7 May 2025

With a GDP of €4.66trn, Germany remains the third biggest economy in the world behind the US and China – but the country is facing persistent stagnation. flow’s Desirée Buchholz explores the most pressing tasks for the new government and how corporates could benefit from the public investment package

MINUTES min read

For years, Germany has prided itself on being the Exportweltmeister (German for global export champion). Driven by small and medium-sized companies that are world market leaders in a particular niche – often in the automotive or mechanical engineering sectors – global demand for products ‘Made in Germany’ boomed. But in the light of geopolitical and technological changes, this export-led growth model is increasingly being challenged.

Since Donald Trump took office as US President for the second time in early 2025, it has become clear that Germany must focus more on itself and Europe. The paradigm of free and rule-based global trade is being openly abandoned by the US – Germany’s most important trading partner in 20241 – and more subtly challenged by China, now the second most important.

“Germany stands at a crossroads in its postwar history”

“The golden years of globalisation are over, and increasingly rough winds in global trade are exposing Germany’s structural weaknesses,” write David Folkerts-Landau, Group Chief Economist, and Robin Winkler, Chief German Economist, in their report for the Deutsche Bank Research Institute on What Germany’s economy needs now, published on 13 March 2025. “Germany stands at a crossroads in its postwar history,” they continue, concluding that “the next legislative term is decisive for Germany's future. It is perhaps the last chance to set the course for growth again.”

The country finally needs to put more emphasis on “competitiveness and on the deepening of the EU single market and less on the Green deal,” said Sigmar Gabriel, Germany’s former Federal Minister for Foreign Affairs and Vice-Chancellor, in a Deutsche Bank client webinar on 26 February – three days after the federal elections took place in Germany. “We have to come back to our leading role in Europe – and that was never a role Germany had on its own, but always in partnership with France and Poland.” This is why he felt the new government needs to “build trust again with France and Poland” and ultimately “to hold the European Union together”.

Fiscal spending to boost growth

Dramatic calls like these have not gone unnoticed by the new federal government. Even before Friedrich Merz was elected German chancellor on 6 May 2025, the parliament voted for a massive investment package that could be worth at least €1trn over the next decade. It consists of a €500bn fund to restore the country’s infrastructure (most importantly roads, bridges and schools), out of which €100bn is dedicated to climate-related projects and an open-ended borrowing leeway for defence.

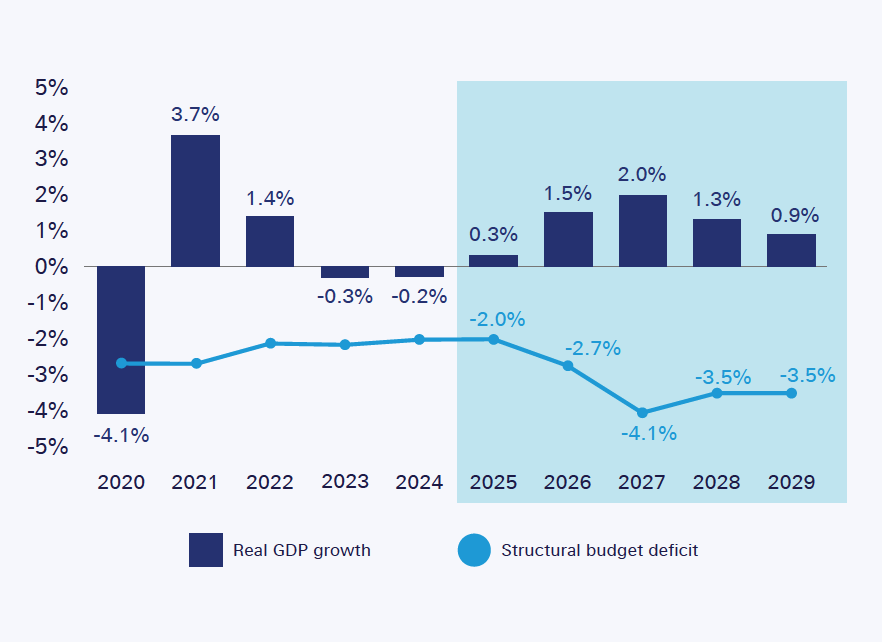

This vote regarded as a historic move – not only among Germans but also by the international public, since the country is known for its very rigid fiscal policy.2 Following this reform of the country’s debt brake, Deutsche Bank Research now expects real GDP growth to accelerate to 1.5% in 2026 and 2.0% in 2027.

