4 Feburary 2025

What does the combination of US tariffs, a potential end to the Russia/Ukraine conflict and the prospect of more fiscal stimulus from Beijing to drive up China’s 2025 GDP mean for industrial metals and crude oil? flow’s Clarissa Dann shares commodities markets insights from the Deutsche Bank Research team

MINUTES min read

When looking ahead to what commodities prices might do in 2025, the change of administration in the White House on 20 January directs the spotlight on US trade policy and how China will react to it.

“Since the US election, USD strength has weighed heavily on industrial metals, and the market is still grappling with a wide range of possible outcomes,” writes the Deutsche Bank Research Commodities team in the 8 January 2025 Commodities Outlook. The report explains that uncertainty over global trade and growth “has risen materially”, and an expected recovery in ex-China metal demand “has not yet materialised” with high inflation, elevated interest rates and a global downturn in manufacturing having been inhibitors.

While China’s economic growth regained momentum in Q4 2024, driven by government policies aimed at boosting domestic demand, the ongoing property sector downturn and the potential escalation of US-China trade tensions remain key risks to the world’s second-biggest economy’s growth trajectory.

Drawing on the team’s insights, this article provides a snapshot of what could lie ahead for industrial metals, and crude oil – both of which serve as barometers of economic growth in developed and developing economies alike.

“Copper…is heavily exposed to a global trade war”

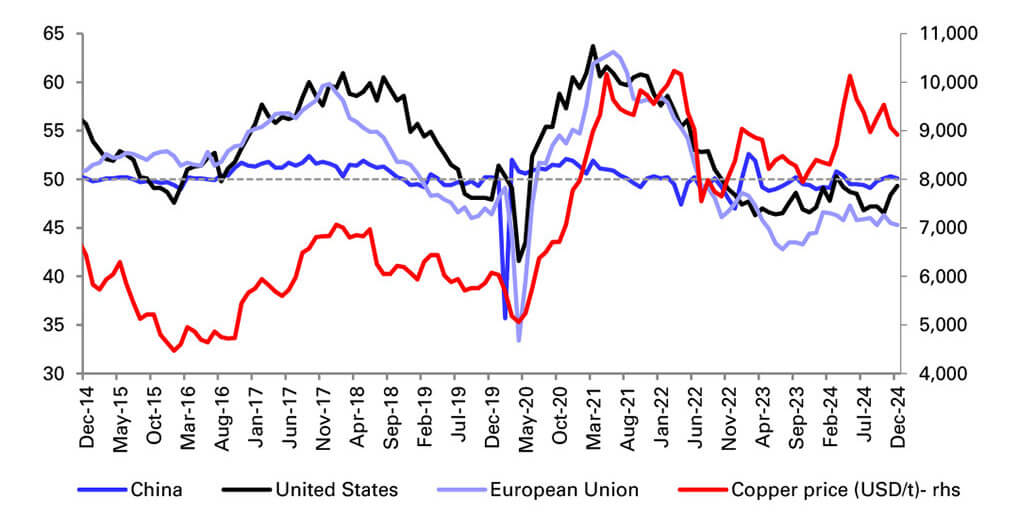

Figure 1: Manufacturing PMIs for China, the US and Europe vs the copper price

Source: Deutsche Bank, Bloomberg Finance LP

Copper, a key metal for electrical wiring alongside many other use cases, “is heavily exposed to a global trade war” and, as the team observed a week later in their follow-up Global Copper Report (16 January),1 “discussions are currently dominated by the potential impact from US tariffs”. While a certain amount of uncertainty has already been priced in, an aggressive trade war “could pose further downside risk”. The team adds that because the US is a net importer of copper, the threat of tariffs following the US election result last November has already led to the price of copper rising by more than a US$300/metric ton (t)2 premium (around 3%) to London Metal Exchange (LME) pricing. What happens next will, they say, “depend on how tariffs are applied and potential exemptions for copper-producing countries”.

The 8 January Outlook anticipates that copper will average US$9,000/t in the first half of 2025, or US$ 8,000/t under an aggressive trade war scenario. But its authors see a recovery in global demand (particularly outside of China) driving prices higher in H2 2025 with the possibility of prices exceeding US$10,000/t by the end of 2026. The market, they add, “is moving into a structural deficit” because of underinvestment and very inelastic mine supply. Furthermore, if prices do not recover towards US$10,000/t, investment will be delayed again, “tightening the medium-term outlook”.

Aluminium

Upstream disruptions across bauxite and alumina markets (from which aluminium is produced) and plateauing primary production in China are tightening factors – China produces more than half the world’s supply of this highly versatile metal, which can be found in cans, foils, buildings, and aeroplane parts. It also has applications that, notes Investing News Network, “make it an important element in the green transition”.3 Europe’s energy crisis limited production outside of China in 2021–22 but now that “energy prices have normalised”, along with some improvements in pricing (if the price is too low, producers can’t make a profit and halt output), production restarted in 2024. “Assuming improving demand and easing alumina prices, we expect additional restarts this year of up to 500,000/t per annum (weighted to H2), including Norsk Hydro’s Norwegian smelters at around 130,000/t per annum and for Chinese production growth to slow from 3% in 2024 to 1% in 2025,” the report predicts.

