21 February 2023

flow takes a close look at the collateralised loan obligation (CLO) ETF market – a nascent yet growing asset class that combines two of the most significant securities innovations in decades

MINUTES min read

What do you get when you cross an ETF with a CLO? Although the question might sound like the start of a bad joke, investors who favour this new product may well have the last laugh.

Exchange-trade funds (ETFs) and collateralised loan obligations (CLOs) are among the most significant innovations in the world of securities of recent decades, and they constitute two of the largest asset classes today. This article explains key features of each product, what their combination – in the form of CLO ETFs – can offer investors and, drawing on Deutsche Bank Research, provides an update on the current state of the CLO ETF market.

About ETFs

ETFs are essentially mutual funds that are listed and can be bought and traded on exchanges via retail brokerage accounts and vehicles. They serve as an investment ‘wrapper’, enabling retail investors to access whatever underlying investments those ETFs hold and providing them with exposure to assets which might not otherwise be accessible. Copper and gold ETFs are traditional examples. Most ETFs are highly diversified, passively managed, and thus low cost (think index tracker ETFs, which simply mirror the constituent stocks in an index like the S&P 500). Today, there are more than 8,000 ETFs,1 traded on more than 60 exchanges globally, holding around US$10trn in assets. In September 2020, a new segment of this investment universe was created when the first exchange listed a CLO ETF – namely the Alternative Access Funds (AAF) First Priority CLO Bond ETF’ on the NYSE.2

CLO refresher

CLOs are actively managed investment products which organise, pool, and structure syndicated collateral made up of corporate loans, dividing them into tranches which are then made available to investors depending on their risk preference. As explained in the flow article ‘Collateralised loan obligations explained’, the main aim of CLOs is to take loans (syndicated and/or leveraged) made to corporate or private equity borrowers, and to securitise them by slicing them up into ‘tranches’ of interest-paying bonds, thereby redistributing them from the lenders’ balance sheets to investors.3 These CLO pools are considerable, typically comprising 150 to 250 loans.4 It should be no surprise (as the article explains) then that CLO managers buy half of all leveraged loans issued in the US, and the 109+ CLO managers in the US hold around US$1trn of assets (these assets being the secured loans to corporates – both investment grade and non-investment grade).

“Actively managed CLO ETFs may evolve into a third driver of the CLO market”

Current CLO ETF market

Conor O’Toole, Managing Director, and Head of European Securitisation Research at Deutsche Bank writes in his 6 February report, US CLOs – Continuing to surprise to the upside that the CLO ETF segment, while capturing at present only 0.2% of the US$955bn US market, is “clearly still at a nascent stage”. He adds that the asset class, is however, attracting well-known managers with vast platforms which, with growing investor appetite for these robust products, could bring the prospect of further increases in assets under management (AUM) beyond the current US$2.25bn. “Actively managed CLO ETFs may evolve into a third driver of the CLO market,” he predicts.

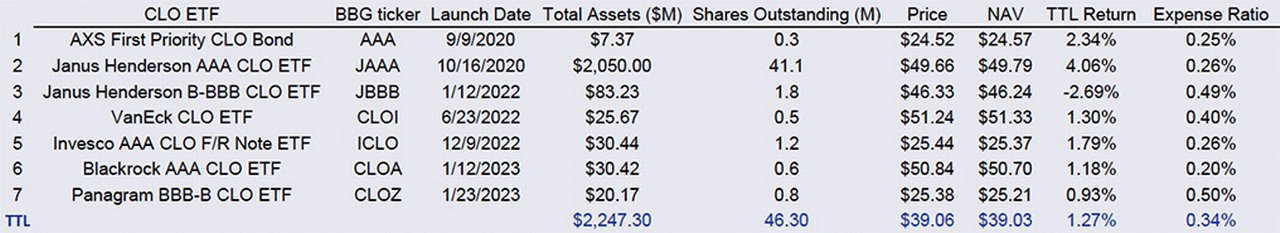

In his report, O’Toole identifies Janus Henderson as the current leader, having scaled up significantly since its October 2020 launch of the first CLO fund in an ETF wrapper to currently hold 95% of all funds invested in this segment. However, more recently BlackRock, and Invesco have also launched CLO ETFs, taking the total number of funds in this segment to nine. See Figure 1.

