11 June 2025

As uncertainty continues to surround Washington’s trade tariff policy, what does this mean for US manufacturing and appetite for inbound US investment? Ivan Castano Freeman digs deeper into what “wait and see” could mean for America’s economy

MINUTES min read

The Trump Administration has put the world on alert with its sweeping new tariffs regime aimed at positioning ‘America first’ and trimming large trade deficits with multiple countries.

Sending shock waves through corporate America, the move has many firms worried that the levies will force them to hike prices, hurting consumer spending and denting economic growth.

Amid heightened uncertainty, US firms are exploring new ways to navigate a very different trade landscape, including shifting manufacturing out of high-tariffed nations (such as China) and streamlining working capital and FX to cushion against the possibility of a prolonged trade crisis. Despite some dialling back from the original 2 April ‘Liberation Day’ announcements, average tariffs are still, as Matt Luzzetti, Chief US Economist at Deutsche Bank Research, puts it, “at the highest levels we have seen for a century,” having noted on 14 April that the ensuing record levels of policy uncertainty and the sharp tightening of financial conditions had already set the US economy “on a weaker growth trajectory”.1

Financial markets and businesses do not like uncertainty and are taking steps to reduce this. “We are establishing the infrastructure and underlying treasury solutions to prepare our clients for all possible scenarios,” says John Cowart, Head of Corporate Banking Coverage, North America, at Deutsche Bank. The lender is helping clients assess new manufacturing locations (with India and ASEAN prime destinations) while providing them with tools to boost working capital, streamline supply chain management and pare their currency risks.

De-risking drive

“A great number of clients are looking to invest in India as they seek to make sure that manufacturing facilities are in optimal locations,” Cowart says. “In trade finance, clients want to leverage structured working capital solutions and manage payment terms appropriately to get cash back into the US.

“There is a great deal of effort to manage the dollar’s downward trend by layering in cash flow hedges that reduce exposure to certain currencies often in high-risk markets,” he continues. “Companies are also expediting dividends and automating inter-company cross-payment flows and sending back to head office” to accelerate that effort, he adds.

The repatriated dollars are, in many instances, then being channelled towards evolving supply chains and invested to set up manufacturing facilities in territories with lower-tariff tensions such as India and at home in the US, Cowart continues. As companies build their factories in the US, capital investment in the automation of routine processes to reduce labour costs at home now makes more economic sense – the low-cost labour geographies become less attractive once tariffs are factored in.

Big investments

President Trump wants to bring back manufacturing to the American heartland and “even the playing field” for American workers. The White House ‘non-comprehensive running list of new US-based investments in President Trump’s second term’ highlights 70 commitments (as at 30 May) from US and global multinationals, with the bulk of the funds coming from technology, manufacturing and pharmaceutical giants, most notably Apple, but also from SoftBank/OpenAI/Oracle (to launch the ‘Stargate’ AI project), Nvidia and IBM. Taiwan Semiconductor Manufacturing, Hyundai, Johnson & Johnson, Roche, Eli Lilly and Stellantis had also pledged investments.2

German firms are participating too. On 6 March, Siemens announced it was “ramping up investments in the US to support and benefit from America’s industrial tech growth” and building two “state-of-the-art manufacturing facilities for electrical products in Fort Worth, Texas, and Pomona, California”. This US$285m investment is, stated the company, expected to generate “more than 900 highly skilled manufacturing jobs”.3

Currently, manufacturing contributes US$2.65trn to the US economy, accounting for 10.3% of GDP and employing nearly 13 million workers, according to the US Department of Commerce.4 The “golden age” for America promised in President Trump’s inaugural speech relies on a resurgence in American manufacturing.5

Wait and see

However, on 28 May, the US Court of International Trade struck down tariffs implemented by the Trump administration under the International Emergency Economic Powers Act of 1977.6 According to Deutsche Bank’s Luzzetti, while this plays out, trade policy uncertainty is “likely to remain elevated for an extended period”. He adds that “prospects have diminished for quick trade deals, and US trade partners will likely want to wait for legal clarity around the proposed tariffs before continuing / finalising discussions”.7

“Most companies are taking a measured approach and not reacting quickly”

He points out that the administration can leverage other legal measures as needed to implement tariffs. “Trump believes in the use of tariffs and has committed substantial capital to this effort,” he says. “The success of the fiscal package in front of Congress also depends in part on the revenue gains from tariffs to defray some of the fiscal cost. Abandoning tariffs altogether is therefore not an option.”

