21 May 2025

The course is set with Europe proposing regulation to effect a move to a T+1 settlement cycle, along with the UK and Switzerland, on 11 October 2027. flow tracks the consultation journey so far, benefits and challenges of a coordinated move, and how market participants can reap long-term gains

MINUTES min read

One year after the US, Canada, Mexico, and Argentina shortened their settlement cycles to T+1, the EU, the UK, and Switzerland are focused on doing the same. They’ll coordinate a move on 11 October 2027 to minimise market fragmentation and operational complexity and improve competitiveness by removing misalignment with other major markets.

flow’s T-day for the EU? traces the start of Europe’s consultation journey. It notes the roadmap1 published by the European T+1 Task Force (led by the Association for Financial Markets in Europe (AFME) and representing 21 industry associations across all market participants) in October 2024, which points to a crucial period in 2027 for systems testing, and the European Securities and Markets Authority’s (ESMA) report on a potential EU move to T+1, published in November 2024, also indicating an October 2027 migration date to T+1 for greater settlement efficiency and better global market integration.

“The AST, the EU T+1 Industry Committee and our technical workstream will help to find a common solution to prevent inconsistencies and ensure smooth functioning of markets across regions”

Following these events, in early 2025, the European Commission (EC) proposed amending the Central Securities Depositories Regulation (CSDR)2, setting T+1 as the settlement date for transactions in transferable securities which are executed on trading venues. In June, the co-legislators (European Parliament and Council) reached a preliminary political agreement on the quick fix to adjust the CSDR with a view to making the required adjustments for T+1, including an exemption for securities financing transactions from T+1 and a possible suspension of cash penalties via the existing Level 2 measures.

