4 June 2025

As the structured finance industry gathers in Barcelona this month for the Global ABS 2025 conference, flow provides an interim update on the securitisation climate in the light of global macroeconomic volatility and Europe’s quest for regulatory simplification

MINUTES min read

Now in its 29th year, the Global ABS annual gathering (‘The Structured Finance Deal-Making Conference’) is a seminal three-day event for leading issuers, investors, and regulatory bodies in the structured finance market to meet for panel debates and networking sessions.

This year’s conference takes place against heightened uncertainty around global trade, with implications for both fiscal and regulatory policy in Europe and North America. So, it is no surprise that this apex of the structured finance year is set to welcome over 4,800 delegates from more than 50 countries, to share best practice and form partnerships.

This article draws on Deutsche Bank Research insights covering asset-backed securities, mortgage-backed securities and collateralised loan obligations in the US and European markets.

CLOs regain momentum

Market dislocation and divergence

At the start of 2025, optimism surrounding the CLO asset class was high following an “outstanding 2024”, according to Conor O’Toole, Managing Director and Jamie Flannick, Research Analyst at Deutsche Bank Research. This sentiment was then undermined by the 2 April ‘Liberation Day’ declaration from Washington. But by the end of May, trade discussions between the US and China were more encouraging, which had a ripple effect on the market. According to their 19 May Outlook, “sectors that are most exposed rallied on the back of the initial signs of progress: Retail, Consumer Durable and Non-Durable Goods, Transportation/Cargo”.1 And in an earlier research report, the pair noted that several sectors most exposed to CLOs – such as Tech, Financials, Healthcare/Pharma, and Business Services – had performed better than average.2

“The almost V-shaped recovery of loan prices and CLO spreads over the first two weeks of May had rebalanced the market”

The rebound in loan prices has been a catalyst in the market’s normalisation post Liberation Day. When looking across CLO portfolio metrics in April 2025, the disconnect between market value and credit metrics was evident, according to O’Toole and Flannick – the April sell off had dragged on leveraged loan prices, denting market value over-collateralisations (MVOCs) and the equity net asset values (NAVs) of CLO portfolios.3 “Market dislocations, if they persist, often foretell credit dislocations that soon follow,” they explained. But the almost V-shaped recovery of loan prices and CLO spreads over the first two weeks of May had rebalanced the market, they noted, leading to an uptick in deal activity and a rebound in market value metrics across platforms.

However, some regional differences between the US and European markets have become apparent over the past five months. This is evident when viewing Q2 CLO Equity payouts – in the US, the median figure was relatively weak at 2.8%, below the historical quarterly average of 3.4%.4 By contrast, European CLO equity distributions were much higher, 4.9%.5

Deutsche Bank’s research suggests that on average the credit quality of US CLOs is sound, although fraying somewhat at the tail end of the distribution across manager portfolios. Less credit softening is visible in Europe, which partly explains the difference in equity payouts between the two markets. However, even amid the heightened degree of uncertainty to date in 2025, both markets continue to keep pace with 2024’s record-setting deal activity, reflective of how strong investor demand has remained.

CLO ETFs

CLO Exchange-Traded Funds (ETFs) have been one of the fastest growing asset classes in the wider credit universe over the past two years. See the flow ‘explainer’ for additional background.

How well US CLO ETFs might respond during a significant market sell-off, however, has been a long-standing question surrounding the asset class. The recent market sell-off provided an important test. The price and fund flows following the events of early April showed that the category responded well to the crises-like level of volatility. As O’Toole and Flannick commented, “In April, CLO ETFs experienced the worst month of outflows in the asset class’s relatively short history. Their ability to stay liquid and to regain footing in the second half of the month, however, should be seen as a test successfully passed.”6

CLOs - main metrics

Figure 1: Annual US CLO issuance

Source: Deutsche Bank Resesarch

In 2024, US CLO new issue volume exceeded US$200bn, led by US$163bn of broadly syndicated loan (BSL) CLOs, and US$39bn of middle market (MM)/private credit (PC) CLO new issuance. The Deutsche Bank Research CLO team forecasts 2025 full year volume to be little changed at around US$205bn, split between US$165bn for BSL and US$40bn for MM/PC. They anticipate the potential acceleration of leveraged buyout (LBO) and mergers and acquisitions (M&A) in the second half of the year, along with the continued swift pace of CLO deal paydowns (bond amortisations) as being two catalysts of deal activity.

