8 April 2025

Following the introduction of the EU Instant Payment Regulation, the volume of real-time payments is increasing. For corporate treasurers this means that they need to review liquidity management, account statement processing, and fraud prevention. But instant payments also create new opportunities, explains Deutsche Bank’s Christof Hofmann

MINUTES min read

From 9 January 2025, all banks and payment service providers (PSPs) in the euro area must be able to receive SEPA Instant Payments. This obligation is part of the EU Instant Payment Regulation1 – and it is already having a positive impact: in January 2025, the volume of SEPA Instant Payments processed via Deutsche Bank systems increased by 27% compared with January 2024. Looking at corporate payments alone, real-time payment volumes stood 13% higher year-on-year. This shows that not only consumers want to pay around the clock and in real time, but companies are increasingly using this payment method – especially those operating in business-to-consumer (B2C) sectors.

“Starting this autumn, treasurers in the euro area can also use instant payments for supplier, M&A, licence, or tax payments”

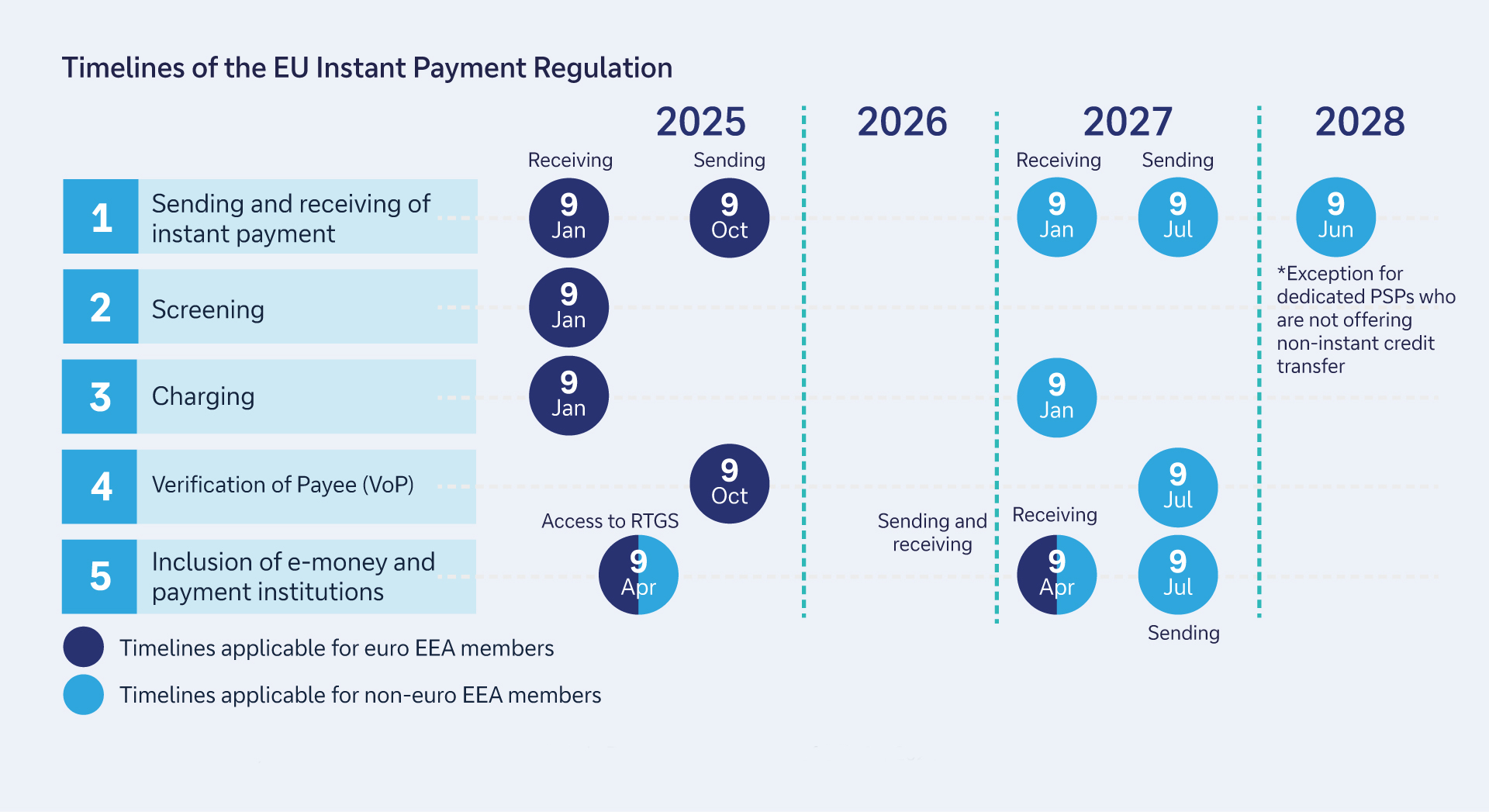

And volumes are likely to rise again in October. By then, all PSPs in the euro area must be able to send instant payments (see Figure 1). At the same time, the threshold for real-time payments, which currently stands at €100,000, will be abolished. This means that starting this autumn, treasurers in the euro area will also be able to use instant payments for supplier, M&A, licence, or tax payments that typically exceed the current threshold. The new regulation could therefore make real-time payments more attractive for B2B business models and treasury payments in Europe.

Figure 1: Timelines of the EU Instant Payment Regulation

Source: Deutsche Bank, flow briefing Taking instant payments in Europe to the next level from May 2024

