13 November 2024

Formerly, it was mainly back-end functions that were outsourced to Asia-Pacific. Today, these hubs drive technological innovation and enhance organisational efficiency on a global scale. What does this mean, both for the treasury function and for corporate banking services?

MINUTES min read

The term ‘outsourcing’ was historically associated with back-office data functions and IT support. From the late 1990s and early 2000s, large multinational companies decided to shift these tasks to countries in Eastern Europe or Asia-Pacific (APAC) to benefit from their low-cost labour. However, as these economies have emerged, so have companies’ approaches towards business process outsourcing (BPO).

The next evolution was to centralise and standardise tasks in IT, finance, and customer services in shared services centres (SSCs). And a couple of years ago, companies began taking this approach even further by concentrating their global activities in areas such as research and development (R&D), cloud computing, data analytics, robotic process automation (RPA) and – most recently – artificial intelligence (AI) under the roof of what are now called “Global Capability Centres (GCCs)”.

“GCCs drive emerging technologies and have become the catalysts of transformation for their organisations,” says Khurshed Dordi, COO for Deutsche Bank Group in India and one of the key sponsors of Deutsche Bank’s own GCC which was originally set up in 2005 and now employs more than 18,500 people.

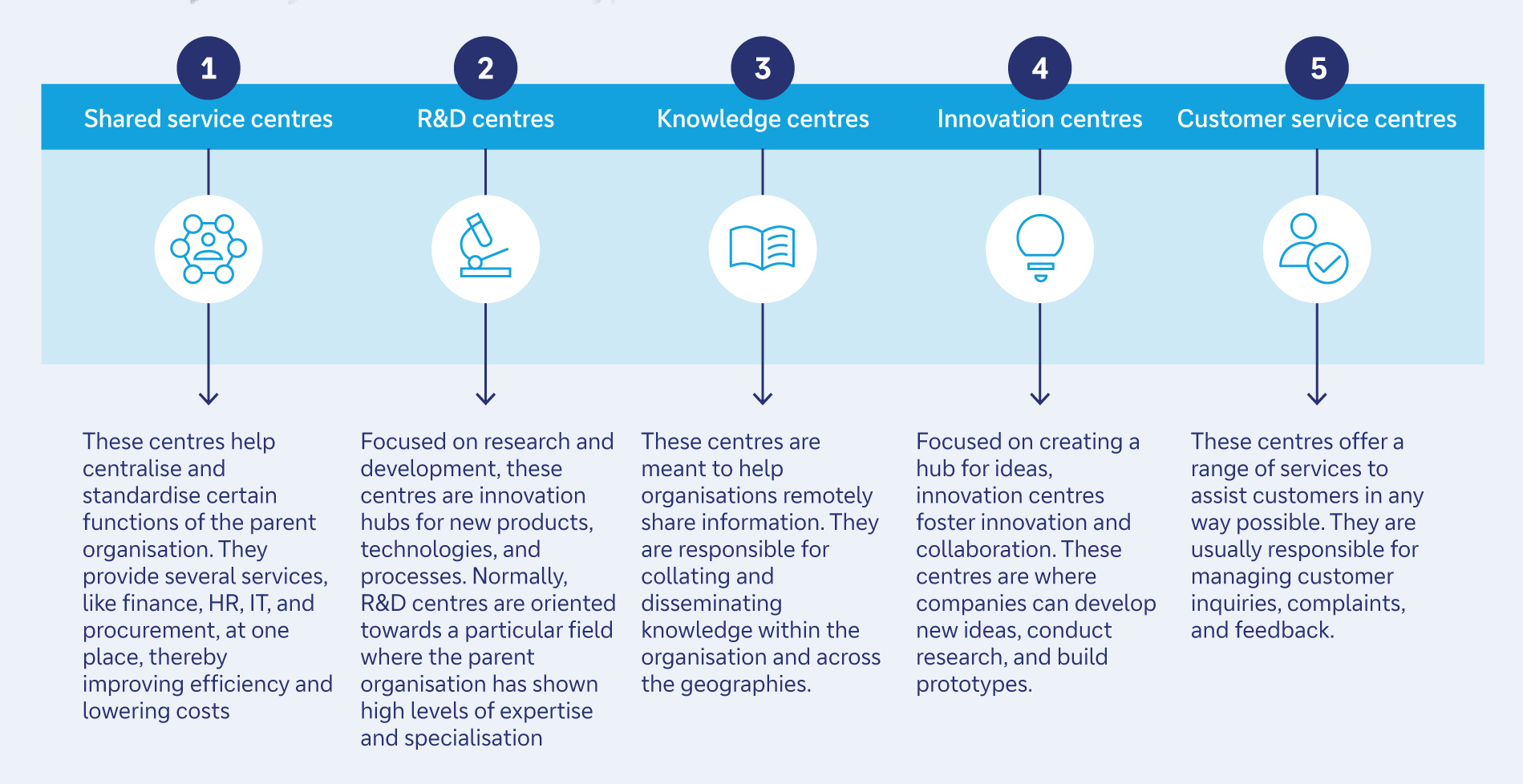

These centres exist in multiple forms today, catering to different business needs (see Figure 1) – and one country has emerged as the GCC champion: According to the consultancy and service provider ANSR, India accounts for more than 50% of the global GCC market with more than 1,600 GCCs up and running in the sub-continent. In 2023, GCCs in India accounted for more than 1% of the country’s GDP and the share is expected to grow. By 2030, ANSR expects the GCC market size in India to have more than doubled in value – to US$110bn from US$46bn in 2023. The number of GCCs in India is expected to reach more than 2,400 entities by 2030.1

