2 July 2025

Improving resilience, preparing for T+1 settlements in the UK and Europe, the role of digitalisation and sourcing future industry talent were key themes discussed at The Network Forum’s Annual Meeting 2025 in Madrid, reports Janet du Chenne

MINUTES min read

The city of Madrid, with its historical significance and role as a financial hub, is the perfect location to discuss the intersection of traditional foundations and modern advancements in securities services. The legacy systems that have long supported the financial markets are now being re-evaluated in light of emerging challenges and the increasing complexity of global markets.

Having just modernised its settlement system and enacted a new securities law,1 it seemed fitting that The Network Forum’s (TNF’s) two-day annual meeting this year convened in the Spanish capital for the first time.

Key takeaways

- Market infrastructure resilience more critical than ever given geopolitical volatility and sanctions impact

- Post-trade efficiency needs to improve to drive more funds into Europe – which needs more equity capital

- T+1 preparation should include foundations for T+0

- Legal certainty around digital assets has been slow to materialise, but due diligence questionnaires now including them

- Asset servicing impacted by low straight through processing levels and lack of standardisation

Evolving risks in securities services

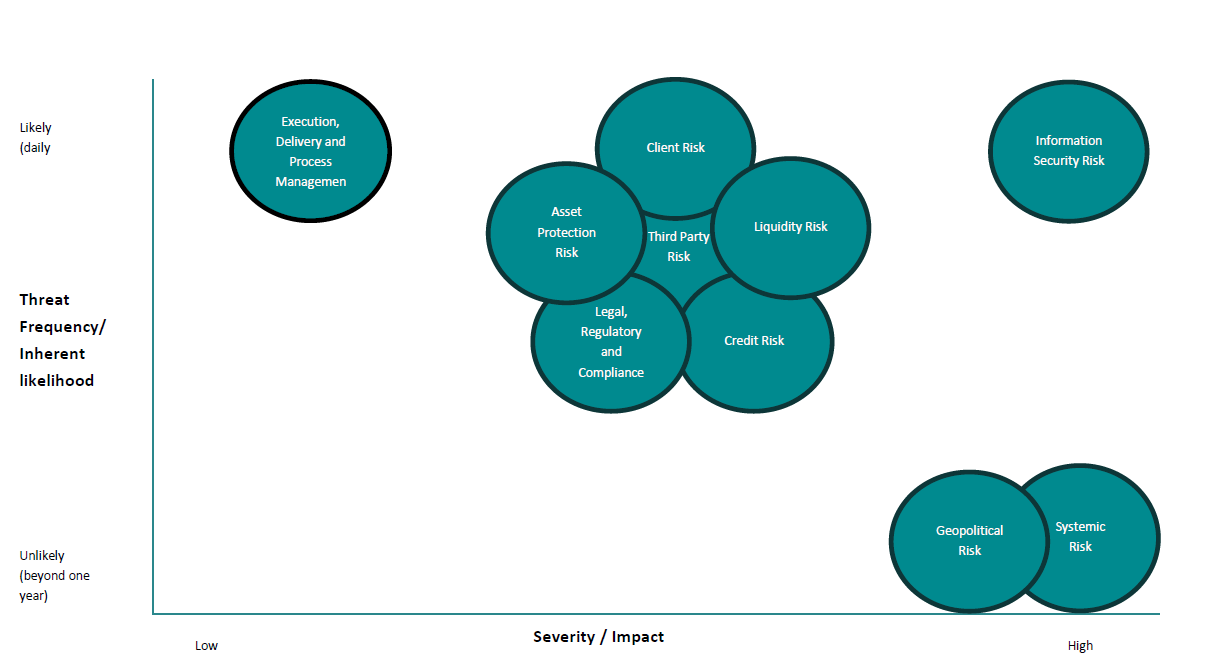

Day 1 discussions began with a panel titled ‘Practical implications of country risk past and present’, given renewed conflict in the Middle East and the International Securities Services Association’s (ISSA’s) Securities Services Risks 2025 report2 charting the threat and impact of evolving risks (see Figure 1).

Figure 1: Key risk categories for securities services in 2025

Source: ISSA Securities Services Risks 2025 report

With tensions in the Middle East increasing, panellists discussed lessons learned from the Russia-Ukraine war. Before the conflict, agent banks’ biggest concerns regarding country risk were liquidity and capital risk. Nothing could have prepared the industry for a scenario in which billions of dollars of cash and securities would be stuck in Russia, due to asset freezes imposed by various countries in response to the war.

Trapped assets have various risk management repercussions, ranging from the potential for legal claims from end investors to increased risk weighted asset implications, to the possibility of asset confiscation. In addition, noted panellists, sanctions have prevented banks from upgrading legacy technology in Russia to protect from cyber-attacks. At the same time, a selective easing of the regime could have multiple operational implications, particularly for IT systems. If sanctions are lifted, trading of Russian securities would not resume overnight and the process would be a laborious and manual-intensive process, requiring a huge and lengthy unwinding of transaction history given Russia’s sizable capital markets.

