14 May 2024

Thanks to the European policy response to Covid-19, Italy moved from economic headwinds to tailwinds. But can it stand on its own feet? flow shares some perspectives on Italy’s prospects for growth and its thriving corporate sector

MINUTES min read

As the world’s eighth largest economy by gross domestic product (GDP) and sixth largest manufacturer, Italy enjoys a trade surplus thanks to its exports of medicines, machinery, consumer goods and its popularity as a tourist destination.

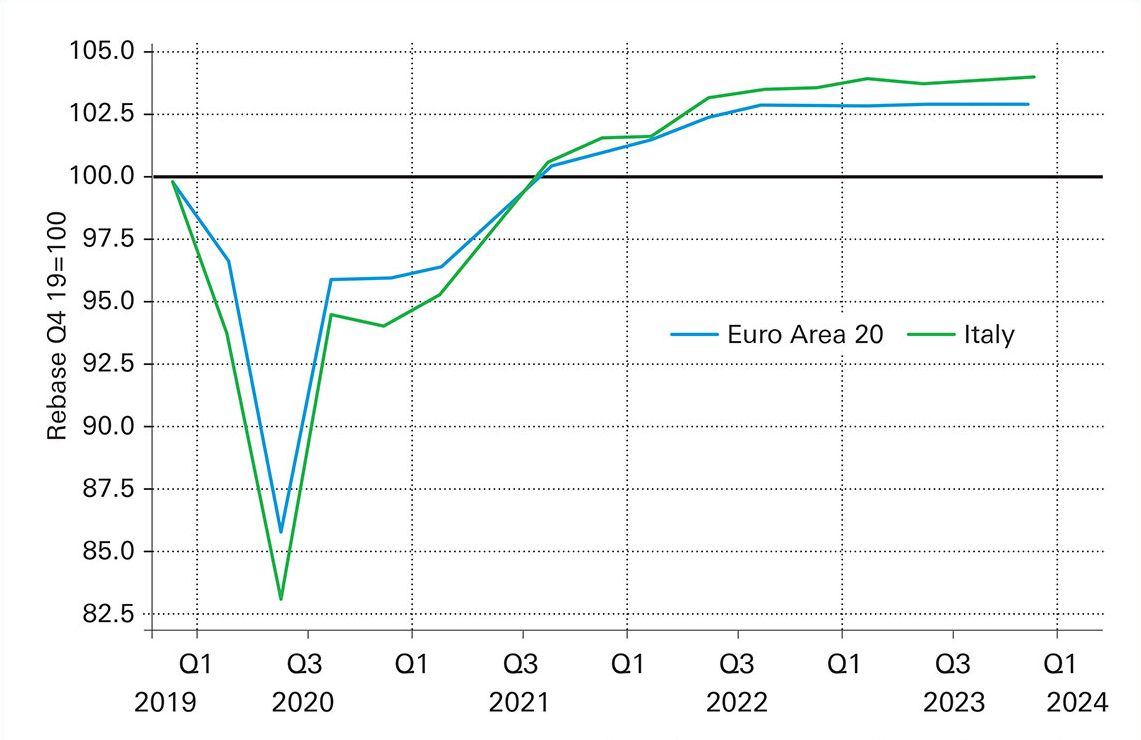

However, pre-pandemic the country was, as Clemente De Lucia, Senior European Economist at Deutsche Bank Research, puts it, “trapped in a self-reinforcing equilibrium of low growth, high debt and high interest rates”. It was underperforming the rest of the eurozone (EZ) and in 2013–2019, average GDP growth rate was more than a percentage point below the EZ average. This meant that Italy had to run primary surpluses well above the euro area average “to keep the debt ratio on a sustainable path,” De Lucia says. But, post-pandemic, Italy’s growth has exceeded its euro area peers.

Figure 1: GDP levels: Italy vs Euro Area

Source: Deutsche Bank, Eurostat, European Commission, Macrobond

Accelerants of this cyclical outperformance include:

- The superbonus – a tax incentive for energy-efficient home renovations that boosted investment spending and construction activity. It cost the country more than anticipated, but access is now tightening, with its effect fading during 2024.

- Italy’s share of the EU’s Next Generation EU (NGEU) funds – so far, notes De Lucia, only €45bn of Italy’s €100bn allocation has been spent. If funds were spent quickly and well, GDP “could rise,” but if Italy’s capacity to spend and absorb the NGEU funds lags, “the market could become more concerned about growth,” he adds.