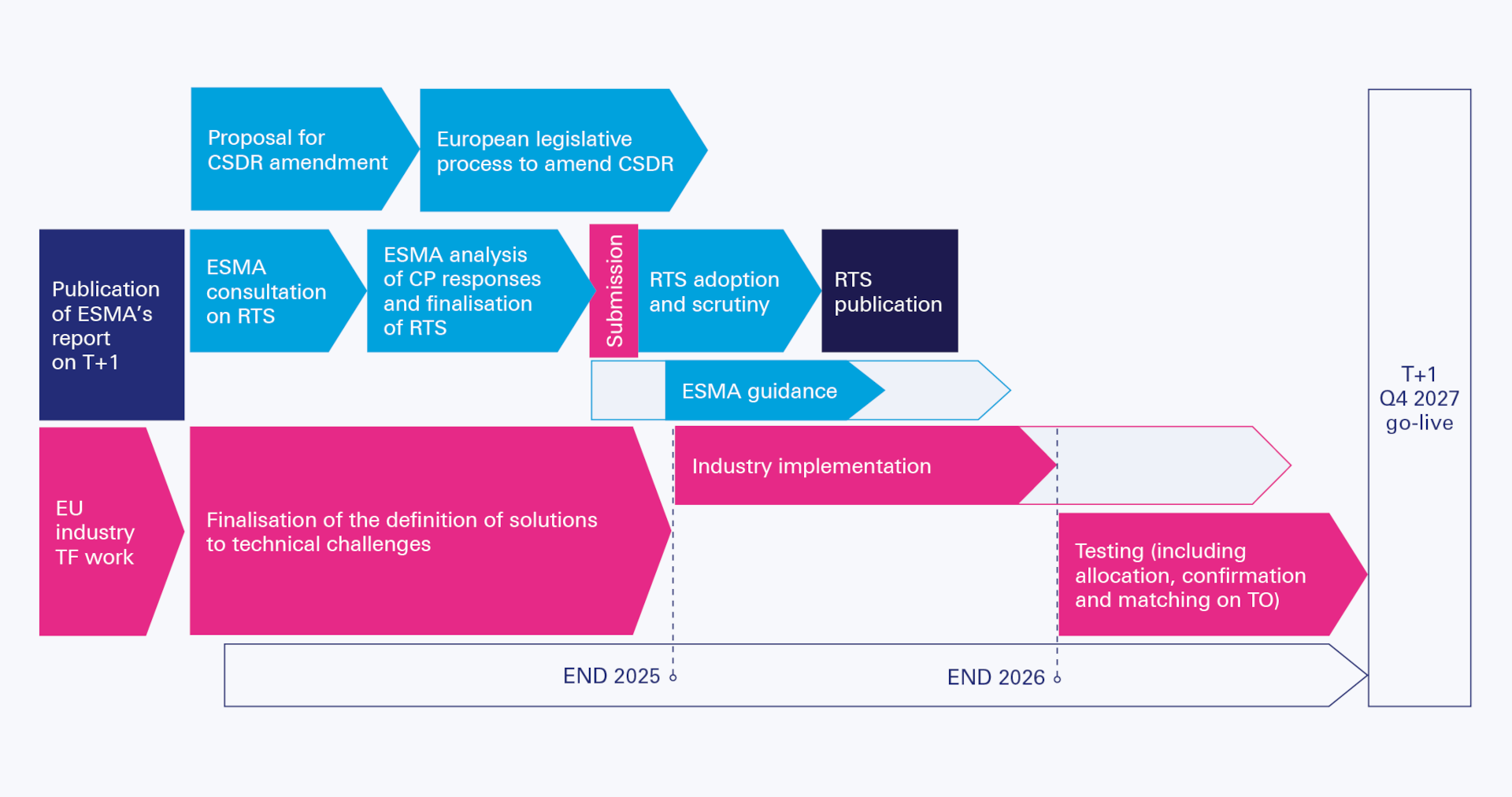

Figure 1: T+1 implementation period

Source ESMA

The EU T+1 Industry Committee published new guidance in its High-level Roadmap to T+1 Securities Settlement in the EU report, issued on 30 June 2025, noting that these “high-level recommendations developed by the Committee serve as a roadmap for the financial services industry, guiding stakeholders through the necessary changes to achieve this pivotal objective”.

T+1 global state of play

These proposals launch Europe into the global settlement compression race, following India, which moved to T+1 in 2023,3 and the Americas, which followed suit in May 2024. Europe is focused on planning and stakeholder engagement, along with the UK and Switzerland, with further consultation and preparation for global alignment with these markets. In summary, stakeholder groups’ actions include:

- ESMA, the EC, and the European Central Bank (ECB): These regulators created a governance framework in January 2025 comprising an EU T+1 Industry Committee, 12 technical workstreams and a coordination committee (with EC, ESMA and ECB representation and an independent chair)4 to assess operational impacts and obstacles to T+1 settlement and propose solutions to help market participants and national-level stakeholders prepare.

- The EU T+1 Industry Committee: This group, comprising the independent chair, association representatives and workstream leads from different industry segments, and its technical workstreams – with broad industry representation – published high-level recommendations on 30 June 2025 for removing critical obstacles to a smooth transition. A playbook is targeted for Q4 2025, including detailed guidance on actions to be taken by individual market participants. Industry Committee Chair Giovanni Sabatini notes: “The Committee’s draft timeline proposes an investment phase for market participants in 2026 and a testing phase in 2027.”

- The UK Accelerated Settlement Taskforce (AST): This unit of industry leaders, and its technical group, published an implementation plan in January 2025,5 requiring firms to accelerate up to 29% of their post-trade instructions for UK trades. The plan has 12 critical operational actions and 26 highly recommended actions.

- Swiss Securities Post-Trade Council (swissSPTC): This independent industry group of financial participant representatives for the Swiss and Liechtenstein markets created the swissSPTC Task Force6 to coordinate and provide recommendations for the transition. Market infrastructure group SIX has proposed amending its exchange rules to make the change.

Sabatini says collaboration among all stakeholders for a common regulatory approach and market practices is critical: “The AST, the EU T+1 Industry Committee and our technical workstream will help to find a common solution to prevent inconsistencies and ensure smooth functioning of markets across regions.”

These actions set the course and make T+1 a strategic concern for all market participants – including buy-side, sell-side, intermediaries and FMI –with readiness impacting bottom lines. According to research by the Value Exchange7 (led by AST and including insights from more than 550 organisations in the investment cycle), 62% of global firms are now engaging in plans to prepare for the UK transition. “It sounds like it is miles away, but trust me, it isn’t,” reflects AST Chair Andrew Douglas.

Europe's market fragmentation challenge

The need for timely preparation surfaced in flow’s Post-trade: Can one become zero?, which analyses the benefits and challenges of settlement compression on a global scale. In a European context, however, the stark reality of heightened risk, in areas such as such as settlement and funding, and potential increases in trade failures if market cut-offs are not met, is now setting in.

“While it all comes under one banner of Europe, there is still a lot of market fragmentation,” explains Fiona Neville, Head of Securities Services Europe, Deutsche Bank. “Each EU jurisdiction has distinct settlement infrastructures, local market cut-off times, and regulatory nuances. While the 24 CSDs connected to TARGET2-Securities (T2S) broadly adhere to the T2S harmonisation standards, including a common T2S calendar and schedule of the settlement day, there are still some gaps reported – mainly around T2S matching fields, T2S corporate action standards, shareholder transparency and restriction on omnibus accounts.”