Operational resilience in the spotlight

A volatile risk environment means that resilience means different things to different market participants. For network managers, it has brought a shift in strategic priorities, beyond financial market infrastructure (FMI) resilience, and what custodians would do in a central securities depository failure. Regulators now want assurances from network teams that they fully understand how an FMI would treat a custodian if that custodian were in recovery and resolution.

Speaking to flow at TNF, Sharon Hunt, Global Head of Network Management at Deutsche Bank, said: “Network managers have always managed third party risk, but now we are becoming increasingly involved in the recovery and resolution planning process, in terms of identifying how we – the client/custodian – would be treated by those third parties in a crisis event and the defensive measures both sides of the agreement would oppose and when.”

Boosting Europe’s capital markets

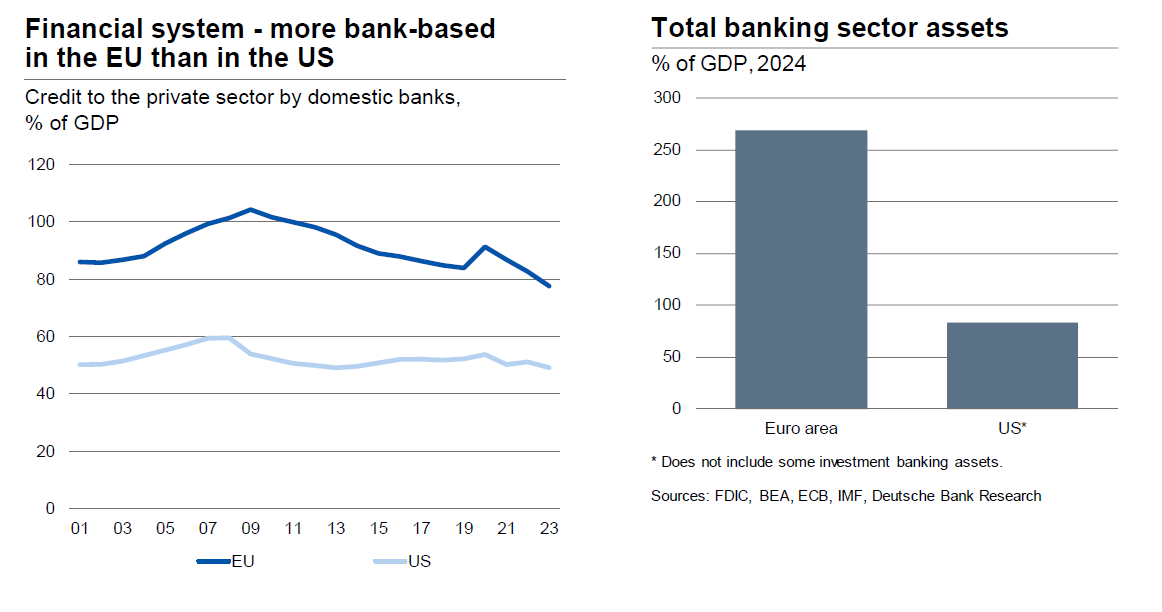

Progress on a single market for capital and banking across EU member states, (the Savings and Investments Union (SIU)), was another discussion topic. Deutsche Bank Research on SIU3 notes Europe’s underdeveloped capital markets, the private sector’s overreliance on bank lending compared to the US (see Figure 2), and the structural barriers to unlocking private capital for Europe’s €750bn a year investment requirement (cited in the Draghi report).4

Figure 2: Europe’s private sector relies on bank debt

Sources: World Bank, Deutsche Bank Research

With debt-GDP levels on the continent at the end of 2024 hitting 87.4%,5 debt financing cannot be relied upon as the sole source. Equity capital is needed. “The SIU needs to find a way to channel more EU savings into European investments,” said Pierre Davoust, Head of Euronext Securities. “To maximise the chances of success, there needs to be further market integration.”

However, fragmentation and divergence of infrastructure are key barriers to integration.

Calls for regulatory agility in furthering post-trade harmonisation have followed the publication last September by Euroclear of a paper6 urging CSDs, Member States and EU authorities to build a resilient, competitive and unified post-trade environment, with aligned market practices that support European competitiveness globally.

Driving flows into Europe requires a concerted push to get people to invest in funds such as undertakings for collective investment in transferable securities and European long-term investment funds. Further consolidation in the funds industry and scalability could lead to the creation of European national asset management champions.

With post-trade inefficiencies impacting cross-border investing, most accept that post-trade consolidation needs to occur if efficiencies are to be realised.

