11 February 2025

CLOs had another stellar year in 2024, but what is their likely trajectory over the next 12 months? There is cause for optimism and flow provides an update drawing on published insights from Deutsche Bank Research’s Conor O’Toole and Jamie Flannick

MINUTES min read

As the flow article ‘Collateralised loan obligations explained’ described, CLOs are actively managed investment products which pool loans made to corporate borrowers that are predominately below investment grade. These loans are then securitised, slicing them into ‘tranches’ based on credit rating and therefore risk, making the interest-paying bonds available to investors.

Today, CLOs are an established asset class, whose structure and surrounding ecosystem (CLO issuers, borrowers, lenders, PE sponsors, arranging banks, credit rating agencies, lawyers, collateral administrators and trustees, investors) has been iteratively improved over the last two decades following the 2008–09 GFC.

Current state of play

Twelve months ago, sentiment surrounding the CLO market on both sides of the Atlantic was one of recovery, resilience, and clearing hurdles in a path to normalisation. And at the start of 2023, the focus was “weathering the storm” amid rising interest rates, market volatility, and concerns about defaults.

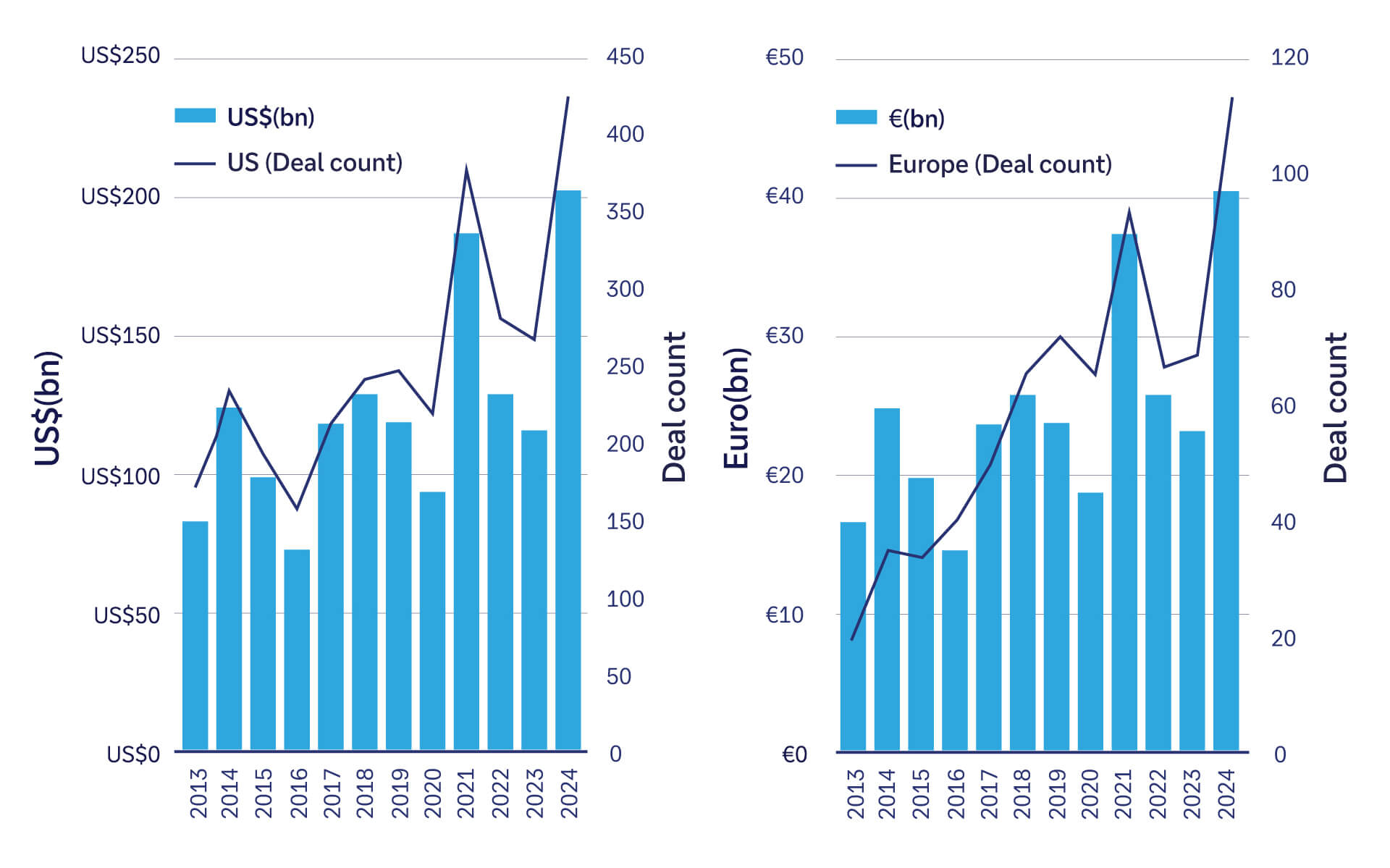

Now, in early 2025, optimism surrounding this asset class is near an all-time high following an “outstanding 2024”, according to Conor O’Toole, Managing Director and Jamie Flannick, Research Analyst at Deutsche Bank Research. For example, new issuance in both the US and EU CLO markets nearly doubled between 2023 and 2024. O’Toole and Flannick note in particular that last year:

- The US market saw US$202bn in new issue deal volumes priced, along with US$223bn in resets and US$38bn in the middle market/private credit (MM/PC) deal activity – “all single year records”; and

- in Europe “outcomes were nearly as impressive – US$52bn (€48bn) in new issue volume along with US$33bn (€31bn) in resets – well north of the US$28bn (€26bn) and US$2bn (€1.8bn) of the previous year”.

In addition, across both markets, median equity distributions reached multi-year highs, with a 16% annualised distribution in the US across all deals, and 19% in Europe. On average, CLO investors target a 14-15% yearly return, making last year’s performance an upsized surprise. CLOs have consistently performed well and offer investors diversity within their fixed income portfolio.

Figure 1: Annual EUR and US CLO new issuance

Source – PitchBook LCD, Deutsche Bank

Reasons for 2025 optimism

As the structured finance community gathers in Las Vegas for SFVegas1 , Deutsche Bank’s Research team reflects how this positive sentiment on the asset class was recognised in December 2024 at the Opal US CLO conference2. “The trends that enabled the year’s outperformance were themes that ran through the conference,” O’Toole and Flannick note, and highlight the following three main themes for 2025.