A fragmented Europe (comprising Switzerland, Iceland, Norway and the UK plus the 27 member countries of the EU and multiple market infrastructures) presents an additional layer of complexity, necessitating end-to-end testing across different participants with varying levels of straight-through processing, and different jurisdictions.

Specific challenges include considerations for investors in different time zones (the EU covers three time zones), foreign exchange (FX) funding deadlines for transactions involving non-EUR currencies, local market nuances, specific requirements across European jurisdictions, and funding and liquidity management across multiple currencies.

Local market considerations

Stakeholder groups are preparing market infrastructure readiness assessments across Europe to address the challenges at a national level and minimise concerns for industry participants. “As an agent bank with local presence and local expertise, as well as local participation in the individual countries’ working groups as they respond to T+1, we are well positioned for our clients – be they global custodians, asset managers or brokers,” says Neville.

Deutsche Bank’s aim is twofold: ensuring clients are aware of those local market nuances, and getting them to think about their funding. It is guiding firms to map local market cut-offs and infrastructure constraints, and making sure that they are aware of the intraday funding timelines. “We have that discussion on a market-by-market basis with our clients,” says Neville.

Taking action

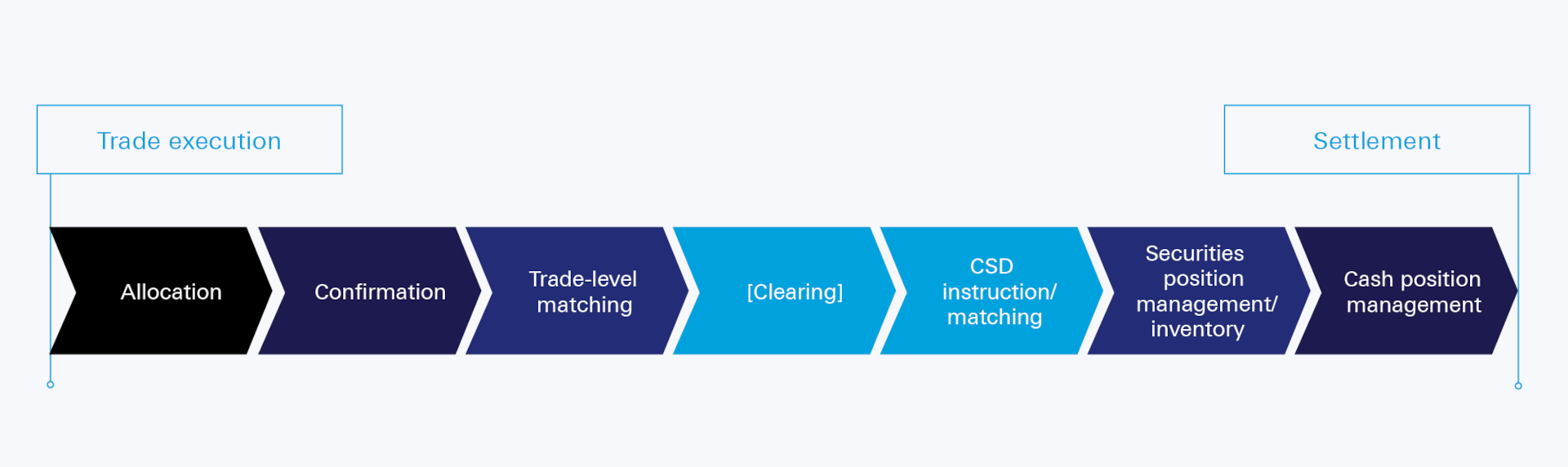

Market fragmentation makes changing to EU T+1 an issue that needs urgent action. flow’s Breaking the settlement failure chain white paper8 captures what’s at stake. It shows how mitigating settlement failures by compression reduces the time to complete settlement, putting pressure on processes (see Figure 2) and legacy systems, increasing the chance of failure. Manual intervention in processes is a common theme.

In a European T+1 environment, that’s no longer viable for legacy systems and processes that lack the requisite variety for such a huge market shift. “That lack of harmonisation is the primary element participants have to get their heads around, especially in securities lending and FX, which then adds complexity under T+1, because there’s just less time to get things resolved,” adds Neville.

The UK faces similar concerns: more than a quarter (26%) of firms responding to the Value Exchange survey indicated they will miss the target date of December 31, 2026, when all trade allocations and confirmations will need to be completed on trade date.