Figure 1: Key growth and fiscal forecasts, 2025-2029

Source: Deutsche Bank Research report, Zahlenwende: revising our German macro forecasts, 21 March 2025

But, while there is no doubt that a fiscal package of this size will boost growth over the next couple of years, deep structural reforms are needed to ensure this growth is sustainable. In their report, Folkerts-Landau and Winkler identify three areas most in need of change:

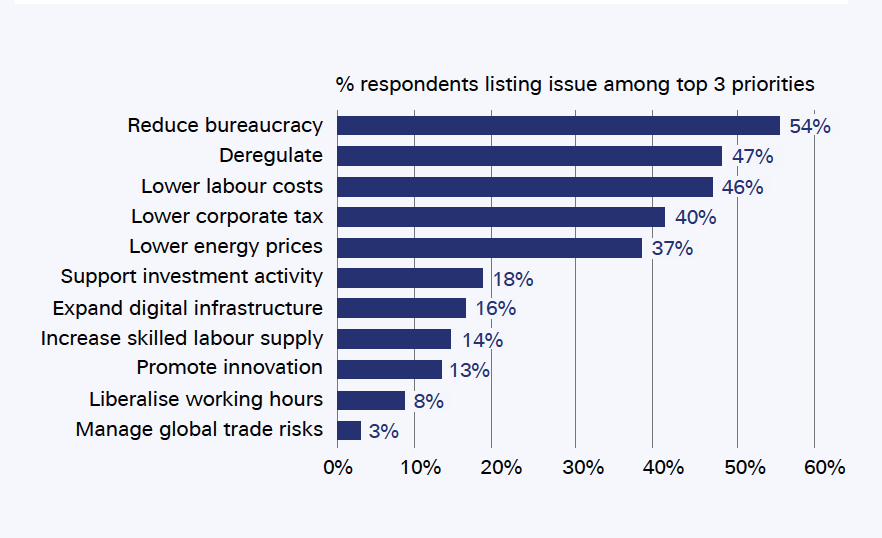

- Reducing bureaucracy: Companies increasingly cite regulation and bureaucracy as the primary obstacle to innovation, investment and competitiveness (see Figure 2). The National Regulatory Control Council estimates annual compliance costs – the direct costs of bureaucracy – at €65bn, or approximately 1.5% of GDP. The actual economic costs are probably twice as high, write Folkerts-Landau and Winkler, citing examples of overregulation from areas such as consumer protection, environmental and climate policy, and labour law: “While quantifying the impact on growth is challenging, significant deregulation could increase potential growth by at least one percentage point.”

- Strengthening innovation: The authors emphasise the importance of ramping up the country’s digital infrastructure to increase the competitiveness of the German economy: “Comprehensive broadband and 5G networks are essential for the continued development of the Internet of Things, a key growth opportunity for German industry.” According to the report, Amazon and Microsoft combined spend about as much on Research & Development (R&D) as the entire German private sector. “Europe has missed out on a large part of the productivity gains that accompanied the digital revolution in the US. Today, Europe and Germany risk missing the artificial intelligence (AI) revolution,” the report says. Therefore, the new government should reduce corporate tax rates to allow for higher private investment, encourage technological spillover effects from the defence industry to civilian R&D and promote the deepening of the German capital market within the context of European integration. “Germany needs to mobilise additional private capital for innovative startups, which traditional banks often find challenging to finance.”

- Improving work incentives: Germany’s labour volume is shrinking due to an ageing population and shorter working hours. This is why the authors call on the government to enhance work incentives for part-time employees, liberalise the labour market and remove bureaucratic obstacles to skilled immigration.

Figure 2: Measures that could boost innovation, investment and competitiveness

Source: IW-Zukunfspanel, winter/spring 2025. Deutsche Bank Research

Financing the energy transition

Moreover, the paper also mentions the importance of reliable and affordable energy supply to ensure local companies can compete with their international peers. Germany was an early leader in offshore wind and solar power and phased out nuclear power in 2023. By 2030, 80% of the country’s electricity supply is due to come from renewable energy sources.3 Despite the country’s progress in delivering on its Energiewende (energy transition – more than 50% of gross electricity was generated from renewable sources in 2023), the country still relies heavily on fossil fuels. In 2023, coal and natural gas accounted for approximately 40% of the energy mix.4

Financing the energy transition is a challenge, in particular for the small and medium-sized companies that form the backbone of the German economy. This is why, in September 2023, Deutsche Bank and the European Investment Bank (EIB) launched a €400m loan portfolio to help firms with between 250 and 3,000 employees invest in renewable energy and energy efficiency. Under the programme, the EIB provide guarantees covering up to 50% of the loan sum.5 So far, the bank has arranged several financing transactions, encompassing for example the installation of solar power as well as an upstream raw slag processing plant to separate and reprocess combustion slag from waste incineration, which increases the recycling rate to more than 50%.