- Tightening. Constructive market fundamentals, such as relatively high all-in yields and a benign credit backdrop, have spiked investor demand over the last 12 months, leading to tightened spreads for CLO bonds. AAA CLO bonds (the highest rated and therefore least risky) were forecast by most Opal delegates to reach three-month SOFR + 110 basis points (bps) at some point in the first half of 2025, marking a 15–20 bps reduction from where Tier 1 names were pricing for standard broadly syndicated loans (BSL) deals at the close of 2024. Note that CLO debt is floating rate, and therefore the spread of a CLO bond is what an investor can expect from a quarterly coupon on top of the three-month SOFR rate.

- Converging. Private credit/middle market CLO spread levels will likely continue to drift closer towards Broadly Syndicated Loan (BSL) levels in 2025, as more investors gravitate towards the segment and as more dry powder is deployed by private credit managers into the direct lending market. The spread tightening indicates that many CLO investors have grown increasingly comfortable with private credit over the last two years, as well as the features it offers when compared to the public market, such as tighter covenants and wider spreads (traditionally) compared to publicly traded loans.

- Broadening. CLO exchange-traded funds (ETFs) surpassed US$20bn at the end of last year. This is remarkable given that in 2023 CLO ETFs had an AUM of US$2.25bn, or just 0.2% of the roughly US$1trn US CLO market. This nearly ten-fold increase reflects the market’s recognition of the combined merits of CLOs and ETFs – and augers well for CLOs expanding their appeal from institutional to retail investors. The advent and growth of CLO ETFs will only further enhance the mainstreaming and liquidity of this segment.

- As O’Toole put it in 2023: “actively managed CLO ETFs may evolve into a third driver of the CLO market. The relative spread value of CLOs compared to corporates, of floating rate as a hedge to interest rate volatility, and of the diversification across industries and borrower names embedded into a CLO, analogous to buying the S&P index rather than a single name, are all features that make CLOs an attractive investment, particularly within an uncertain macro environment.”

- The rise of CLO ETFs received outsized attention at the Opal conference, and for good reason – the implications caused by the marginal demand were seen in AAA spread tightening last year, as well as a net addition of US$15bn of capital into the market, or roughly 7% of last year’s US$202bn total in new issuance. The global ETF market is valued at around US$14trn.

