5 December 2024

Now that the European Securities and Markets Authorities (ESMA) is recommending 11 October 2027 as an optimal T+1 transition date for shorter settlement cycles, what does this mean for financial market infrastructure participants? flow tracks the consultation journey so far and lessons learned from markets already on T+1

MINUTES min read

While the EU, the UK and Switzerland have had the ‘T+2’ post-trade settlement model in place since 2014 (Bulgaria, Germany and Slovenia were already settling on a T+2 basis before then), a move to next business day settlement (‘T+1’) looks increasingly likely now since the US, Canada and Mexico made the transition at the end of May 2024.

At Sibos Beijing 2024, delegates at the ‘Hype or hope? T+1 reality check’ panel session heard that while there was general acceptance that “most markets would make the move”, the process of consultation and preparation invariably takes a huge amount of planning and stakeholder engagement.

On 14 October 2024, the European T+1 Industry Task Force set up in 2023 by the Association for Financial Markets in Europe (AFME) published a Roadmap for Adoption of T+1 in EU Securities Markets. This outlined its preliminary analysis on the regulatory, technical, and operational changes required to facilitate a successful transition to T+1 in EU securities markets.1 The Task Force comprises 21 trade associations involved in the European capital markets and contains representation from industry associations representing all types of market participant, including buy-side, sell-side and market infrastructures.

This Industry Task Force report was shared with the European Commission, ESMA and the European Central Bank. According to the Central Securities Depositories Regulation (CSDR), ESMA was mandated to submit to the European Parliament and to the Council an impact assessment report on EU move to T+1; this report was published on 18 November 20242 which recommends an EU T+1 move in October 2027 and preferably a coordinated approach across Europe.

Here, ESMA reiterates that a move to T+1 will increase the efficiency and resilience of post-trade processes which, in turn, will induce greater settlement efficiency in the EU, and better global market integration.

Background and context

The move to migrate to T+1 in Europe comes in the wake of the US, Canadian, Mexican and Argentinian transition from T+2 to T+1 in May this year after three years of US preparation and India in January 2023. The EU, alongside a number of APAC markets including Japan, Australia and Korea, currently uses T+2, meaning securities transactions settle within two business days after the trade date. Regulatory momentum, technology advances and trade volumes mean that international capital markets are increasingly focused on transitioning to a faster securities settlement cycle.

Mainland China operates same-day securities settlement (T+0), while India not only moved to T+1 almost two years ago but has also ‘soft-launched’ T+0 on its stock market in limited form.

As explained in the flow article ‘Post-trade: can one become zero?’, the acceleration of the settlement cycle is primarily driven by the push to reduce market risk and margin requirements. With the delivery of trades in a shorter time frame, the potential for systemic risk, operational risks, counterparty exposure risk and liquidity risk is reduced. This reduction in risk exposure then translates into lower margin costs. In other words: the wider the gap between the execution of a trade and the time securities settle, the greater the risk that a counterparty to a trade may not fulfill its obligations. This risk becomes elevated during bouts of market turbulence. In simple terms, under T+2 risk is spread over two full business days. By reducing the settlement cycle to T+1, a full day of risk is eliminated from the market.

An additional case for T+1 in Europe is that it will strengthen the harmonisation of global markets as part of its intentions to enhance the global competitiveness of European markets. With the US already operating T+1, the hope is that Europe’s adoption of the regime will synchronize settlement practices across the world’s two largest capital markets. The move to T+1 would also provide the opportunity to further automate post trade processes.

“We are confident the move [to T+1] will bring greater efficiency and market harmonisation,”

“While there is no avoiding the significant amount of work required to move to T+1 in EMEA, we are confident the move will bring greater efficiency and market harmonisation,” says Fiona Neville, Head of Securities Services Europe at Deutsche Bank. “We are fortunate that we can leverage the effort deployed across technology, people and process. This ensured the smooth and seamless transition to T+1 in India, and more recently in the US for our clients and we will replicate this in Europe.”

Challenges and risks

The roll out of T+1 in the EU carries obvious logistical challenges, given that the 27 member countries that make up the Union will need to transition simultaneously. An aligned and coordinated approach across the European Economic Area, Switzerland and the UK is required. Add to this the complexity of multiple currencies, jurisdictions and depositories and it’s easy to see why the transition to a compressed settlement cycle in Europe entails significant challenges from both a risk and operational perspective.

While the European T+1 Industry Task Force is broadly supportive of the adoption of T+1, it notes in its report (see above) that the move will be a complex undertaking that will “require the collaboration of all industry stakeholders” to ensure new risks are not introduced and to avoid damaging “the existing efficiency, liquidity and functioning of EU securities markets”. Among various potential pitfalls that are identified, the Task Force highlights the risk of “fragmentation” induced by separate market standards, if the UK and Switzerland were to move to T+1 before or after the European Economic Area.

Another concern centres on foreign exchange (FX) challenges arising from the difference in time-zones between Europe and other global markets. A Swift Institute working paper published in June 2023 estimates that bankers and brokers will have roughly 80% less time to manage cross-border settlements under T+1, due to the added complexity of time-zone and FX challenges.3 This is before considering the 50% reduction in time for carrying out post-trade processing that losing a day automatically entails.

