26 February 2025

Copper is one of the key energy transition metals – as well as an essential component of the digital revolution, so all eyes are on its availability. Financial writer Ivan Castano Freeman provides an overview of this versatile metal and talks to copper processor KME Group about financing production

MINUTES min read

Copper has been around for 9,000 years, with ancient civilisations using it to make coins, jewellery, and tools, while several millennia later during the Industrial Revolution entrepreneurs employed it for electrical wiring and machinery.

Versatility and conductivity

Today, this base metal is the main component powering the digital revolution, energy transition and the advent of AI chatbots. Demand is brisk, with some observers predicting order books will swell up to 30% by 2029 and even double by 2045.1 All of this will happen as more electric vehicles (EVs) hit the roads, new renewable energy infrastructure is installed, and artificial intelligence (AI) data centres continue to dot the planet, sucking up vast amounts of energy.2

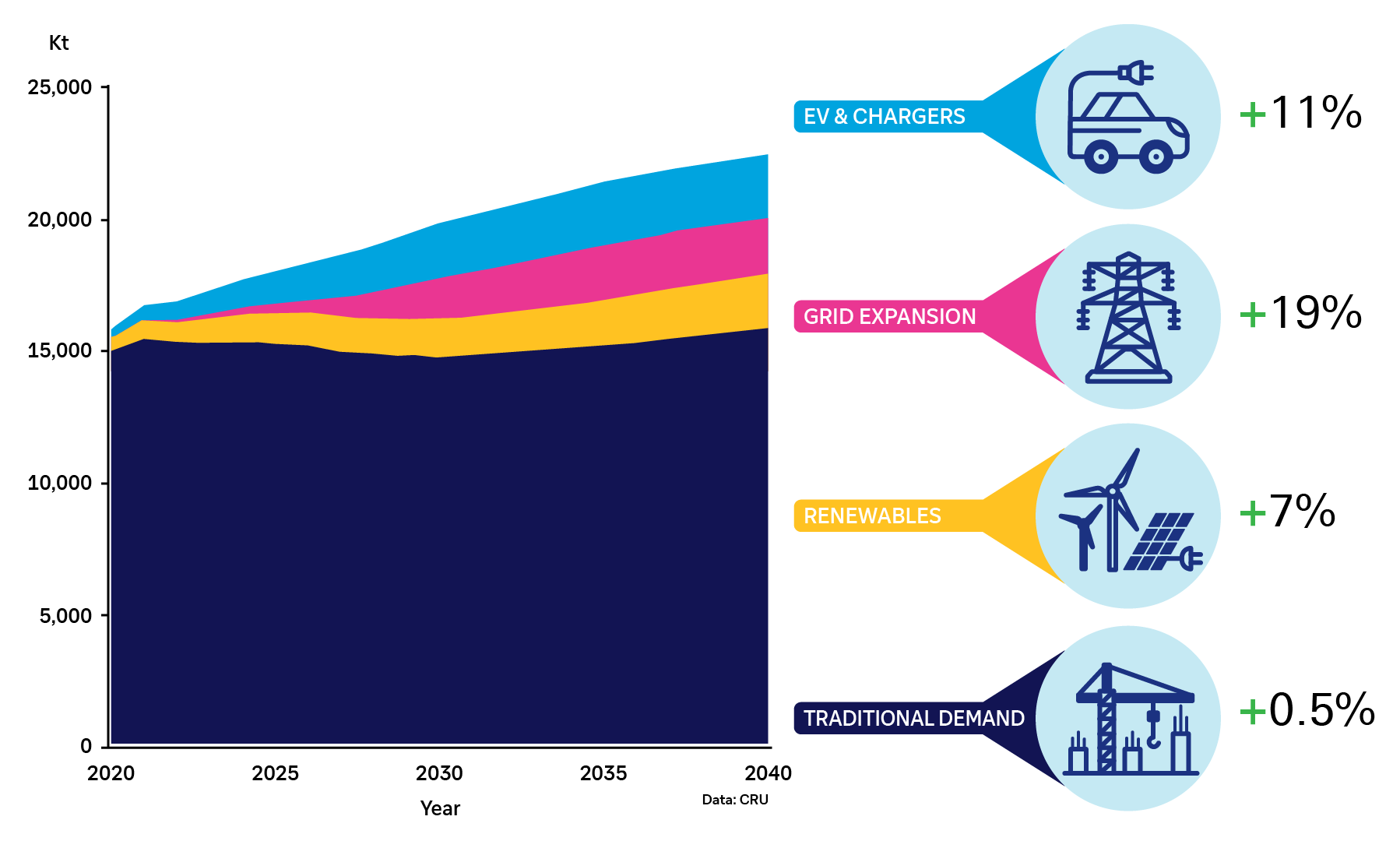

Figure 1: Copper cable demand: green vs traditional applications

Source: International Copper Association

Copper is an excellent electricity conductor, which is why it's seeing huge demand from the energy and IT industries. Its soft and malleable qualities make it an essential component of electrical wiring, industrial machinery, electric vehicle (EV) batteries, solar and wind-power infrastructure. Myriad electronic devices benefit from its high conductivity to transfer electronic signals between intricate circuits.

