29 May 2024

As the US, EU and UK central banks tackle persistent inflation with a “higher for longer” approach to interest rates, what impact is this restrictive monetary policy having on the collateralised loan obligation (CLO) market? Drawing on insights from Deutsche Bank’s Research and Trust and Agency Services teams, flow explains the asset class’s key health indicators

MINUTES min read

Like other parts of the securitised market, CLOs provide needed liquidity to the capital markets by buying and securitising leveraged loans, which are granted to high-growth but credit-sensitive borrowers with a BBB rating or lower. At more than US$1trn, the CLO market offers an ample funding source for corporations to access while providing pension funds, insurance companies and asset managers with a compelling investment product that offers multiple layers of risk exposure and associated yields.

However, CLOs, like the underlying leveraged loans that the structure bundles up, are floating-rate in nature. When interest rates rise, the borrowing rate tied to the loan rises alongside them. This structural element is designed to insulate investors from interest rate risk – yet the feature is a double-edged sword as it increases borrowing costs for corporations during periods of heightened interest rates, which is what most western markets have experienced since early 2022. (See ‘Collateralised loan obligations explained’ in flow, August 2022, for further context to the CLO asset class.)

“The underlying health of the leveraged loan and CLO markets remains broadly constructive”

Signs of stress, but no signs of breaking

Although some commonly held borrowers in the CLO market have either experienced a ratings downgrade or undergone a distressed exchange so far in 2024, the underlying health of the leveraged loan and CLO markets remains broadly constructive despite the high-rate environment, according to Deutsche Bank CLO strategists Conor O’Toole and Jamie Flannick in their report US CLOs some signs of stress, but no signs of breaking (February 2024). This is due to many companies being able to successfully undertake cost rationalisation initiatives to maintain bottom line health. Additionally, many borrowers have been able to successfully refinance or amend and extend their debt, moving the maturity wall of the leveraged loan borrowers into 2028.

Additionally, the default rate for CLO assets (loans and bonds held by CLOs) remains relatively range bound. After reaching 3.3% in January 2024, the average percentage of defaulted assets in US CLOs across manager portfolios moderated to 3.1% at the end of the first quarter (Q1).

