26 June 2024

The energy transition is suffering from a lack of investment. While an increase from US$1trn to US$1.8trn is an improvement, an orderly transition is going to cost US$4trn a year. With insights from commodities analysts Wood Mackenzie, flow’s Clarissa Dann explores this collective responsibility and what it means for the metals and mining industry

MINUTES min read

When the G7 Leaders meeting in Hiroshima (May 2023) invited the International Energy Agency (IEA) “to make recommendations… on options for how to diversify the supplies of energy and critical minerals as well as clean energy supplies”, it defined the energy policy trilemma of “meeting sustainability, security and competitive goals”.

In other words, how can the world reach net zero emissions before 2050 to meet the goals of the Paris Agreement, while ensuring ongoing energy security – something that is complicated by geopolitical tensions such as the Russia/Ukraine crisis and the current instability in the Middle East?

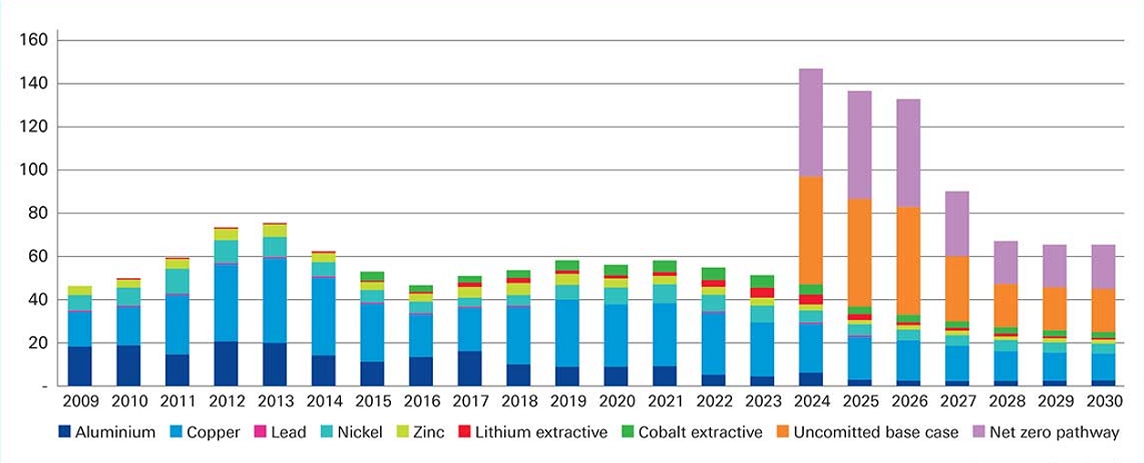

The answer is investment – and a lot more of it. “The need for investment is unquestionable, the challenge is convincing stakeholders to deploy capital and time is short,” said Julian Kettle, Senior Vice President and Vice Chair, Wood Mackenzie at a Deutsche Bank Natural Resources Finance Investor Day in February 2024 (see Figure 1). “And risk-adjusted internal rates of return (IRR) and net present values (NPV) are challenging.” However, original equipment manufacturers (OEMs), sovereign wealth funds, private equity funds and government policy could be part of the solution, he added.

“The need for investment is unquestionable, the challenge is convincing stakeholders to deploy capital“

Two months later, on Trade Finance TV,1 he underlined that, for metals and mining corporates, there is simply not enough free cashflow to distribute dividends, decarbonise themselves and deliver growth.

Yann Ropers, Head of Natural Resources Finance at Deutsche Bank, sees metals and minerals investment as a collective responsibility where banks and financial institutions can help, despite the complexity of financing metals, and says that those markets are more volatile than those of oil and gas. “Banks need to form an appetite for the industry,” he said. And this can mean taking a view on what prices will do in 15 years’ time.

Figure 1: Global mine, smelter and refinery investment capex (US$bn in nominal terms)