Other popular GCC locations in APAC include Vietnam, Malaysia, Singapore, and the Philippines, where for example pharmaceutical multinational Boehringer Ingelheim has set up a shared services centre in 2022 – as explained in the August 2024 flow article Treasury forward.

Figure 1: Different types of Global Capability Centres

Source: JLL Research, GCC Office Guide 2024

Access to high talented young tech professionals

So, what has attracted companies such as AstraZeneca,2 Henkel,3 Kraft Heinz4 and Airbnb5 to choose India as a strategic hub for their global capability centres?

As described in the flow article India’s new growth frontiers, Deutsche Bank Research forecasts show that the Indian economy is set to double to US$7trn by 2030 with per capita income also nearly doubling to US$4,500 over the same period. According to research from the Indian National Association of Software and Services Companies (Nasscom) and the consultancy KPMG India6 as well as the real-estate investment firm JLL Research,7 five key factors make India the preferred choice for global companies:

- Talent pool: In a survey conducted by Nasscom/KPMG India among more than 75 GCC leaders, 72% identified talent availability, capability, and employability as a key priority. With more than 600 million people aged between 18 and 35, India had the largest number of millennials and Gen Zs globally.8 According to numbers collected by the UNESCO Institute for Statistics, 34% of students in India are picking courses in science, technology, engineering and mathematics (STEM), which – given its sheer size – means that the country produces the most graduates in total for these disciplines globally.9