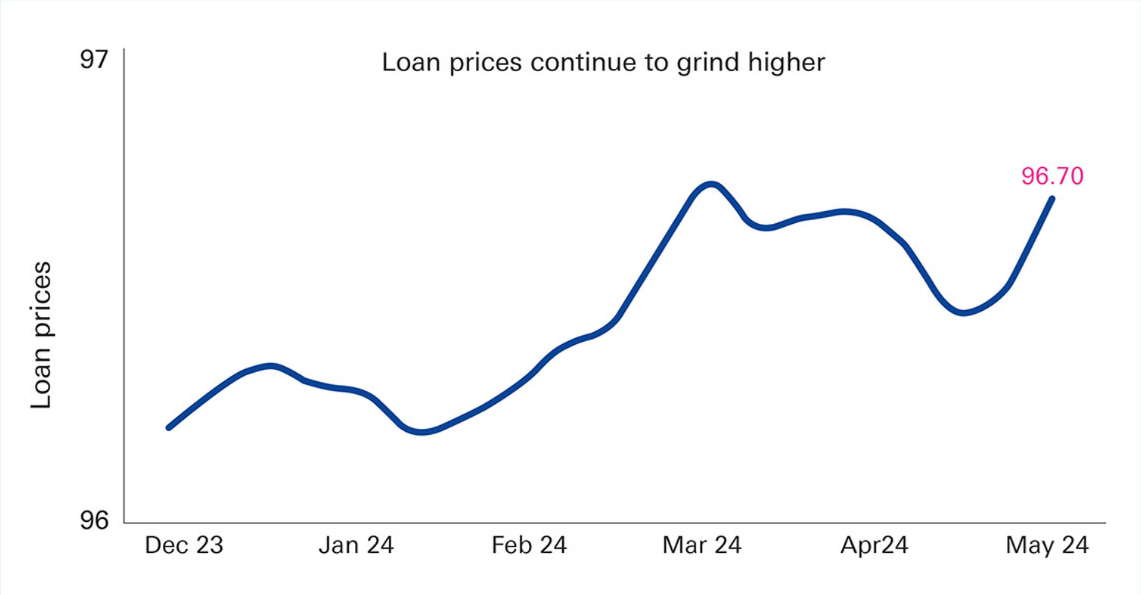

A few trends in the loan market are providing support for this decline. As at the beginning of May 2024, the trailing 12-month (TTM) ratio of loan downgrades to upgrades in the LLI (US leveraged loan index) continued to moderate from a local peak of 2.54 in July 2023 to 1.94, its lowest level in more than a year. Second, loan prices continued to march northward after bottoming out at 92.9 at the end of May last year, reaching 96.7 a year later. And finally, in the three months to May this year, loan maturities began to extend past 2028, with US$92bn of financing having a maturity date of 2029 or later.

Figure 1: Loan prices continue to grind higher

Source – Bloomberg Finance LP, Morningstar LSTA Leveraged Loan Index, Deutsche Bank

The Deutsche Bank CLO research team expects these loan trends to continue being supportive in the near term, yet they are also mindful of the impact “higher for longer” rates have on the tail of leveraged finance borrowers. Considering this, they have lowered their CLO portfolio default rate forecast to 4.2% by year end, an 80bps drop from their initial default forecast of 5% in March.1

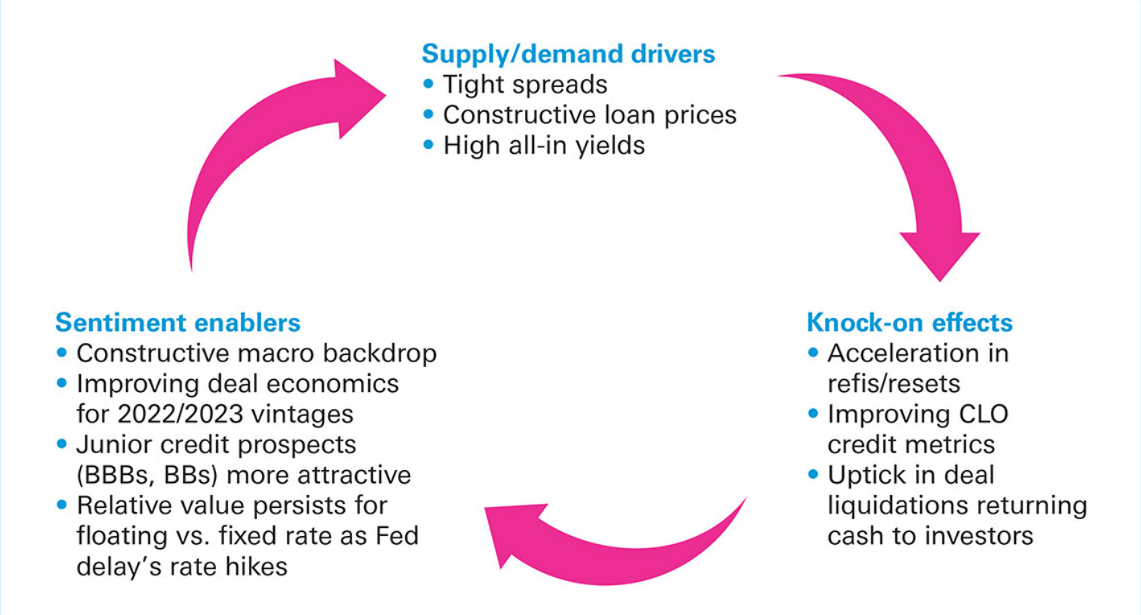

A flywheel effect

Underlying collateral health is one factor driving one of the most robust years in terms of deal activity in the CLO 2.0 era. As Deutsche Bank strategists noted in the report A flywheel effect (March 2024), when taking a step back and looking at the CLO market holistically, a pattern is emerging – there are several moving parts currently driving deal activity and the linkages between these moving parts are beginning to reinforce each other, creating a flywheel effect.

