8 April 2025

Boosting demand for electric vehicles (EV) is key to decarbonising road transport. With corporates accounting for 60% of car purchases in Europe, incentivising companies to electrify their motor fleets is essential. flow’s Desirée Buchholz reports on how E.ON Drive is contributing to this goal – and why efficient payment processes and APIs are part of its success

MINUTES min read

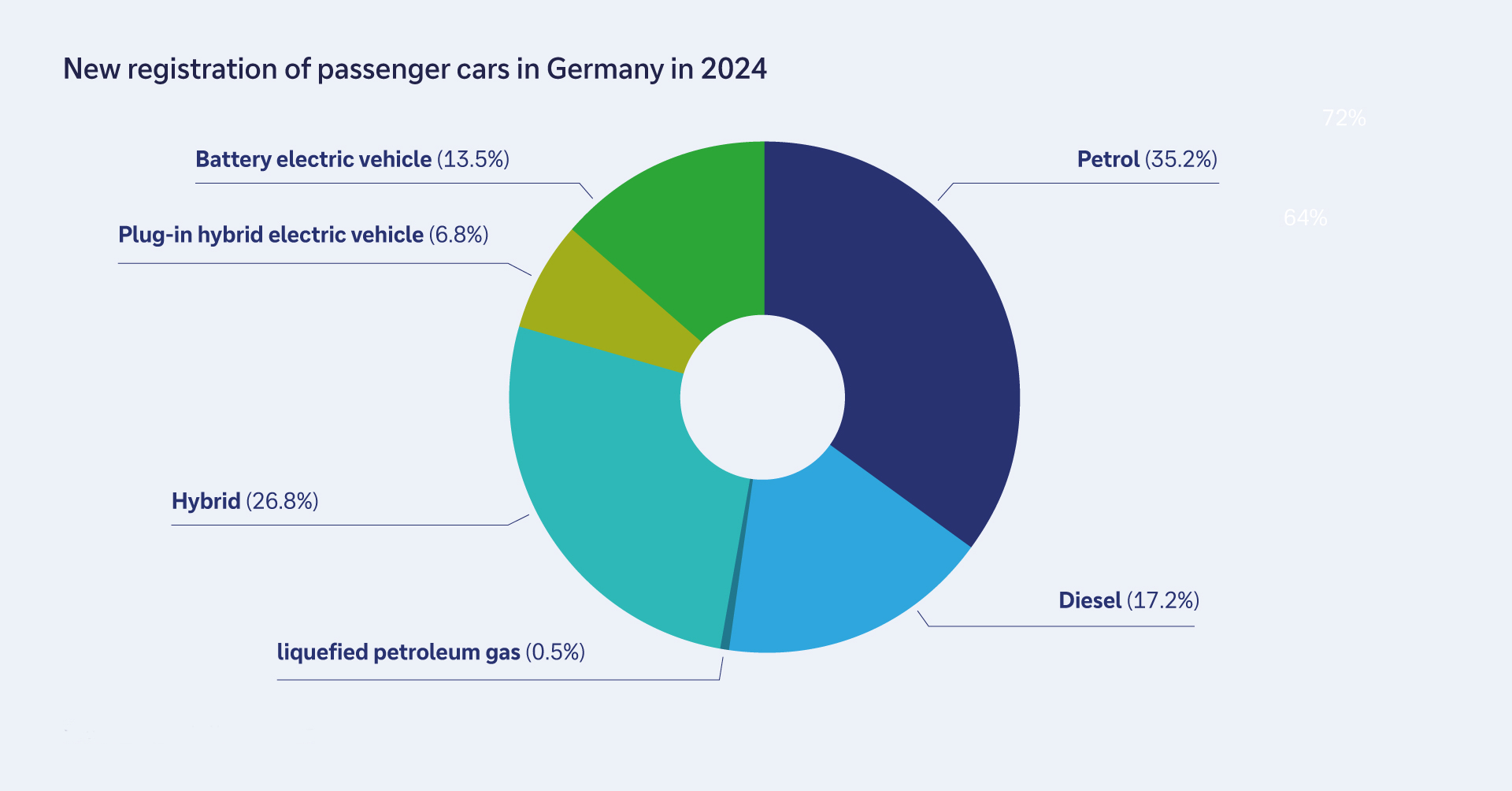

While 2024 was another record year for global electric vehicle (EV) sales – increasing 25% year-on-year to more than 17 million cars1 – one of the world’s largest automotive markets experienced a setback to its clean mobility transition. In Germany, registrations of battery electric vehicles (BEVs) declined 27.4% year-on-year (YoY). According to the European Alternative Fuels Observatory, this led to a 4.2% increase in average CO₂ emissions for newly registered cars.2 In December 2023, the German government had abruptly announced an end to subsidies for EV purchases,3 which cooled consumer interest.