As the tariffs ordeal is sorted out, most companies are staying on the sidelines, taking a ‘wait and see’ approach until the future rules of the game become clearer. “Most companies are taking a measured approach and not reacting quickly,” according to Cowart. “They are engaged in an assessment of what is happening, rather than making quick or sudden moves.”

The drive to diversify production and reduce concentration is also nothing new. The Covid-19 pandemic brought significant supply chain disruptions and key component shortages when China’s staffing shortages highlighted the need for American importers to shift away from distant suppliers. “It’s something companies were already moving towards,” Cowart adds. “This has been a five-year journey since Covid, and tariff talks are just accelerating an existing reshoring trend in a number of cases; it’s not a sudden move.”

The pivot has seen companies gradually outsource production to new ASEAN destinations such as the Philippines, Malaysia and Indonesia. Eastern Europe, notably Poland, is also gaining momentum.

Despite the trade noise, Cowart remains positive about the US’s long-term prospects. “The markets are pricing in continued volatility, but at this point most clients are optimistic about next year and that tariffs will be negotiated by that point.”

European investors

The US remains by far the world’s largest economy, growing 2.8% to US$29trn last year, with China in second place with nearly US$19trn in GDP. This means American exceptionalism remains strong and likely to remain in place for some time.

Despite America’s vast economy, European investors have expressed caution. Deutsche Bank Research’s Matthew Luzzetti and US Head of Rates Research Matthew Raskin met with more than 50 clients across Finland, Sweden, Italy, France and the UK during the last week of April.

In their report, Notes from the road (5 May), they reflect how European clients are “generally pessimistic on the outlook for the US economy and policy-making, seeing recent pronouncements and actions as a regime change in the US’s role on the global stage”. They add, “In particular, the US is now viewed as a less reliable and more unpredictable partner that has leveraged trade and economic policies”.

Investors “unanimously believe they have become over-allocated to USD assets and signalled their intention to reduce exposure over time,” say Luzzetti and Raskin.