This discussion regarding ETFs might portray CLOs as passive products, but they are anything but. Most CLOs are actively managed, which means that the final returns of a CLO for investors are partially impacted by the skill of the CLO manager at various stages of the life cycle, from the selection of loans at a CLO’s inception to the active management of the loan portfolio throughout the first few years of its duration, prior to the deal’s unwind. Navigating what may be increased geopolitical and macro uncertainty over the coming year will require precisely such expertise.

“The direction of geopolitical events and macro conditions in 2024 look set to further evolve in 2025”

The year ahead

As we have seen, there are many reasons to be positive about CLOs in the year ahead. Yet O’Toole and Flannick add that “a heightened degree of uncertainty also accompanies the market in 2025, as the direction of both geopolitical events and macro conditions that took shape in 2024 look set to further evolve in 2025”. They see the following four issues as most likely to impact the CLO market in months ahead:

- Interest rates and GDP

- When it comes to the path of interest rates, the Federal Reserve’s Federal Open Market Committee is constrained by the degree and pace of rate normalisation by GDP and labour market figures that continue to remain robust, and core inflation that remains stubbornly elevated.

- This has tempered market expectations for rate cuts in 2025, currently implying a base rate of 4–4.25% at year-end. Deutsche Bank Research’s US Economics team foresees a more cautious Fed in 2025 due to these macro factors but also to the uncertainty around fiscal and trade policy changes.

- Uncertainty surrounds the potential policy changes and potential knock-on effects enacted during the initial stages of President Trump’s second term. For example, two-year inflation expectations have increased since November, which has the potential to factor into Fed policy, as well as household spending levels and thus the corporate profits of the underlying loans within CLOs.

- LBO and M&A activity

CLOs to some degree sit between the capital markets and credit markets. Higher rates may therefore serve as a dampener to leveraged buyouts (LBOs) and mergers and acquisitions (M&A) activity, if rate uncertainty remains, potentially leaving buyers and sellers at an impasse until greater clarity can be gained. This would constrain new CLO deal formation, given that CLO managers buy over half of all leveraged loans issued in the US – more than any single counterparty, providing vital liquidity to the market and serving as a key component of the loan market. - Distressed exchanges