At the start of 2025, CLO outstanding had grown to roughly US$1.1trn, a 6% YoY growth rate. Paydowns/ amortisations finished 2024 at roughly US$140bn, a multi-year high. Through Q1, redemptions were roughly US$25bn, with amortisations accounting for 70% and liquidation 30%.

Due to a benign macro setup at the start of the year, the bank’s US research team anticipates paydowns/amortisations to further gather steam and surpass US$160bn in 2025. This would translate into net issuance of US$45bn and 2025 ending with US$1.13trn of CLOs outstanding, levels that point to a market that is still in the process of expanding.

Upside risks to the forecast include:

- Increased demand by banks and insurance companies, particularly for AAAs and AAs, due to regulatory capital charges and the floating rate nature of CLO bonds in the face of rate uncertainty.

- Increased demand by CLO ETFs, which should see continued positive retail inflows throughout 2025.

- Continued marginal growth of direct lending, and the use of MM/PC CLOs as a funding mechanism.

However, the Deutsche Bank strategists identify a few factors that could adversely affect performance:

- Pivot in trade and tax policy that leads to weaker economic fundamentals in the back half of 2025.

- Higher long-term interest rates that weigh on growth assets and hinders sectors tied to leveraged loans.

- Rates volatility that leads to choppiness in primary and secondary pricing and deal activity across mezzanine and investment grade tranches.

Like the primary market, the secondary market has shown resilience over the past two months. As O’Toole and Flannick highlight, the market volatility has led to elevated secondary trading volumes, particularly for higher rated CLO bonds. The second week of April saw the highest level of CLO bonds traded in the secondary market since the onset of the Covid-19 pandemic in March 2020. The elevated level of activity reflects the volatility in the market, but also points to an increasingly deep and liquid market, even during periods of market stress.7

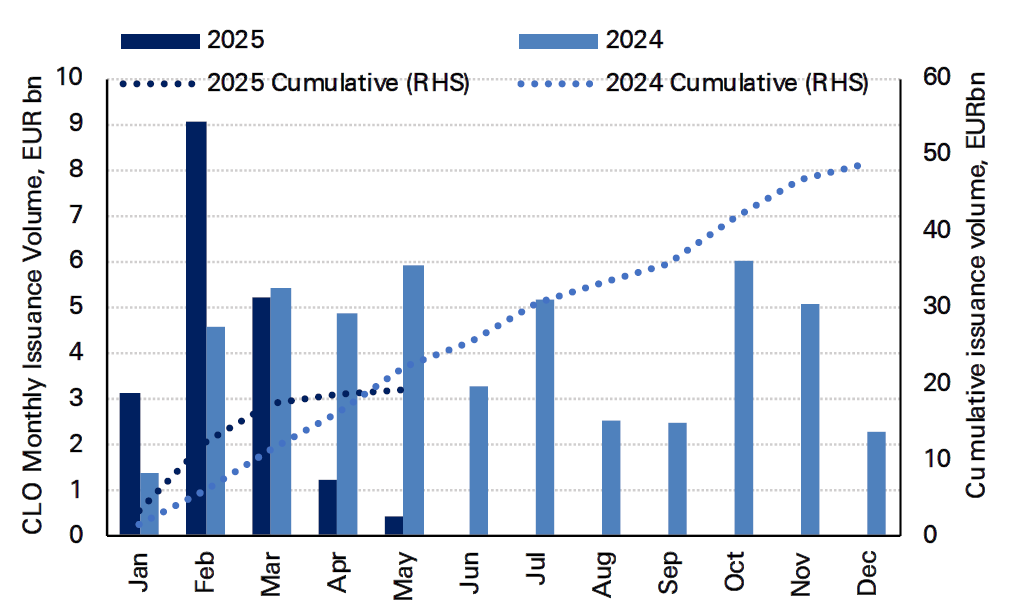

Figure 2: Annual European CLO issuance

Source: Deutsche Bank

The European CLO primary market reacted sharply to trade war uncertainty in April, witnessing a significant drop in issuance after a few early deals. Despite the market reopening at the end of April/early May, new issue and reset volumes slowed. However, like in the US market, deal activity has once again normalised and at roughly €20bn priced through mid-May, the DB team’s 2025 FY forecast of €50bn remains within reach.

