24 June 2024

In a year that saw commodity prices holding up and traders recording strong profits, a deglobalised world order has intensified the focus on their supply chains. Following a packed two days at TXF’s annual conference in Amsterdam, flow’s Clarissa Dann reports on markets and transaction patterns

MINUTES min read

Although the flight from London to Amsterdam across the North Sea is less than an hour – the crossing on 20 May this year was unusually eventful, with severe turbulence shaking our small plane around as if we were in a washing machine. Happily, the pilot calmly exited the storm, found an alternative runway and landed us smoothly to a round of applause. Passengers on a long-haul flight far further east that same day did not emerge quite so unscathed.1

Turbulence, volatility, unusual weather patterns and dealing with the unexpected were themes that underpinned the TXF 2024 Global Natural Resources and Commodity Finance event whose distinctive artwork, appropriately, took Lewis Carroll’s Alice in Wonderland for its theme. Now in its tenth year, having started out with a 120 people gathering in the Amsterdam Commodities Exchange, the event welcomed more than 300 delegates, bringing together producers, traders, financiers together with other advisers to the 170-years old Antara Grand Hotel Krasnapolsky in the city’s Dam Square – that shining example of Thai foreign direct investment.

“There was a strong turn-out from senior producer and trader representatives across agricultural, energy and metals and mining sectors,” observed Amsterdam-based Willem Calame, Deutsche Bank’s Head of Commodity Trade Finance. In a post-event flow video, Calame, together with Deutsche Bank’s Head of Natural Resources Barry Pieters highlighted the collective global challenge of achieving the US$4trn a year investment needed for an orderly renewable energy transition. “It’s going to take a big effort – clients and partners are willing to make this effort, and this is where we as a bank play our role,” added Pieters.2

“AI and data centre growth will consume more power than electric vehicles (EVs)”

Growth patterns

Despite last year’s widespread predictions of recession for 2024 (including those from our own research), ultimately, as Saad Rahim, Chief Economist at Trafigura (the global commodities trading and marketing company) noted, a serious downturn was averted. As he explained:

- US growth has stayed strong, but with inflation remaining sticky and by May 2024 analysts’ Federal Reserve rate cut expectations had been scaled back – at the time of writing (June 2024), the timing of the Fed’s first cut is still uncertain.3

- China’s growth, which began to revive by Q3 2023, is holding up – supported by exports comprising batteries, electric vehicles and solar panels.

- European manufacturing is tentatively recovering as energy prices come off the boil and external demand recovers.

Rahim also highlighted concerns about low inventories of commodities such as copper and the wider issue of overall supply side underinvestment (which became a recurrent theme at the event). Technological developments such as AI and data centre growth will, he predicted, “consume more power than electric vehicles (EVs) within a couple of years,” a point made by the panel moderator Jean François Lambert of Lambert Commodities in a separate flow video interview post-event.4 Closing with a reflection that “there is a lot of growth ahead of us” particularly in emerging economy cities such as Lagos and Dar-es Salaam, he cautioned “but not enough investment in commodities to meet it all”.