Figure 1: US CLO ETF appetite by manager

Sources: Bloomberg Finance LP, Credit Flux, ETF Strategy, Deutsche Bank

Some funds are targeted at senior bonds rated AAA and AA while others focus on investments further down the CLO stack to include non-investment grade (IG) risk.

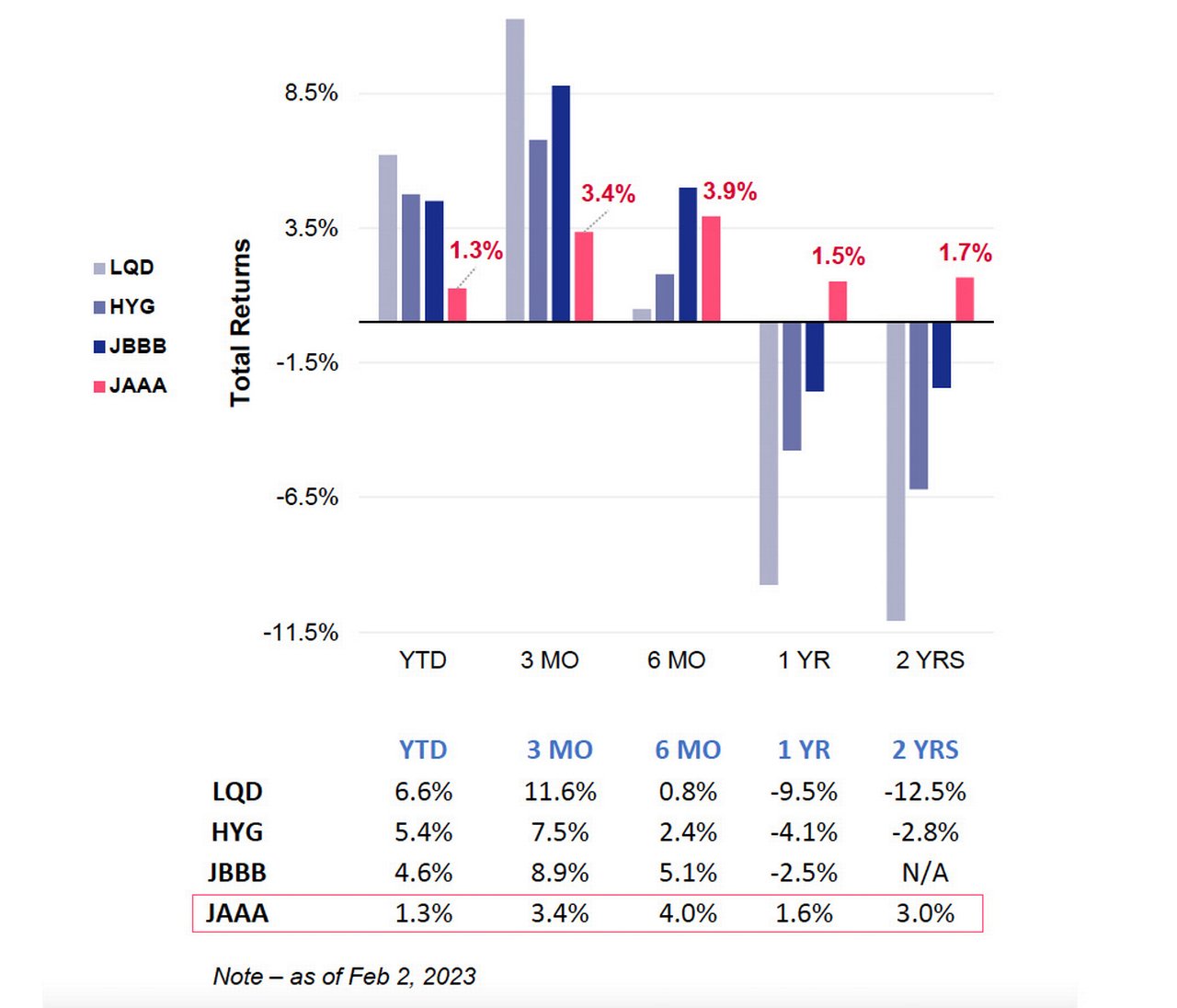

Figure 2: ETF total returns: IG, HY CLOs

Sources: Bloomberg Finance LP, Credit Flux, ETF Strategy, Deutsche Bank

As Figure 2 of O’Toole’s report shows, Janus Henderson’s BBB to B-rated CLO ETF returned almost 9% over the three months to 2 February 2023 and this success may well encourage further CLO managers to launch CLO ETFs targeting mezzanine-rated CLO paper. But it is not just CLO ETFs at this end of the capital stack that are performing well: Janus Henderson’s AAA CLO ETF (listed in October 2020, and thus the pioneer in this segment) has provided total returns of 4.09% to the holders of its 41 million shares since inception. Putting this particular CLO ETF in context, it has outperformed – from a total returns perspective – both high yield (HY) and investment-grade (IG) ETFs over the past 12 to 24 months. It is precisely these types of risk-returns that make CLO ETFs so attractive to investors; CLOs are also ‘out-of-index’, which offers investors an additional way of generating alpha.

“From a market positioning perspective, a diversified pool of CLO ETFs enables a platform to segment their customer base along the same risk/reward paradigm offered to institutional investors participating directly in the primary market,” notes O’Toole in the report. “It may also prove to be a signal of manager execution, which could feed into a platform’s ability to attract institutional investors to its new issues and influence pricing.”

Becoming a mainstream product

The advent and growth of CLO ETFs will only further enhance the mainstreaming and liquidity of this segment of the fixed income securities market. CLO managers already buy-up more leveraged loans than any single counterparty, providing vital liquidity to the market and serving as a crucial component of the loan market. As flow reported in its coverage of the SFVegas conference in 2021, CLOs are too big a market to ignore.5