Yet reviving demand for electric vehicles (EV) is essential for meeting climate goals in Germany and other European Union (EU) member states, with road transport the only major economic sector where CO₂ emissions have risen since 1990.4 Increasing demand for EVs is also needed to respond to supply-side measures in the EU: From 2035 onwards, new cars and vans in the region will be allowed for registration only if they are zero-emissions.5 While Chinese EV manufacturers have been able to bring down prices for their models thanks to healthy domestic demand, European manufacturers don’t share the same advantage.

Figure 1: New registration of passenger cars in Germany in 2024

Source: Kraftfahrtbundesamt

This drawback explains why the EU is now turning its attention to corporate vehicle registrations, i.e. cars purchased by legal entities. They represent around 60% of all car registrations in the EU, so incentivising businesses to switch to EVs is as important as convincing individual consumers. However, in 2024 the zero-emissions vehicle share of corporate car fleet sales stood at only 12.4% compared to 13.8% for individuals.

“An accelerated demand for zero-emission vehicles from corporate fleets can help regain growth and competitiveness of the European automotive sector, reduce overall cost of operations over the lifetime of the vehicle for fleet operators and help consumers by improving second-hand car market offerings and hence reducing the costs of zero-emission vehicles”, reported the EU Commission in its Industrial Action Plan for the European automotive sector published on 5 March 2025.6

E.ON Drive: Managing corporate fleet EV transition

One company which is supporting firms’ efforts to electrify their fleets is E.ON Drive – a 100% subsidiary of E.ON, one of Europe's largest energy companies based in Germany. While its parent company provides clean energy to companies and consumers E.ON Drive, aims to “enable corporates, private households as well as cities and municipalities to switch from internal combustion engines (ICE) to EVs”, says Billy Chorosis, Business Segment Lead Manager B2B for Germany, Austria and Switzerland at E.ON Drive in an interview with flow.

This case study examines how new business models – such as E.ON Drive’s – are changing traditional treasury processes. It explains how embedding digital solutions can lead to cost savings, streamlined payment processes and real-time insights and why application programming interfaces (APIs) are key. Ultimately, it shows how treasury can become a business enabler.

Since its foundation, E.ON Drive has installed more than 50,000 EV charging points across 14 European countries for its corporate clients, with the majority in Germany, UK, and Sweden. For German car manufacturer BMW alone, the company operates several thousand charging stations at BMW premises or at employees’ homes. E.ON Drive takes care of the billing, fleet management as well as the maintenance of the charger wallboxes and delivers the electricity. The company charges its corporate customers a monthly fee that reflects the scope of service.

“We help companies reduce the total cost of ownership of their EV fleets and cut energy costs across the entire site”

“With the E.ON Energy Ecosystem, we help companies to bring down the total cost of ownership of corporate EV fleets and cut energy costs across the entire site, from charging to building operations,” explains Chorosis. He cites a 2024 Fleet-Charging Study by USCALE, which found that two-thirds of German companies plan to switch their fleets to electric vehicles.7 “Companies are electrifying their fleets because this significantly contributes to reducing their CO₂ emissions, which improves their ESG performance,” he adds.

Reimbursing employees for charging at home

A better understanding of the services E.ON Drive provides to its corporate customers is gained by considering what electrifying corporate fleets requires. Out of the numerous changes, this case study focuses on a particular challenge: that refuelling an internal combustion engine works so differently from recharging a battery, which require companies to revamp internal processes when transitioning their fleets from ICEs to EVs.

When a company provides its employees with internal combustion engine (ICE) cars, they usually also issue a fuel card, which runs on a corporate bank account. However, with an EV, employees have the options to charge at work, at public charging points or at home – and in the latter case, the cost will be paid via their private electricity bill. “Therefore, the company needs to find a smart and efficient way to reimburse employees for charging at home,” explains Chorosis.

He notes that this is particularly important as charging at home is usually more convenient and cheaper thank public charging, which is why a company would want to incentivise its employees to charge their business cars not only at work, but also at home to save costs. However, this requires an efficient and convenient reimbursement process for both sides.

Billy Chorosis at the Deutsche Bank Finanzforum on 20 March 2025

In practice this is what happens: When an employee wants to charge his corporate EV at home, E.ON Drive installs a wall box that complies with calibration law to allow the company to track every charging process. “When the charging process starts, our backend system is informed in real-time,” he continues. It tracks how many kilowatt hours (kwh) were charged at what cost and makes this data available to the employee via an app installed on his/her smartphone. “We also know the price every household pays for its electricity to calculate the total cost of the charging process.”