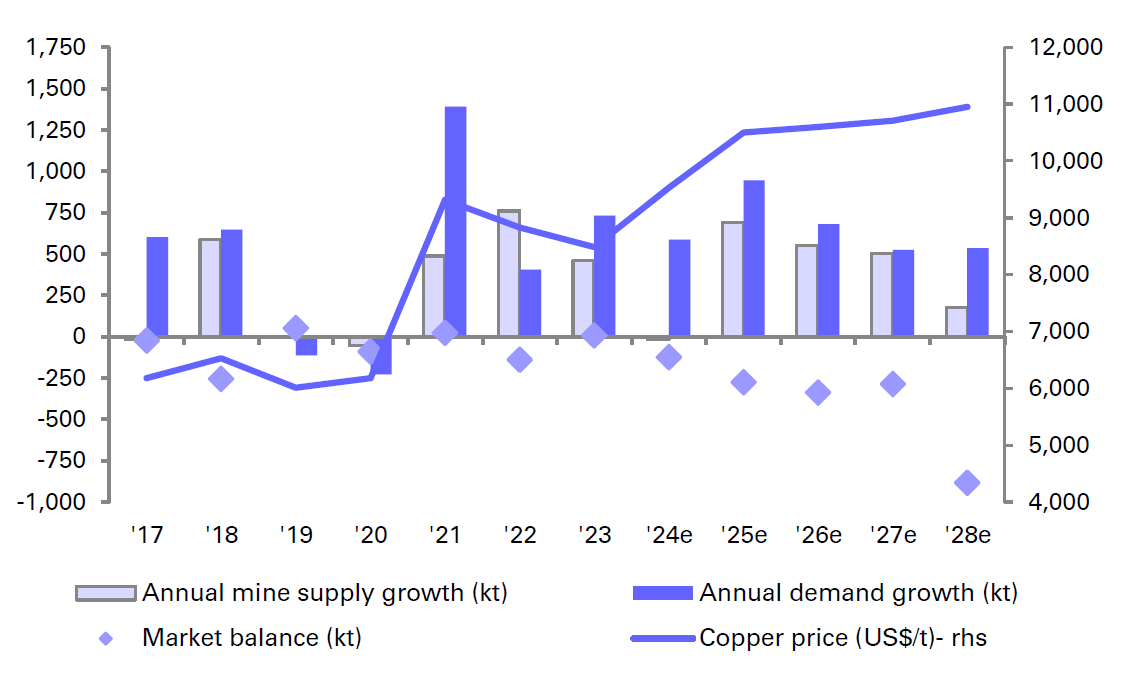

Published only days after the event, the Deutsche Bank Research report, Global copper: show me the copper! (5 June 2024) confirmed how the ubiquitous metal had reached US$10,000/t, “reflecting improving global growth and a surge in speculative flows against a backdrop of structurally tight supply”. The reporting team points out that the attempt of BHP to acquire Anglo American5 (another much discussed theme in Amsterdam) “highlights the strategic importance of copper and the challenges in adding new supply at a time when ‘future facing’ demand drivers (electrification broadly) are building momentum”. See Figure 1.

Figure 1: Copper market to move into deficit from 2024

Source: Deutsche Bank estimates, CRU, company data

Joining Rahim and Lambert on the TXF podium was Kona Haque, head of Research at ED&F Man, the agricultural commodities trader. She commented on how the increased frequency of droughts, flooding, extreme temperatures, and unusual frost events were creating price volatility in cocoa and coffee. “There was not enough supply compared with demand – and this was exacerbated by extreme weather events. Prices went through the roof and then crashed down,” she said, pointing out that insufficient surpluses are being held to protect against future weather events and resulting price spikes.

The International Cocoa Organization agrees. “Significant declines in production are expected from the top producing countries as they are envisaged to feel the detrimental effect of unfavourable weather conditions and diseases,” the ICO confirmed in April.6

All that gas

On 5 December 2022, Singapore-based commodity trader Trafigura signed a US$3bn loan agreement guaranteed by the German government to secure gas supplies when the Russia/Ukraine crisis triggered energy security concerns. The syndication was oversubscribed with 25 banks participating in the award-winning export credit agency (ECA) deal.7 This, together with the Gunvor €400m LNG agreement with Italian ECA SACE8 were examples of how governments are using an existing structure – ECAs – to avert the risk of market distortion in the bid to ensure certainty of energy supplies.

This spirit of collaboration between ECAs, commodity traders and financial institutions has since gathered momentum, said TXF Reporter Ralph Ivey in his introduction to the panel session comprising Oliver Schenkenberg (Gunvor), Yannick Luce (BGN); Maria Maliniemi (Finnvera) and James Lowrey (SMBC).

“Traders are continuing to deploy their liquidity on strategic acquisitions”

Panelists agreed that ECAs are now focused on developing access to supply chains for their exporters. The next growth area for ECA involvement could be soft commodities such as agricultural products, particularly for countries with strong domestic food distributors. Producers could also benefit as governments consider establishing funds to invest in metals.

Helped by sizeable profits in recent years that allows for more flexibility, larger traders are securing their supplies by lending to smaller companies unable to access bank liquidity. In response to a question from the floor to the ‘Keynote traders panel”, as to whether traders were the “new banks”, one panelist responded that while some traders were awash with cash with low utilisation of banking lines, “this could all change again in three years.”

Traders, however, are continuing to deploy their liquidity on strategic acquisitions – investing in physical assets to control price and supply chain risk. Two examples featured in trade press rooms included Trafigura’s South Korean nickel refinery (December 20239) and Mercuria’s US Gulf Coast energy storage assets (June 2024).10 In addition, Vitol extended its presence in the renewable energy market via its acquisition of BioMethane partners in April 2024.11

Across the 150 commodity finance transactions logged by TXF in 2023 totalling US$128.78m; oil and gas remains the dominant sector, notes Ivey in his report summary, “until a fundamental shift in energy demand take place” with traders and producers unlikely to see any kind of reduction in demand for these products “as developing countries grow”.12 This can hardly be a surprise given that access to energy, food staples and healthcare products top the import lists of economies climbing out of poverty or recovering from crises such as default or geopolitical conflict.