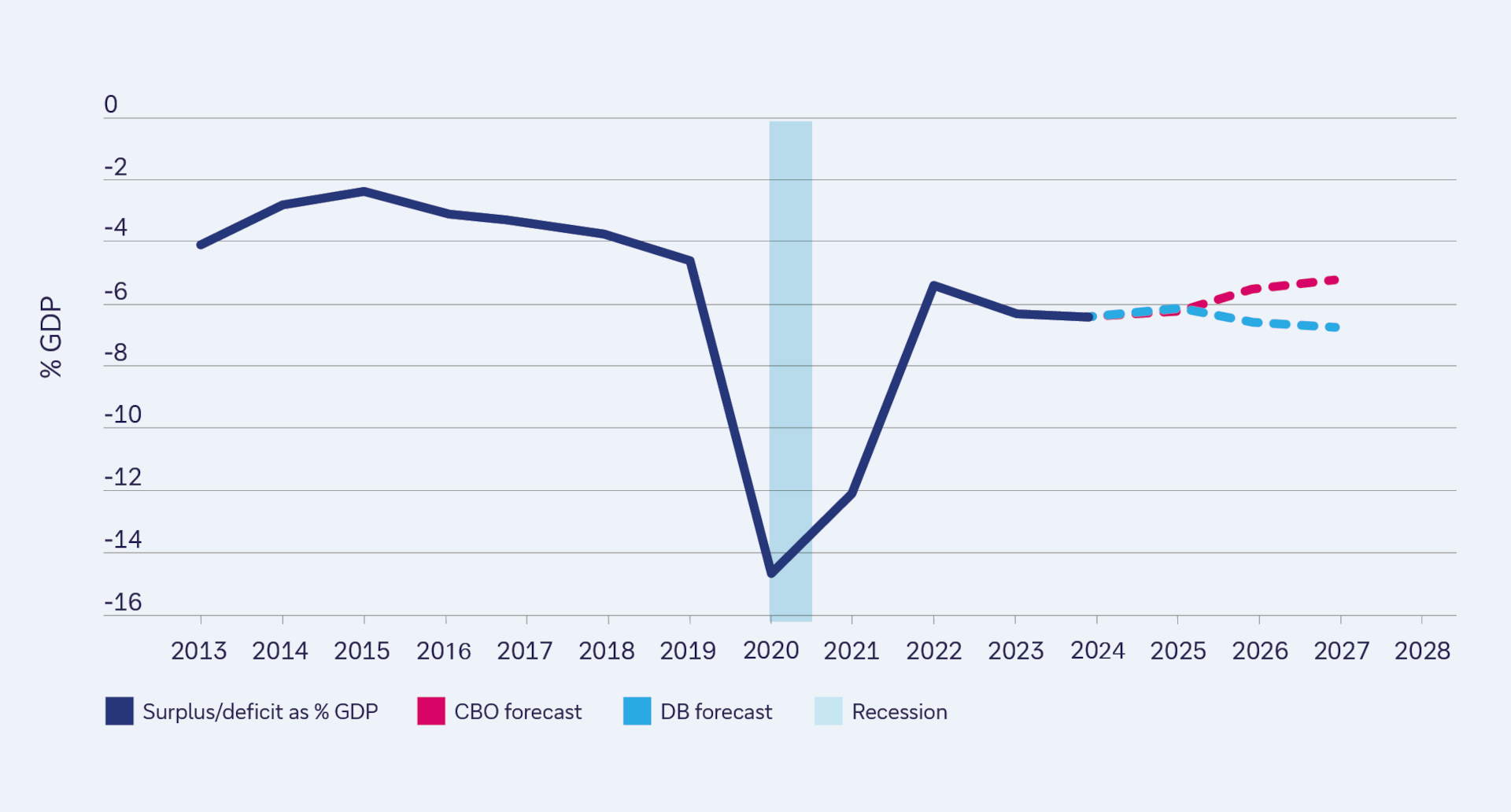

Figure 1: Federal budget deficit projected to remain historically elevated in the coming years

Source: Congressional Budget Office (CBO), Haver Analytics, Deutsche Bank

Fiscal fears were also flagged as the US’s ballooning, US$36trn-plus debt remains a growing concern (see Figure 1). Deutsche Bank expects the nation’s budget deficit-to-GDP ratio to hover near 6.5% over the next few years.

“If the US fiscal package this summer confirms our baseline expectations of no deficit reduction, this could be a catalyst for renewed sell-off at the long end (along with potentially disorderly moves),” Luzzetti and Raskin write in their report of the meetings, adding that the Federal Reserve is unlikely to bail the bond market unless it sees “true signs of market breakdown”.

Targeting new markets

Meanwhile, American retailers are signalling big concerns over the duties.8 Apparel giant Gap said on 29 May that if the 30% levies on China and 10% tariffs on most other countries remain at current levels, it could cost them up to US$300m this financial year. The company did say, however, that it will not yet raise prices to offset duties, contrary to several other big-box retailers.

On the other side of the world, Chilean copper suppliers are looking at alternative markets in case there is a 10% levy on the South American nation’s exports. While Chile’s copper currently enters the US duty free, the country has been included in Washington’s 10% baseline tariffs, so it could start paying levies later this summer. “If there’s any tariff above 0%, there’s going to be an incentive to look at new markets,” Jorge Cantallopts, Executive Director of Chilean industry think tank CESCO, told flow. “And the higher the tariff, the higher the incentive will be, of course.”

Chilean producers are already approaching new potential European customers, including Italy, Germany and Spain,9 to sell higher-priced refined copper as well, as the EU’s planned defence build-up will boost demand for the metal, according to Cantallopts.

Chile’s state-owned supplier Codelco sends 15% of its copper to the US, 55% to China and the rest to Japan, Europe and South Korea. Like other entities, however, it is also exploring India as a new potential market. “India is industrialising quickly and has installed new [copper] smelters, so it could be a buyer for our concentrates,” Cantallopts says.

Cause for optimism

Despite what Cowart sees as “probably the most volatile of moments” and the fact that it is unlikely anyone can predict whether comparative normality will resume in, say, 12 months’ time, he stresses that clients are ensuring they are in a position to cater for all scenarios. Which is really all anyone can do.

Ivan Castano Freeman is a freelance financial journalist

Sources

1 See US Outlook: Tariff-struck, Deutsche Bank Research, 14 April

2 See whitehouse.gov

3 See press.siemens.com

4 See commerce.gov

5 See bbc.com

6 See natlawreview.com

7 See US Economic Perspectives: Liberation from Liberation Day tariffs? Deutsche Bank Research, 29 May

8 See fortune.com

9 See "How KME's copper is fuelling the digital age" at flow.db.com