New opportunities for steering global liquidity

One major advantage of instant payments is overcoming the early cut-off times of traditional automated clearing house (ACH) and high-value payment systems. By allowing treasury teams to execute transactions later in the day, instant payments improve liquidity management, reduce reliance on short-term credit and simplify cash forecasting.

Moreover, some treasurers may also be interested in using real-time payments for capital markets-related transactions – such as bond and stock exchange investments or foreign exchange (FX) hedging. However, in practice, instant payments are likely to play a rather minor role for these kind of transactions for now. This is due to the constraints in operating hours of the respective markets, which limit the relevance of 24/7 payments for these transactions.

Instant payments are challenging the cash pool structure

Yet, if a company receives real-time payments around the clock in the future, corporate treasurers are also confronted with completely new questions. For example, what does it mean if large amounts are credited to bank accounts after the cash pool run has taken place? Who allocates these funds? Currently, real-time payments received after the end of the banking day are not moved to the master account until the following day. As instant payment volumes increase, this practice could lead to larger amounts remaining in sub-accounts overnight.

For treasurers, this could be another argument for introducing virtual accounts, where incoming payments are credited directly to the intended account. In any case, in a real-time payment’s world, automation and close cooperation with the cash pool banks will become even more important – if the treasury function does not want to operate in shifts to disposition funds manually to maintain an optimal liquidity management.

