7 October 2024

Three months after the European Central Bank, the US Federal Reserve delivered its first interest rate cut since the pandemic – and now China’s own stimulus is taking root. flow reviews Deutsche Bank Research analysis of this latest round of dovishness, and ongoing monitoring of these central banks’ balance of inflation control vs threatened recession and unemployment

MINUTES min read

“How deep is your dove?” asked Deutsche Bank Research US economists Matt Luzzetti and Brett Ryan on 17 September in advance of the Federal Reserve’s interest rate announcement a day later. The 0.5% cut delivered (to 4-75%-5%) reflected the Federal Open Market Committee’s (FOMC’s) “greater confidence that inflation is moving sustainably towards 2%” and judgement that “the risks to achieving its employment and inflation goals are roughly in balance”.1

A follow-up note (Fed Notes – September FOMC recap: Powell delivers some good dovin’) immediately after the rate cut included Chair Powell’s insights from the press conference the same day. The team reflected how the “outsized cut” of 0.5% was more likely a one-off move and not “the new norm”. It was, after all the Fed’s first downward shift since the onset of the Covid-19 pandemic in March 2020.

“[Chair Powell] projected a view of a fundamentally strong economy and a labour market that was still historically solid”

The 50bps reduction was, they added, “framed as a one-off to right-size monetary policy to lower inflation and the shift in the risk distribution”, while Fed Chair Jerome Powell “projected a view of a fundamentally strong economy and a labour market that was still historically solid, even if it has cooled.” The team felt that “this tone avoided adverse signals about the economy and aimed to dissuade the market from pricing a steeper descent to neutral”.

Smaller reductions of 25bp in the months to March 2025 were indicated in the FOMC’s 18 September meeting, before two further cuts next June and September. “That leaves the Fed funds rate in the 3.25–3.5% range at end-2025, near our estimate of nominal neutral.”

