12 June 2024

As China’s Year of the Dragon progresses, its bounce-back following overseas investor nervousness is creating opportunities for corporate banking services. flow examines trade corridors, the turning of the tide in foreign direct investment (FDI), and an agile FX solution as Western economies’ monetary policy gives the RMB (Renminbi) a chance to shine

MINUTES min read

For the first time ever, Sibos – the annual conference, exhibition and networking event organised by SWIFT for the financial services industry – is being held in China. “Home to most of China's biggest companies, Beijing houses the largest number of Fortune Global 500 companies in the world, as well as the world's four biggest financial institutions by total assets. Beijing attracts talent and investment from around the globe and is a driving force in shaping the future of the global economy,” explains SWIFT.1

Deutsche Bank has long appreciated the business needs of those trading in and with China. In 2022, the bank celebrated its 150th anniversary in Asia Pacific (Shanghai was the bank’s first foreign branch). Fast-forward two years and this article provides an update on the country’s economy and markets. It also provides further details on the bank’s role in supporting its clients in key sectors such as renewable energy and personal transport and, overall, in supporting China’s stronger integration with global markets in the 21st Century.

Economic update

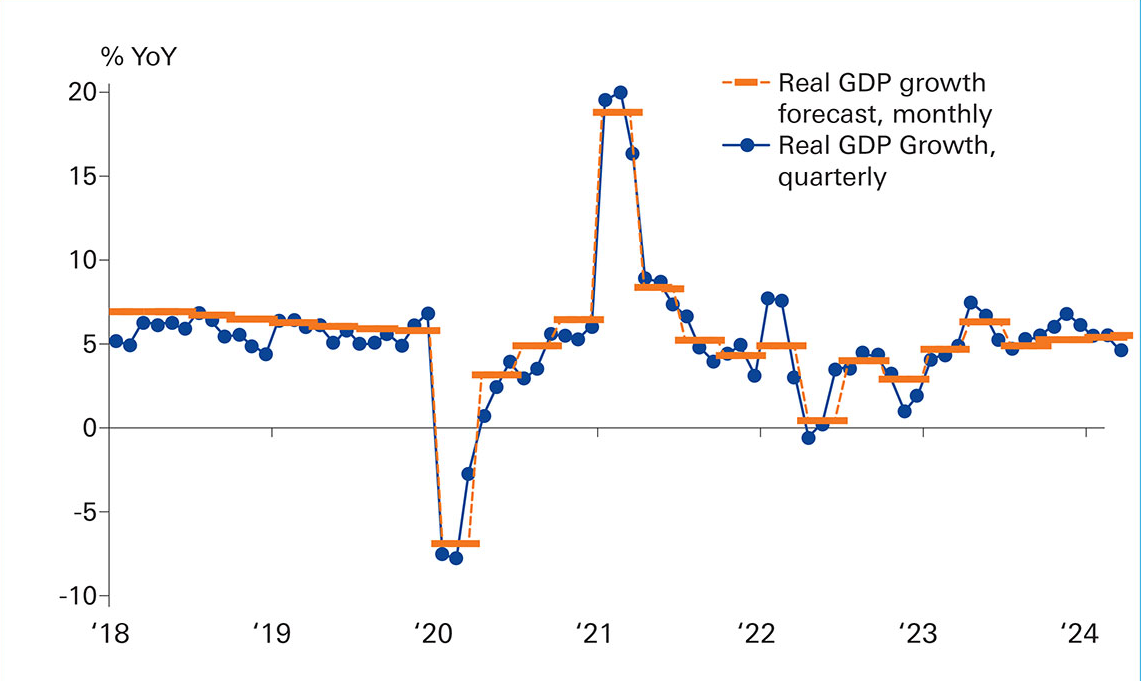

Figure 1: China’s GDP growth rates

Source: Deutsche Bank Research, NBS, WIND

Although economic growth has slowed in recent years, China remains the world’s second largest economy with gross domestic product (GDP) of US$17.7trn in 2023 (according to the World Bank) and it is recovering well from the pandemic – despite some fears at the time about its zero-Covid policies and reduced consumer spending. China made a strong start to 2024, with the government setting a 5% growth target at the National People’s Congress held on 5 March that was “higher than the market consensus growth forecast of 4.6% growth this year,” according to Deutsche Bank Research’s Chief Economist for Asia, Yi Xiong.2

Reporting on Premier Li Qiang’s first Government Work Report, presented at the 5 March Congress, Yi highlighted the fiscal policy change with the confirmation of RMB1trn of ultra-long-term special China Government Bonds (CGB) in 2024 to fund key investment projects, along with the intention to “continuously issue ultra-long-term bonds for the next few years. An acceleration in the fiscal spending in the upcoming months,” largely of receipts from such government bond issuances, “will be crucial for achieving the aforementioned growth target of 5%,” he added.