Furthermore, given that most renewables energy projects are not categorised as commodity finance, the barometer of demand and supply of clean energy is determined by the number of clean energy projects being financed (either through project finance or export credit agency deals) – and the minerals and metals being used to make them happen.

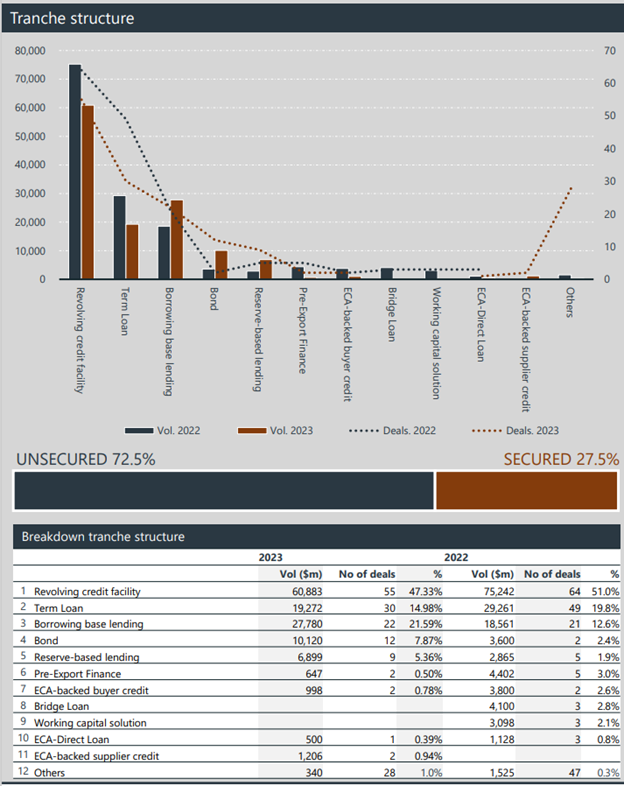

Figure 2: Breakdown of lending tranche structure

Source: TXF Commodity finance full year report 2023

Although the value and number of revolving credit facilities (RCFs) in the 2023 table had reduced in 12 months with borrowing base lending and reserve-based lending having risen, RCFs still comprise 47% of all lending. This surprised some of the ‘Global heads reunite’ financing panelists. “Around 10% of our limits are RCFs with 90% secured transactional financing of trade – going up to large traders as well”, was one comment.

Deutsche Bank’s Willem Calame and Rabobank’s Michiel Teunissen reflect on the shape of commodity finance transactions

Supply chain resilience and resource nationalism

flow and Trade Finance TV trade economics expert Dr Rebecca Harding opened the second day of proceedings by thanking TXF for 10 years of partnership and its support in publishing her now, seemingly prophetic 2017 report, The weaponisation of trade – the great unbalancing of politics and economics.13 In it, she declared, “trade is much about politics as it is about economics. It can be wielded by a state as an instrument of policy with the objective, in some circumstance, of bending other states to do its will”. Seven years on and she reflected on how, “supply chains around the world have been coerced and weaponised through policy” and, increasingly, “commodities have become embroiled in strategic wars”.