Source: Wood Mackenzie

Three pathways

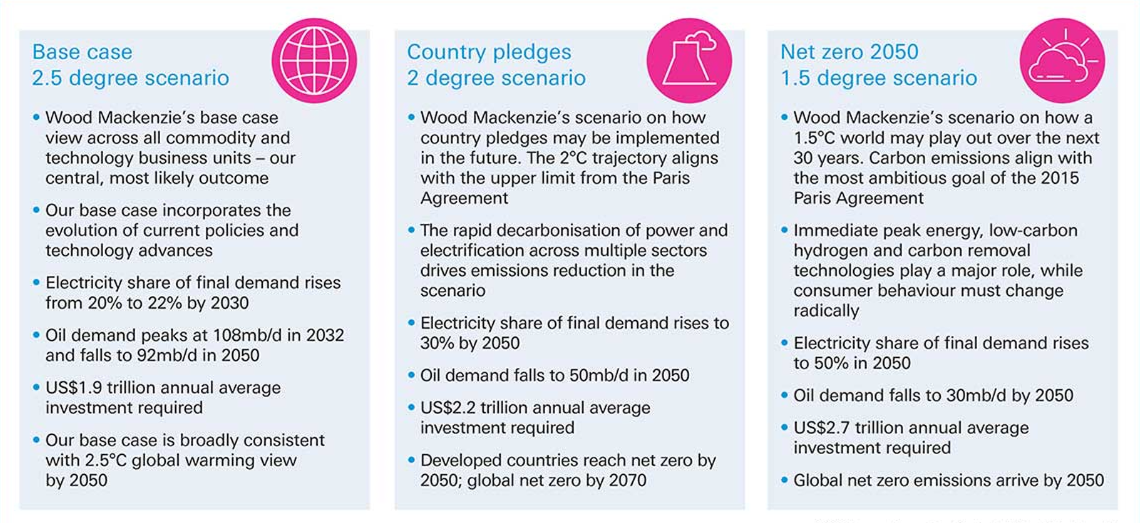

In their 2023 Energy Transition Outlook, Wood Mackenzie set out what would need to happen to achieve net zero by 2050 (in line with the 2015 Paris Agreement). The most likely outcome, the report notes, given the current rate of investment and technology and policy advances, is “consistent with a 2.5 degrees global warming by 2050.” Key drivers of what will determine the scenarios are:

- Renewables

- Electrification

- Policy

Figure 2: Wood Mackenzie 2023 Energy Transition Outlook

Source: 2023 Energy Transition Outlook (Wood Mackenzie)

“The energy transition is, and will continue to be, metals intensive – metals and mining is a key strategic growth driver over the next two decades,” explains Deutsche Bank’s Ropers. For this reason, he sees constraining factors, including the availability of minerals and metals to support green energy decarbonisation investments (which include increased electrification), as obstacles in the pathway to net zero.

Somewhat controversially, there is no getting away from the fact that a successful transition does mean ongoing investment in oil and gas so that supplies of affordable energy are not interrupted along the way. “Much more investment and accelerated project cycles in critical minerals/metals are primordial to support the decarbonisation of the global economy. The Wood Mackenzie report indicates that oil and gas will still have to play a role in the energy transition,” says Ropers.

Figure 3: Energy consumption and demand

The Wood Mackenzie estimate of total final energy consumption demonstrates how the share of electricity and low-carbon hydrogen in total final consumptions “rises to 34% in the base case and 61% in our net zero scenario by 2050”. See Figure 3.

In its response to G7 Leaders in December 2023, the IEA applauded the rise in clean energy investment to US$1.8trn from US$1trn five years earlier.2 But, it adds, “today’s clean energy investments remain well short of the amounts needed to align with the net zero emissions by 2050 pathway, which requires spending of well over US$4trn annually by 2030.” It also expresses concern that “many clean energy supply chains exhibit a high degree of geographical concentration, both for the mining and processing of critical minerals and ultimately in the manufacturing of clean technologies, many of which rely on critical minerals.”

Given that the EU is a net importer of oil, gas and critical minerals, the bloc remains exposed to market volatility and high energy prices – impacting competitiveness. The other issue is the energy/electrification needed in the first place to extract and process metals as well as recycling them – at present, renewables infrastructure is insufficient to meet total primary energy demand.

China’s investments in clean energy supply chains have helped bring down costs around the world for key technologies, explained the IEA in its Energy Technology Perspectives.3 However, the issue surrounding geographical concentration in global supply chains, it adds, “creates potential challenges that governments need to address”. In short, “for mass-manufactured technologies like wind, batteries, electrolysers, solar panels and heat pumps, the three largest producer countries account for at least 70% of manufacturing capacity for each technology – with China dominant in all of them.”

The specific dominance of China in electric vehicle (EV) inputs was highlighted in March 2024 by science journal Nature. The article, Electric vehicle battery chemistry affects supply chain disruption vulnerabilities, explains the three segments of the EV battery supply chain:

- Upstream (mining and extraction of raw materials);

- Midstream (processing of raw materials into battery-grade components); and

- Downstream (cell and pack manufacturing, as well as end-of-life recycling and reuse)

“While upstream mining is geographically distributed by material, China dominates every part of the midstream and downstream supply chains of all materials, from material processing and refining to electric vehicle production,” note authors Cheng, Fuchs, Karplus and Michalek.4

“The energy transition is, and will continue to be, metals intensive”

Wood Mackenzie’s Kettle believes that China does not care which part of the value chain generates the returns “as long as the total returns are there”. In the West, “we look at each individual part of the value chain. If we are going to wean ourselves off China, there are higher capital costs and higher prices – so the returns might not be there at first.” In short, says Kettle, “we are going to have to do more risky things to deliver the transition.”