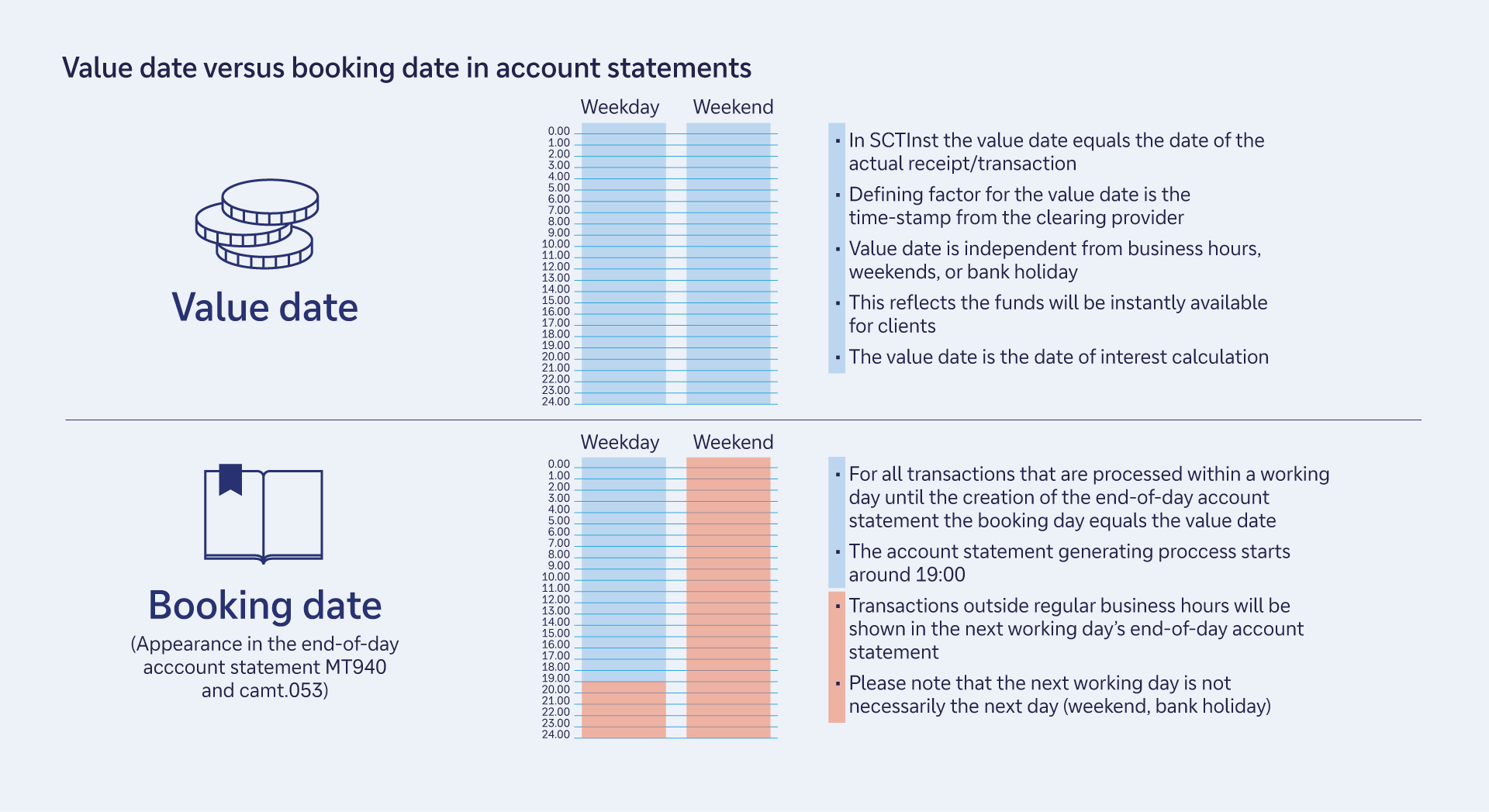

It's also important to understand that the booking and value dates can differ for real-time payments. The value date refers to the point in time at which the funds are settled. This control goes hand in hand with interest bearing. However, for all transactions received after the end of the banking day, the booking date is recorded for the next business day for accounting purposes – meaning the payment only appears on the account statement in a later stage.

Figure 2: Value date versus booking date in account statements

Source: Deutsche Bank

The risk of fraud must also be reassessed with increasing instant payment volumes, because with real-time payments, criminals can transfer funds to their accounts within seconds. To prevent fraud, the EU has therefore developed the ’Verification of Payee‘(VoP) procedure: From October 2025 onwards, the payer's bank must request from the recipient's bank whether the recipient's name stated on the transfer matches the IBAN – both for real-time transfers and traditional SEPA transfers.2 Some banks already offer a service for comparing this data, usually in connection with master data maintenance. The VoP procedure could complement this service and thus become one of various protection mechanisms for treasurers.

Becoming a strategic partner for the business

At the same time, instant payments will reinforce the trend of the treasury department becoming a strategic partner for the business. Many customers, especially in the B2C area, expect that – if they pay in real time – immediate actions will follow, such as their order being shipped immediately, or a subscription being activated directly. For this to happen, however, information about the incoming payment must also be processed in real time.

This is enabled via push notifications, which the bank sends to the company via application programming interfaces (APIs), as set out in the flow case study How BioNTech masters real-time treasury. The good news is that the use of APIs is becoming easier because providers of treasury management software are embedding these interfaces into their systems as part of their standard offering. As a result, the conditions for managing treasury in real time are therefore constantly improving.

Sources

1 See "Taking instant payments in Europe to the next level" at flow.db.com

2 See europeanpaymentscouncil.eu