21 May 2025

Becoming a next-generation financial market infrastructure requires balance. Euroclear CEO Valérie Urbain spoke to Janet Du Chenne about how she’s doubling down on client-centricity and innovation while retaining the company’s DNA as a trusted settlement engine in capital markets

MINUTES min read

Since becoming Euroclear’s CEO in May 2024, Valérie Urbain has changed things beyond what might be considered normal for a traditional financial market infrastructure (FMI).

It’s hardly surprising, given Euroclear’s place at the centre of the capital markets ecosystem, settling trades. As the European provider of settlement and safekeeping services for cross-border transactions in 50 markets, connecting more than 2,000 markets and participants, Urbain’s strategy is to do more with what Euroclear has got. “We are gradually moving into the next generation of Euroclear, using more digital and data-enabled processes to continue to meet our clients’ needs,” she says.

Changes include expanding in Asia Pacific, taking a strategic stake in distributed ledger technology (DLT) market infrastructure operator Marketnode and providing an end-to-end fund distribution solution in private markets.

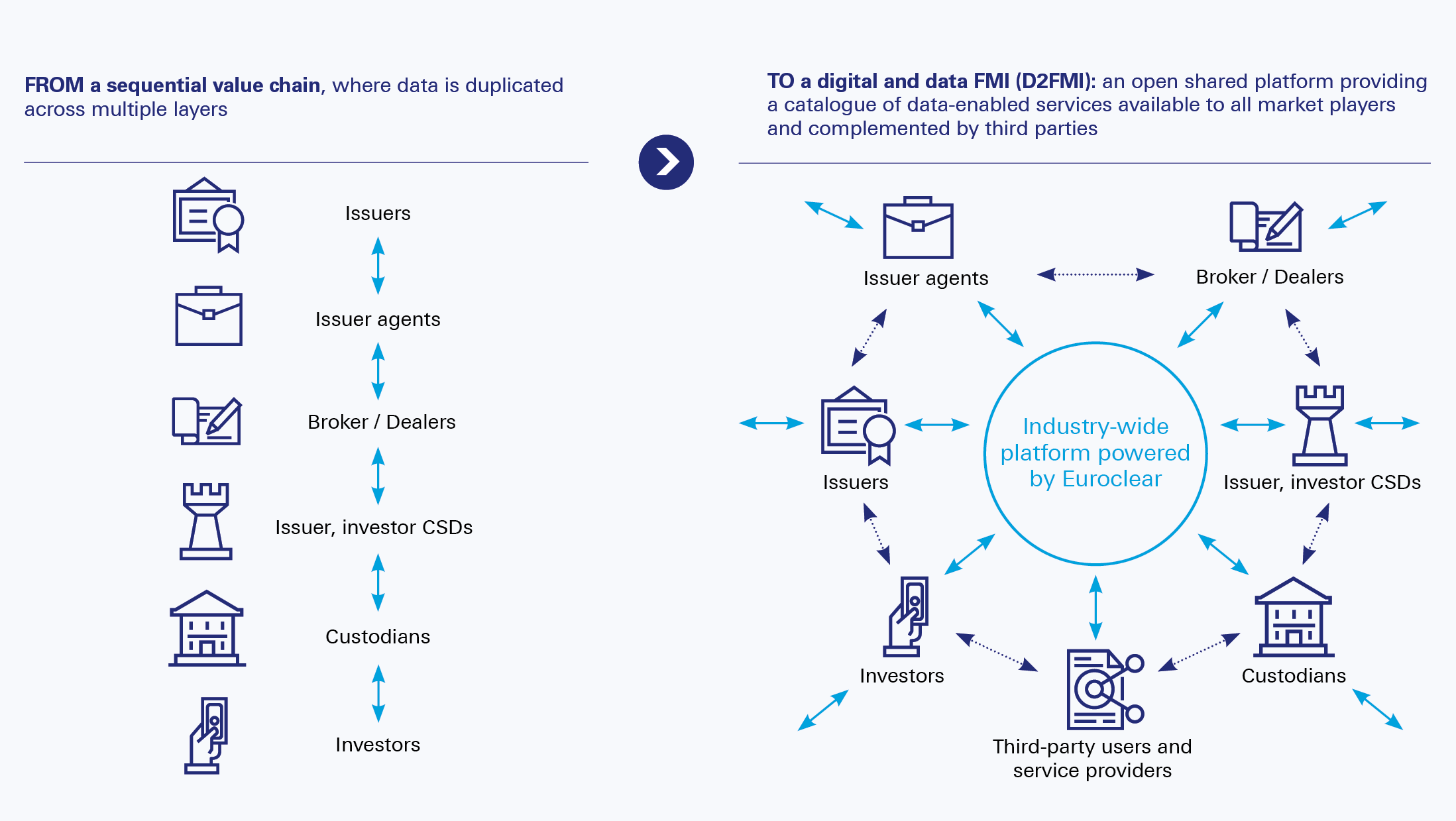

As investors explore new markets and assets, and digitalisation quickens, Euroclear is moving beyond the current sequential market model for securities (see Figure 1), where data duplication leads to inefficiencies and risks, towards an open, shared platform to provide data-enabled services for all market players. It is exploring technology and unleashing the potential of the vast amount of data it sits on as a provider to reduce risk and increase efficiency and connection within the ecosystem.

