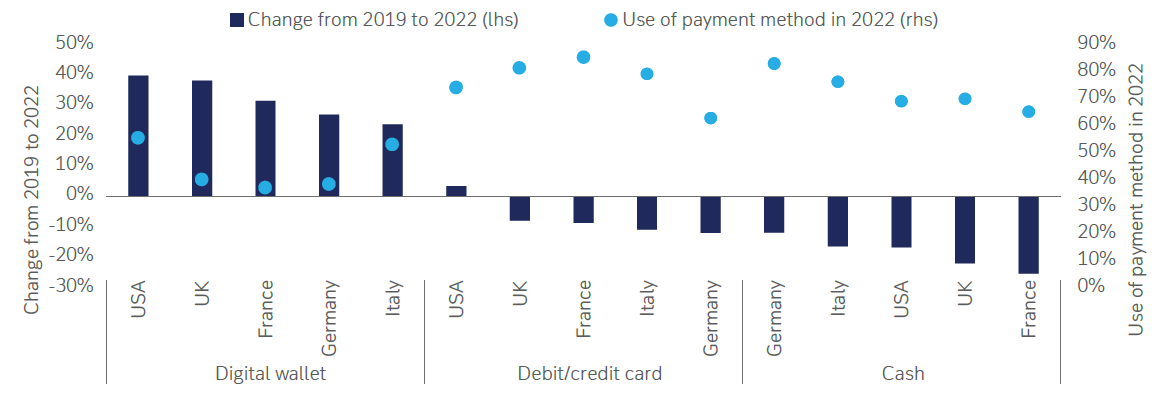

Cash usage has steadily declined and in Sweden nearly disappeared. Covid lockdowns worldwide accelerated the process as cash transactions gave way to card or digital payments. In 2022, card payments across Europe represented a record 34% of point-of-sale (PoS) transactions, against 25% in 2019 and 16% in 2016. “This shift is unlikely to reverse, with the drive for change propelled by the vested interest of financial institutions and their efforts to make digital payments more seamless and user-friendly,” note the report’s authors.

Figure 1: The change in use of selected payment methods, pre-Covid (2019) and post-Covid (2022)

Sources: Deutsche Bank, dbDIG Survey. Note: Question asked, "In the last six months, which of the following methods have you personally used to make a small, regular in-store purchase? Please select all that apply." The change is in relative percentage terms.

The pandemic also changed the broader macroeconomic environment. In 2020–21, near-zero interest rates were associated with increased cash in circulation, but the global inflationary spike has since prompted central banks to start raising rates and “will likely incentivise consumers to deposit or save their money, further reducing the amount of physical cash in circulation.”

A new era for payments

Driving the shift towards digital payments is convenience for consumers and merchants and the report highlights three contributory trends:

- Digital ID: For security, card users must use two-factor authentication for purchases. Contactless payments work up to a limit (£100 in the UK); higher amounts entail inserting the card into the terminal to enter the PIN, slowing the checkout process and inconveniencing customers who forget their PIN. Digital IDs, however, make digital payments more convenient. Using facial recognition and fingerprints addresses the merchant’s need for strong authentication and prevents costly chargebacks. And as digital ID users usually do not face limits, customers can make speedy, hassle-free payments.

- Mobile wallets: The expediency of digital IDs, the convenience of mobile wallets and growing popularity of super apps have encouraged a steady increase in mobile payments. November and December 2022 saw unprecedented adoption of Apple Pay, relative to other payment methods.

Alipay introduced mobile payment capabilities to China in 2009, WeChat Pay following in 2013. By 2021, mobile payments represented 66% of transactions and 59% of transaction value. Since January 2022, China has piloted the digital yuan (e-yuan), and access to the CBDC depends on using digital wallets serviced by Ant Group (MyBank) and Tencent (WeBank) on the People’s Bank of China’s (PBoC) digital e-yuan app, further encouraging consumers’ use of digital wallets. - Advance in B2B lending: Instant consumer financing, as a form of Business-to-Consumer (B2C) lending, has grown strongly via “Buy Now, Pay Later” (BNPL) payment plans, but instant merchant credit or Business-to-Business (B2B) embedded finance has hardly developed. The report predicts that B2B embedded financing will gain traction as SMEs face cash flow problems in the slower macroeconomic environment. Payment service providers (PSPs) and financial institutions will review their offerings and respond to changing needs. The B2B embedded finance market had transaction volume of US$700bn in 2021, and 26% compound annual growth rate (CAGR) is expected by 2025.

