11 June 2025

How can Brazilian businesses finance cross-border trade in a volatile global landscape? Drawing on the example of Banco do Brasil – the country’s second-largest bank – flow explores the role that correspondent banking plays in enabling these transactions

MINUTES min read

How do you finance the import of solar panels from Germany into São Paulo? Or enable a Brazilian airline to source major engine parts from overseas suppliers? What about helping Brazilian farmers to export soybeans to Asia, or supporting Rio’s clothing retailers in buying new lines from Paris?

The solutions lie in correspondent banking – the backbone of international trade and payments. This global network of interbank relationships facilitates cross-border transactions by providing banks with access to financial services such as cross-border payments and trade finance in jurisdictions where they might not have a direct presence. This particularly assists emerging markets, where correspondent banking plays a major role in supporting trade flows, expanding financial inclusion and fostering global economic integration.

For banking institutions such as Banco do Brasil – the second-largest banking institution in Brazil – that rely on those services for international treasury operations, including money market transactions, trade finance solutions and interbank deposits, “correspondent banking relationships are foundational to Brazil’s integration with the global economy,” João Fruet, Director at Banco do Brasil, tells flow. “These relationships facilitate international trade, which represents a significant portion of our gross domestic product and supports millions of jobs across various sectors, particularly in agribusiness, where Brazil is a global leader.”

Brazil and global trade

As Latin America’s largest economy (and one of the world’s five major developing economies dubbed the ‘BRICS’), the country’s import profile reflects an economy in industrial transition and consumerist expansion, with imported goods ranging from heavy machinery, electronics and industrial chemicals to pharmaceuticals and refined petroleum products – all of which are vital to Brazil’s ongoing industrial development and growing consumer base.1

Brazil’s top exports – soybeans, crude oil, iron ore, raw sugar, and corn – are also essential commodities for global supply chains, fuelling demand from key large trading partners such as China, the US and the EU.

Over the past two decades, China has emerged as Brazil’s largest trading partner, accounting for 28% of exports and 24% of imports to Brazil in 2024, resulting in a surplus of US$30.7bn, as data from Deutsche Bank Research shows. The EU is the country’s second-largest trade partner in goods, but Europe’s share of trade with Brazil has declined relative to the China-led boom, as the bank’s Research Analyst JP Schuchter points out. Looking at the US, Brazil had a deficit of US$283m with the world’s largest economy in 2024, “the lowest deficit registered since the Great Recession of 2008, prior to which Brazil had trade surpluses with the US,” Schuchter adds.

There are signs that the China-led trade boom could continue. First, the two countries signed 37 acts to strengthen collaboration in fields such as agriculture, trade, investment, infrastructure and finance during the state visit of the President of the People’s Republic of China, Xi Jinping, to Brazil in November 2024.2

Second, Brazil could benefit from the changing global tariff regime. In the past, China mainly used to buy agricultural products from the US, but following the introduction of tariffs on all US imports, China could now seek to diversify the source of its supplies.3