“It’s what I’d call Euroclear 3.0 – continuing to do what we do, but in a different way,” notes Urbain.

Figure 1: Euroclear aims to evolve the securities value chain into an open platform

Source: Euroclear

Opening up

To deliver a digital and data-enabled FMI with an open platform, Urbain is accelerating taking a stronger client lens, launching and scaling initiatives to serve issuers, investors and dealers, and developing solutions to deliver growth across geographies and asset classes. With this strategy, Euroclear is targeting obtaining half its income from non-core activities (funds, global and emerging markets, and financing) while maintaining growth across European markets and Eurobond offerings.

Urbain’s vision for Euroclear aligns with the insights she’s gained since her arrival there in 1992. “Working with domain experts is motivating, and our central position allows us to contribute to capital markets and the real economy,” she says. “I have never been bored, which is why I stayed. I’m always learning.”

Serving in various roles, Urbain saw Euroclear as greater than the sum of its parts, which informed her vision of where it needed to go. In client-facing positions, she was at the centre of remaining relevant for clients as the market evolved. Where they go, Euroclear follows. Working across the Euroclear Group, including its International Central Securities Depository (ICSD), gave Urbain further insight into clients’ domestic and global activities.

She also served as Group Head of HR, a role that’s been her greatest teacher in people-centricity. “Understanding the relationships with business partners and collective interest in moving forward, as well as how you recruit and nurture people, is a mindset shift,” she says.

At the centre

Today, Euroclear is at the centre of the securities value chain, serving multiple assets and countries. It has an ICSD Euroclear Bank and six CSDs (in Belgium, Finland, France, the Netherlands, Sweden and the UK) serving cross-border and domestic trades. “Where I am now, of course, I would tell you we are at the centre, but I mean it,” says Urbain.

There’s plenty of evidence. Euroclear has come a long way since the early years of solely providing settlement infrastructure for Eurobonds, and there is now increased competition in the space. “I value our competitors because they continue to push us to innovate,” she reflects.

Globalisation and the euro made Euroclear diversify into providing market access to international players. Merging with CSDs in France, Belgium and the Netherlands and acquiring the UK-based CREST settlement system “demonstrated that we were a European financial market infrastructure playing a leading role in Europe”, reflects Urbain. From here, Euroclear developed links with other markets outside Europe, including the US and Japan.

The FundSettle platform (now FundsPlace) for mutual funds broadened its asset offering, while the collateral highway allowed firms to use their securities to finance their operations and secure exposure. The highway surpassed €2trn in mobilised collateral in February 2025. “While settlement used to be our most appealing service, collateral management is moving into that role,” explains Urbain.

With growth in core areas, and assets worth €40trn, Euroclear is ready for the next chapter.

Enhancing client-centricity

Directing this settlement giant towards an open platform requires several changes.

Urbain is leading cultural and organisational transformation to drive client-centricity and innovation. In addition to streamlining and simplifying the company structure, she has redesigned the structure and composition of her top management team, hiring Sebastian Danloy from BNP Paribas as Chief Business Officer to drive a stronger focus on business operations, people and clients. Having finalised her management team at the end of 2024, she says, “I truly believe in having a diverse team of people with different personalities, backgrounds and experiences, because that is the best way to make an informed decision.”

Urbain’s people-centric leadership style of engaging different people was instilled from a young age. As the daughter of Belgian diplomats, born and raised in Senegal, her first 14 years were foundational for her awareness and understanding of the perspectives of people different from her. “I was on the outside and looking in, which helped me see others’ points of view,” she reflects.

“Without our clients, we don’t exist. We put ourselves in their shoes to be relevant and foster a good experience”

Through this lens, she’s transforming Euroclear’s culture towards a purpose-driven mindset, collaboration, empowerment, accountability and client-centricity. “Without our clients, we don’t exist,” she says. “We put ourselves in their shoes to be relevant and foster a good experience, which doesn’t necessarily mean saying yes to everything, but understanding their constraints and how we can help.”

Simplicity is also key, and Urbain encourages more proportionality in risk management to reduce waste and simplify relationships and internal processes.

