30 April 2024

Electric vehicles (EV) are a pivotal technology for sustainable mobility. This means affordability for all if the automotive sector is to achieve net zero. flow’s Desirée Buchholz reports on how the newly-formed European battery company ACC aims to lower costs and gain control over supply chains with support from four European banks

MINUTES min read

The transition to clean mobility is a mammoth task given that 20.7% of the world’s CO2 emissions in 2022 arise from transportation1 – out of which 48% stem from cars and vans.2 Yet, the news is encouraging: According to the International Energy Agency (IEA), CO2 emissions from cars can be reduced in line with net zero targets by 2050, if electric vehicles (EV) sales growth experienced in recent years can be sustained.3

EV technology is key to the decarbonisation of road transport. Currently, EV greenhouse gas emissions are about 17–30% lower than the emissions of petrol and diesel cars, the European Environment Agency calculates. But, as the production of EVs is expected to become more efficient, and the electricity used for charging is set to get cleaner, the life-cycle emissions of a typical electric vehicle could be cut by at least 73% by 2050, the report concludes.4

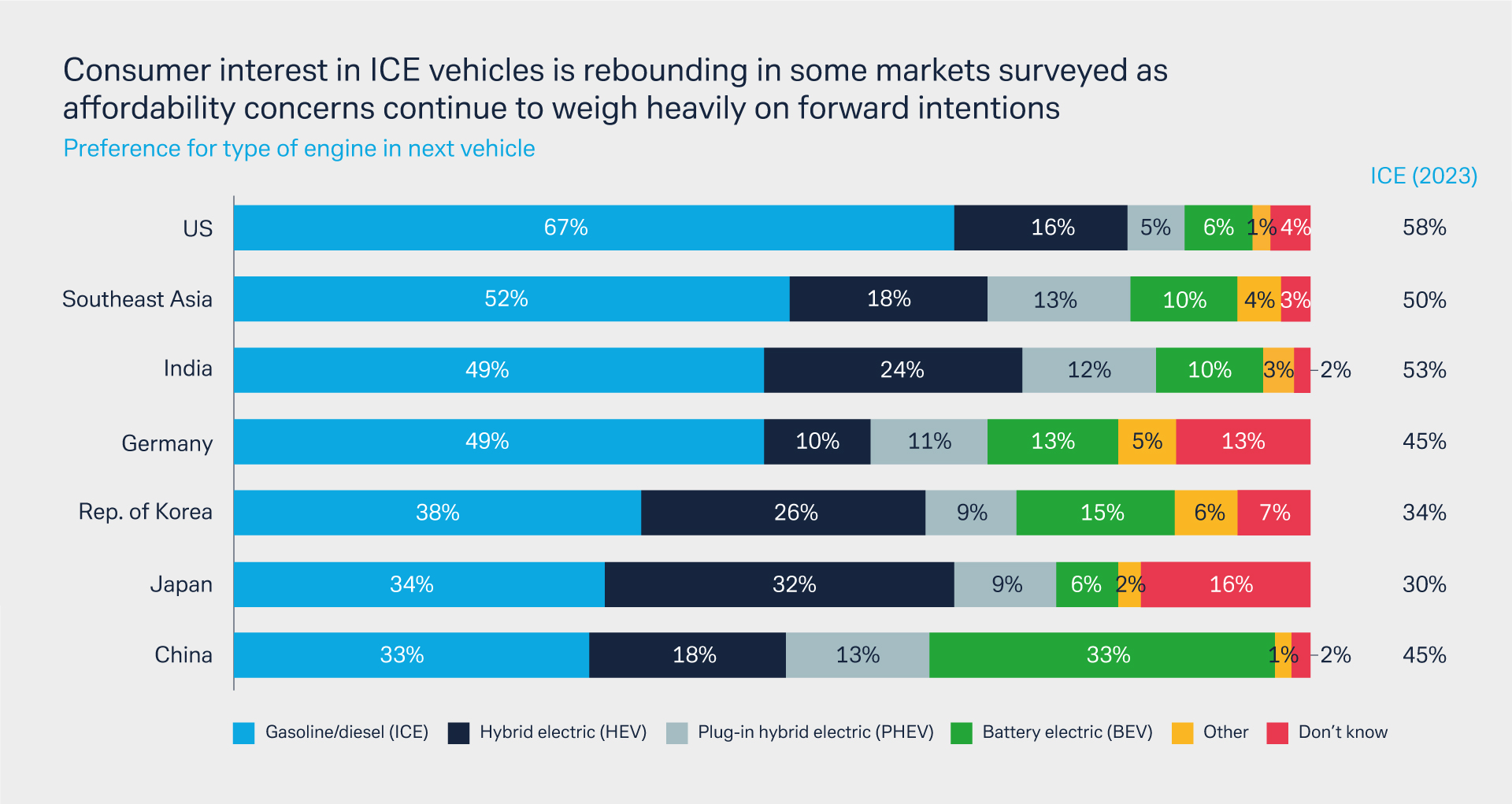

Yet, there are still several barriers to EV mass-market adoption. According to Deloitte’s 2024 Global Automotive Consumer Study, consumers are most worried about charging times and driving range – followed by the higher costs of EVs compared to internal combustion engines (ICE), concerns around battery safety and the lack of public charging infrastructure. In some markets, the consultancy even confirms a rebound in consumer interest for ICE vehicles. If EVs were to remain a privilege for a few, Deloitte warns that slowing momentum may be putting current decarbonisation timelines in jeopardy.5

Figure 1: Rebounding consumer interest in ICE vehicles

Source: Deloitte’s 2024 Global Automotive Consumer Study (see note 5)

S&P Global Mobility is less pessimistic as it projects global battery electric passenger vehicles (BEVs) sales to hit 13.3 million units in 2024, accounting for an estimated 16.2% of global passenger vehicle sales. In 2023, 9.6 million BEVs were driving on roads globally (12% market share). Still, S&P forecasts show that while China is leading the pack – with a projected BEVs share of 28.6% in 2024 –, Europe (22.2%) and the US (13.2%) are lagging behind.6

Creating a European battery champion

