7 June 2023

Despite market volatility, concerns about rising levels of underlying asset defaults, and lower levels of issuance, collateralised loan obligations (CLOs) are holding strong in tough times. flow reports on the market’s pulse at two recent CLO events and finds it in a stressed yet stable condition

MINUTES min read

Twelve months ago, when flow reported on the April 2022 Information Management Network (IMN) Annual Investors Conference and the May 2022 Creditflux Symposium, the mood among delegates at both events was one of caution, but offset by moments of optimism. This was despite Black Swan events such as the outbreak of the Russia and Ukraine conflict and China’s economic slowdown disrupting the economy. A year later it is clear that this community has learned to live with volatility and the unexpected.

Reflecting on the past couple decades, the dominant themes of the CLO market are ‘evolution and resiliency’. These features will likely continue to prove useful, given the headwinds facing the European CLO market today of high and persistent inflation, sharp interest hikes and growing geopolitical risk.

Jason Connery, Deutsche Bank’s Head of Trust and Agency Services, EMEA said, despite the turbulence seen recently, the CLO structure itself and the underlying loans that make up the structure in which they are held, has proved to be incredibly resilient. It has withstood the challenges of the last three years.

“The CLO structure has withstood the challenges of the last three years”

Pipeline from loans to CLOs: challenges, competitors, and calls

The sum of its parts

Leveraged buyouts (LBOs) and mergers and acquisitions (M&A) are off to a slow start in 2023, with rising interest rates, persistent inflation and continued economic uncertainty. Leveraged loans, which are mainly used for LBOs and M&A, and which make up at least 50% of the CLO market1 are down approximately 50% in Europe in volume terms according to Deutsche Bank Research data. However, private equity houses are still sitting on significant dry powder, which they will look to deploy fully, and volumes should increase towards the second half of this year as the market stabilises.