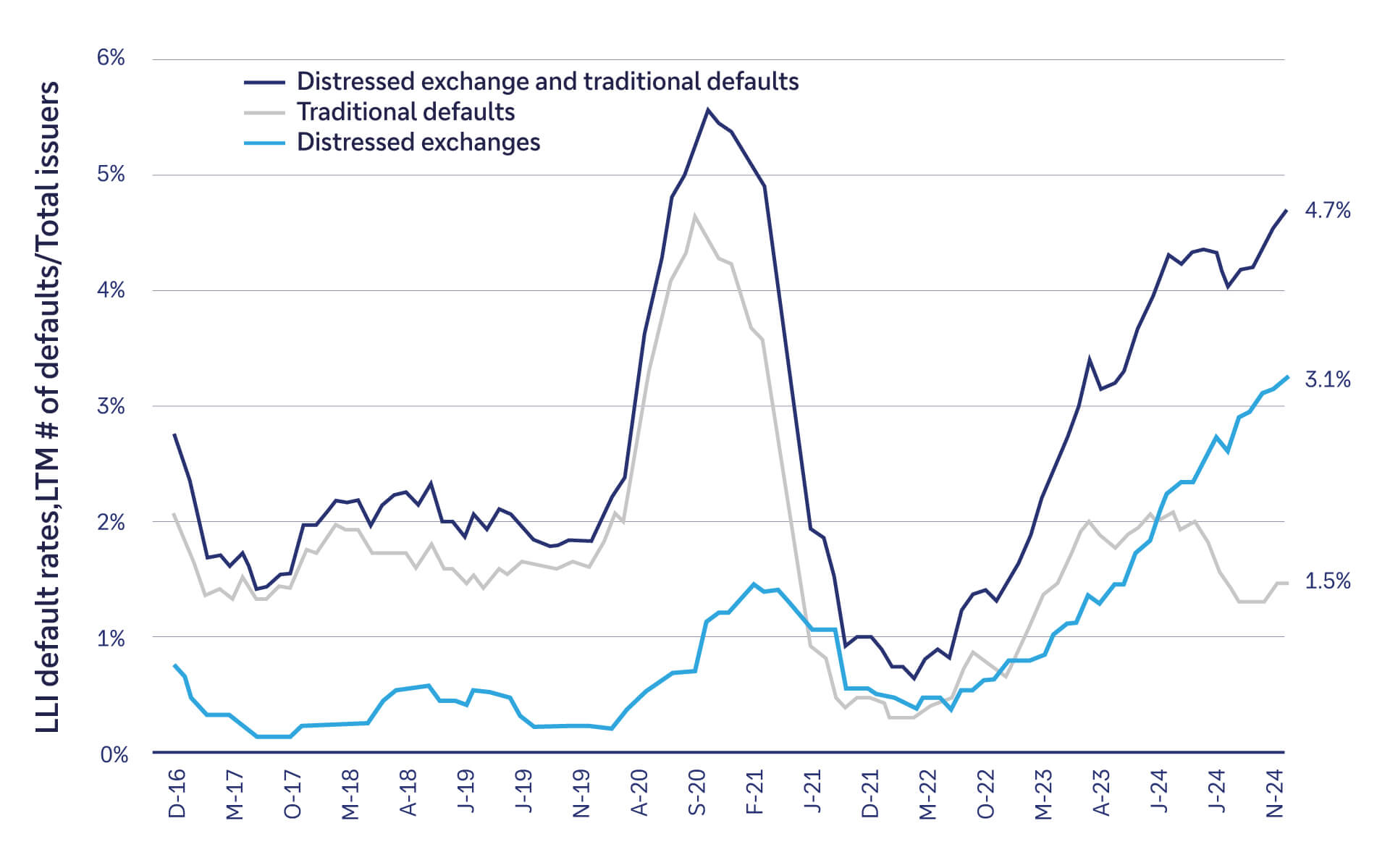

The potential for extended higher than anticipated interest rates in 2025 will also provide fertile ground for the continued rise of Liability Management Exercises (LMEs), or out-of-court debt restructurings (distressed exchanges). Recoveries following an LME, unlike a Chapter 11 bankruptcy proceeding, will in most cases be disproportionately divided between lender groups, with one or more groups seeing a higher recovery price compared to other lenders. Distressed exchanges continue to remain elevated at the start of the year, representing more than 3% of the Morningstar LSTA’s (Loan Syndications and Trading Association) US Leveraged Loan Index (LLI) default rate of 4.7% (see Figure 2). Although this level should moderate over 2025, it continues to serve as a potential hazard for CLO managers who are unable to steer clear of the distressed exchange cohort that will materialise throughout 2025.

Figure 2: Default rate, US Leveraged Loan Index

Source – PitchBook LCD (Morningstar LSTA US Leveraged Loan Index), Deutsche Bank - Europe/US divergence

- A broader macro question impacting the CLO market’s trajectory is how the path of interest rates and growth could diverge between Europe and the US in 2025.• A growing concern for the Eurozone in 2025 is one of a sustained slow growth environment, further exacerbated by political and trade uncertainty both in the region and elsewhere. The European Central Bank is forecasting GDP growth of 1.1% in 2025, up from 0.8% in 2024.• This level stands in contrast to the US, where year-on-year real GDP is expected to stay firm, yet moderate slightly in 2025 from the near 3% in 2024.