“Sustainable transition has to be economically sensible and increasing energy efficiency most clearly is”

“Sustainable transition has to be economically sensible and increasing energy efficiency most clearly is, as it allows us to bring down costs and improve resilience,” says Hauke Burkhardt, Head of Trade Finance and Lending for Germany, Austria and Switzerland at Deutsche Bank. “Providing the necessary financial resources is key to enable a successful transition.”

In addition, in April 2025, the bank, together with the European Investment Fund (EIF), set up a €250m guarantee portfolio where the EIF covers between 50% and 70% of the loan sum. This makes it possible to grant loans up to a total amount of €500m. The guarantee is designed to support small companies with up to 500 employees to invest in projects around innovation, digital transformation as well as sustainable transition.

Moreover, to ensure a cost-effective electricity supply from renewable energy sources, grid expansion needs to pick up significantly in the years to come, to avoid energy shortages at times when there is little wind or sunlight. Financing private investment in network infrastructure is therefore a key task going forward.

In March 2025, German transmission system operator 50Hertz announced plans to quintuple its investment in grid infrastructure between 2024 and 2028 to €23bn.6 Energy provider E.ON plans to invest €35bn in infrastructure in the same timeframe. Yet, the company’s CEO, Leonhard Birnbaum, also stressed the importance of the new government setting a clear regulatory framework: “The prerequisite for this in Germany is a return on our network investments that’s competitive by international standards. Whether this will be the case for the new electricity regulatory period starting in 2029 is not foreseeable for us today.”7

From automotive to defence

Provided that the new German government delivers on the structural reforms discussed above, the country is well positioned to regain trust among investors and thus attract more foreign direct investment. With a GDP of €4.66trn in 2024, Germany is the third biggest economy in the world,8 and it is of course also part of the European Union – whose single market, with a GDP of €16trn, is the largest in the world.9 “The level of education in Germany is high, we have strong research and science institutes as well as the “Mittelstand” that thinks innovatively and entrepreneurially,” says Burkhardt.

That’s why the fiscal investment package offers great opportunities for German companies, but also for international corporates – most obviously for those in the defence sector, which hope to benefit from public orders to ramp up Germany’s defence capabilities and military production.

“German companies are now back in an investment mindset”

Germany boasts a solid defence industrial base, with existing military capabilities in radar (Hensoldt), air defence systems (Diehl, Hensoldt, Rheinmetall) and military engines (MTU Aero Engines). Yet, as pointed out by a team writing for the Deutsche Bank Research Institute, the German defence industry is conspicuously small relative to the country’s economy, its industrial sector and other countries. “Data for the top 100 defence companies globally suggest that the German defence industry is the eighth largest in proportion to the national economy, with arms sales of German companies amounting to only 0.2% of German GDP.”

Therefore, the open-ended borrowing for defence also offers unique business opportunities for the ailing German and European automotive sector. German automotive production in 2024 was down 31% versus its peak in 2011. However, as very little capacity has been reduced, this has led to severe overcapacity across the automotive original equipment manufacturers and parts suppliers. Therefore, “moving capacity to defence could materially cut the price tag for restructuring the auto industry,” write Adrian Cox and team in their report German defence: Germany’s shrinking auto industry may be key to defence ramp up. “The auto industry brings personnel, facilities and expertise to ramp up production and deploy unused capacity.”

Indeed, there are signs of a transfer from automotive to defence capacity. In June 2024, Rheinmetall signed an agreement with Continental to employ ex-automotive staff.10 According to media reports, Hensoldt has similar plans,11 and Rheinmetall may even consider taking over entire production facilities from automotive companies.12

Another sector which hopes to benefit from the fiscal spending package is the construction industry – given that €500m of the package are linked to public infrastructure such as bridges, schools and hospitals. “German companies are now back in an investment mindset”, observes David Lynne, Head of Corporate Bank, Deutsche Bank. While investments don’t happen overnight and companies are waiting for public infrastructure orders to hit the ground, as he emphasises, the business sentiment has improved significantly in the construction space.13 “As companies ramp up their investments, this will require financing, and we are prepared to provide this financing to our clients.”

Sources

1 See gtai.de

2 See bbc.com

3 See iea.org

4 See statista.com

5 See db.com

6 See renewablesnow.com

7 See eon.com

8 See germanpolicy.com

9 See statista.com

10 See continental.com

11 See handelsblatt.com

12 See deutschlandfunk.de

13 See ifo.de