Balancing innovation with market resilience

As Euroclear develops its position in the capital markets, Urbain strongly believes a digital future needs a resilient market infrastructure.

“European financial market infrastructure has demonstrated throughout several decades that we have been extremely resilient during crises,” she says. She highlights, for example, how Euroclear kept running consistently during the war in Ukraine and subsequent countermeasures against Russia, such as the freezing of sovereign assets held in Euroclear Bank.

“We have also demonstrated the value of the legal framework in Europe for asset protection and settlement finality, highlighting the importance of the rule of law, especially during a crisis,” declares Urbain. “That’s led many investors to trust the European capital markets.”

“I love working on digital and new ideas, but our raison d’être is to be here, day after day, secure and resilient”

“I always say to my team that it is a balance – I love to work on digital and new ideas, but our raison d'être is to be here, day after day, secure and resilient,” she adds. “A significant chunk of our investment portfolio remains in the resilience and security of our services and the legal certainty of what we are doing – that remains key.”

Harmonising Europe

Urbain is equally passionate about Euroclear’s role in making Europe’s capital markets more efficient, to attract investors and issuers globally, and she advocates financial integration and scale to support this.

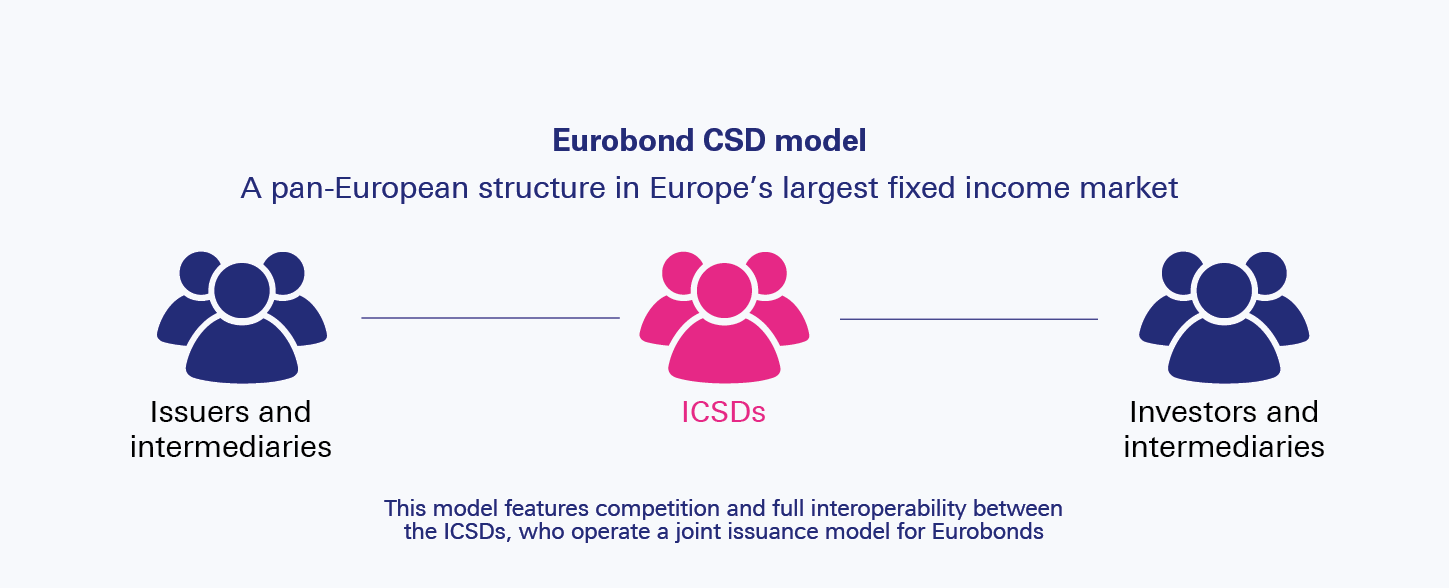

In a recent paper,1 Euroclear urges CSDs, Member States and EU authorities to work together to build a resilient, competitive and unified post-trade environment that supports European competitiveness globally. Highlighting Eurobond settlement as an example of an interoperable framework (see Figure 2), the report urges alignment of market practices across Europe, embracing technology-driven efficiencies, and providing an environment that balances robust regulation with innovation.

Figure 2: Eurobond market integration benefits Europe’s capital markets

Source: Euroclear

Urbain notes that the Capital Markets Union (now Savings and Investments Union) plan to create a single market for Europe has slowed, but further harmonisation is necessary to move things forward. “In our domain, size matters, so the more you harmonise, the bigger the addressable markets become, and the more you can automate, the more synergies you bring, and the more efficiency gains for the market there are,” she says. “The private sector should be allowed to freely compete while also being permitted to build on some integration to ensure the critical mass adds value.”