Ensuring supplies of primary metals

The ongoing power generation mix, energy storage deployment plans together with the impact of EV sales is “a massive draw on mine supply,” according to Wood Mackenzie. Current technologies’ intensive use of metals for low-carbon power and transportation “massively increase our exposure to metals and now with an increasing focus on sustainability,” explains Kettle.

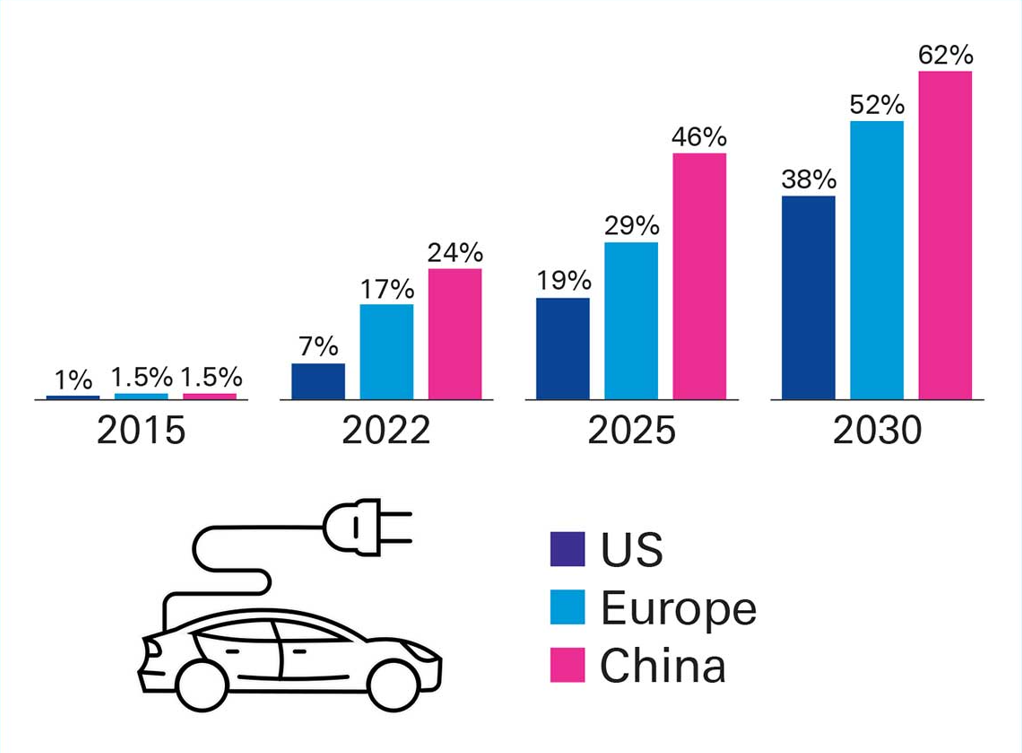

Take the move to EVs – strong adoption incentives from governments such as tax cuts and subsidies in the EU, the US and China are driving up the EV proportion of new vehicle sales. (See Figure 4).

Figure 4: EV share of new vehicle sales

Source Wood MacKenzie

Having hit 14 million in 2023, EV sales could reach around 17 million in 2024, according to the IEA report Global EV Outlook 2024, accounting for more than one-in-five cars sold worldwide.5 Electric cars continue to make progress towards becoming a mass-market product in more countries. Tight margins, volatile battery metal prices, high inflation, and the phase-out of purchase incentives in some countries, have sparked concerns about the industry’s pace of growth, notes the report. It adds, “the pace at which electric car sales pick up in emerging and developing economies outside China will determine their global success.” The vast majority of electric car sales in 2023 were in China (60%), Europe (25%) and the United States (10%). By comparison, these regions accounted for around 65% of total car sales worldwide, showing that sales of electric models remain more geographically concentrated than those of conventional ones.

Given that China dominates most of the EV supply chain, with the accompanying cost advantages, this geographical distribution is hardly a surprise.