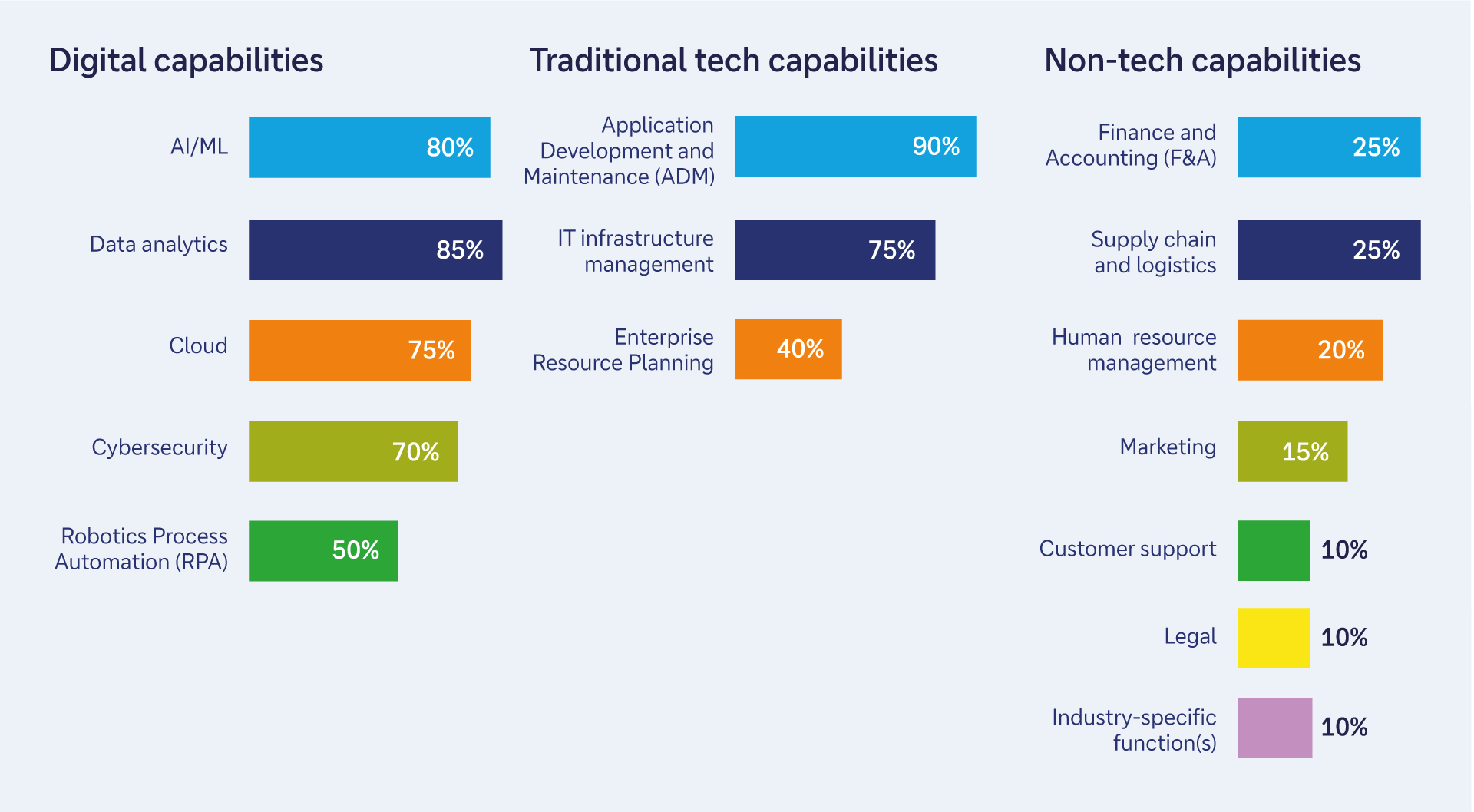

- Start-up ecosystem: In H1 2024, Indian tech startups raised US$4.1bn, which makes India the fourth-highest funded country globally in the tech startup landscape.10 The government has also put in place several initiatives, such as the India AI stack – a comprehensive framework which provides open-source and interoperable AI components and platforms to enable GCCs to experiment and develop AI solutions cost-effectively. Hence, digital and tech capabilities are the ones that MNCs most commonly allocate to GCCs in India (see Figure 2).

- Supporting regulatory environment: India’s government has set up special economic zones (SEZs) where companies have access to various tax and customs duty incentives. Moreover, there have been efforts to streamline processes, digitise compliance procedures and amend labour laws to promote flexibility and efficiency, as the Nasscom/KPMG report points out.