The 2023 flow white paper, Breaking the settlement failure chain, identifies settlement compression as an aggravating factor when it comes to the risk of trades failing.4 With less time to complete settlements, more pressure will be placed on technology systems and the upstream operational processes that support securities settlement. In turn, this may increase the likelihood of trades failing, and subsequent fines and other associated costs for market participants.

“Investing in technology… to meet T+1 requirements will lead to increased operational efficiencies”

And what of the costs of implementing the systems and processes to cater to T+1? Deutsche Bank’s David McNally, Head of Transformation, Securities Services, acknowledges that there will be significant implementation costs as European market participants strive to improve and enhance their post-trade processes and automation capabilities through investment in technology. However, in the long-term firms may reap the rewards of increased modernisation. As McNally points out, “investing in technology, including artificial intelligence, in order to meet T+1 requirements will lead to increased operational efficiencies and less human error. This can only be a good thing when it comes to lowering the risk of trade fails and subsequent financial penalties.”

Rollout timeline

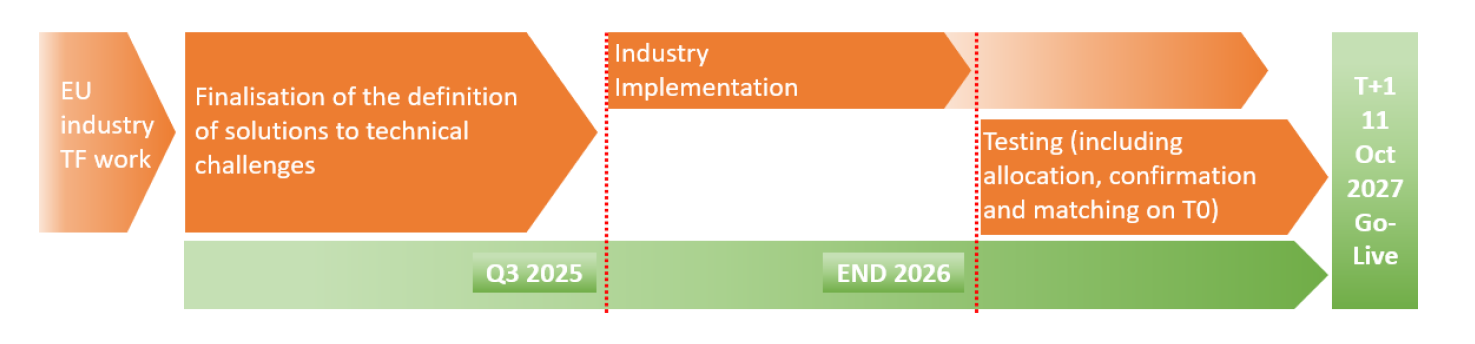

Figure 1: Three phases of the operationalisation of T+1

Source: ESMA assessment of the shortening of the settlement cycle in the European Union

ESMA has recommended 11 October 2027 as an optimal date for the transition to T+1 in the EU and a three-phase approach to its operationalisation (see Figure 1). However, the Task Force has not recommended an explicit date as there were mixed views from the consultation process. As noted above, a coordinated approach across Europe is important. ESMA has recognised the need for specific governance to be implemented, to cater to the complexity of trading and post-trading in EU capital markets.

Hence, amendments can be expected to article 5 para 2 of the CSDR.5 It mandates the settlement of transactions in transferable securities which are traded on a trading venue ‘no later than on trade date plus 2’ which should be changed to ‘no later than trade date plus 1’ going forward as proposed by ESMA in its T+1 report. The current scope of asset classes and transaction types is proposed to remain unchanged, e.g. Exchange Traded Funds (ETFs) and Securities Financing Transactions (SFTs) remain in scope. This would provide legal certainty that all EU markets migrate at the same time with the same scope of asset classes and transaction types to T+1.

With regards to the CSDR cash penalties and provided substantial evidence from market participants shows that settlement efficiency could significantly deteriorate by the shift to T+1, ESMA proposes the consideration of a time-limited suspension of the application of cash penalties by the European Commission to alleviate the potential increase of the overall level of cash penalties.

Moreover, respondents to ESMA’s October 2023 Call for Evidence on Shortening the Settlement Cycle encouraged the body to engage with APAC stakeholders (who would be particularly affected by the EU’s adoption of T+1 due to time zone discrepancies,6) and study lessons learned from North America’s adoption of T+1 in May 2024.

In the meantime, market participants will need to examine their readiness for T+1. The transition may require significant investment in areas including technology, systems and controls, staff training and compliance. Deutsche Bank’s McNally notes that smaller firms could find this more of a challenge, while larger, global organisations might be better placed, due to existing processes and infrastructure, and lessons learned from the US transition. Despite the challenges posed, the shortening of the settlement cycle in Europe presents firms with a unique opportunity to harness the long-term benefits of automation and cost reduction while embedding lasting efficiencies.

Header picture ©ESMA

Sources

1 See Roadmap for Adoption of T+1 in EU Securities Markets

2 See ESMA assessment of the shortening of the settlement cycle in the European Union

3 See swift.com

4 See Deutsche Bank’s flow whitepaper, Breaking the settlement failure chain (June 2023)

5 See finance.ec.europa.eu

6 See esma.europa.eu