The role of technology in addressing this – removing inefficiency and manual processing in the securities value chain – is irrefutable. Increased operational efficiencies will lower the risk of trade fails and financial penalties. There’s more clarity on what that looks like, and firms can prioritise technology solutions and leverage workflows and straight-through processing to ensure the trade lifecycle is as seamless and fluid as possible, says Neville.

A move towards greater end-to-end automation, improved allocation/confirmation, matching rates (speed and accuracy), and real-time data reconciliations is part of that. “We can’t just assign more of our workforce to this task,” continues Neville. “The solutions need to be technology-driven.”

Figure 2: Pre-settlement processes

Source: ESMA

These solutions include electronically managing standard settlement instructions (SSIs) and keeping them up to date so that same-day settlement can happen, automating stock lending and corporate actions, and dashboards with real-time view of trades.

Reaping long-term benefits

Ensuring the trade lifecycle is as seamless as possible for European T+1 also relies on centralised tools for checking settlement instructions and monitoring real-time settlement.

“Partnering with scalable technology-driven providers ... allows clients to leverage shared infrastructure”

For this, approaches that drive immediacy and connectivity are key. “We’re automating delivery of information back to clients, so they have data in near real time and are not relying on batch processing overnight to see if a trade has settled, as this causes challenges from a funding perspective that wouldn’t exist in real time,” says Neville. Data is where Deutsche Bank sees long-term benefits from T+1 investment, he explains: “Deutsche Bank is going through a complete restructuring of its custody platform into a proprietary new custody system called S2; a modern tech stack which is adaptable and can communicate directly via APIs, so clients can consume trade and settlement data back into their system and see it almost immediately.”

In this vein, Neville sees T+1 as an opportunity to catalyse strategic change by leveraging technology to improve connection points to reduce friction and increase automation. S2 demonstrates how the bank works with industry partners to make that happen: “Partnering with scalable technology-driven providers such as Deutsche Bank allows clients to leverage shared infrastructure, enhanced market infrastructure connectivity, the benefits of our investment in existing automation, and our experience managing the transition to a shorter cycle in India and the US.”

Lessons from US T+1

Lessons from the US experience make the case for technology clear. Many firms, including Deutsche Bank, adopted automated post-trade solutions, such as real-time trade matching and driving efficiencies in the allocation and affirmation process, helping to avoid settlement delays and issues. The Depositary Trust & Clearing Corporation (DTCC) showed that affirmation rates improved in the days after T+1 went live, reaching well over 90%.9

The DTCC noted that collaboration among market participants and authorities was also critical to smooth implementation. In the context of a fragmented Europe, this becomes even more important.

What’s next?

While we continue to prepare for T+1, we anticipate that attention will progressively turn towards T+0. The industry has started to compare the marginal benefits of moving from T+1 to various forms of flexible settlement such as multilateral netting (for market side trades) with an accelerated timeline, real-time gross settlement or atomic settlement via distributed ledger technology/blockchain. The benefits of further acceleration will need to be carefully weighed against the investments required before any consensus can be reached.

So far, India is taking the lead, with plans to roll out T+0 settlement on an optional basis on 1 November 2025 (extending the original deadline of 1 May).10 However, for firms trading in Europe, T+1 is where the focus remains, and it will rely on strong market engagement and collaboration through associations such as AFME, the International Securities Services Association and working groups to build that consensus.

Global timeline of T+1 settlement cycle transitions

June 2023: India adopts T+1

May 2024: United States, Canada, Mexico and Argentina adopt T+1

October 2024: EU Industry Task Force publishes EU T+1 roadmap for transition planning

October 2024: ESMA proposes moving to T+1 settlement

January 2025:

EC proposes a change to CSDR to effect a T+1 transition

ESMA, EC and ECB create governance committee to kick-start planning

UK AST publishes implementation plan with recommendations and critical actions for T+1 readiness

Swiss Post Trade Council proposes the move to T+1 settlement

June 2025: The EU co-legislators reach a preliminary political agreement on the CSDR quick fix

June 2025: EU T+1 Industry Committee publishes high-level recommendations for firms to move to T+1

Q4 2025: EU T+1 Industry Committee to propose best practices for firms to adhere to recommendations

November 2025: India to roll out T+0 on an optional basis

2026: Industry investment phase in Europe

2027: Industry testing phase in Europe

Source: ESMA, EU T+1 Industry Committee, UK AST, swissSPTC*

Sources

1 See icmagroup.org

2 See ec.europa.eu

3 See swift.com

4 See esma.europa.eu

5 See acceleratedsettlement.co.uk

6 See six-group.com

7 See acceleratedsettlement.co.uk

8 See "Breaking the settlement failure chain" - corporates.db.com

9 See dtcc.com

10 See sebi.gov.in