So, how can EV production be fostered and costs for consumers brought down? In Europe, this is where the Automotive Cells Company (ACC) comes into play. The Paris-based joint venture was founded in 2020 by global automaker Stellantis (famous for brands like Peugeot, Fiat, Maserati, Jeep or Opel) and French energy provider TotalEnergies (via its subsidiary Saft). In 2022, they were joined by German car automaker Mercedes-Benz.7 ACC designs and produces lithium-ion battery cells and module sub-assemblies that store energy. These elements are then assembled into battery packs by car manufacturers to power the car.

“Since the battery accounts for about 40% of the price of an electric vehicle —and the vast majority of manufacturers are currently in Asia— setting up battery production sites in Europe will cut costs significantly,” ACC promises in its mission statement. But it’s not just about cost. The company’s goal is to “accelerate the transition to cleaner, greener transport for all. And we plan to do it by revolutionising battery technology and producing sustainable, affordable, high capacity and longer lasting batteries”.8

This also includes the adoption of a circular model, i.e. designing products that can be repaired, re-used or recycled. Indeed, starting from 2025, the EU will gradually introduce maximum limits on the carbon footprint of EV batteries (and other rechargeable industrial batteries) including targets for recycling efficiency and material recovery. This new regulation is supposed to increase security of critical raw materials needed for sustainable transition and enhance the EU’s strategic autonomy.9

“Setting up battery production sites in Europe will cut costs significantly”

As outlined in the flow special whitepaper How to ensure commodities security in a volatile world, demand for key metals such as lithium, cobalt and nickel – that are also needed for EV batteries – will massively increase. Yet, of the 30 critical raw materials that the European Commission identifies, 10 are mostly sourced from China and eight from Africa which leads to dependencies that are uncomfortable to have – especially in the light of geopolitical tensions, the whitepaper outlines.

Moreover, so far, almost the entire battery value chain is controlled by Asian countries – from the extraction and refining of ores to the manufacture and assembly of components. In 2022, Chinese companies made up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%). One-third of the world’s EV batteries came from China-based CATL, Korea’s LG Energy had a market share of 14%.10