However, open competition and access conditions in Europe’s capital markets face several barriers, as highlighted in the report. “Europe needs to remain an open economy to foreign investors to support growth and its financing needs,” says Urbain. “Closing it would be a big mistake.”

Euroclear also plays an active role in moving the UK and Europe towards a shorter settlement cycle. “We are always looking for the stability of the financial markets, so it’s in our interest to collaborate on the changes needed for a smooth transition and raise issues to avoid problems later,” says Urbain. “We should also support investors outside of Europe to cope with the time zone differences.”

Exploring innovative technologies

Building an open, shared cross-asset platform, reinforcing core client services, and further expanding in growth areas while targeting acquisitions and partnerships, means assessing how technologies drive efficiencies in the securities post-trade value chain. “Due to our nature, we assess how the market is evolving. At the same time, we are increasingly using new technology, such as artificial intelligence and natural language processing (AI and NLP), in our operations to improve and increase efficiency,” says Urbain.

“As we grew comfortable with these technologies internally and listened to our clients, we explored their use in creating services and products.”

That exploration has unearthed several uses in the past year. One of these is an issuance platform in DLT. “DLT won’t replace the entire technology stack, however,” says Urbain. “We first want to ensure that clients adopt the technology and that there are enough benefits.” Through a seven-year strategic partnership with Microsoft, announced in early 2025, Euroclear is also exploring developing services around data, digital and AI to enhance its service offering.2

Euroclear’s funds practice is also key to its D2FMI strategy of becoming a provider of data and digital-enabled Financial Market Infrastructure services for all market players. The strategy evolves the company beyond its latest Digital-Financial Market Infrastructure (D-FMI) platform, as it looks to include the alternative fund space and explores ways to support private assets. Urbain expands: “We want to be a one-stop-shop for all fund types. We started with mutual funds, and we’ve also built an efficient exchange traded funds (ETF) franchise. Replicating our Eurobond settlement model allows multiple ETF listings with a single liquidity pool. We’re allowing the market to benefit from wider solutions but with a simple settlement offering.”

Another strength is collateral management, where Euroclear continues to optimise its pool of assets. “We’re collaborating with external parties to bring more sophistication and optimisation of tools to allocate collateral,” says Urbain. An example is Euroclear’s diversification into the US market with the launch of a DVP repo service for US Treasuries.3 “Collateral management is a good example of client-centricity and part of our strategy to be a diverse provider of services for clients’ needs.”

Growing globally

Noting Euroclear’s European anchorage and global footprint, Urbain has set her sights on further expansion. “Asia and the Middle East are areas where we play an important role,” she says. “We’re shifting our approach where commercially, we’re already benefitting from a large footprint with Asian investors, custodians and insurers, especially through the Eurobond practice. But, given our geographic evolution, we’re talking to local partners about how we can contribute to the growth of the Asian market by sharing our know-how and partnering with them on common initiatives.”

Euroclear’s strategic stake in Marketnode in Singapore4 is one example. The initiative will initially target building a DLT utility for funds. “These are the type of partnerships we find interesting because we can bring our experience, our network of clients, and know-how while still being local,” says Urbain. A wholesale banking licence in Singapore also enables it to offer services there.5

As part of Euroclear’s Asia growth strategy, Urbain appointed long-time colleague Phillipe Laurensey6 as Asia Pacific CEO to drive efficiencies based on the company’s experience of Europe, which has similarly fragmented rules and landscape. “There is never a single Asian strategy,” she says. “Players must accommodate different regimes and ways of working. We’ve thus partnered with Deutsche Bank for local custody in a few markets to make them Euroclearable, including Malaysia and South Korea. We help international investors gain comfort with local rules and work with the market to adopt standards.”

Euroclear is also considering replicating its expertise in Asia, given the region’s ambitions to play at a digital level. “With trading flows within Asia Pacific and the Middle East increasing, we intend to play a role here,” says Urbain. “Our geographic shareholding has also evolved. One-third of our shareholders come from Asia Pacific, which creates new opportunities.”

With an approach to open platforms, and a focus on people, clients and operations, Urbain is setting Euroclear up to remain relevant and resilient in a digital future. Her strides towards D2FMI show that wherever clients are, in whatever form – digital or traditional – Euroclear has positioned itself to be at the core, and open to enable their growth.

Janet Du Chenne is a freelance financial journalist and a former Co-Editor of flow and of Global Custodian

Image credit: © Euroclear

Sources

1 See euroclear.com

2 See euroclear.com

3 See euroclear.com

4 See euroclear.com

5 See euroclear.com

6 See euroclear.com