As the payments industry is largely cyclical, economic slowdown and higher rates will crimp volume growth in 2023. But this is a mere blip in the structural shift towards digital. Many European countries, especially Germany and Italy, are highly underpenetrated in terms of card usage and digital payments. They face a structural shift in coming years, which payment companies like Nexi and Worldline will benefit from.

“We are now beginning to see buy-in being driven by added functionality”

For payment companies more exposed to discretionary spending and/or e-commerce volumes, growth may prove more elusive. Those exposed to non-branded transactions, and which provide all payment methods. are most likely to succeed. For example, Apple Pay’s sizeable market share gain in the UK, the US, Germany, and France has been mainly at PayPal’s expense.

Beyond payment methods, diversity in solutions such as embedded financing is seen as the key to further securing growth. Dutch company Adyen is cited as a leader, positioned to outpace market growth through its best-in-class technology and investments into new solutions.

“While many people have embraced digital payment options due to their greater availability, we are now beginning to see buy-in being driven by added functionality (i.e., super apps and integrated mobile PoS systems),” the report notes. This creates a growing digital payment processing “pie”, and revenue opportunities for PSPs like Adyen, Nexi, and Worldline.

A winning game for digital payments

The pandemic forced consumers to switch from cash to contactless, digital payments and shopping online. In Europe, online jumped from 6% of transactions in 2019 to 17% in 2022 while cash shrank from 79% of transactions in 2016 to 59% in 2022. Even Germany, with its strong cash culture, saw cash payments for goods and services fall from 74% in 2017 to 58% in 2021 as the share of total turnover attributable to online commerce rose from 6% in 2017 to 24% in 2021, with 34% already using apps for transactions.

A European Central Bank (ECB) survey on cash use during the pandemic found consumers cited convenience as their main reason for choosing digital payments at the PoS, followed by warnings against using cash, government recommendations, and fear of viral infection. In China, more than 100 million adults made their first digital transaction after the first lockdown. While cash has recovered since, accelerated growth in card and digital payments is expected to continue.

Wider availability of mobile devices and the internet has seen tech-savvy consumers bypass cards and go straight from cash to digital payments. The pandemic saw financial institutions and PSPs attempt to eliminate frictions in digital payments via higher contactless limits and new options such as Tap to Pay. Some providers even lowered merchant fees charged for small transactions. This increased convenience of digital payments encouraged merchants and customers to use this method more often.

Asia’s digital payment trend is assisted by new super apps like WeChat, Alipay and Kakao, offering consumers services such as messaging, e-commerce, consumer-to-business payments, peer-to-peer payments, and potentially even credit. They are offered in one location rather than across multiple apps and providers, increasing convenience and keeping consumers within one firm’s universe of products.

Elsewhere, Adyen is enabling merchants to accept payments on their iPhones while Nexi and Worldline have introduced SoftPOS, allowing Android devices to be similarly used. These applications expand digital payment acceptance capabilities to micro and mobile merchants who once were cash only.