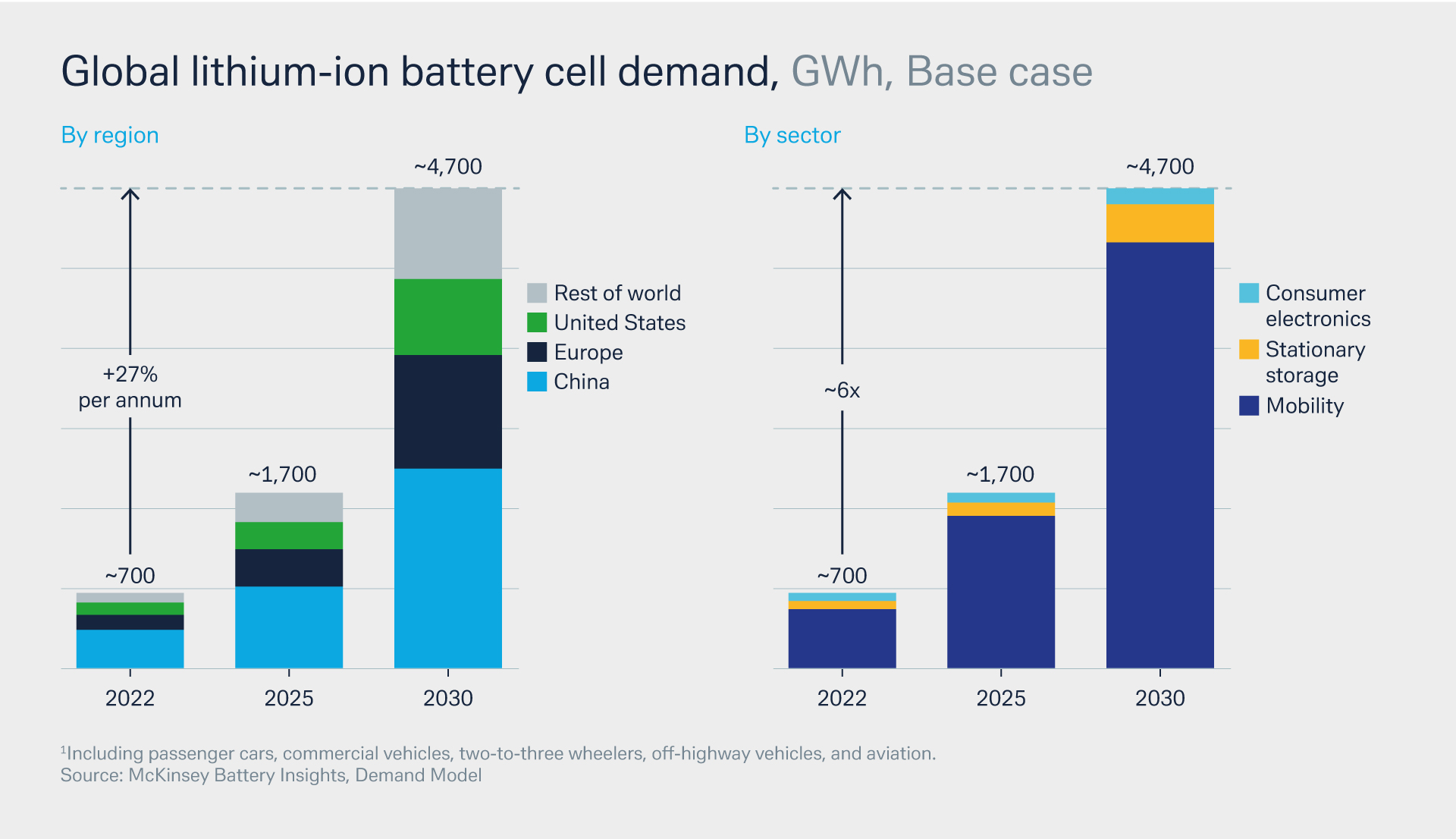

This has been an eyesore for the EU for several years now – given that batteries are highly relevant for a successful sustainable transition of the automotive sector, which currently employs some 3.5 million workers in manufacturing activities in the EU. Following the union’s decision that after 2035 all new cars that come on EU markets are CO2 neutral, it is clear that more batteries will be needed for European car makers to remain competitive.11 Global demand is expected to grow significantly (see Figure 2).

Figure 2: Global lithium-ion battery cell demand, GWh, Base case

Source: McKinsey: Lithium-ion battery demand forecast for 2030 | McKinsey

This is why already in 2018, the EU Commission designated battery development and production as a strategic imperative for Europe12 – a goal which has since grown in importance in the light of ongoing geopolitical tensions which could impact Europe’s access to key technologies such as EV batteries.

