11 June 2025

Singapore boasts the second largest port in the world and remains a core hub for asset and wealth managers – as well as being home to more than 400 commodities companies. flow looks at this trading city’s remarkable evolution as it turns 60 in 2025

MINUTES min read

With the head of a lion and body of a fish, the Merlion guards the mouth of the Singapore River in Merlion Park, looking out over the Marina Bay Sands hotel. The statue celebrated its 50th birthday in 2022 and the Republic of Singapore’s official mascot remains an emblem of its humble beginnings as a 14th century trading settlement.

In 2025, this Asian powerhouse turns 60 after the country’s independence from Malaysia was confirmed on 9 August 1965. The country has also elected its 15th parliament in May. This article provides a backdrop to Singapore’s unique position as a hub for Association of Southeast Asian Nations (ASEAN) market access, not only as a trade powerhouse due to its optimal location and vast port infrastructure (making it particularly appealing to commodity trading companies), but also its attractiveness to investors and asset managers.

As the Monetary Authority of Singapore, or MAS, (the country’s central bank) reported in July 2024, “Global assets under management (AUM) increased by 12% and Asia AUM … trended up by 8% in 2023, on the back of gains in global bonds and equities after a challenging 2022.” Singapore’s total AUM rose to US$4.1trn – faster than the overall AUM growth in Asia. “Singapore serves as a key gateway for global asset managers and investors to tap into the region’s growth opportunities, with 77% of AUM sourced from outside Singapore, and 89% of total AUM invested outside the country,” added the MAS report.1

As Deutsche Bank’s Singapore-based Head of ASEAN Burkhard Ziegenhorn points out, “Singapore stands out from a transaction banking perspective and as a hub it gives you access to local markets, which is very convenient for multiple ASEAN markets. At Deutsche Bank we have seen more than 60% growth in assets under custody over the past 12 months.”

The country has also been at the forefront of instant payments, advancing the connection of real-time payment infrastructure across the ASEAN region. The value of gross digital payments across the six largest ASEAN economies reached US$806bn in 2022, up 14% year on year, and is forecast to rise to close to US$1.2trn in 2025.2 This has much to do with the efforts Singapore has made to connect its rapid payment systems with those of other key Southeast Asian markets –most notably India and Thailand.3