The same underlying drivers of CLO deal volume – tight spreads, high all-in yields, constructive loan prices – are producing positive knock-on effects: improving market value and credit portfolio metrics, an acceleration in ReFi/reset activity and an uptick in deal liquidations.

These in turn are further boosting investor sentiment for the market, and ultimately driving more demand

when combined with a constructive macro backdrop in which GDP (gross domestic product) remains relatively robust and unemployment relatively low, amid a broadening of the investor base as US domestic banks return as active buyers.

The interplay of these moving parts is creating a circular tailwind that is pushing the market along at pace and should help to sustain a constructive level of deal volume in the quarters ahead. But several factors could potentially disrupt this and check the market’s current momentum. Disruptors such as geopolitical risk and US Federal Reserve interest rate uncertainty, both of which remain high, have the potential to cause spreads to widen and loan prices to soften. However, until either of these or another market risk flares up, the momentum that the CLO market has built up throughout Q1 looks durable.

Figure 2: A flywheel effect – multiple factors have created a virtuous circle, driving the market along

Source: Deutsche Bank

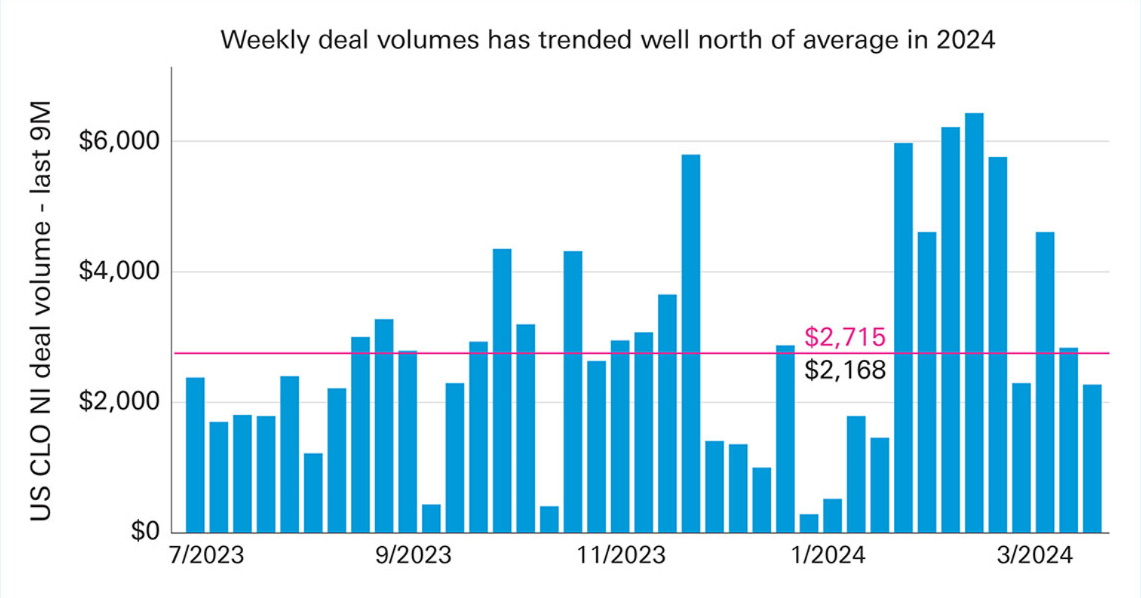

Guiding higher

The core drivers of this virtuous circle are expected to persist and, as a result, the Deutsche Bank Research team raised their full year 2024 new issue forecast in the US to US$145bn from a previous target of US$115bn at the start of the year, and to €38bn in Europe.