Monetary policy is also important. China’s central bank, the People’s Bank of China (PBOC), kept its policy rate unchanged in March amid “an upward surprise in CPI inflation and the PBOC’s efforts to resist depreciation pressures on the currency,” Yi noted. He added that Deutsche Bank still expects the PBOC to cut the medium-term lending facility rate by 20bps in 2024, with the first 10bps rate cut likely in June.3

“The government has reiterated a set of measures to attract foreign investment”

Ben Li, Deutsche Bank China’s China Head of Securities Services, points out that in a world where central banks have been increasing interest rates to inhibit inflation, the PBOC’s efforts to reduce rates stand out. This also drives demand for RMB-denominated cross-border financing (given the cheaper cost of it).

Importantly for foreign banks operating in the region, “the government has reiterated a set of measures to attract foreign investment, including removing entry barriers to the manufacturing, telecom and healthcare sectors, and resolving issues with cross-border data flows. The government also aims to increase the share of private companies’ financing obtained from banks and the bond market,” Li adds. This interest rate disparity certainly also helps bolster this RMB-denominated financing.

The size and importance of the real estate sector has grown exponentially in recent years, assisted by – among many other factors – the attractiveness of the real estate investment trust (REIT) structure (including H-REITS) and of deploying investor funds through these structures throughout China, but especially in the Greater Bay Area (GBA). As our earlier analysis explained, on 2018 figures the GBA alone would have comprised the world’s 12th largest economy, with a total population of more than 70 million.4 But while high debt levels have caused cash flow challenges for some high-profile players in the sector, this has still produced some high-yielding investment opportunities for investors with the appropriate risk profile. Overall, however, “the property sector will likely continue to recover,” a Deutsche Bank report found,5 although Yi Xiong noted that the sector is still weak.

Trade and supply chains

Key corridors

Trade flows can be analysed and named in a variety of ways. An examination of, for example, China’s key trading partners (the US, Germany, Japan, India, ASEAN countries, and the Middle East) is a helpful indicator of the region’s extensive supply chains and overseas investment priorities. Deutsche Bank’s trade and investment transaction pipelines are growing as Middle Eastern investors increasingly view China as a strong economy.

Turning to the wider concept of a ‘trade corridor’ adds a useful macro dimension, as it shines a light not only on those trading partners and the routes between them, but also the investment in intermodality and step-change in strategy that was displayed initially when China began its Belt and Road Initiative in 2013. Examples of these trade corridors highlight developments that underscore China’s position as a global trade hub:

- New International Land-Sea Trade Corridor – a trade and logistics passage with an operational hub at Chongqing, connecting more than 490 ports in 120 countries and regions. Established by China and ASEAN countries and now part of the Global Shipping Business Network, it connects the Silk Road Economic Belt, the 21st Century Maritime Silk Road and the Yangtze River Economic Belt. Launched in 2017, it continues to grow in use, aided by its intermodal technologies. For example, recent figures show it experienced year-on-year growth of nearly 15% in terms of TEU (containers) transported.6

- EU Middle Corridor Trade Route – The Trans-Caspian International Transport Route (TITR), better known as the Middle Corridor, is a network of transport routes that replicates the ancient Silk Road, extending from China to Europe across Kazakhstan, the Caspian Sea and the Caucasus into Turkey. Operational since 2017, the Middle Corridor is a multimodal transport system relying mostly on existing basic rail and port infrastructure. The EU has already allocated €10bn for infrastructure-related investments in China, through its Global Gateway initiative - and is considering deepening its engagement.7

Energy transition investment

China’s investments in decarbonisation have predominated along these trade corridors, and from electric vehicles (EVs) to infrastructure and renewables, China has provided beneficial FDI to trading partners around the world. Two examples from Central Europe are:

- Chinese battery and component manufacturers have announced more than €10bn of investments in Hungarian factories in the past 18 months. In August 2023, for example, Contemporary Amperex Technology Co., Limited (CATL) announced an investment of €7.34bn to build a 100GWh battery plant in Debrecen, eastern Hungary, which is also its second battery plant in Europe following its investment in a site in Thuringia in central Germany.8 Construction of the first production facilities is under way.9 EV maker BYD also announced in December 2023 a raft of new factory projects in the country – such as a car factory to be built in Szeged in southern Hungary.10

- Chinese EV investments are also being made in neighbouring Slovakia. China’s Gotion High-Tech has created a joint venture with local Bratislava-headquartered InoBat to produce EV batteries at a plant with annual output of 20GWh, to be built in Šurany in the west of the country.11

Edward Hui, Head of Structured Trade and Export Finance (STEF) for APAC at Deutsche Bank, points out that the bank has worked with Sinosure (the China Export & Credit Insurance Corporation) on export finance solutions that support the work of clients since 2007. These range from “medium and long-term export credit insurance, investment insurance, [to] domestic trade credit insurance and beyond”12 in what Hui calls a “series of firsts” for an international bank. Sinosure’s risk coverage – of up to 95% of an investment – has increased Deutsche Bank’s appetite for funding such projects. This can be seen in sustainability finance the bank has structured and arranged, from wind farms in Australia to hybrid solar projects in Africa, to green methonol-powered container ships.13