The July 2023 IMF Country Report No. 23/273 commended the Italian economy’s resilience to sequential adverse shocks, noting the strong recovery in output and employment. The report noted that the fiscal deficit has “widened sharply, the public debt ratio is very high, and core inflation remains elevated.” As a declining working-age population could lower economic growth over the longer term, the country needs “to focus on fiscal adjustment and ambitious structural reforms to raise productivity and potential growth,” according to the IMF.1

Italian-German cooperation

Roberto Parazzini, Deutsche Bank’s Chief Country Officer for Italy, is bullish about Italy’s prospects. “We have a very positive view of the country, not only on the banking sector, but also on the competitiveness of the system and its growth, especially regarding its role in the EU. After Germany, which, plays in a different league, for us Italy is the second country of reference in the EU and we have a great desire to continue on this path,” he told Class CNBC (the Italian arm of CNBC) on 27 March.2

“German and Italian companies think very highly of each other and in many areas work together"

In Berlin on 22 November 2023, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni signed a bilateral ‘Action Plan’ to deepen Italian-German cooperation. The plan, noted Reuters at the time, “also pledged to enhance regular dialogue”.3

“Cooperation between the two countries at the business level is very good,” reflected Parazzini, in an interview with Milano Finanza’s Luca Gualtieri ten days later.4 “German and Italian companies think very highly of each other and in many areas they work together. This agreement has further strengthened relations, bringing the two countries even closer together.”

Paolo Maestri, Country Head of the Corporate Bank, sees this in how Deutsche Bank defines its Italian presence: “In essence we are a truly global bank and a truly local bank at the same time.” Italian subsidiaries of European, US and Japanese multinationals plug in to Deutsche Bank Italy to collect and pay locally with highly domestic instruments, while Italian corporates and financial institutions ask for our support to go global, he adds.

“A peculiarity of the Italian economy,” Maestri continues, “are the well-known mid-caps. Similar to the German Mittelstand, these companies are very well run, super innovative and are often global leaders in their respective niches.” In 2001 the benchmark index Euronext STAR Milan Segment was created by the Borsa Italiana to “promote excellent SMEs and to increase their visibility towards Italian and foreign investors”.5

“A peculiarity of the Italian economy are the well-known mid-caps, similar to the German Mittelstand”

"Deutsche Bank’s long heritage of working with the Mittelstand in Germany allows us to credibly cover them alongside the Italian blue chips,” says Maestri. The segment has needed a lot of nurturing during the recent climate of higher interest rates and tackling high inflation. In a market such as the European one, where banks still provide around 70% of the total resources to support businesses, refinancing with such high rates has become a key area of discussion with Corporate Bank clients, explained Corporate Bank and Investment Bank Head Fabrizio Campelli to Milano Finanza on 27 April.6

Recent transactions

A recent example of German-Italian cooperation is the sustainability-linked supply chain finance programme Deutsche Bank developed with Epta Group, an Italian-based commercial refrigeration multinational, which features a very strong presence in Germany. In March 2024, the company announced the programme explaining: “The finance programme developed with Deutsche Bank is an additional milestone in our mission of being the green transition enabler in the commercial refrigeration sector,” Simone Salani, Epta’s Group Purchasing & Procurement Director, said. “We are proud to take a further step in this direction and we believe the decision to support our sustainable partners is a strong message to the market and our stakeholders.”7

Another example of the cross-country collaboration, as well as of the strength of the relationship between Deutsche Bank and Italian Export Credit Agency SACE, is the signing by Germany’s Salzgitter AG of a SACE/SIMEST-covered green loan financing totalling €500m, in connection with the DRI (direct reduced iron) plant supplied by Italian companies Tenova and Danieli to support the decarbonisation of its steel manufacturing operations.8 Deutsche Bank acted as joint-mandated lead arranger and lender, and sole sustainability coordinator, for which the bank ran the green loan classification process.

Finally, Automotive Cells Company (ACC), a Paris-based joint venture comprising global automaker Stellantis, German automaker Mercedes-Benz and French energy provider TotalEnergies, closed a landmark deal in February 2024. This secured €4.4bn project financing from four European banks (including Deutsche Bank) for the development of three gigafactories in France, Germany and Italy, as well as for research and development (R&D).9

Sources

1 See imf.org

2 See video.milanofinanza.it

3 See reuters.com

4 See milanofinanza.it

5 See borsaitaliana.it

6 See milanofinanza.it

7 See eptarefrigeration.com

8 See salzgitter-ag.com

9 See "Powering the European EV transition" at flow.db.com