Spreads in secondary have returned to early April/late March levels, retracing roughly 50bps. And as in the US, secondary trade activity remains higher at this point in 2025 than in 2024, reflecting market uncertainty but also European CLO secondary market liquidity.8

Wider European securitisation picture

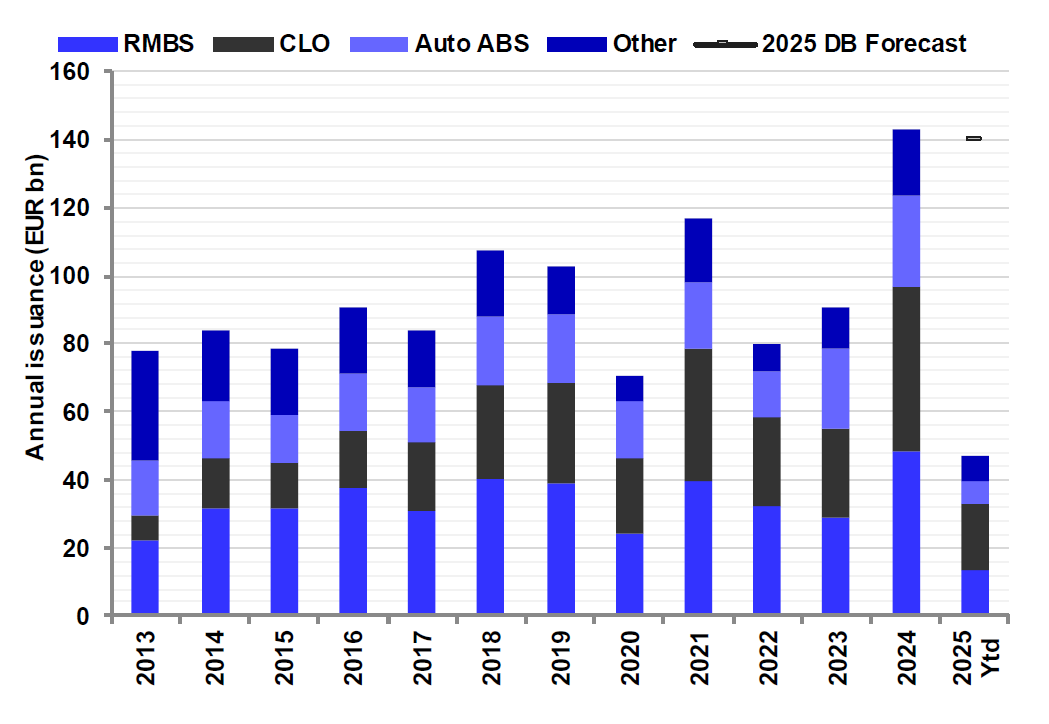

Figure 3: Annual European asset-backed issuance

Source: Deutsche Bank

Looking at the wider European issuance picture (see Figure 3) – comprising residential mortgage-backed securities (RMBS),9 CLOs, auto asset-backed securities (Auto ABS) among others – May 2025 totalled €15.5bn, a decrease from the €20.5bn (CLOs were €5.9bn) in May 2024. This brings year-to-date issuance to €61.2bn, relatively close to, yet just south of the €64.8bn seen in the same period of 2024. Although issuance was exceeding 2024 levels before the US tariff announcement, the subsequent macro-induced volatility slowed down activity, most notably in CLOs. The market experienced a turnaround during May, with new issuance volumes gaining traction towards the end of the month. This was particularly evident in the CLO market, which saw seven new issue CLOs price in the final week. While issuance volumes in the non-CLO market are still behind expectations, spread performance remains robust. The significant spread tightening observed in May has brought most sectors into line with their YTD tights, supported by a strong supply technical.10