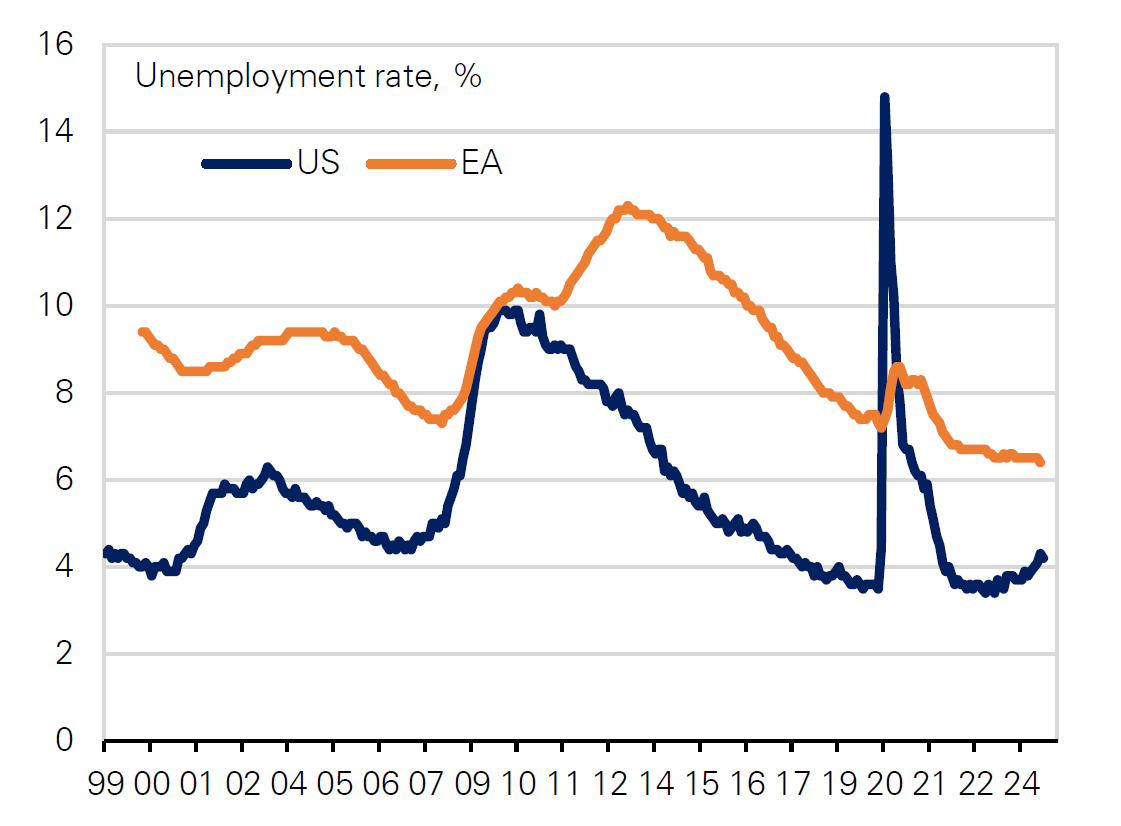

While the US team have said their base case remains that the Fed “will cut by 25bps at each meeting through March of next year before shifting to a quarterly pace of cuts with the policy reaching 3.375% at the September 2025 meeting”, by 25 September they had added the proviso that should unemployment exceed the median 4.4% forecast (see Figure 1), the FOMC “could well opt for another 50bp cut at their next meeting”.2

The FOMC Is not scheduled to meet again until the day after the 5 November Presidential election – its next opportunity to cut rates – although the central bank’s independence from politics was emphasised in the July 2024 meeting note, which declared: “We never use our tools to support or oppose a political party, a politician, or any political outcome. The bottom line is, if we do our very best to do our part and we stick to our part, that will benefit all Americans. If we get it right, the economy will be stronger. We’ll have price stability. People will find jobs. Wages will rise in real terms. Everyone will benefit. So that’s what we believe, and that’s how we will always act."3

Figure 1: The unemployment rate has increased in the US, not in Europe

Source: Deutsche Bank, Eurostat, BEA, Haver Analytics LP

Across the pond

With Europe’s recent economic growth less robust than that of the US, the European Central Bank (ECB) is, understandably, ahead of the Fed with its own rate-cutting cycle. Back on 6 June the Bank announced reduced interest rates on its main refinancing operations and the reduced interest rates on the marginal lending facility and the deposit facility by 0.25% to 4.25%, 4.50% and 3.75% respectively.4

“Maximum optionality is being retained”

Commenting the same day, Deutsche Bank Research’s Europe Chief Economist Mark Wall called this a “hawkish cut” and pointed out that there was no guidance on the next steps in the monetary policy cycle – “maximum policy optionality is being retained”. However, he added, “with policy rates still restrictive and underlying confidence in the wages and general disinflation narrative growing, President [Christine] Lagarde was at least implicitly confirming the direction of travel is further rate cuts. When exactly they happen will be determined by the data”.5

By mid-September, the ECB had revised its 2024 growth forecast from 0.9% to 0.8% – and the key deposit facility was trimmed a further 0.25% to 3.50%, with heftier 0.60% reductions, to 3.65% and 3.90%, for the other two rates. Opinion is divided on whether the ECB will pause or cut again at its upcoming 17 October meeting, with further 0.25% reductions in December regarded as more likely.

“The ECB is neither ruling in nor ruling out a rate cut at the next Governing Council meeting in October, but the impression is it is not very likely,” observed the Deutsche Bank Research team on 12 September.6 “The ECB will have a lot more information available at the December meeting. It will also know the outcome of the US election … and hence whether Europe is facing Trump’s proposed tariffs or not. A trade war would significantly weaken the outlook for 2025. This is one of many sources of significant uncertainty.”

But a fortnight later, a more doveish stance was anticipated. “We had been expecting the ECB to follow a gradual normalisation of monetary policy with 25bp rate cuts once per quarter until a terminal rate of 2.00–2.50% is reached around end-2025, in line with our view of neutral,” said Wall and the DB Research Europe team in their report, ECB Call Update: Moving into the fast lane (26 September). “We are moving to a faster normalisation call, with the ECB to reach the same terminal rate of 2.00–2.50% six months earlier in mid-2025. We expect this more rapid easing cycle to be achieved with back-to-back 25bp cuts from December, but we do not rule out a 50bp cut in December.”

Easing, and tightening towards a “soft landing”

On both sides of the Atlantic, consensus appears to be that the inflation genie is returning to his bottle after escaping in 2022 and 2023, with the 2% target rate once more attainable and enabling interest rates to be eased.

Next year should further confirm that the economy has managed a “soft landing”, with the FOMC now raising its projections for US unemployment rate “by two-tenths to 4.4% and 4.3% respectively, while 2025 core l PCE) inflation was lowered a tenth to 2.2%.”