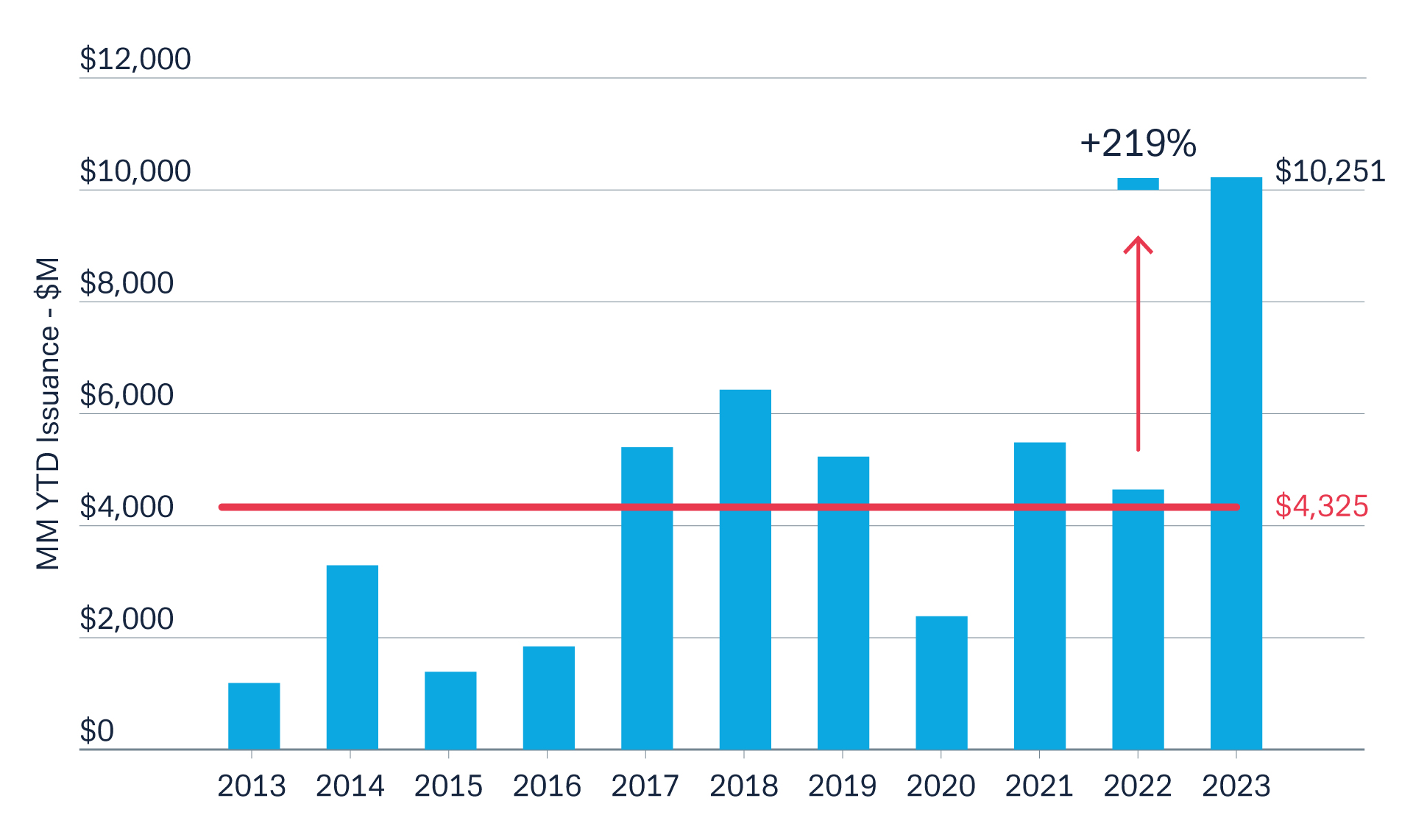

Analysis was also provided on sub-parts of the lending market, namely mid-market CLOs. Mid-market deals are printing in the U.S and said to be looking healthy with over 2x year-over-year growth and accounting for more than 20% of market share.

Figure 1: MM – investor interest leading to 2x growth

Source: Deutsche Bank Research

Market-shifting regulations

Sam Allender, Head of European CLO trading at Deutsche Bank, observed that the capital adequacy requirements for insurers under Solvency II and for banks under Basel IV have made both the client/sell-side more capital-intensive in Europe. This has had market-wide knock-on effects for both liquidity and caused higher hurdle rates.

“When banks step back from corporate lending, private credit steps in,” observed a speaker and is a common theme in economic history. Direct lenders were viewed now as direct competitors to banks, concentrating on everything below US$500m. It was noted that markets are converging (not just between the broadly syndicated loans and private credit markets) and that it will be interesting to revisit the market in 12–18 months’ time.

Concerns were raised regarding other ‘big ticket’ market regulations. Questions were asked whether the LIBOR to SOFR transition is going ‘super smooth’, flagging this as a space to watch. Attention was drawn to trans-Atlantic regulatory developments featuring broadly defined terms/concepts, such as the use of ‘securitisation participant’ in the SEC’s new ‘Conflict of Interest Rules,’1 or the ‘extraterritoriality’ ambit of recent EU regulations. Both have implications for parties acting as arrangers, investors, managers, trustees, and other key roles in the CLO ecosystem.