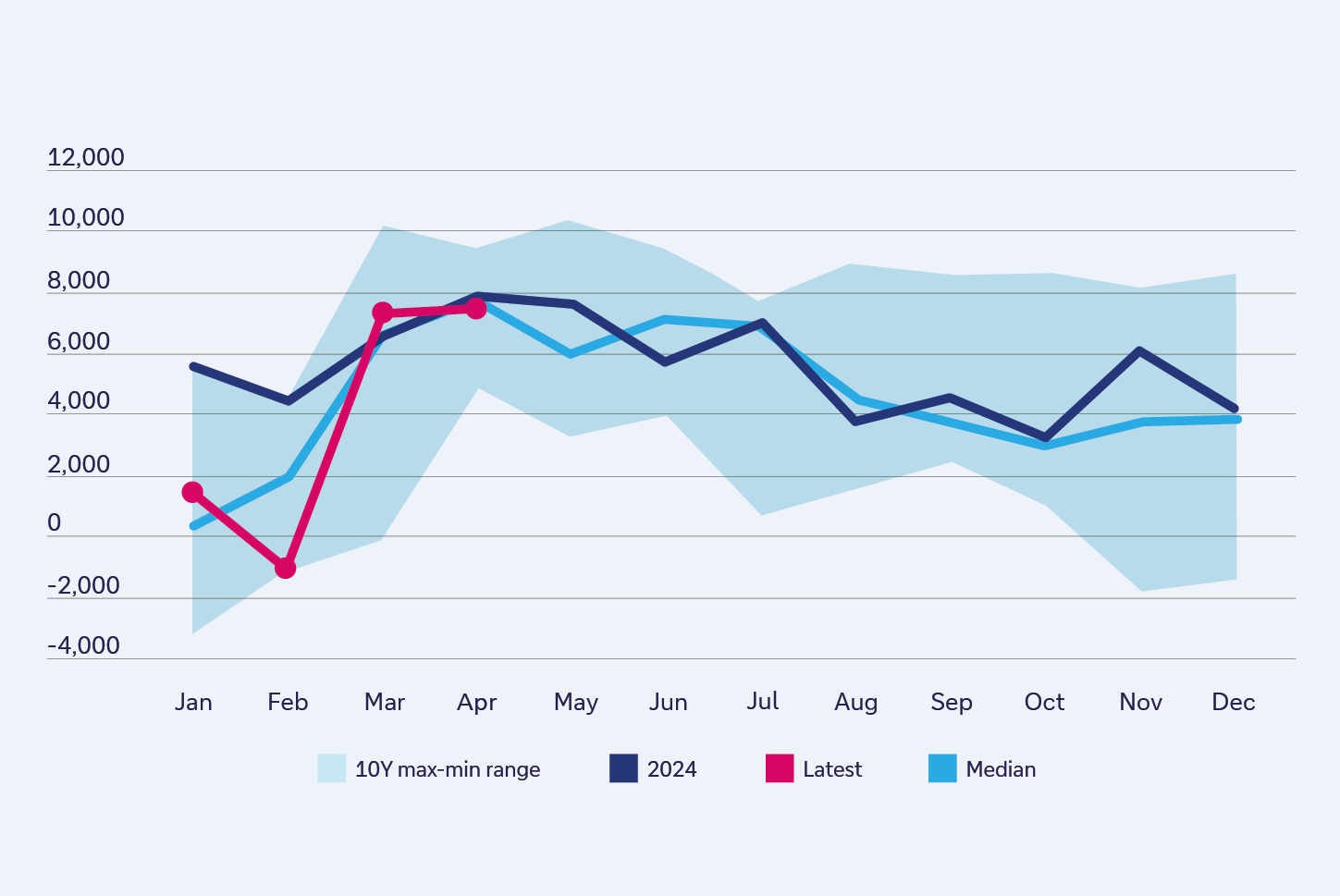

One immediate impact has been to spur on Brazil’s agricultural sector, with China importing record levels of soy in Q1 2025 – leading to a surge in export volumes for March following a subdued start to the year (see Figure 1). While Brazil may see some short-term gains, the longer-term impact – and how global supply chains might be reshaped as a result – is not yet clear.

Figure 1: Brazil's global trade balance 2024 - 2025 (USDm)

Source: Deutsche Bank Research

The changing trade patterns are also impacting local banks. Banco do Brasil’s international strategy, for instance, is firmly rooted in supporting two key client segments: local companies expanding abroad and foreign corporates engaged in Brazil-related business. Achieving this requires not only global reach, but also capabilities that extend beyond the bank’s existing infrastructure. This is where correspondent banking comes into play.

“Our international structure is organised around three main liquidity centres that function as agencies: New York covers North and Central America, London handles Europe and Arab regions, and Tokyo manages Asia-Pacific relationships,” explains Fruet. “With our balanced credit portfolio across agribusiness, corporate and retail segments, effective correspondent banking services are essential for financing international operations. These relationships also support capital flows into Brazil, including foreign investments in our sustainable development projects.” For instance, Banco do Brasil has leveraged R$800m (US$140m) into R$5bn (US$870m) through the Brazilian Government’s Eco Invest programme, enabling the application in projects with environmental and social benefits.