“The bulk of the Committee now sees the risks to unemployment as weighted to the upside and the risks to inflation as broadly balanced,” said Luzzetti. “This stands in stark contrast to the June assessment when inflation risks were weighted to the upside, while those for unemployment were roughly balanced.”

Responding to the pandemic in March 2020, the Fed resurrected its quantitative easing (QE) policy, buying large quantities of Treasury debt and mortgage-linked securities. From mid-2022 this was succeeded by quantitative tightening (QT) as its balance sheet is gradually reduced by not reinvesting all the proceeds of maturing securities.

This summer, the pace of QT slowed as the shrinkage in its Treasury securities portfolio was revised from US$60bn a month to US$25bn. This has sparked expectation that QT could also end later this year, or in early 2025.

But for the time being, Chair Powell is indicating that QT can continue alongside rate cuts. “The Fed continues to see no fundamental tension between normalising their two tools – the policy rate via rate cuts and the balance sheet through QT,” explained Luzzetti. “So, with no evidence of reserve scarcity, balance sheet rundown is set to continue.”

China’s stimulus

The Fed’s recent shift towards an easing cycle aligns with the direction of China’s stimulus travel, noted Deutsche Bank’s China Chief Economist Yi Xiong in his report, China macro: How is this time different? (30 September). “This alignment is crucial as it mitigates the risk of capital flight and currency depreciation, allowing China's stimulus to take root without triggering destabilising financial outflows. This supportive global backdrop wasn't present in previous efforts, highlighting a key difference this time around, “ he explained.7

This difference is because of its comprehensive scale and good timing, the People’s Bank of China (PBoC) displaying a strategic focus on reviving market sentiment by supporting asset prices; and a clear commitment to further action if needed.

The report goes on to say that while “early market reactions have been positive, sustained momentum hinges on swift implementation of announced measures and delivering on the highly anticipated fiscal stimulus”. Ultimately, said Yi Xiong, success “will depend on its ability to deliver a rebound in domestic demand and a turnaround in the struggling property sector”.

Deutsche Bank Research reports referenced

Fed Notes: September FOMC preview: How deep is your dove? By Matthew Luzzetti and Brett Ryan, Deutsche Bank Research (17 September)

Fed Notes – September FOMC recap: Powell delivers some good dovin' by Matthew Luzzetti, Brett Ryan, Justin Weidner, Amy Yang and Peter Hooper (18 September)

Fed Notes: How high is the bar for another 50? By Matthew Luzzetti and Brett Ryan, Justin Weidner and Amy Yang, Deutsche Bank Research (25 September)

ECB Reaction: A maximum optionality easing cycle, by Mark Wall, Clemente Delucia, Sanjay raja, Peter Sidorov, Michael Kirker, Maria Contreras, and Kuhumita Bhattachary, Deutsche Bank Research, (6 June)

ECB Reaction: Retaining optionality by Mark Wall, Clemente Delucia, Sanjay Raja, Peter Sidorov, Michael Kirker, Maria Contreras, and Kuhumita Bhattachary, Deutsche Bank Research, (12 September)

ECB Call Update: Moving into the fast lane, Mark Wall, Clemente Delucia, Sanjay Raja, Peter Sidorov, Michael Kirker, Maria Contreras, and Kuhumita Bhattachary, Deutsche Bank Research (26 September).

China macro: How is this time different? By Yi Xiong, Chief Economist China, Deutsche Bank Research (30 September 2024)

Sources

1 Fed Notes: September FOMC preview: How deep is your dove? By Matthew Luzzetti and Brett Ryan, Deutsche Bank Research 17 September 2024

2 Fed Notes: How high is the bar for another 50? By Matthew Luzzetti and Brett Ryan, Justin Weidner and Amy Yang, Deutsche Bank Research 25 September 2024

3 See federalreserve.gov

4 See ecb.europa.eu

5 ECB Reaction: A maximum optionality easing cycle, by Mark Wall (and others), Deutsche Bank Research, 6 June 2024.

6 ECB Reaction: Retaining optionality by Mark Wall (and others), Deutsche Bank Research, 12 June 2024

7 China macro: How is this time different? By Yi Xiong, Chief Economist China, Deutsche Bank Research (30 September 2024)