“CLOs continue to be an attractive asset class with an attractive risk profile and notable durability”

The tremendous growth in issuance has come from both broadly syndicated loans (BSLs) and from the mid-market, which constitute 90% and 10% of US market volume respectively. Such leveraged loans are well-suited to securitisation because there are many issuers, who consistently pay interest (monthly or quarterly), the loans trade in a highly liquid secondary market and, given they are often ‘over-collateralised’, they have historically shown high rates of recovery in default scenarios.6 The additional merits of the US mid-market CLOs have been previously analysed by flow here.

Such issuance has continued apace, as investors realise that CLOs not only generate excellent returns but do so regardless of the challenges thrown at them. As John Polito, Deutsche Bank’s Managing Director and Head of Trust and Agency Services US Sales observes, “CLOs continue to be an attractive asset class with an attractive risk profile and notable durability. The continued demand for middle-market lending and heightened activity in the private structured market are trends that we expect to continue.”

With overall CLO issuance in the first weeks of 2023 continuing to be strong and the current cycle of rising interest rates potentially with further to run, the surprise to the upside noted by O’Connor could well extend further over the coming months – with CLO ETFs clearly an asset class to watch.

Deutsche Bank Research reports referenced

US CLOs – Continuing to surprise to the upside by Conor O’Toole, Deutsche Bank Research (6 February 2023)

Sources

1 See statista.com

2 See etfdb.com

3 See „Collateralised loan obligations explained“ at flow.db.com

4 See „Collateralised loan obligations explained“ at flow.db.com

5 See „Loan asset sweet spots from Vegas“ at flow.db.com

6 See „Collateralised loan obligations explained“ at flow.db.com

Trust and agency services solutions Explore more

Find out more about our Trust and agency services solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print