“Correspondent banking relationships are foundational to Brazil’s integration with the global economy”

Navigating de-risking

Yet correspondent banking has not escaped the impacts of today’s increasingly uncertain global environment. Over the past decade, there has been a sustained trend of de-risking among correspondent banks, with financial institutions limiting or severing relationships with certain clients or client categories to reduce exposure to risks related to financial crime such as money-laundering, terrorist financing, corruption and bribery. A recent report by the Bank for International Settlements revealed that Latin America and the Caribbean had experienced the largest decrease of active correspondents between 2011 and 2022.4

Why is that the case? According to Deutsche Bank Research’s LatAm Outlook 2025, Brazil is one of the most vulnerable emerging markets when it comes to adverse growth and fiscal reforms, with the government’s current strategy of expanding middle-class income transfers risking fiscal instability, higher inflation and weaker currency performance – all of which serves to heighten the perceived risk for international banks.

While some banks see risk as black and white, Deutsche Bank has taken a more nuanced approach. For example, the bank is enhancing its partnership programmes to better support financial institutions in high-risk markets, offering guidance to help improve risk management and reduce exposure (see the flow article ‘An ecosystem approach to limit de-risking’).

“Jurisdictions that are considered high-risk shouldn’t automatically preclude engagement,” says Trish Sullivan, Global Head of Institutional Cash Management, Deutsche Bank. “With the right governance, risk appetite, financial crime risk controls and transactional insight, banks can manage risk dynamically. That’s why we’re highly deliberate in choosing our partners – working only with institutions that demonstrate the same rigour we apply ourselves in serving our communities. It’s about building long-term, resilient relationships, not looking for blanket risk avoidance.”

“It’s about building long-term, resilient relationships, not looking for blanket risk avoidance”

Choosing the right partner

At the same time, respondent banks are evolving their own strategies. “Over the past 10 years we have witnessed consolidation among global correspondent banks, resulting in fewer but deeper relationships,” confirms Banco do Brasil’s Fruet. “This trend has influenced our approach to partner selection, focusing on relationships that offer comprehensive solutions rather than maintaining numerous limited connections.”

The bank has not only rationalised its international footprint and reinforced its risk and compliance frameworks, but has also increased its reliance on trusted correspondent partners – deepening ties with institutions such as Deutsche Bank. “We have expanded beyond traditional services into areas like Euro clearing and structured products. This approach ensures we maintain critical services while optimising our international banking relationships,” explains Fruet.

In selecting a correspondent banking partner to meet both current and future needs, Banco do Brasil now considers several key criteria:

- Local understanding and adaptability. The bank prioritises partners with a deep understanding of Brazil’s economic landscape and the flexibility to tailor services accordingly. This includes support for sustainable finance initiatives, with Banco do Brasil having already deployed approximately R$400bn (US$70bn) in ESG-related transactions in areas such as carbon credits.

- Technological integration. As it expands its digital capabilities, Banco do Brasil seeks partners with strong application programming interface connectivity and real-time processing to enable seamless operational efficiency.

- Regulatory compliance support. In a landscape of diverse global financial regulations, Banco do Brasil values partners who can help navigate complexity while maintaining efficient and reliable services.

- Funding diversification solutions. Correspondent banks that offer competitive pricing and access to innovative structured products are seen as essential to supporting Banco do Brasil’s funding diversification strategy.

These criteria are more than a checklist – they actively shape Banco do Brasil’s global partnerships. “Deutsche Bank’s integrated approach to cash management and trade finance has provided us with increased operational efficiency,” adds Fruet. “This integration has been particularly valuable for our international operations, where we require seamless coordination between payment processing and trade finance services.”

In an environment of de-risking and accelerating consolidation, long-term correspondent banking relationships continue to prove their enduring value. These partnerships underpin the sustained success of businesses in Brazil and, more broadly, the country’s real economy. “As a key emerging global trade corridor, it’s clear that we need more – not fewer – links between Brazil and the rest of the world,” says Sullivan. “Deutsche Bank is the gateway to Europe and beyond and we are committed to supporting Banco do Brasil for the long term, with correspondent banking services that are underpinned by robust risk management and a strong compliance framework.”