- Good quality infrastructure: Through its National Infrastructure Pipeline (NIP), the government aims to invest US$1.4trn from 2019 to 2025, in improving India’s physical and digital infrastructure, including roads, railways, power grids, communication networks and data centres.11

- Lower cost of operating: Compared to regions such as Western Europe, the US, and the UK. This is due to lower salaries, lower real estate costs, and favourable exchange rates.

Figure 2: Key capabilities in focus when companies expand their centres

Source: GCCs in India: Building resilience for sustainable growth published by KPMG India and Nasscom

ERGO Group’s GCC journey in India

India’s pool of highly skilled professionals was also the main driver when ERGO Group – one of the major insurance groups in Germany and Europe – decided to establish a GCC in Mumbai in early 2022, explains Mehmood Mansoori, CEO of ERGO Technology and Services (ET&S) in India, in an interview with flow he reveals, “ERGO has a very ambitious digital agenda which means we need access to great talents at a good cost level – and India offers this.”

“ERGO has a very ambitious digital agenda which means we need access to great talents at a good cost level – and India offers this”

ET&S India is the captive technology hub and responsible for providing IT solutions in the insurance space for the entire ERGO Group, which operates in over 20 countries worldwide, Mansoori continues: “We carry out all activities relating to IT & IT enabled services (ITES), knowledge process outsourcing (KPO) and additional digital services for the Group companies.”

The GCC currently employs 550 people and have ambitious growth plans over the next few years. “In fact, we were able to move faster than we anticipated as the original plan was to have hired only 400 people by now,” says Mansoori, which he suggests shows the strong support of the Indian regulatory regime for GCCs.

Moreover, he continues, it was also helpful to have Deutsche Bank’s Dordi’s advice given Deutsche Bank’s own GCC in the country and the learning it went through. Mansoori adds. “Deutsche India Pvt. Ltd. is an integral part of the bank’s massive digital transformation, helping local and global clients transform their respective business models and integrate our financial services into their digitalised business models,” explains Dordi.

Implications for payments and FX

While ET&S is making good progress, the entity faced several challenges in its daily financial operations. This was due to the cross-border nature of its business – which is typical for most GCCs offering services to offshore parent companies. In ET&S’s case, the company doesn’t do any business within India but operates purely on a cost-plus model with monthly billing to the parent for the services offered to the group.

This means that ET&S comes under export of services regulation in India, so needs to conduct cross-border FX payments and address the associated FX risks – which can be challenging due to the country’s regulatory environment. Along with others, ET&S must undergo a certification process mandated by the Reserve Bank of India (RBI) for software and related service exports (‘Softex’).

This reporting is done through Authorised Dealer Banks such as Deutsche Bank to match export details with the data provided through the Export Data Processing and Monitoring System (EDPMS) that was introduced by the RBI in 2014 to improve foreign trade operations.12 However, exports are still a document-intensive process, which can be very time consuming and prone to errors.

“We are delighted to partner with ERGO in offering bespoke solutions that leverage cutting edge banking technologies efficiently”

This is where Deutsche Bank plays its part, says ET&S’s CFO, Pramod Agarwal: “Deutsche Bank had already supported us with the rounds of equity and fund infusion from the parent to grow our business. The expert regulatory advisory has helped us navigate complex financial landscapes with confidence.”