Figure 3: weekly deal volume has trended well north of average in 2024

Source: PitchBook LCD, Deutsche Bank

If these forecasts were to materialise it would amount to the second-largest year ever for both European and US CLO new issues, just shy of 2021’s €39bn and south of 2021’s record-setting US$187bn. After two years of declining growth, these levels would symbolise a sharp bounce back in deal activity and point towards a market that has fully normalised from an extended bout of elevated interest rates and restrictive monetary policy. See the Deutsche Bank Research reports: European CLO Monthly (April 2024) and the US CLO Weekly, ‘Guiding higher’ (March 2024).

Institutional investor support

The increasing interest of investors such as pension funds and insurers in the equity tranches of CLOs is significant given CLO equity is viewed as the riskiest portion of its structure.

“What makes CLOs really compelling is the optionality during an uncertain rate environment”

This move created headline news in early 2024 but, as Phong Lam, Global Head of CLO Product Strategy at Deutsche Bank observed, it could be argued that this should not be surprising; the 2020 research report from the US Federal Reserve entitled Who Owns U.S. CLO Securities? An Update by Tranche2 revealed that “just over half of the securities held by insurance companies were mezzanine or equity tranches” and pension funds were not far behind, with over one-fifth of their investments in the mezzanine or equity tranches.

There are concerns whether traditionally conservative investors such as pension funds should even be investing in CLO equity, given the potential for rising defaults in the underlying loan portfolio coupled with lower-than-expected recoveries. Although there were clear signs of stress following the rapid central bank rate hikes, it could be argued that the CLO market has performed better than expected, as Lam explains: “Even at a default rate of 5%, this means the remaining 95% of borrowers are performing and adapting to the elevated rate environment of the past year, giving ample opportunity for active management by the portfolio manager.” He further adds that “the historical double-digit returns allied to regular quarterly cash flows of CLO equity is highly attractive, but what makes them really compelling is the optionality during an uncertain rate environment”. The ability of CLO equity holders to refinance the rated tranches at more favourable rates can significantly boost the IRR (internal rate of return) of CLO equity given the average 10x leverage employed.

In addition, the rapid growth of US CLO ETFs (exchange-traded funds) over the past year is bringing in new investors to the most senior, safest tranches. In addition to making the product available to retail investors, the liquidity and transparency of ETFs makes this a highly suitable vehicle for institutional investors to become acquainted with the benefits of investing in CLOs. The first actively-managed CLO ETF vehicle (Janus AAA) has grown to almost US$10bn in size and could easily act as the anchor buyer of the AAA portion of primary deals.

It is worth restating that no CLO AAA tranche rated by S&P has ever defaulted,3 so while there remain some regulatory hurdles to introducing CLO ETFs into EMEA, this may only be a matter of time.

The wider acceptance of CLO equity, allied to new investors in the rated tranches, could mean that any pickup in the leveraged buyout (LBO) or mergers and acquisitions (M&A) markets would be like adding fuel to the ‘flywheel effect’, overcoming any remaining inertia.

The “higher for longer” rate environment has positively impacted CLOs by highlighting the resilience and benefits of the CLO structure, from the safest AAA rated notes down to the equity tranches. Duration and credit risk are two key aspects to consider with any fixed income strategy, and on both counts CLOs tick the boxes with their floating rate coupon and structural protection features. However, they are not just a good hedge against rising rates but an attractive asset class relative to similarly-rated instruments, reflected in the broadening investor base in both the equity and rated tranches.

In summary, the continued innovation, relative value and historically low default rates through multiple economic cycles make CLOs a compelling option in this “higher for longer” rate environment.

Sources

1 See The default rate for CLO assets is falling, Deutsche Bank Research, 28 March 2024

2 See federalreserve.gov

3 See spglobal.com