Trade and finance hub

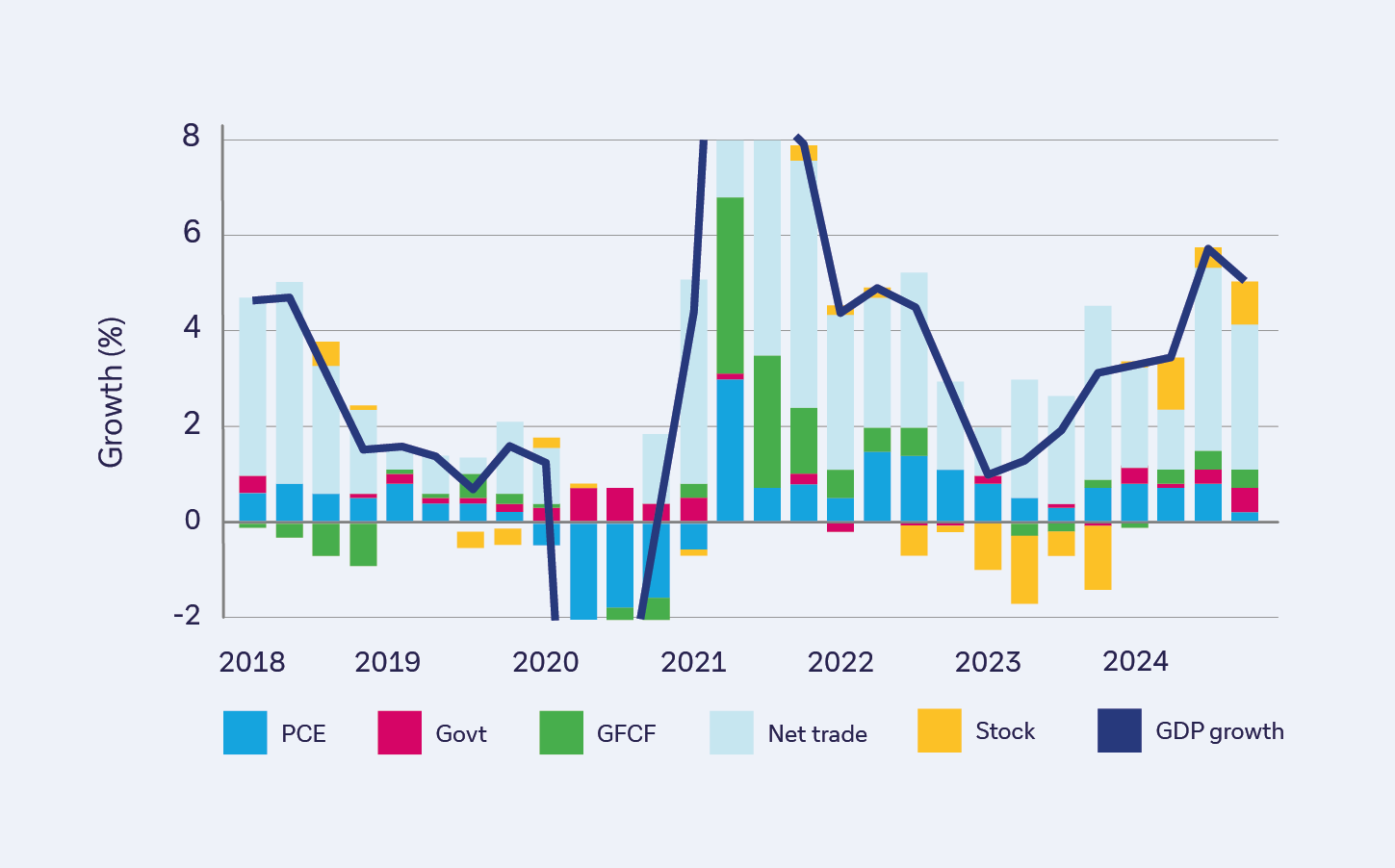

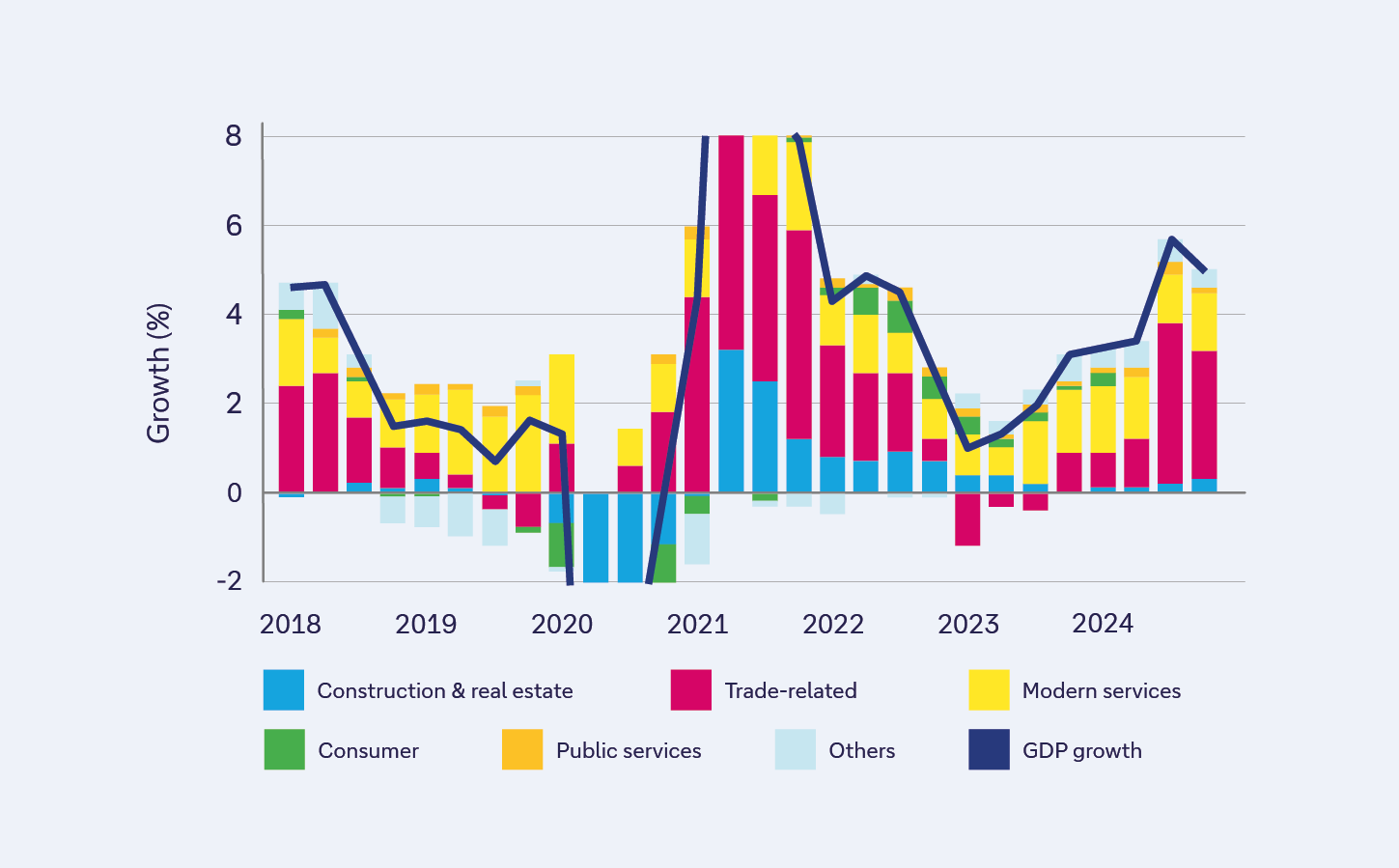

Singapore is the nexus of trade in the Asia-Pacific (APAC) region, thanks to its low taxes, free trade environment, and geographical location. While it has not emerged unscathed from the US round of tariffs announced on 2 April, Deutsche Bank Research commented a week later that along with other non-China Asian economies there are no plans for retaliatory tariffs and reciprocal tariffs are expected to fall through negotiations.4 However, even with a broader trade deal in Asia, exports would still be a drag to Singapore’s overall growth. In 2024, net trade contributed 2.5 percentage points to the 4.4% overall growth. By sector, manufacturing, wholesale trade, and transport and storage contributed 2.1 percentage points. (See Figures 1 and 2)

According to the government, Singapore’s growth may slow to between 0-2% in 2025.5 This reinforces the Research team’s view that “Singapore’s external demand is unlikely to pick up to a level meaningful enough to increase inflationary pressures back within the historical mean of just below 2%”.6 Consequently, Deutsche Bank Research expects greater support from the authorities this year, with MAS likely to ease its monetary policy further, and potential additional fiscal measures to support households through near-term strains and labour market dislocations.