Issuance volatility, and warehousing

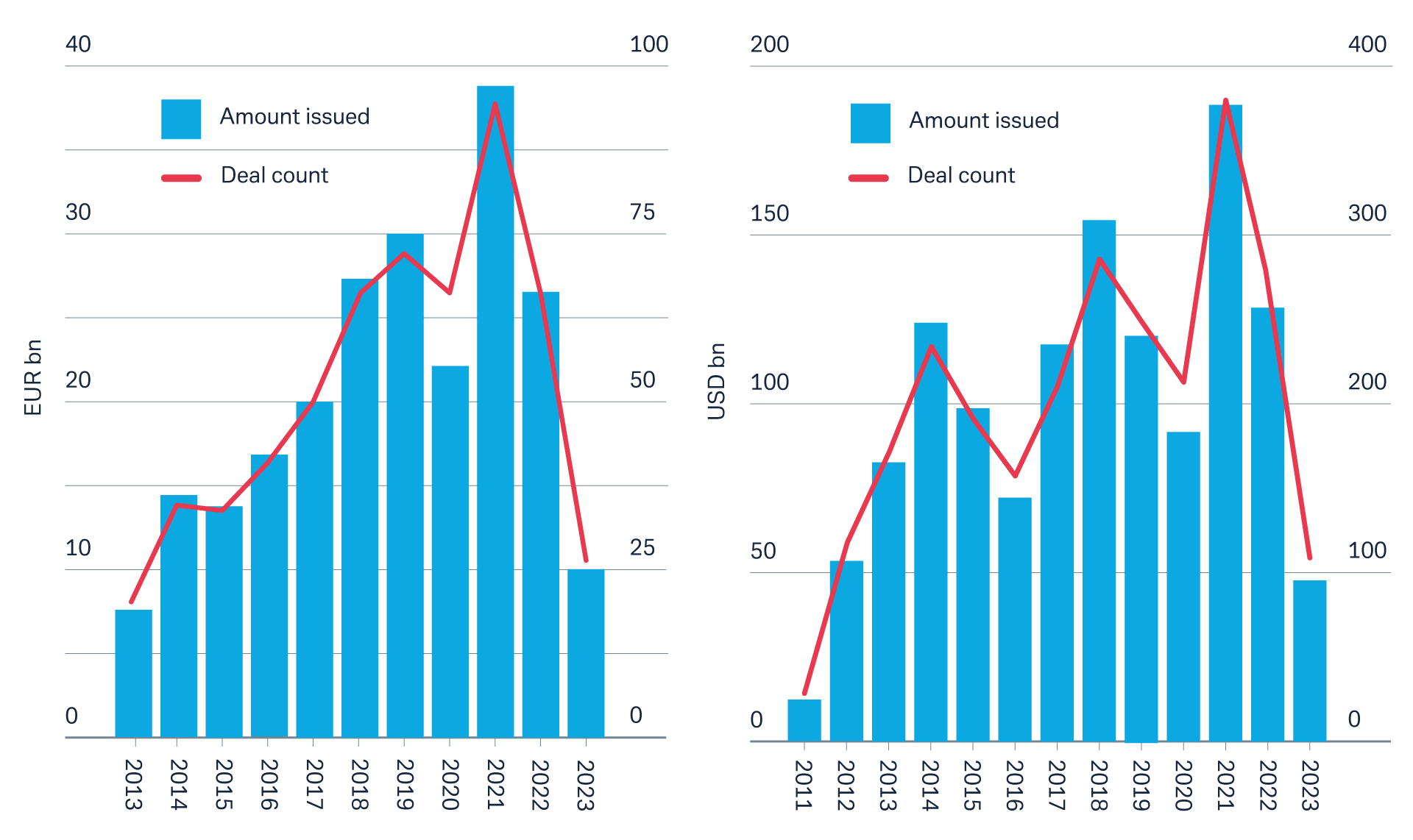

Figure 2: Annual EUR CLO issuance and Figure 3: Annual US$ CLO issuance

Source: Deutsche Bank Research

Views on issuance were mixed. Volatility, a market buzzword in the past year, has itself been another driver of lower issuance. Some thought Q1 of 2023 started well, at least until the regional banking crisis came to the fore in mid-March. Others suggested that it was neither the strongest start to the year, nor the worst, demonstrating how robust the CLO market has been in Europe and the US – there being no threat that it might close.

There were differing opinions on how long volatility would persist. Some considering it to be the new normal and unlikely to disappear in the next six months, while others expecting there to be greater stability in the CLO market by autumn. In such an environment, warehousing is being very tightly managed, and it is going to take a bit more time to build.

Investors, pricing, and relative value

Investors

The market needs more investors on the CLO liability side, but the challenge is attracting new entrants; particularly for AAAs, which account for 60% of the capital stack (the pricing of AAAs being “what really drives the market”). The recent paucity of investors in AAAs was partly attributed to deposit outflows having had a big impact on their buyer base. It is estimated that of the investor base remaining – “20% of AAAs are held by Japanese investors”, and that this group is hungry for more. The consensus was that the market needs to increase the number of investors at this AAA level, as well as growing the CLO investor universe.

Finding value in Europe and the US

Overall, CLOs are still a popular product. They are considered cheap, offer good credit, and stand out in the structured product universe on a relative value basis. While arbitrage is now particularly challenging: pricing and relative value can certainly change quickly, as has been seen over recent years - timing is everything.

With CLOs, each aspect of the capital stack is sold, so every investor at each level gets what they are seeking. Some consider the top of the capital stack ‘cheap’ and that the sweet spot is BBBs, whose 9–10% yield is tremendous for that risk. Some felt AAs and As were the most mispriced, others saw the greatest value in BBs, providing good income for the risk. Last year BBBs had been preferable for the same reason. Moving further down the capital stack, one CLO manager pointed out that not all CCCs are created equal and that it depends on where the CCC concerned is on its journey.

Collateral and default risk

After 12–13 years of essentially zero interest rate policy, it is not just sectoral hotspots set to suffer, because many business models do not work with higher rates. Leveraged companies are most vulnerable, given their reduced cash flow post-rate hikes. One irony flagged was that what were previously the more defensive sectors are now among the most leveraged (such as healthcare), precisely because defensiveness had also enabled their PE acquirers to pile on debt. Accordingly, many CLO managers now favour collateral in retail and commodities, sectors inherently more cyclical but with a track record of coping with a more volatile environment.