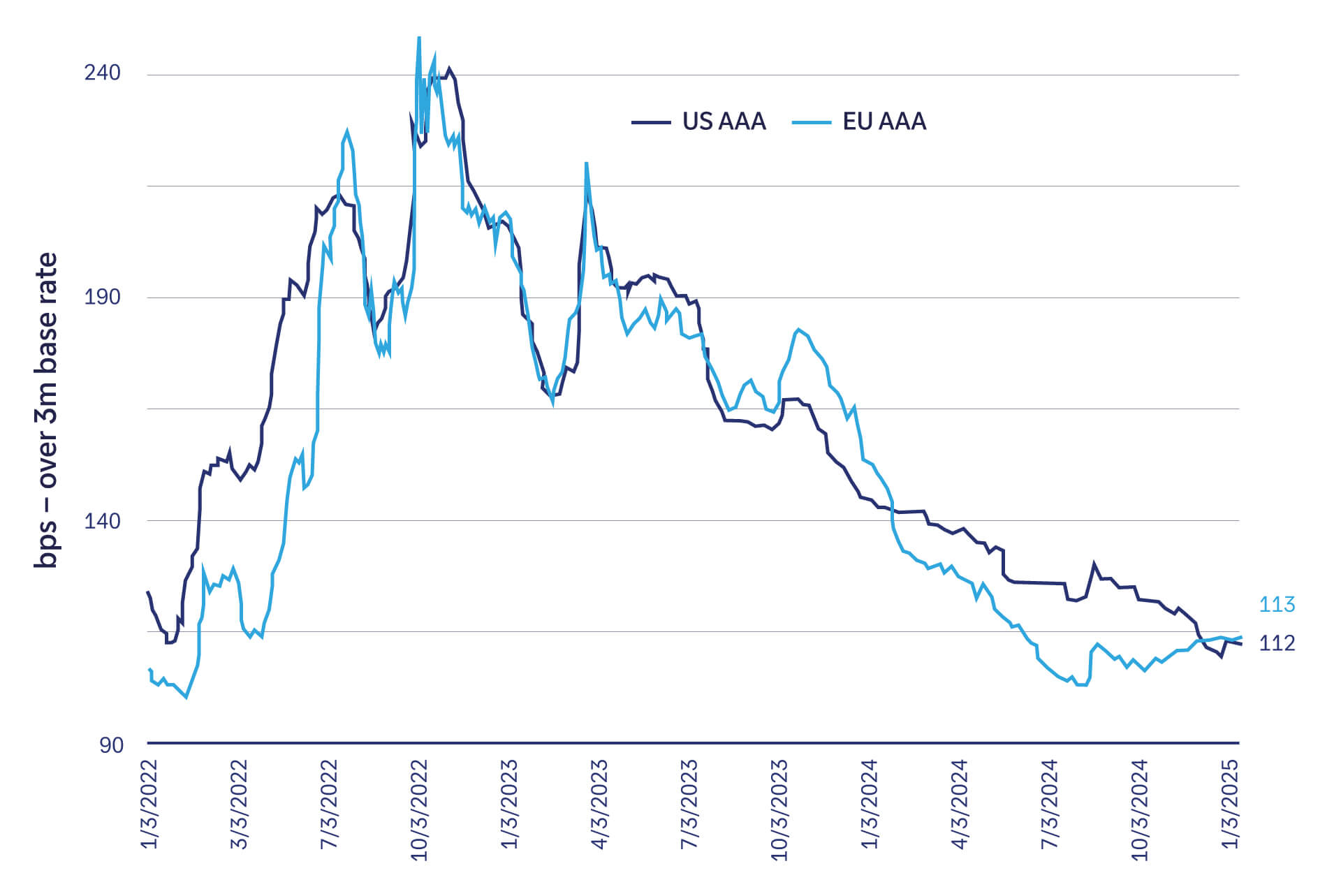

- The diverging economic paths between the two regions materialised at the end of Q3 2024, with data prints surprisingly to the downside in the Eurozone and to the upside in the US. This divergence trickled into the CLO market – late Q3 coincided with a divergence in CLO secondary spreads, with US AAAs showing relative tightening compared to European AAA spreads, as depicted in Figure 3.

- This spread direction reversed what had been relative European outperformance starting in January 2024 and extending for AAAs until August, culminating with a 24-bps divergence in the first week of August.

- The broad implication here for CLO investors with the mandate of being able to invest across both regions is that Europe may be more attractive in 2025 than the US market. In recent years, some US CLO managers have expanded their operations to the European CLO market, enabling them geographic diversity. These managers could be well-placed to capitalise upon a divergence.

“Having a strong strategy and technology investment to support growth is vital”

Figure 3: European/US AAA secondary convergence

Source – Palmer Square US CLO index, Deutsche Bank European CLO index

Robust and ready for investment

As a reminder, no CLO AAA tranche from either the 1.0 (pre-GFC) or 2.0 (post-GFC) era has defaulted. This is partly due to the diverse pool of loans that form the underlying collateral , but also in large part due to the structure itself and the nature of most deals being actively managed – meaning the credit selection and trading skills of the CLO manager can meaningfully impact returns, as well as avoid loan losses.

Technology plays a critical part in this evolution as managers and trustees look for scale, efficiencies, and a resilient platform, explains David C West, Global Head of CLOs & Transformation, Trust and Agency Services at Deutsche Bank. “Having a strong strategy and technology investment to support growth is vital. Now more than ever clients want real time data and a stable environment to scale together with their ambitions,” he adds.

The challenges and changes that CLOs have faced – such as the global financial crisis, pandemic, risk retention rules and transition in benchmark reference rates from LIBOR to SOFR – have served to amend and strengthen the asset class. And through the growth of the CLO ETF market, the asset class is now more widely available to a larger pool of investors.

Deutsche Bank Research reports referenced

US CLOs: three questions for 2025 by Conor O’Toole and Jamie Flannick (6 January 2025)

US CLOs: Diverging paths by Conor O’Toole and Jamie Flannick (16 December 2024)

US CLOs: On the cusp of becoming a household name by Conor O’Toole and Jamie Flannick (9 December 2024)