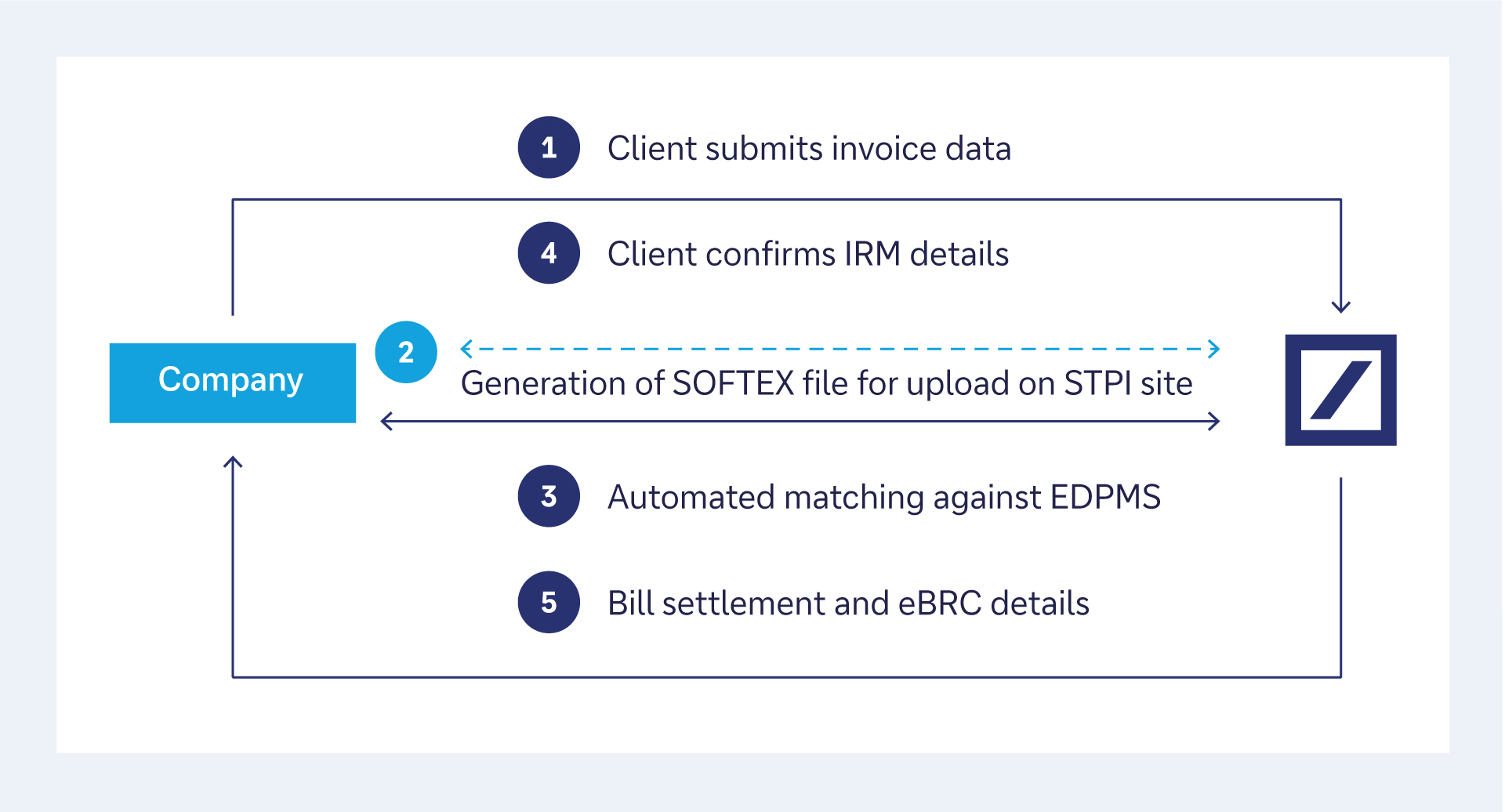

When the business was up and running, Agarwal and his team decided to implement the bank’s Trade Pay platform to automate exports. The platform provides a direct link to the RBI portal for EDPMS eliminating all manual interference and providing real-time updates of the status quo on its dashboard (see Figure 3).

Figure 3: Workflow in the Trade Pay platform

Source: Deutsche Bank

ET&S is also making use of the bank’s Autobahn Cash Manager payment execution and deposit booking. “The centralised host-to-host-integration with our enterprise resource planning ensures seamless transmission of payment instructions”, the CFO explains. “This allows us to focus more on strategic initiatives rather than administrative tasks.”

“We are delighted to partner with ERGO in offering bespoke solutions that leverage cutting edge banking technologies efficiently,” adds Divya Soni, Head of Relationship & Transaction Management APAC, Deutsche Bank. “Our ongoing investments into technology, our deep understanding of the regulations borne also out of the experience with our own GCC as well as the market making FX capabilities are key differentiators.”