Euronext’s plan for a common platform across the four Euronext Securities CSDs (Copenhagen, Milan, Oslo and Porto) for post-trade services for equities7 is one example of this. However, panellists did raise concerns that Euronext is focused just on equities, and the proposed platform risks creating asset class fragmentation.

Get ready for T+1 in Europe and the UK

With the UK and Europe coordinating a move to shorter settlement cycles in October 2027, Andrew Douglas, Chair of the UK Accelerated Settlement Taskforce (AST), kicked off the T+1 sessions by urging firms to accelerate their preparations.

“This is an ideal opportunity to future-proof yourself for T+0”

Firms should work on their T+1 plan and implementation process before the end of the year budgeting cycle, build and develop their systems in 2026, and test in 2027, until the October transition. “This is an ideal opportunity to future-proof yourself for T+0," suggested Douglas. "Why do one migration for T+1, if you are going to have to do another one for T+0 five years later?”

flow’s Europe braces for T+1 highlights the benefits and challenges of a coordinated move, with the EU T+1 Industry Committee having published new industry recommendations in its High-level Roadmap to T+1 Securities Settlement in the EU report on 30 June 2025. “Enhancing automation and eliminating manual interventions across all stages of the post-trade lifecycle are key themes of the report,” said Giovanni Sabatini, Industry Committee Chair.

A panel session titled ‘Delivering the right environment for a successful transition’ warned against complacency. 44% of respondents to a ValueExchange survey said T+1 implementation was more difficult than they expected.8 Given that the US has fewer FMIs, the statistic provides a stark warning for Europe.

Panellists discuss ‘Delivering the right environment for a successful T+1 transition (Source: The Network Forum)

Unfortunately, complacency is creeping in across Europe due to the perception that in May 2024 T+1 went live successfully in North America “While this is true, we certainly do not want people to think the process was easy,” said Virginie O’Shea, Founder of Firebrand Research, which published a June 2025 white paper on the challenges of settlement compression in collaboration with Clearstream, the DTCC and Euroclear. This revealed that €70.43m a month was paid on average in financial penalties in 2024 for settlement failures on the ECB’s TARGET2-Securities settlement platform.

Leveraging lessons learned from US T+1, Nadine Readie, Global Product Lead Custody & Clearing and Regional Head of Product Management Europe, UK & Ireland, Deutsche Bank echoed that preparation is key: “Engagement is necessary, analysing internal processes front to back, and talking to clients who are not on the automation journey as it’s not a ‘throw on bodies’ solution.”

Swift’s Unique Transaction Identifier (UTI) was highlighted as a tool to help counterparties better manage shorter settlement cycles ahead of T+1,9 through fewer exceptions and investigations, better automation, and less fails, as well as identifying root causes of fails. “The UTI is a standardised reference, and it gives users better visibility and transparency into the transaction flow, which is particularly important given the compressed settlement timeframes under T+1,” said Roberta Dibenedetto, Senior Manager, Go-to-Market Securities at SWIFT.

Digitalisation in focus

The roles of digital and data in transforming post-trade was a key topic on Day 2. Fintech executive and former banker Dr. Leda Glyptis shared transformation insights from her latest book, titled Beyond Resilience – Patterns of Success in Fintech and Digital Transformation. In solving problems big enough to matter, the culture of an organisation and the contextual enablement of what it is trying to achieve should guide the journey, she suggests.

Digital assets were in focus with a panel surveying their adoption and implementation into the post-trade plumbing. An audience poll provided a reality check on appetite versus readiness: 53% of those polled have a live digital asset custody product, while half have participated in a review of a digital asset/crypto custody service provider in the past 18 months.

Another panel questioned whether tokenisation is delivering as expected. An audience poll revealed 30% have tokenised assets live in production, while another 36% said private market access is where tokenisation delivers the most tangible benefits. Legal certainty around approvals and returns not meeting expectations are blocking further adoption.

Network management’s digital evolution

As digital assets become more embedded in institutional portfolios, network managers are incorporating questions about digital assets into due diligence, particularly when agents have crypto-custody offerings.

The Association for Financial Markets in Europe is updating its due diligence questionnaire (DDQ)10 with a set of digital asset questions, but these had not been published at the time of writing.

Artificial intelligence’s (AI’s) game-changing role was also highlighted at TNF. In DDQs, Deutsche Bank has a set of criteria, which it expects its agents to meet in areas such as business continuity planning. It will use AI to go through the agent banks’ DDQ response and confirm whether the criteria are being met.

Many network teams in banks are assessing AI uses and whether this can be applied. “In the next 12 to 24 months, it is likely there will be a scenario in the DDQ process where the AI being deployed by receivers and responders meets [i.e. the questions and answers are both AI generated]. I imagine it is this type of scenario that will draw attention from the regulators and as a result guidelines may be issued,” said Deutsche Bank’s Sharon Hunt.