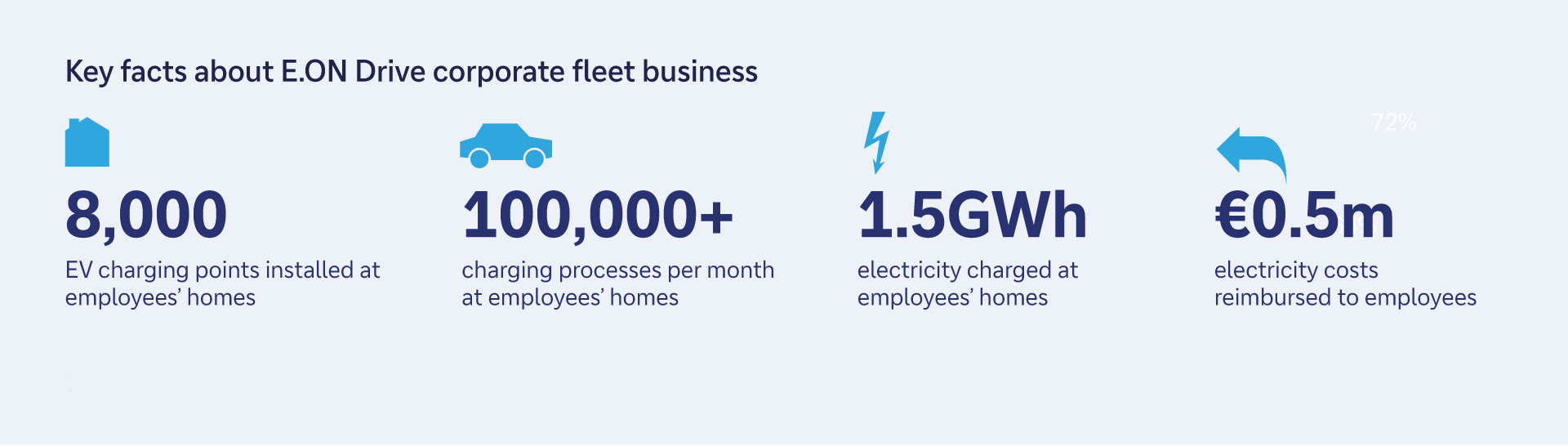

Figure 2: Key facts about E.ON Drive corporate fleet business

Source: E.ON

The role of payments and APIs

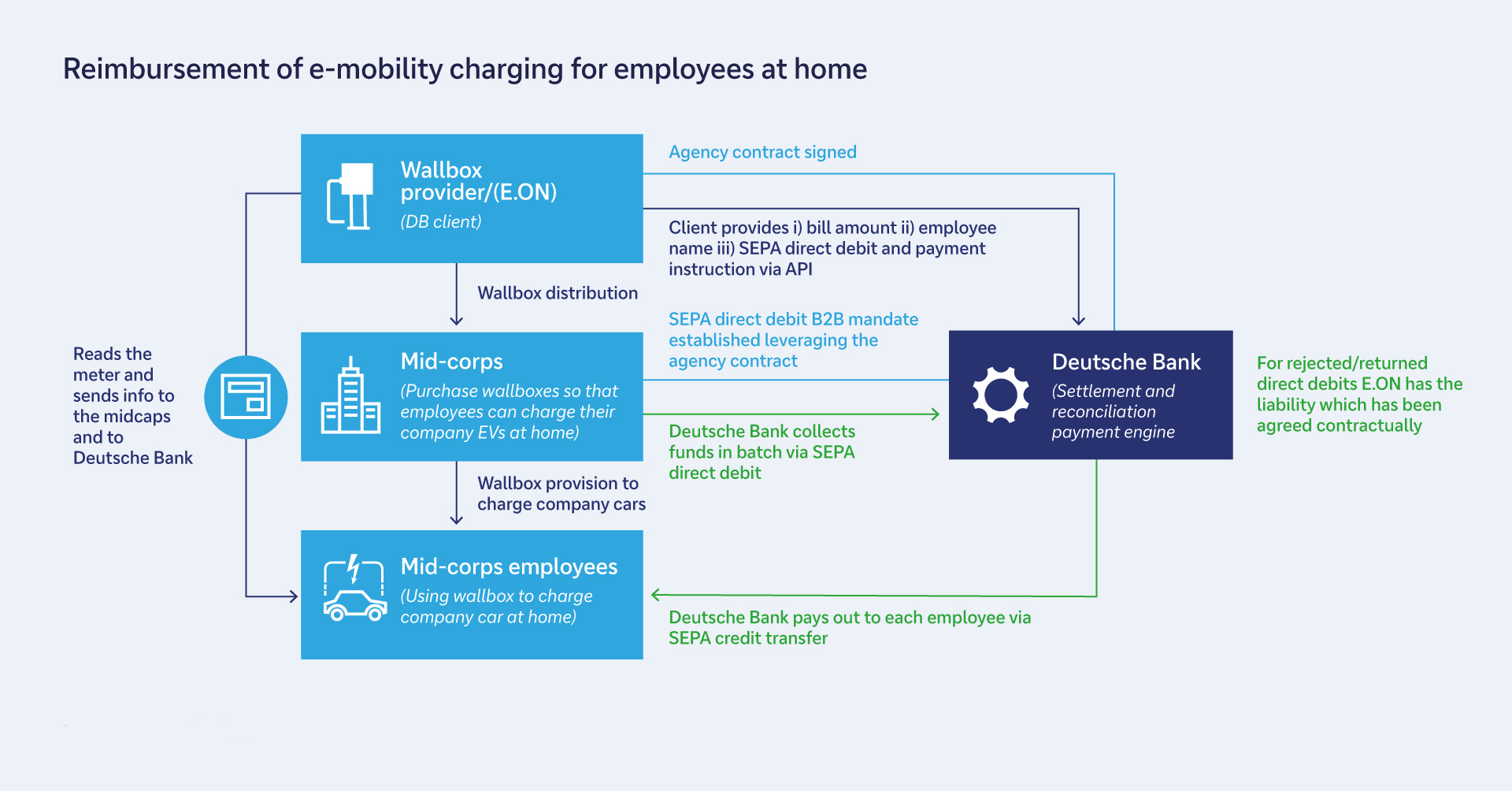

Once a month, E.ON Drive creates an overview of all charging procedures the respective employee conducted at home. This report is submitted to the employer who then reimburses these costs to its employee. Technically, this process is handled by E.ON Drive. But for the payment the company partnered with Deutsche Bank to ensure the payment process is highly automated and in line with the German Federal Financial Supervisory Authority’s (BaFin) regulation. As it involves funds from a third party, i.e. the employer, E.ON Drive would have needed a bank licence and/or a ZAG licence to manage those payments.

Once E.ON Drive’s corporate client has checked and approved the reimbursement, it initiates the payment process (see Figure 3). Via an API, E.ON Drive instructs Deutsche Bank to orchestrate that the payment flow. As initial step, Deutsche Bank collects a SEPA Direct Debit from the company. In a second step, it submits a detailed breakdown of the payout to individual employees of the underlying company. Deutsche Bank then conducts the payout via SEPA credit transfers and reconciles.

Figure 3: Reimbursement of e-mobility charging for employees at home

Source: Deutsche Bank

Reimbursement is conducted once a month to ensure it aligns with the monthly electricity bill of the employee. “For a typical household, private EV charging increases annual electricity demand by 1,800 kwh. This accounts for approximately half of the overall electricity demand of an average household, which is why timely reimbursement is necessary,” says Chorosis.