Billed as the third most-used metal globally, after iron and aluminium,3 the world's largest copper mines are in Chile, Peru, Congo, China and the US. Chile and Peru are by far the biggest producers, churning out five million metric tons (mt)4 and 2.5mt respectively, in 2023. China, meanwhile, is the biggest buyer, employing copper in its large property, construction, and automotive industries.

"We know for sure that in the medium term the market will grow a lot," enthuses Pierpaolo Di Fabio, Chief Financial Officer of German-Italian copper processing group KME, which is quickly growing its working capital facilities to gain expansion funding. "In three to five years, we expect at least 20% to 30% growth. And in the next 20 years, worldwide copper demand could double to 50mmt.” That should bode well for the metal, which mainly trades on the London Metals Exchange (LME) and whose price has surged to roughly US$9,000mt from US$6,000mt in 2020.

KME and industrial revolutions

Milan-based KME manufactures a wide range of rolled copper and copper alloy products for diverse business applications. With sales of €1.9bn in 2023, it produced around 200,000 metric tons (t) of the popular metal. It currently employs around 3,400 people and operates eight production facilities spread across Germany, France, Italy, and The Netherlands.

The company has travelled far since its beginnings in 1886 in Italy. SMI (now KME Group Spa) began selling copper to feed the Second Industrial Revolution (1870–1914).

The company expanded further with the growth of the automobile industry in the 1920s and 1930s benefiting from copper's thermal and anti-corrosion qualities. Further down the road, the enterprise began selling products to cool heavy machinery as well as for the booming construction sector, including plumbing and/or roofing materials, Di Fabio recounts. In the 1950s, the appearance of televisions and new household appliances also lifted demand for its products, he adds. Nowadays, the bulk of KME's operations are focused on selling processed copper for modern electronics such as computers and cell phones, for AI data centres and aerospace application.

Rolled copper (source: KME SpA)

To become KME SpA, the Milan-headquartered multi-country European group it is today, KME embarked in the Eighties on a series of acquisitions as add on to the existing Italian operations (Europa Metalli). A key phase was in 1987 when the firm bought Trefimetaux from French state-owned copper and aluminium group Pechiney (subsequently acquired by Canada’s Alcan in 2003). Other acquisition followed: Kabelmetal AG in Osnabrück (Germany), Stolberger Metallwerke (Germany), Locsa (Spain) and Yorkshire Copper Tube (UK) were added.

“We knew the market was trending toward electrification and energy transition”

Targeting electrification

Under another acquisition spree launched in 2019, KME bought full or partial stakes in European rivals such as MKM, Ilnor, Aurubis Zupthen, AML and most recently Germany's Sundwiger.5 Simultaneously, it started unwinding its less profitable copper-for-building franchise that once comprised the lion's share of its business. All of this transformed the company, which was officially named KME (taking the most recognised German subsidiary trade name) in 2006, as a leading European supplier of rolled copper targeting the booming electronics sector.

"We knew the market was trending toward electrification and energy transition, so we began selling our brass rods and tubes business," Di Fabio, who also joined the firm in 2006 as a corporate director of finance and treasury, explains during an interview with flow. "Today, more than 90% of our sales are rolled copper – mainly to customers in EU – and less than 10% is related to building application."

KME sells its products to around 5,000 customers worldwide including leading electronics, digital infrastructure, transportation and aerospace related firms.

In recent years, KME has been working to improve the environmental, social and governance (ESG) profile of its foundries, mainly by boosting copper recycling. In 2023, around 43% of output stemmed from re-used copper, says Di Fabio, adding that KME also moved to streamline its foundries or raw copper processing facilities to achieve its environmental goals. The firm has also significantly reduced water usage and substituted gas furnaces with more environmentally friendly electric ones. According to Di Fabio, KME is on track to achieve its ambitious ESG target by 2030.6

Bigger credit facility

Announced on 28 November 2023,7 KME enlarged a borrowing base trade finance facility (BBF) to €460m from the previous €330m with a banking syndicate coordinated by Deutsche Bank as mandated lead arranger. BNP Paribas, Intesa Sanpaolo and Banca Nazionale del Lavoro acted as sustainability coordinators for the newly enlarged banking pool. Simultaneously, KME extended €376.5m of factoring lines. The €460m signed in November 2023 bolstered the BBF by €130m compared to the expiring credit line, available on a revolving basis and maturing on 30 November 2025. The agreement also provided an additional, one-year extension option on lenders' consent, according to a company press release. KME says the accord "confirmed the flexible structure of the facility" to cope with the group's working capital needs primarily linked to inventory.