Why HOERBIGER manages its treasury out of Singapore

While India is the GCC hub champion, other countries in APAC are popular among corporates as well as a hub for certain central functions in locations outside their headquarter. Singapore has long been among the most popular locations for establishing regional treasury centres (RTCs) in Asia due to its well-established financial centre and its attractive tax regime13 – which are maintained by the stability of its political system and the ease of doing business, especially evident during the Covid-19 restrictions when companies benefitted from the country’s very advanced digitalisation efforts.14

For HOERBIGER, a technology company that supplies performance-defining components for the energy sector, automotive industry, safety technology and the electronics industry, Singapore proved so attractive that the company decided to move its entire global treasury function to the city state during the pandemic. HOERBIGER is a privately owned company, headquartered in Zug, Switzerland with a global presence in 43 countries. In 2023, the company generated revenues of €1.42bn – out of which almost 25% originated from Asia.15

“Asia starts the day such that reporting and consolidation can be worked on once America closes”

“Since 2012, the treasury middle office functions liquidity planning and trade finance were performed in Singapore,” recalls Carl Lee, Head of Treasury at HOERBIGER. “This was mainly because Asia starts the day, such that reporting and consolidation can be worked on once America closes.” By afternoon Asia time – which is morning time in Switzerland, the numbers would be ready for the CFO, the Treasury Front Office and the Corporate Finance team to work with.

As Covid spread globally in early 2020, the early availability of data became crucial, explains Lee, as treasury had to report the cash position to the Executive Board daily to ensure there was “enough liquidity to meet our commitments, such as paying salaries, rentals, taxes and utilities”. Since 70% of the work was done in Singapore by then – and everybody was working remotely anyway, the management decided to relocate the entire team there.

It’s really this time advantage that matters most, emphasises Lee as Switzerland and Singapore otherwise have many similarities. As he notes, “They are both open economies with a robust financial hub, political stability, safe environment, reliability that things run on time, highly educated talent, strategic location, progressive financial policies, robust regulatory framework, modern infrastructure, stable currency and low corruption.”

According to Lee, the main challenges his team faces are:

- Dealing with Know Your Customer (KYC) requirements of banks

- Ensuring payment security

- Forecasting cash and FX exposures thru AI

To address the first two challenges, HOERBIGER considered implementing Deutsche Bank’s virtual account solution to reduce the number of physical accounts. “Deutsche Bank also provides with a unique way to allocate our global credit facilities to HOERBIGER’s local entities via local Deutsche Bank”, says Lee.

Outlook

As this article has outlined, GCCs have come a long way from pure back-office functions towards entities that manage key front-office tasks and have become catalysts for growth and innovation for their respective companies. Driven by a large talent pool, supportive governmental policies and a growing tech-start-up ecosystem, India has emerged as the leading hub for establishing GCCs across various sectors – followed by countries such as Vietnam, Malaysia, Singapore, and the Philippines.

As more companies are setting up GCCs, the need for efficient cross-border banking services in India and the other markets is increasing. For these hubs to fulfil their core functions, operational processes like conducting cross-border payments, managing FX exposures, and setting up internal financing structures need to be as efficient, cost-effective, and seamlessly integrated as possible.

Sources

1 See GCC Quarterly Landscape Q2’24 published by ANSR in September 2024

2 See astrazeneca.in

3 See henkel.com

4 See thehindubusinessline.com

5 See airbnb.com

6 See GCCs in India: Building resilience for sustainable growth; May 2024 Report published by KPMG India and Nasscom

7 See GCC Office Guide 2024: a reckoner to help set up a Global Capability Centre in India; 2024 Report published by JLL

8 See statista.com

9 See weforum.org

10 See cxotoday.com

11 See ey.com

12 See shankariasparliament.com

13 See treasurers.org

14 See straitstimes.com

15 See hoerbiger.com