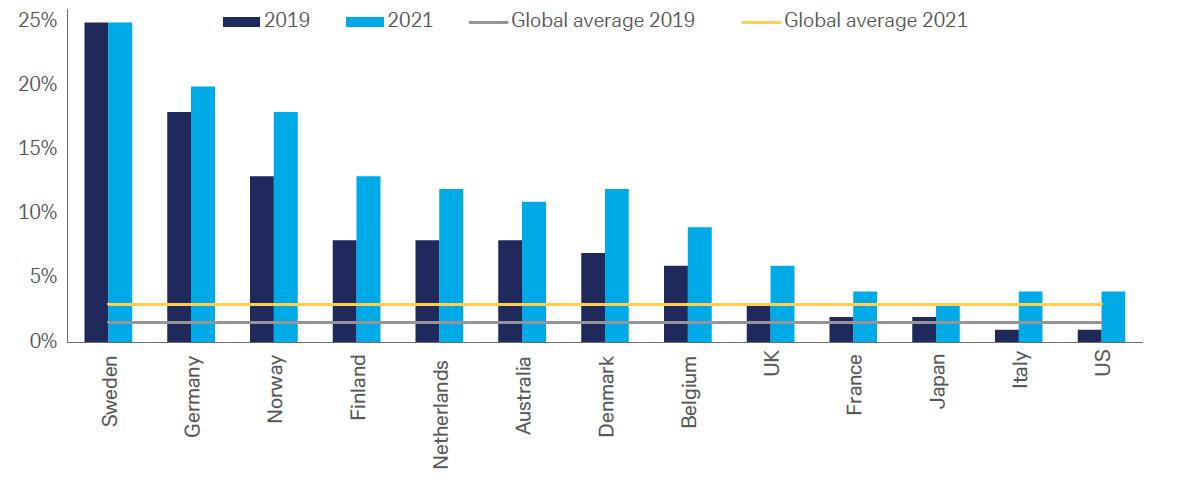

Over two decades, the payment industry has observed various needs and cultural behaviours. New means of payment such as BNPL and account-to-account payments have emerged. Consumers ineligible for a credit card can now access instant credit through BNPL. Between 2019 to 2021, the number of BNPL loans originated within the US by the five top lenders grew 970%, and dollar volume by 1,092%. Initially used by fashion retailers, BNPL products spurred others in travel, healthcare and automotive to design similar solutions and move beyond big-ticket purchases to restaurants and grocery stores.

Figure 2: share of BNPL* in e-commerce

Sources: Deutsche Bank, Statista. Note: *BNPL stands for Buy Now, Pay Later, and is a type of short-term financing offered at the checkout which offers consumers to pay for the product/service they purchase at a later time in future. These products are usually interest free but come at a high cost if the consumer defaults.

Old and newer payment methods are now merging for consumer convenience, with BNPL providers aiming to expand their offerings beyond e-commerce channels and at the PoS through cards or mobile payments. While merchants were once limited to using bank transfers and cheques to pay their suppliers, now vendors can use various means including virtual cards and account-to-account transfers. At the same time, embedded finance allows small merchants with cash flow problems to access an instant loan based on their transaction history.

Ease of use, low hurdles, and potential speed of getting credit on both sides of the value chain have encouraged greater liquidity in the market, the speed of money circulation and economic growth in recent years but rising interest rates is likely to change this.

Payment innovation extends both to new products and longer-established solutions. Pre-paid cards now help manage household financing, so children’s pocket money in cash is replaced by an allowance via a virtual pre-paid card on their smartphone. The convenience of using apps to manage family expenses has drawn attention from fintechs and neobanks, promoting the use of digital payments and driving growth for these players. The transaction value for neobanks is set to witness global CAGR of 18% between 2023 and 2027.

The end of cash?

Yet despite these developments the mantra “cash is king” remains true. Although the pandemic, the report estimates, accelerated its decline by three to five years, cash is unlikely to disappear.

As a store of value, cash usage as a percentage of GDP continues to increase in developed economies. It is still a major means of payment in a world where 1.4bn people are still unbanked, groups such as the elderly still rely on cash, and it remains popular among consumers: one-third of Americans and Europeans still rank cash as their favourite payment method.

After the collapse of Lehman Brothers in 2008, use of banknotes across the eurozone soared. When Covid struck in 2020, cash usage as a percentage of GDP continued to rise across major economies. It is vital when natural disaster makes online access unavailable. In the US, the Federal Reserve’s Cash Product Office (CPO) provides access to cash if the digital payment infrastructure is damaged.