Capital flows and investor behaviour

Inbound flows of capital

A country’s direct investment liabilities are a gauge of foreign capital flowing into it. Data released by China’s State Administration of Foreign Exchange (SAFE) indicated that China’s totalled around US$23bn in 2023 – or an 82% decline on the previous year and the lowest annual figure since 1993.14

However, by Q2 of 2023, the tide seemed to be turning. According to market data,15 foreign investments in the China Interbank Bond Market (CIBM) had increased for seven consecutive months. In short, reflects Deutsche Bank’s Ben Li, “inbound investment is more positive than last year” and flows from “corridor clients” in ASEAN countries and the Middle East have increased. The following two transactions serve as powerful illustrations of this:

- Zhuhai Wanda. Middle Eastern investors ADIA and Mubadala featured in a consortium leading by PAG to invest in China recently, specifically in Zhuhai Wanda, a leader in shopping mall management for over 20 years. The transaction saw the consortium acquire 60% stake in Newland Commercial Management, the new holding company of Zhuhai Wanda, which is Dalian Wanda’s commercial management business. Newland Commercial Management is the world’s largest operator of shopping malls by square footage. It currently manages around 500 malls across 227 cities in China with gross floor area under management of 65.6 million m2 and an average occupancy rate of 98.7%. In 2023, it generated revenues and net profit of US$4.0bn and US$1.1bn, respectively. The transaction was valued at US$8.3bn, implying an enterprise value of US$13.9bn. Deutsche Bank was the sole financial adviser to Wanda Commercial on the transaction.

- Saudi Arabia’s Saudi Aramco has invested in the construction of oil refineries in the eastern Zhejiang province, valued at RMB83.7bn (US$11.83bn).16 The transaction involves Saudi Aramco finalising and upgrading a planned joint venture and acquiring an expanded stake in a privately controlled petrochemical group.

For further details on the background and framework to China’s inbound investment landscape, see the flow article ‘China’s post-zero investment boom’.

Cash management/treasury/payments

RMB Internationalisation

Since 2009, the PBOC has permitted cross-border settlement in the reminmbi (RMB), initially in selected provinces, and then expanded nationwide. Despite a slow start, RMB usage has expanded significantly in recent years.17 The SWIFT monthly RMB tracker noted that as at April 2024 in terms of international payments excluding payments within the Eurozone, the RMB ranked fourth in the world by volume with a market share of 4.7%.18

By August 2023, it was becoming clear that the global rate hike cycle was picking up momentum resulting in clearer separation of trajectory vis-à-vis the lower rates of RMB counterparts. Deutsche Bank’s Kok-Leong Lee, Head of Trade Finance, Lending and Corporate Cash Management Greater China, explains that “cross-border RMB financing makes sense in the current macro environment considering the interest rate differential between RMB and other major currencies of the rest of the world". He adds, " We are also able to leverage on our global liquidity support and pricing advantages to meet client’s needs for exchange rate risk management and we are the first bank to complete the first yuan-oriented loan offering in the Latin America market. With deepened application of the yuan globally and the sustained interest rate environment, we expect to see meaningful demand for cross-border RMB financing." Lee says that the Deutsche Bank team have "put together a solution that allows clients based outside of mainland China to access cost-competitive funding for bank loans and Panda bonds for as long as the interest rate differential lasts".

In addition to growing inbound investment there are many PRC-based Chinese corporates who are expanding their operations overseas. This stimulates demand for additional banking support beyond that relating to cross-border RMB financing and range across varying sectors and geographies such as e-commerce platforms, EVs or garment manufacturers.

Outlook

The region’s growth, flexibility and attention to decarbonisation reflect the elements of the Year of the Wood Dragon, according to the Chinese Zodiac and five-element theory. With its stringent pandemic-era restrictions now behind it, Sibos Beijing 2024 indeed looks set to “connect the future of finance”.

The skyline of Beijing at sunset ©bjdlzx beijing, China (from iStock)

Sources

1 See sibos.com

2 See Asia Macro Insights, Deutsche Bank Research (27 March 2024)

3 See China Macro: Politburo commits to more policy support, Deutsche Bank Research (30 April 2024)

4 See reuters.com

5 See "China’s post-zero-Covid investment boom" at flow.db.com

6 See seatrade-maritime.com

7 See ecfr.eu

8 See catl.com

9 See catl.com

10 See byd.com

11 See reuters.com

12 See sinosure.com.cn

13 See projectcargojournal.com

14 See safe.gov.cn

15 See shanghai.pbc.gov.cn

16 See reuters.com

17 See imf.org

18 See swift.com