Default rates

From historic lows, there has inevitably been an uptick in expected defaults. With rising interest rates, the refinancing risk is a given. While things are bumpy, it may get bumpier still, with any uptick due to distressed debt exchange. Indeed, these days, defaults may be seen as technical, and there are many distressed debt funds with aggressive new money offers which will pay off the CLOs. Similarly, many obligors today happen to have PE houses behind them, which also (in addition to direct lenders) have spare capacity, suggesting solutions in the event of any distress. No-one expects a AAA to default, and if it does, we’ve got bigger problems than just the CLOs. But while defaults will rise, managers have time to move out of the risky names. Furthermore, time is very valuable, as the gap between now and the impending maturity walls enables CLO managers to realise disposals, and for lenders to respond and reduce their exposure.

CLO structures: innovations and trends

“CLO investors are taking a closer look at the documentation underpinning CLO structures”

Adaptable documentation

The view that it is ‘going to be a longer lasting storm’ means CLO investors are taking a closer look at the documentation underpinning CLO structures, noted Brendan Condon, Vice President in the CLO Origination and Structuring team at Deutsche Bank. US CLO documents were described as a bit more liberal by one panelist, whereas another considered them to be very loose.

Deciding how much flexibility is a ‘good thing’ was seen as a function of both the manager and the situation, with one speaker underscoring that the aim of a CLO is to get par back. But document looseness and CLO structure flexibility are far from recent developments.

It became clear after the global financial crisis (GFC) that CLO managers needed to be able to put new money in. Flex was introduced into deals of an older vintage: usually the introduction of new terminology occurs at the point of refinancing to bring in new funders. Building upon this, so-called anti-priming measures have been a widespread new feature of European CLO documents over the past year – the concept imported from the US.

Part of their oft-mentioned robustness comes from the constant innovation in the CLO product space. Recent examples of this include the modifiable and splitable or combinable tranches. aka ‘MASCOT’ and applicable margin reset (‘AMR’) CLOs. ‘MASCOT’ CLOs enable debt investors to gain whether spreads widen or tighten (and not at the expense of equity). ‘AMR’ CLOs are ‘applicable margin re-sets’ and use modified Dutch auctions to set new interest rates when refinancing each participating class of CLO securities. AMR CLOs can refinance quarterly, for example. With such innovations – and with 10-year offerings, CLOs are almost becoming permanent capital vehicles.

Bond buckets within CLO structures

Given the increasing interest rates, bonds have become more attractive. Many appreciated the bond buckets of European CLOs, noting that bonds were:

- Cheap for their risk;

- A helpful pull to par; and a

- Good way to express views on rates

Now is the moment to fill up the bond buckets, suggested one CLO manager, proud that his fund was chock-full of good quality BBs. Moving funds to bonds is not a risk-free trade warned another and can often mean trading one risk for another.

ESG

Some CLO managers feel they are receiving too many ESG questionnaires, so the London-based European Leveraged Finance Association (ELFA) has tried to ease the burden by simplifying the questions. Standardisation of ESG definitions and scores enables comparability and peer-to-peer analysis, and to that end the EU’s Sustainable Finance Disclosure Regulation has helped a little.2 Given that ESG is a ‘framework for holistic risk analysis’ at sector and borrower levels it was agreed that finding a solution is a priority. ESG factors can impact the value of the loans.

CLO manager performance

CLOs are of course dynamically managed products, where the management can either add value or destroy it. In the current CLO market, manager ability is coming to the fore. CLO managers making the right mistake is important. For example, there is a time to burn par, and a time to build par. One speaker mentioned that his firm was happy to do a bit of the former now in the hope of, to coin a phrase, ‘building back better’ – by adding credits the firm liked.

It is too early to say precisely what impact current market conditions will have upon manager performance in the longer term. However, despite the volatility, CLO performance has held up and been commendably stable.

In the months ahead success will be determined not only by the assets but by the manager team and whether it offers distressed investing experience through multiple cycles. This track record is certainly being required for those CLO managers seeking to raise new capital today.

The IMN CLOs and Leveraged Loans 2023 Conference was held at London’s Hilton Bankside on 4 April 2023

The Credtiflux CLO Symposium 2023 was held at London’s The Landmark on 3 May 2023