One potential tailwind in the second half of the year may be a significant legislative milestone. On 17 June, the European Commission is expected to release its proposal revising the securitisation framework.11 Recognising its potential to fuel strategic priorities and diversify risk, they acknowledge that current regulations, while initially intended to enhance safety, have become overly complex, hindering growth. The Commission aims to simplify the framework, making it more proportionate and risk-sensitive while maintaining stability. Adjustments will target transparency, due diligence, and prudential regulations for banks and insurers. Deutsche Bank Research views the European Commission's efforts to revitalise the securitisation market positively, aligning with previously stated requirements for scaling the market. Charles Dennis, Asset-backed Research Analyst explains, “We believe targeted measures are crucial for significant volume increases. These include reduced capital charges for banks and insurers, and competitive liquidity buffer regulations for banks, mirroring those for covered bonds. While the Commission's focus is welcomed, substantial progress is unlikely before 2026, and we anticipate that CLOs will be excluded from these regulatory changes.”

By allowing banks to transfer the risk of some of their exposures to other institutions, or long-term investors such as insurance companies and asset managers, securitisation not only provides new investment opportunities, but it also makes it possible for banks to free up the capital they have set aside for covering this risk and generate new lending. It is this liquidity the Commission is keen to see at work in the European economy.

From new securitisation policies, to what the second half of the year might hold for markets, suffice to say that there will certainly be much for market participants to discuss in Barcelona.

Global ABS 2025 runs 10–12 June at CCIB, Barcelona, Spain

Deutsche Bank speakers at Global ABS 2025

Deutsche Bank has speakers in each of the four main tracks of the conference:

- Macro and regulatory (Track A) – Christopher English from Deutsche Bank’s Trust and Securities Services team is a panelist on the ‘Trustee perspectives on current market issues’ session.

- Wholesale asset finance (Track B) – Brendan Condon, Head of European CLO Structuring at Deutsche Bank, talks about ‘The ‘Arb' of War: CLO Market Structures & Performance Outlook’ covering primary and secondary issuance, spreads, and pricing across Broadly-Syndicated Loans (BSL) and Mid-Market (MM) segments.

- Financing mechanisms (Track C) – Ryan Morgan, Director within the European Lender Finance team at Deutsche Bank, discusses ‘NAVigating Private Credit: Fund Finance & NAV Lending’.

- Balance sheet asset management (Track D) – Zak Chaudary, Head of SRT Syndicate at Deutsche Bank, leads a session entitled, ‘The Big Issue: SRT Issuer Perspectives’. Chaudary’s team is responsible for the structuring and arranging of Deutsche Bank- and third party-issued significant risk transfers (SRTs).

Deutsche Bank reports referenced

US CLOs: Reset Activity – reasons to be constructive for H2, 19 May 2025

US CLOs: Sector Positioning, 29 April 2025

US CLO Manager Barometer: Coming into balance, 14 May 2025

US CLOs: 2025 CLO equity – a sub 3% print, 8 May 2025

European CLO Manager Barometer Market value metrics rebound, 14 May 2025

US CLOs: Passing the test, 5 May 2025

European CLO Monthly: CLOs in a shifting trade climate, 7 May 2025

European CLO Monthly: Mid-year review & outlook, 3 June 2025

European RMBS Monthly: Dutch Buy-To-Let RMBS Primer, 9 May 2025

European RMBS Monthly: Mid-year review & outlook, 3 June 2025

Note links to Deutsche Bank Research reports in footnotes are only accessible to Deutsche Bank Research clients

Sources

1 See research.db.com

2 See research.db.com

3 See research.db.com

4 See research.db.com

5 See research.db.com

6 See research.db.com

7 See research.db.com

8 See research.db.com

9 See research.db.com

10 See research.db.com

11 See research.db.com