4 April 2024

As financial markets around the world move to shorter post-trade settlement cycles, what does this mean for settlement success, market stability and the optimisation of technology? With rigorous planning from all stakeholders, it can all work with new considerations, saysDeutsche Bank’s Hui-Ying Mew

MINUTES min read

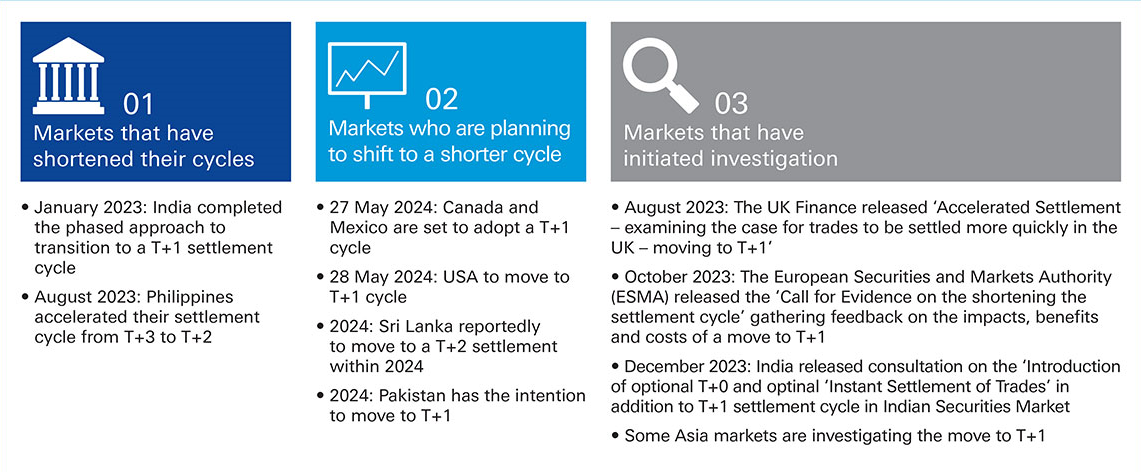

Over the course of the past two decades, the post-trade industry has witnessed an acceleration in settlement cycles from T+3 to T+2. More recently, we see the trend in the following markets:

- Markets that have shortened their cycles;

- Markets planning to shift to a shorter cycle; and

- Markets that have initiated investigation

See Figure 1.

Figure 1: Three types of acceleration trends

Sources: Accelerated Settlement – Examining the case for trades to be settled more quickly in the UK – Moving to T+1 (UK Finance); Call for evidence on shortening the settlement cycle (ESMA)

Benefits and challenges of a shortened settlement cycle

The acceleration of the settlement cycle is primarily driven by the push to reduce market risk and margin requirements. With the delivery of trades in a shorter time frame, various risks such as systemic risk, operational risks, counterparty exposure risk and liquidity risk are reduced. This reduction in risk exposure then translates into lower margin costs.

Furthermore, the acceleration of the settlement cycle is seen as an opportunity for operational efficiencies and costs savings, as well as further automation opportunities.

However, the transition into faster settlement, which implies faster pre-settlement processes, also presents new operational challenges accompanied by certain heightened risks such as settlement and funding, which will need to be carefully managed. Compressing the settlement cycle may also lead to an increase in trade failure if the new market cut offs are not met, causing negative impacts on market liquidity.

“Reducing operations and balance sheet costs through faster settlement cycle could lead to new credit and systemic risks… this exemplifies the dual-edged nature of progress”

In Asia, accelerated settlement cycles are not new, and they offer references to models that work at a heightened speed. For example, the Chinese securities market has been operating on a T+0 timing and the Northbound Stock Connect that solved this speed for cross-border participants has become a success. India successfully moved to T+1 and is now amid consulting on its planned move to T+0 and possible future instant settlements.

This article summarises three key considerations to be taken on board in the move to a shorter securities settlement cycle.