Three gigafactories in France, Germany and Italy

With this in mind, ACC was founded in August 2020 “to make France and Europe key players in all stages of the electric battery value chain”.13 While ACC is tapping into Saft’s knowledge of producing high-end batteries, Stellantis and Mercedes are contributing their knowledge as shareholders when it comes to mass production of quality vehicles.

Since the official launch nearly four years ago, a lot has happened: ACC has not only built its first prototypes of lithium-ion battery cells in its research and development centre near Bordeaux. The construction of the companies’ first gigafactory in Billy-Berclau Douvrin in North France close to the Belgium border was also finalised, with the first batteries rolling off the production line since the end of 2023 with the ramp-up to mass production planned for the first half of 2024.

By 2030, ACC aims to have a production capacity of 120GWh, which translates into more than 2.5 million batteries per year – a goal which can only be achieved as two more gigafactories are already in the making: the second will be based in Kaiserslautern in Germany and is expected to open in 2025. The third is set to be built in Termoli in Italy.

First Gigafactory in Billy-Berclau Douvrin

Billions for batteries

In order to achieve these ambitious goals, immense funding is needed – which is why the company closed a landmark deal in February 2024 securing €4.4bn project financing for the development of its three gigafactories in France, Germany, and Italy as well as for research and development (R&D). Deutsche Bank is one of four European banks – next to BNP Paribas, ING, Intesa Sanpaolo – tasked as underwriter, lender and hedging banks on this transaction. The consortium has underwritten the entire loan amount of EUR4.4bn.14

“The deal showcases how we support the transformation of the European economy across countries”

“This deal represents a big milestone for Deutsche Bank and our Corporate Bank. It showcases how we support the transformation of the European economy across countries and, at the same time, one of the most important industries for Germany,” said David Lynne, Head of the Corporate Bank, Deutsche Bank. “It also demonstrates our strategic focus on structuring and facilitation the energy transition.”

The Deutsche Bank underwritten amount of €1.1bn also contributes to the bank’s target of providing a cumulated volume of €500bn sustainable finance by 2025 as defined under the bank’s sustainable finance frameworks.15

The debt package was supported by the Export Credit Agencies of France (Bpifrance), Germany (Euler Hermes), and Italy (SACE). In the past, ACC had already received a €437m grant from the German government and from local authorities in September 2021 for its gigafactory in Kaiserslautern, under the IPCEI (Important Project of Common European Interest). An IPCEI is defined as a multinational project that makes “an important contribution to the growth, employment and competitiveness of the European Union industry and economy”.16

While this showcases the strong political will of EU decision makers to support ACC’s ambitions, the new project finance package was also backed by fresh equity from the stakeholders. Following the capital injection Stellantis now owns 45% of ACC's shares, Mercedes-Benz 30% and Saft 25%. According to ACC, “Stellantis and Mercedes-Benz have both confirmed their commitment as leading shareholders and customers of ACC’s battery modules”.

“With this world-class financial community supporting us, we see clear evidence of the confidence that is placed in the ACC project”

“The transition to the electrification of vehicles is still on the way. To meet this immense challenge, our customers must be able to rely on robust and reliable European players like ACC, capable of delivering high volumes of competitive batteries with a low CO2 footprint,” said Yann Vincent, Chief Executive Officer of ACC. “With this world-class financial community supporting us, we see clear evidence of the confidence that is placed in the ACC project.”

All in, the company has now secured more than €7bn of investment including €1.3bn of public funds. Moreover, the battery producer has secured long-term offtake contracts from Stellantis and Mercedes. The key task for the management will now be to ramp-up mass production, establish themselves against the Asian competition and proof that sustainable battery production is possible in Europe – a tough, but exciting challenge.

Bruges’ R&D Centre where battery prototypes are conceived and refined in ACC laboratories

Note: all images are © ACC Automotive Cells Co

Sources

1 See statista.com

2 See statista.com

3 See iea.org

4 See eea.europa.eu

5 See deloitte.com

6 See spglobal.com

7 See acc-emotion.com

8 See acc-emotion.com

9 See environment.ec.europa.eu

10 See greencarcongress.com

11 See eur-lex.europa.eu

12 See eca.europa.eu

13 See acc-emotion.com

14 See acc-emotion.com

15 See db.com

16 See ipcei-batteries.eu