Figure 1: Singapore's GDP growth by expenditure

Source: Deutsche Bank Research, Department of Statistics

Figure 2: Singapore's GDP growth by industry cluster

Source: Deutsche Bank Research, Department of Statistics

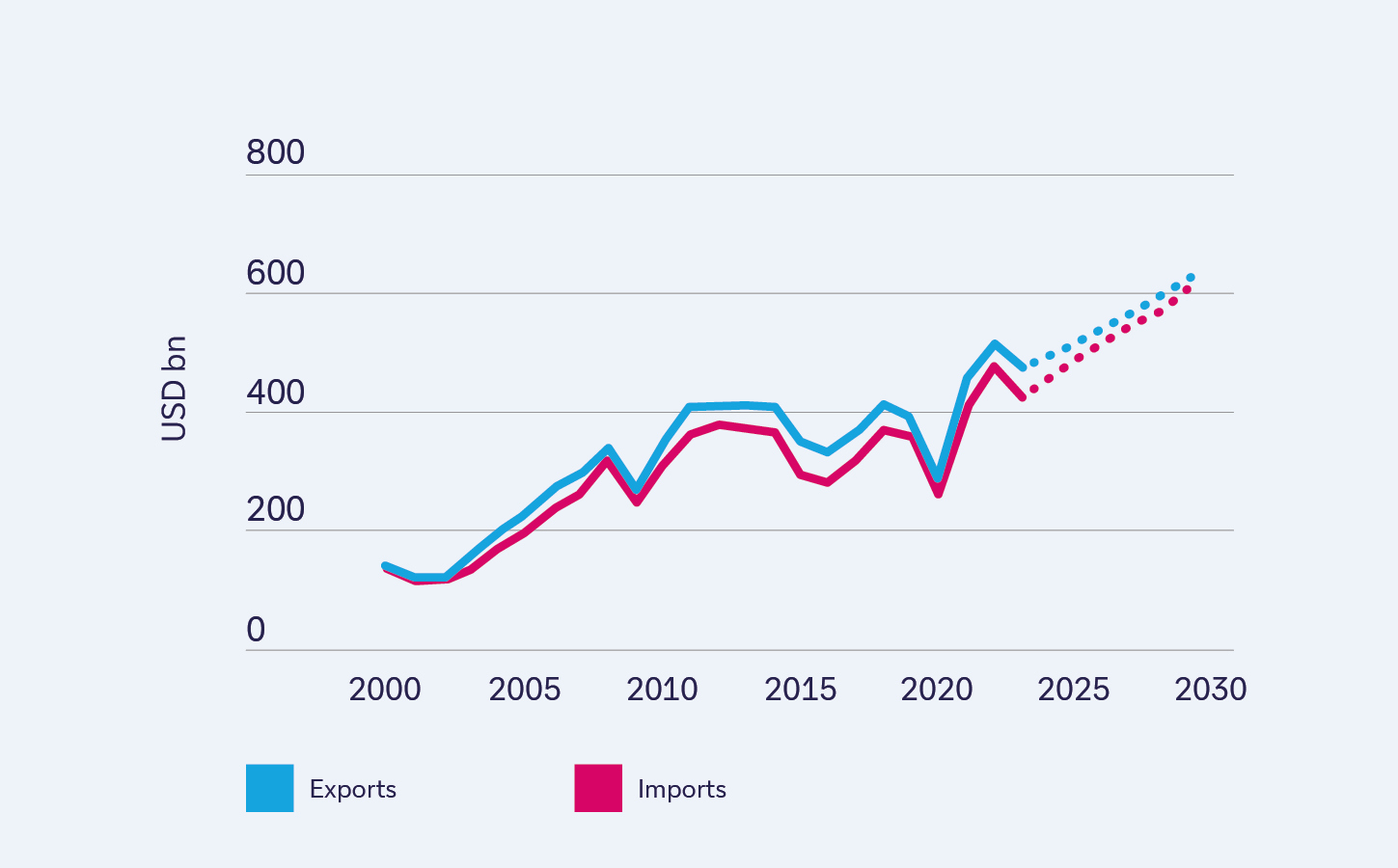

According to the 2025 DHL Trade Atlas report, Singapore’s total trade volumes hit US$951.6bn in 2025, making it the 15th-largest trading economy in the world. Its exports (US$494.8bn) comprise mainly machinery, mineral fuels, and precious metals (see Figure 3).7

Figure 3: Singapore's trade value growth, 2000 - 2029 (forecast)

Source: DHL Trade Atlas 2025

The city state is one of the largest global commodity trading hubs, despite having few natural resources of its own, and the world’s largest trading companies have all taken the opportunity to establish bases here. The Global Trader Programme and Finance & Treasury Centre initiative provide various incentives for eligible trading companies.8 Aaron Tay, Deutsche Bank’s Head of Corporate Cash Management Singapore, points out that these companies use regional treasury centres to manage the region’s payment and collections, risks and exposures, and liquidity among many other priorities; while leveraging one of the largest trading and financial hubs in the world to access and manage their APAC set-up effectively. This growing ecosystem also creates a space for international businesses to interact closely to form more trade corridors over time.

Singapore’s ongoing investment in logistics helps retain its attractiveness to exporters – it is host to the largest air cargo hub in Southeast Asia. In October 2024, the Changi Airport Group announced the opening of Changi Nexus One, a refurbished air logistics facility within Changi Airfreight Centre.9

The Maritime and Port Authority of Singapore has been busy developing a premier global port hub and international maritime centre “to advance and safeguard Singapore’s strategic maritime interests”. It runs the Port of Singapore, one of the largest ports in the world and the world’s second busiest after Shanghai. It shifted39 million twenty-foot equivalent unit (TEU) containers through its facilities in 2023.

The under-development Tuas Port, which opened in September 2022, is expected to have a handling capacity of 65 million TEUs when it is fully completed in the 2040s. As a ‘smart port’, it will deploy artificial intelligence and the Internet of Things to use driverless automated guided vehicles, smart sensors, and data analytics to predict congestion areas.

Global connectedness in the form of exchange and openness is key to Singapore’s dynamic economic growth. The DHL Global Connectedness Index measures the depth and breadth of international flows of trade, capital, information and people from 2001 to 2024. Singapore remains top of the leader board, thanks to its investment in strengthening its global physical and digital connectivity. “Trade is our lifeblood. We continue to enhance our connectivity and trade links to remain a critical and trusted node in global supply chains, facilitating international trade and flows of capital, information and talent” said Chan Ih-Ming, Executive Vice President of the Singapore Economic Development Board on publication of the 2024 index last year.10

Singapore has done much to restore confidence in its financial crime prevention after a series of commodity finance scandals involving false trade finance documents that erupted during the Covid-19 pandemic.11 “The Association of Banks in Singapore now have this code of conduct we all have to implement and a trade finance registry where we put documents for authentication has just been launched – there are no duplicate documents,” reflects Deutsche Bank’s Ziegenhorn.