Attracting and retaining future talent

A panel session titled ‘Get your staff in place: People in custody, next gen recruitment and mentoring – how the young modernise the old’ brought together experienced industry executives and rising talent. Younger industry professionals want to contribute to existing foundations (rather than simply modernise them). Giving them space and having open conversations about exploring the areas they want to be in and finding their niche are key.

“The ability to move internally creates a great dynamic flow of talent throughout an organisation”

Reflecting on her career path from investment bank middle office to securities services, Fiona Neville, Head of Trust and Securities Services Europe at Deutsche Bank said, “Prior to moving into [this field] I didn’t know much about securities services, but I quickly realised the scope, complexity and impact of working in this part of the ecosystem. The skills I brought from my previous roles certainly helped me excel in my new role. Bringing skills from different parts of the business creates a great dynamic flow of talent throughout an organisation.”

An audience poll revealed culture (36%) is the most important criteria for the younger generation when choosing where to work, so creating an organisation of purpose and allowing individuals to show up authentically is key.

Asset servicing and collateral management

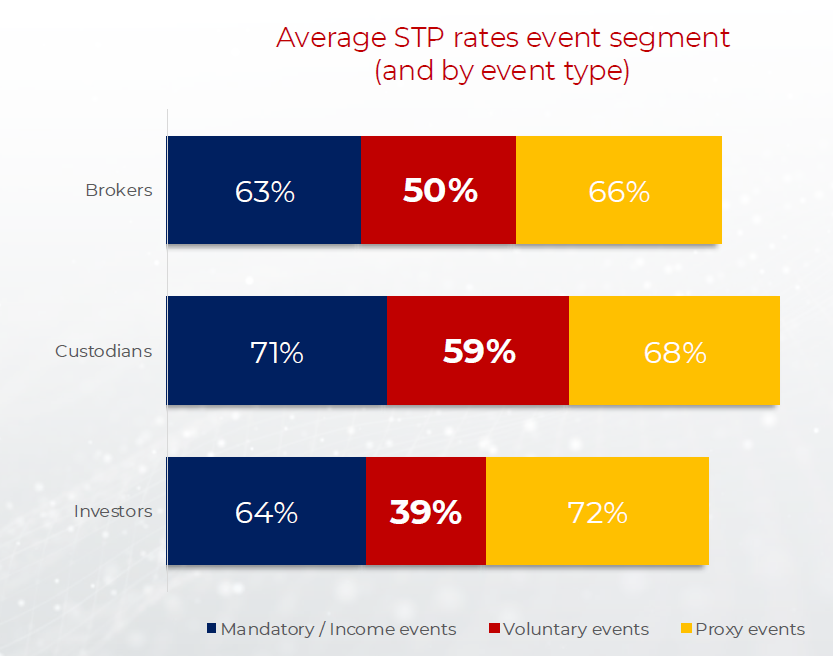

The asset servicing focus streams looked at the findings of a ValueExchange research report on industry efficiencies through asset services automation.11 It indicated that the industry still faces alarmingly low straight-through processing (STP) rates and massive manual inefficiencies (see Figure 4). The research reveals that while everyone talks about AI and automation, the industry first needs to solve fundamental data quality and system integration issues that come from legacy systems.

Figure 3: Average STP rates event segment (and by event type)

Source: The ValueExchange

Looking at the root causes of inefficiency, Martin Lawrence, Chief Customer Officer of The ValueExchange, pointed to alarmingly low STP rates for both voluntary and mandatory corporate events, forcing extensive manual processing. “There’s also a lack of clarity on event details and data inconsistencies, causing errors to the tune of around US$5.3m worth of costs,” he said.

Industry experts suggest regulation may be necessary to drive standardisation. In Europe, 79% of automation projects are driven by regulatory requirements, particularly around proxy voting, according to the research.

Another panel also discussed the increasingly important role that the US$29trn collateral market plays in asset services.12 Panellists emphasised that collateral management has evolved from basic risk mitigation to a revenue-generating, relationship-building function requiring sophisticated technology and real-time visibility.

Recent innovations and market-making tools support banks’ balance sheets, and this includes data-driven optimisation where banks now use algorithms to match supply with demand across central counterparty clearing houses.

The Network Forum’s Annual Meeting 2025 was held at Hotel Meliá Castilla, Madrid from 16-18 June

Janet Du Chenne is a freelance financial journalist and a former Co-Editor of flow and of Global Custodian

Sources

1 See bolsasymercados.es

2 See issanet.org

3 See dbresearch.com

4 See commission.europa.eu

5 See ec.europa.eu

6 See euroclear.com

7 See euronext.com

8 See citibank.com

9 See swift.com

10 See afme.eu

11 See thevx.io

12 See bny.com