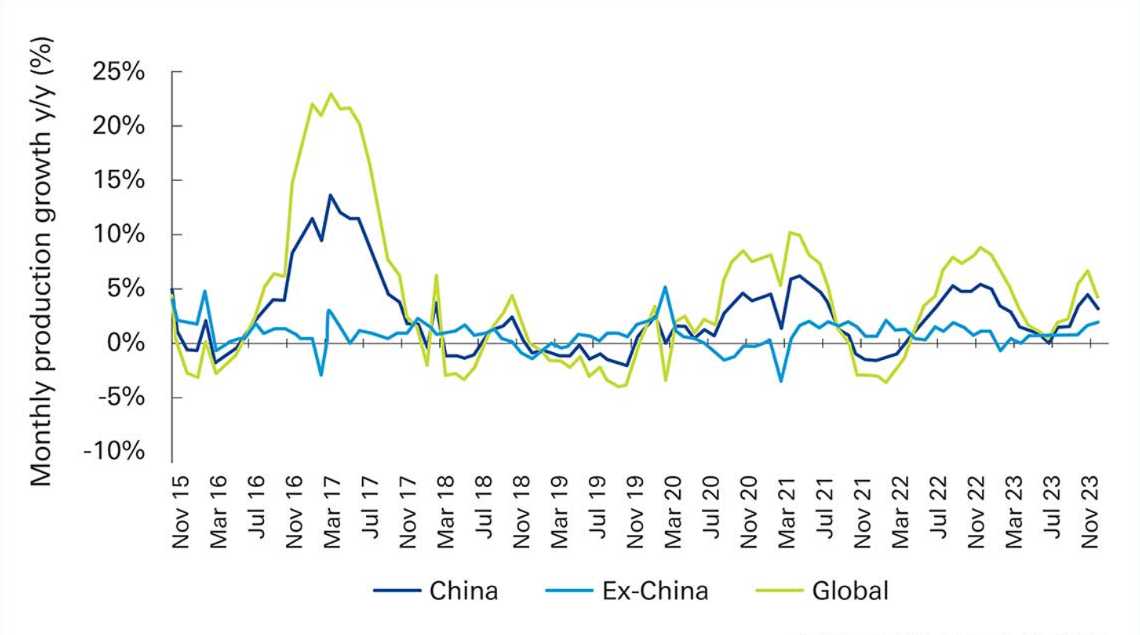

This intensifies demand for critical metals, with aluminium, copper and zinc leading the pack for clean energy and copper and aluminium in battery EVs. During 2023, Deutsche Bank Research reported, “China copper demand growth was strong (>5%) ... driven by EVs, property completions and grid/renewables. For 2024, we forecast growth of 2-3%, although a sharper-than-expected slowdown in completions is a potential downside risk.”6 They add that there was stronger-than-expected demand for aluminium in China, with supply disruptions having tightened the market towards the end of 2023.7

Figure 5: Global aluminium production slowing after a China-led rebound earlier in 2023

Source: Deutsche Bank, IAI, SMM

There is a real risk that supply shortages of primary metals needed for clean energy technology and transportation could hold back even the ‘base case’ energy transition scenario – i.e. consistent with 2.5°C global warming enabled by steady advancement of current and nascent technologies, reflects Kettle. The other complication is that metals development lead times are long, with raw materials production of, say, copper typically taking up to 12 years from feasibility through to ramp-up.

The most accessible rare earth metals are in geopolitical choke points and situated within the boundaries of non-US allies. China dominates the production of rare earths, producing 72% of the world’s supply in 2023. “Decarbonisation targets drive long-term structural rare earth demand. The EU may need 700–2600% more neodymium, dysprosium and praseodymium by 2050 to reach climate neutrality,” says Deutsche Bank Research Strategist Marion Laboure. She adds, “physical, regulatory, or geopolitical disruptions have impacted rare earth supply and the average mine takes more than 16 years from discovery to first production.”8

Financing transition minerals and metals

Circling back to what financial institutions can do to support investment – structured natural resources finance solutions across the global commodity markets value chain (oil and gas, metals and mining and soft commodities) are available. These can be used for capital investment and mergers and acquisitions as well as working capital.

Supply security and the transition to a ‘low carbon’ economy are, concludes Deutsche Bank’s Ropers, “long-term trends that will shape Deutsche Bank’s risk appetite and propel growth in natural resources finance transactions; metals and minerals demand, new supply corridors, alternative metals processing capacity and low carbon energy.” He is confident this is already under way.

Sources

1 See tradefinancetv.net

2 See iea.org

3 See iea.org

4 See nature.com

5 See origin.iea.org

6 See Global Copper: A make or break year; previews & outlooks (Deutsche Bank Research, 22 January 2024)

7 See Commodities Outlook: Demand still grinding; supply starting to squeeze (Deutsche Bank Research 10 January 2024)

8 See Rare Earth Metals: What to expect in 2024 (Laboure and Ainsworth Grace, Deutsche Bank Research, March 2024)

Additional reference: The Oil and Gas Industry in Net Zero Transitions, IEA, November 2023