“We continue to enhance our connectivity and trade links to remain a critical and trusted node in global supply chains”

Custody reach

Singapore continues to be a focal point for fund management companies and investors as an attractive investment destination. This is due to its stable political and economic environment, strong regulatory framework, and attractive tax regime. Deutsche Bank’s Pallavi Shetty, responsible for custody and securities services in the ASEAN region, points out that Singapore is a popular country for Indian and Chinese families to set up family offices. “Before investment by family offices was restricted to local markets, but now with more conducive regulations there is an opportunity to invest in offshore markets via setting up fund structures in Singapore – that is where we have been supporting with custodial services.” Singapore’s Variable Capital Company (VCC) structure is a prevalent choice with fund managers as the preferred domicile for launching investment funds targeting Asian markets and beyond. Family offices and wealth management companies are increasingly setting up VCCs as the preferred vehicle to manage their investment portfolios.

The launch of MAS’s Project Guardian12 is contributing to the growth of Singapore’s fund ecosystem and positioning as a global asset tokenisation hub, drawing financial and technical expertise with positive spillovers to the broader economy. Being the launchpad for driving innovation, accessibility and cost efficiencies in tokenised products, it has enabled the successful issuance of the first digital native VCC to bring together the cost and distribution advantages of tokenisation with the flexibility of a VCC structure, and is further assessing the development of an open digital infrastructure (Global Layer 1) to connect fragmented liquidity pools.

Singapore continues to be a focal point for fund management companies and investors as an attractive investment destination. This is due to its stable political and economic environment, strong regulatory framework, and attractive tax regime. Deutsche Bank’s Pallavi Shetty, responsible for custody and securities services in the ASEAN region, points out that Singapore is a popular country for Indian and Chinese families to set up family offices. “Before investment was restricted to local markets, but now with more conducive regulations there is an opportunity to invest in offshore markets – that is where we have been supporting with custody services.” Singapore’s Variable Capital Company (VCC) structure is a prevalent choice with fund managers as the preferred domicile for launching investment funds targeting Asian markets and beyond. Family offices and wealth management companies are increasingly setting up VCCs as the preferred vehicle to manage their investment portfolios.

The launch of MAS’s Project Guardian13 is contributing to the growth of Singapore’s fund ecosystem and positioning as a global asset tokenisation hub, drawing financial and technical expertise with positive spillovers to the broader economy. Being the launchpad for driving innovation, accessibility and cost efficiencies in tokenised products, it has enabled the successful issuance of the first digital native VCC to bring together the cost and distribution advantages of tokenisation with the flexibility of a VCC structure, and is further assessing the development of an open digital infrastructure (Global Layer 1) to connect fragmented liquidity pools.

“With more conducive regulations there is an opportunity to invest in offshore markets”

Why corporates choose Singapore

“Singapore has a very unique status globally as well within the region,” reflects Kenny Khoo, Head of Intra-Asia Coverage (excluding Japan) at Deutsche Bank. He explains this is not just down to its macroeconomic performance, but that its talent pool with a broad range of linguistic skills positions Singapore very well to build its relationship with China. Having established formal diplomatic relations in 1990, further diplomatic ties were announced in November 2024.14 In addition to the Chinese family offices setting up in Singapore, he is seeing a lot of multinational Chinese corporates and other foreign corporates positioning their overseas hubs in Singapore. Its geography (access to ASEAN), favourable tax regime and intellectual property and intangible assets strategy15 making it particularly attractive.

As explained in the flow article, ‘The rise of global capability centres in APAC’, Singapore proved so attractive for HOERBIGER, a technology company that supplies performance-defining components for the energy sector, automotive industry, safety technology and the electronics industry, that the company moved its entire global treasury function there during the pandemic. HOERBIGER is a privately owned company, headquartered in Zug, Switzerland with a global presence in 43 countries.

“Since 2012, the treasury middle office functions liquidity planning and trade finance were performed in Singapore,” recalls Carl Lee, Head of Treasury at HOERBIGER. “This was mainly because Asia starts the day, such that reporting and consolidation can be worked on once America closes.” By afternoon Asia time – which is morning time in Switzerland, the numbers would be ready for the CFO, the Treasury Front Office and the Corporate Finance team to work with.

Sources

1 See mas.gov.sg

2 See asean.org

3 See bis.org

4 See research.db.com

5 See mti.gov.sg

6 See research.db.com

7 See dhl.com

8 See enterprisesg.gov.sg

9 See aircargoupdate.com

10 See dhl.com

11 See gtreview.com

12 See straitstimes.com

13 See straitstimes.com

14 See straitstimes.com

15 See ipos.gov.sg