So, what’s next? In the EU, the Instant Payment Regulation is supposed to make instant payments the normal. As of January 2025, all banks and payment service providers (PSP) in the euro area need to be able to receive real-time payments. Starting in October, they will also be obliged to send instant payments. For treasurers, this creates new opportunities as described in the flow article How the EU Instant Payment Regulation impacts corporate treasurers.

As yet, however, he does not see a major benefit in switching to SEPA Instant Payments, which would allow the corporate to immediately reimburse its employee for every single charging process. “This would create too much administrative work for the employer,” he adds. Yet, going forward there may be other use cases where instant payments could become relevant in EV charging. “It’s not a question of ‘if’ we use them, but how we are going to use them.”

For the next stage, the company is looking to expand this solution across Europe; so far it is available in Germany and Austria, while focusing on automating its internal processes to further bring down costs. It also tests artificial intelligence (AI) to improve fraud detection and enable smart charging to minimise grid fees and make use of times when electricity prices are lowest. Ultimately, it’s all about making corporate fleet electrification as attractive as possible and support the clean mobility transition.

Sources

1 See reuters.com

2 See alternative-fuels-observatory.ec.europa.eu

3 See bmwk.de

4 See europarl.europa.eu

5 See climate.ec.europa.eu

6 See transport.ec.europa.eu

7 See uscale.digital