"The BBF is really important," says Di Fabio, who worked as a treasurer and financial manager at GE Power Controls, (now part of GE Vernova), before joining KME. "We use it to finance our inventory cycle and enable us to cope with fluctuating copper prices, while we mainly use non-recourse factoring to finance our receivables."8

“The BBF supports the working capital requirements in a flexible way”

Deutsche Bank’s Barry Pieters, Head of Natural Resources Amsterdam confirms that the BBF is the cornerstone funding programme for KME’s business. “It supports the working capital requirements in a flexible way. Deutsche Bank has been acting as sole coordinating bank and facility agent for the borrowing base facility for more than 10 years – a testimony to a great collaboration,” he adds.

Data centre surge

The expansion of the facility, collateralised by KME's inventory and receivables, provided the firm with liquidity at a time when copper demand is set to surge amid soaring electricity demand to support the world's AI frenzy. Indeed, demand is so huge that AI data centres in US struggle to cope.

AI will need a tremendous amount of computing power in the future, meaning more copper will be needed to make high-performance computing (HPC) motherboards that need it for quick data transfer while keeping systems cool, adds Di Fabio. The US's fledgling 'Stargate' project, which envisages US$500bn of investments from OpenAI, SoftBank and Oracle to build new AI infrastructure in the country,9 is also seen as bolstering future demand.

Market recovery

Meanwhile, Deutsche Bank Research analysts see global mining activity increasing in 2025 but caution that this key metal “is heavily exposed to a global trade war”. They note that because the US is a net importer of copper, the threat of tariffs following last November’s US election result had by January 2025 already led to the price of copper rising by more than a US$300/t premium (around 3%) to London Metal Exchange (LME) pricing. What happens next will, they add, “depend on how tariffs are applied and potential exemptions for copper-producing countries”.10

By 2030, world supply of copper should rise around 4.2% each year from the 22.9mt anticipated for 2024 (up by 3.2% on 2023), with the top five producing countries being Chile, the DRC, Russia, Zambia and China, according to a report by Research and Markets.11 Latin American mining projects, notably the Tia Maria, Zafranal and Michiquillay (which will add 450,000 tonnes of new capacity to the global supply network) will fuel the gains, it added.

Latin America accounts for 46% of global copper output and 40% of reserves. The region is expected to garner almost US$100bn by 2030 as 20 mining projects get underway in Peru but also in Chile, Argentina, Mexico, Ecuador and Brazil, according to KPMG.12

"We are seeing the vast majority of global copper investment going to Latin America," Henry Ziemer, an associate fellow at the Center for Strategic and International Studies (CSIS), tells flow. Chile alone drew US$680m last year, he says. The world's largest producer churned out 5mt of copper in 2023 (mainly by top supplier, Codelco), while Peru made 2.5mt, according to Ziemer. This compares with other leading producer, Australia, which delivered 1mt.

Some analysts worry that the prospective US tariffs could sap demand and scupper investments, prompting the globe's largest miners such as BHP Billiton (which runs the largest mine in Escondido, Chile) and others such as Rio Tinto or Anglo American to dial back spending in the fledgling projects.

But Ziemer doesn't see the 47th President’s trade agenda hurting that much. "I am not sure it will delay any projects," he says, adding that global demand should remain brisk, boosting Latin American production to account for 47% of the world's 31mt expected usage by 2030.

Plenty of copper

Meanwhile, KME’s Di Fabio dismisses claims that the world is facing a supply shortage, saying a lot of inventory is unaccounted for.

"There's enough copper out there," he notes. "Two years ago, there was an expectation that 2025 would see shortages but that hasn't happened. Plus, there is a lot of hidden inventory out there, beyond the official warehouse everyone looks at."

Nimble suppliers such as KME can also quickly reshuffle inventory to meet demand spikes for certain industrial products. "You can allocate your machinery and capacity to target the most popular product," he explains. "That way you only make that product that it has more demands and more interesting profitability" to balance supply.

Recycling should also keep stocks in abundance, adds Di Fabio. “Every year, all new copper that goes into the market is in addition to the overall stock that can be recycled," he says. "Potentially, in 50 years, there may not be a need for mining because there will be so much product that can be recycled," he concludes.

Ivan Castano Freeman is a freelance financial journalist based in the US

Sources

1 See internationalcopper.org

2 See "Mining tomorrow’s energy infrastructure" at flow.db.com

3 See rapidmetals.co.uk

4 Note that prices are in metric tons, not short tons. One metric ton equals 1.1023 short tons and is the industry standard measure in metals pricing

5 See kme.com

6 See kme.com

7 See kme.com

8 See Deutsche Bank's "A Guide to Trade Finance" at corporates.db.com, Chapter 4, for an explaination of the BBF structure

9 See theguardian.com

10 See "Commodities outlook for 2025 prices" at flow.db.com

11 See researchandmarkets.com

12 See riotimesonline.com