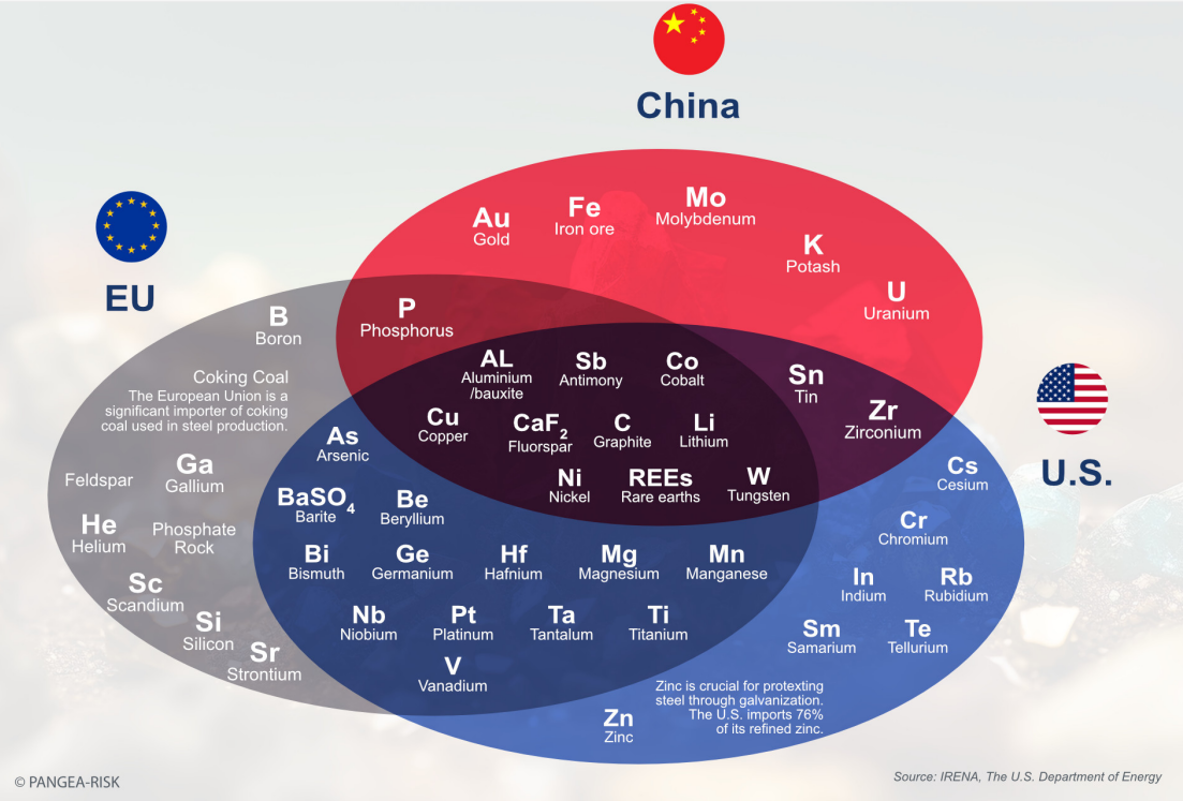

Given that strategic metals and minerals needed for electric vehicles and renewable energy infrastructure are among those commodities, it was fitting that Robert Besseling, CEO of advisory firm Pangea Risk further developed this theme of global rivalries. His focus was the African continent, home to the world’s most valuable deposits of metals and minerals needed to drive the Fourth Industrial Revolution globally.

He explained how access to critical minerals now drives driving geopolitical country risk fuelled by demand for “all these cellphones here, laptops, and electric vehicles”. Referencing the Pangea Risk report, Growing demand for Africa’s critical minerals intensifies geopolitical rivalries,14 he pointed out that Africa’s role here is “increasingly pivotal” as it holds around 30% of the world’s reserves. The region also leads on renewable energy consumption – Ethiopia (Africa’s second most populous country after Nigeria) drawing 90% of its power supply from renewables (mainly hydroelectric power). “Much of Africa’s mineral wealth is exported raw, primarily to China, which dominates the global processing market” he explained, underlining the opportunity for the continent to develop local processing industries and enhance value addition (something other panels had noted was true both of metals and minerals, and also cash crops such as cocoa and coffee).

Figure 3 Critical minerals to global superpower security

Source: IRENA, The U.S. Department of Energy

While the EU, China, and the US each list their own set of critical minerals and metals, Figure 3 sets out the core elements universally demanded for renewable energy technologies and the wider Fourth Industrial Revolution. Besseling added that it was not only governments but also producing companies making strategic moves to shore up supplies – hence BHP’s recent interest in Anglo American, and the copper assets of Glencore and Norilsk.

Outlook

As the packed two days concluded, it was clear that much had changed over the decade since this event began welcoming delegates to Amsterdam. As the world journeys towards 2050 and meeting energy transition targets, industry cooperation to finance the journey has never been more important.

The TXF 2024 Global Natural Resources and Commodity Finance took place 20-22 May 2024 in Amsterdam

Sources

1 See msn.com

2 See e.video-cdn.net

3 See reuters.com

4 See e.video-cdn.net

5 See bhp.com

6 See wsj.com

7 See trafigura.com

8 See gunvorgroup.com

9 See trafigura.com

10 See mercuria.com

11 See vitol.com

12 See txfnews.com

13 See amazon.co.uk

14 See insight.pangea-risk.com