Iron ore

The combination of weak domestic steel demand in China and strong supply from Brazil drove iron ore prices down almost 20% over the course of 2024. The sluggish state of the Chinese property market has a direct bearing on iron ore/steel demand and prices (steel being a core metal for building structures). Iron ore exports from Australia and Brazil combined increased by 2.5% year-on-year in 2024 with Brazilian exports returning to 2018 levels – before the Brumadinho dam failure in 20194 – and 14% above 2020 levels.

Having fallen to US$90/t in September 2024, prices have since rebounded to US$100/t following government stimulus announcements in China.5 For 2025, Chinese steel production looks set to fall by -2% with gradual declines of -1% each year thereafter, notes the report. “Unless domestic demand returns to positive territory in 2025/26, the iron ore market is headed for sustained multi-year surpluses, although we only expect a moderate surplus in 2025,” it adds.

Crude oil

In December 2024, the OPEC+ countries took the decision to further delay an output increase to April 2025, and to extend the schedule for increase by six months. “This reduces the scope for oversupply in 2025,” notes analyst Michael Hsueh from Deutsche Bank Research.

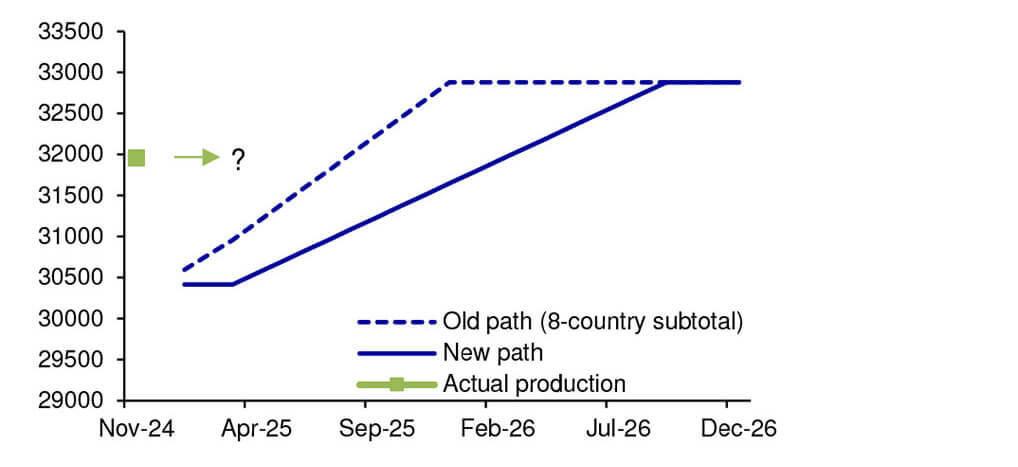

Figure 2: OPEC+ ramp up is slowed, but current production higher than planned

Source: IEA data from Monthly Oil Data Service © OECD/IEA 2024, www.iea.org/statistics, Licence: www.iea.org/t&c; as modified by Deutsche Bank (published in the 8 January Outlook)

His report goes on to explain that the targeted end point of improving supply has been pushed back by nine months and the team assumes a modest ramp-up of production delayed to July 2025 of 370 thousand barrels a day in total for the year for all OPEC+ countries.

According to the US Energy Information Administration (EIA), downward oil price pressures look set to continue over much of the next two years, “as we expect that global oil production will grow more than global oil demand”. The EIA forecasts that Brent crude will average US$74/bbl in 2025, less than in 2024, and continue to fall by another US$11% to US$66/bbl in 2026.

As for consumption, the EIA anticipates growth to be less than the pre-pandemic trend, with liquid fuels expected to increase by 1.3 million b/d in 2025 and 1.1 million b/d in 2026, “driven by consumption growth in non-OECD countries”. Much of the expected growth is in Asia, “where India is now the leading source of global oil demand growth,” says the EIA.

“We are optimistic about the medium-term structured debt opportunities in North American commodities market”

Impact on natural resources finance

While natural resources finance is more medium-term focussed and the Deutsche Bank Research Commodities Outlook has a more short-term demand/price change focus, the overall sense of optimism about the medium-term structured debt opportunities – particularly in North American commodities markets – is very evident, notes Yann Ropers, the Bank’s Global Head of Natural Resources Finance. “The business is optimistic about the medium-term structured debt opportunities in the region and has adequate risk appetite and financing products across the commodities value chain to cater for short-term price volatility,” he explains.

Deutsche Bank Research reports referenced

Commodities Outlook: Silver linings beyond the macro clouds, 8 January 2025, by Liam Fitzpatrick; Michael Hsueh, Bastian Synagowitz; Corinne Blanchard; and Edward Goldsmith from Deutsche Bank Research

Sources

1 See Global copper: Trump tariffs, latest demand and supply trends, company previews and outlooks, 16 January by Deutsche Bank

2 Note that prices are in metric tons, not short tons. One metric ton equals 1.1023 short tons and is the industry standard measure in metals pricing

3 See investingnews.com

4 See sciencedirect.com

5 See gov.cn