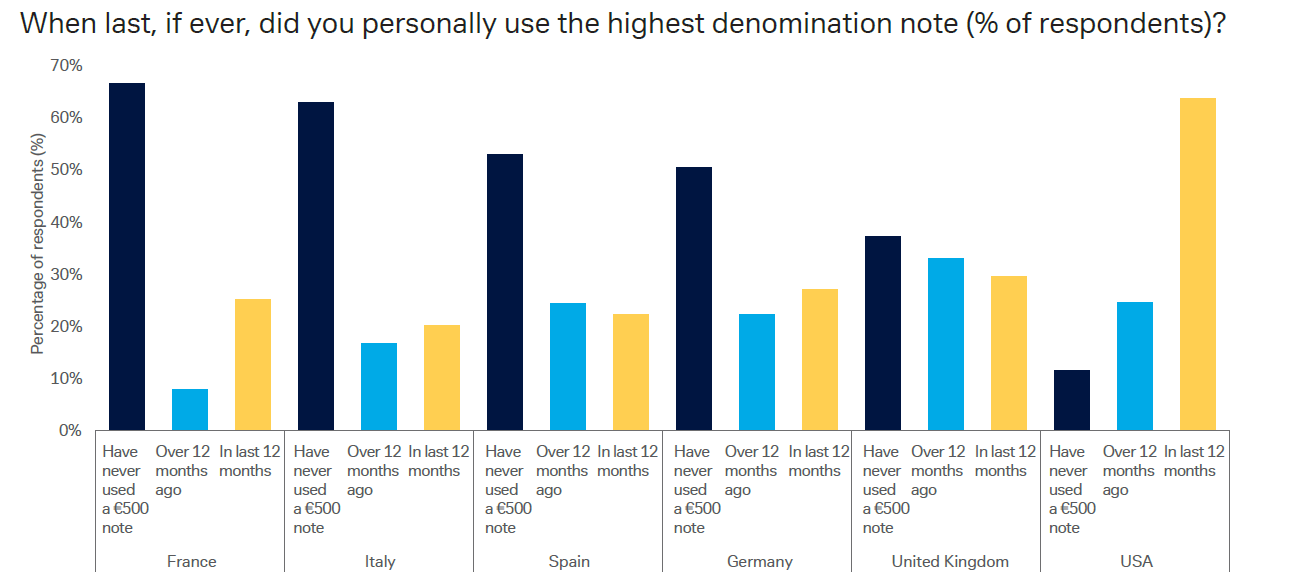

Cash remains popular with consumers post-pandemic, although India’s campaign to eliminate high denomination banknotes has also been undertaken by other governments. As of December 2022, over 50% of individuals in France, Italy, Spain and Germany had never used their highest denominated banknotes. And an estimated two-thirds of US$100 notes are held outside the US, suggesting they may be used in black market activities more than everyday transactions.

Figure 3: DbDIG Survey responses on highest denomination notes

Sources: Deutsche Bank, dbDIG Survey.

Rising interest rates are incentivising consumers to deposit or save money. Historically, high rates contribute to decreasing the amount of cash in circulation and in the UK, the money supply has declined over £1bn from its peak in Q4 2021 to Q1 2023.

ECB describes high inflation as a long-term challenge. In the Deutsche Bank Research report, When inflation hits 8% through history, what happens next? (25 October 2022) The authors point out that historical evidence showing once inflation spikes above 8% it takes two years to fall beneath 6%. Inflation will remain sticky and interest rates stay high in 2023 as central banks attempt to tame it. In coming years, higher rates are likely to mean less cash in circulation, fuelling the transition to digital payments and to CBDCs.

With demand for digital payments increasing, cryptocurrencies have enjoyed significant growth in the past five years and forced economies to reconsider the definition and use of payments. The space now faces greater headwinds, both macro and micro. At the same time, central banks have invested in adapting to meet changing demands and entered the battle with private digital currencies. Several countries have already seen CBDC projects go live, with varying degrees of success. For China, the e-yuan clearly represents a crucial and innovative step towards internationalising the renminbi (RMB) in the context of intensifying tech and payments competition with the US.

“It seems 2023 could be a pivotal year for the future of payments,” the report’s authors conclude.

Deutsche Bank Research report referenced:

The Future of Payments, Series 4 – Part 3: Bye-bye cash, hello digital payments by Marion Laboure, Nooshin Nejati and Cassidy Ainsworth-Grace (April 2023)

When inflation hits 8% through history, what happens next? By Jim Reid, Henry Allen and Galina Pozdnyakova (25 October 2022)