1. Onshore and offshore stakeholder communities

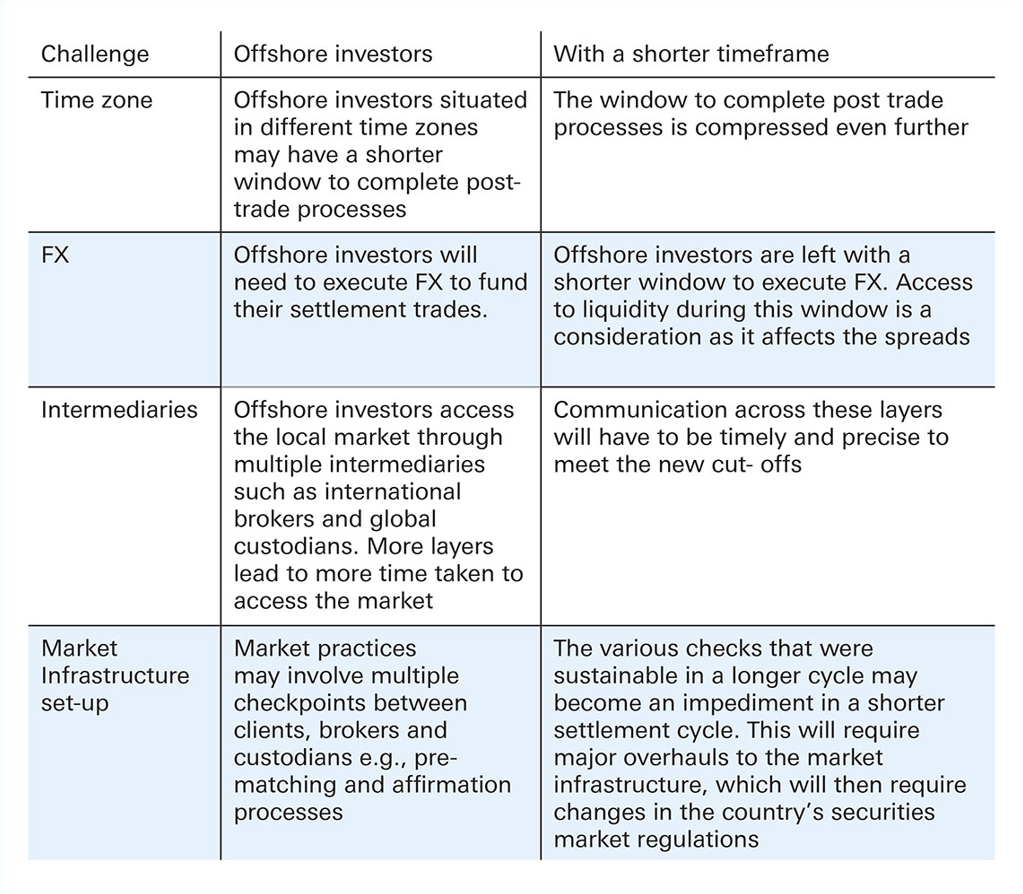

When assessing the impacts of a shorter settlement cycle, markets that have significant inflows from foreign capital and highly liquid international markets (such as currency-controlled markets) need holistic attention take on board implications for cross-border investors and intermediaries. The challenges to offshore investors and intermediaries can be particularly complex due to the current market structure of intermediary layers that need time to process, and information flows that are not always perfect. These challenges could also be further compounded by time zone differences. See Figure 2.

Figure 2: Challenges facing offshore investors with shorter settlement cycles

Indeed, even after the shorter workflows have been ironed out, documents such as service level agreements, standard operating procedures etc. are likely to need re-documentation and sign-off by the number of parties involved.

These key challenges should be considered when determining the implementation date for an accelerated cycle, bearing in mind that offshore investors and intermediaries would require additional time in their preparation for new processes associated with the accelerated cycle.

2. The automation strategy

When markets move from a T+2 to a T+1 settlement cycle, market settlement cycle cut-offs are brought forward by a day. Activities that are carried out across the T+2 windows must be completed by T+1, with the bulk of activities to be completed on T Date itself. According to the DTCC, this reduction of 24 hours can effectively leave offshore investors and intermediaries with 2 hours or less depending on their location, making it a race against time to complete the settlement process.1

Technology automation tends to be viewed as a silver bullet solution to solve this compressed time challenge. There are three main approaches to deploying technology, each with its own trade-offs:

2.1 Forced automation

This approach seeks to automate all current processes that are manually intense to allow operations staff to complete the same number of tasks within the shorter timeframe. Figure 3 shows a non-exhaustive list of steps in the settlement process – now required to be completed within two days of a T+1 cycle.

Figure 3: Main steps in trade settlement process

Source: Referenced from Securities Operations by Michael Simmons (Wiley, 2002)

To manage this compression of activities into a shorter time frame, firms aim to implement straight- through-processing (STP). Activities that tend to be manual such as the pre-matching of trades with counterparties can be standardised and automated. For full STP to be realised, data harmonisation must be achieved across the various systems involved.

Unsurprisingly, this approach has its limitations. Implementation, for example by using “bots” to achieve higher level of STP would help to complete the same number of tasks in a shorter time span. However, not all processes can be fully automated, for example, exceptions from reconciliation breaks will still require human expertise to investigate and reconcile in a timely manner.

Another inhibitor to full automation is the external dependency on counterparties to have compatible systems for synchronisation. For example, a custodian may be able to automate all SWIFT instructions. However, if the client instructs via email, STP can only begin after the email instructions has been converted into SWIFT messaging format for the systems to pick them up.

Furthermore, STP does not result in the total elimination of operational risks. Proper checks and balances will always have to be in place to prevent errors.

2.2 Shortening the settlement process

Another way to quicken the time taken to settle a trade is to reduce the number of steps in the settlement process. Certain practices can be realigned, combined, or removed completely. This would require a full front-to-end review of the firm’s current processes at every step of the trade lifecycle. For example, let us look at when the client first instructs the executing broker. The broker then provides a confirmation to the client, after which the client generates a settlement instruction to their custodian. Can there be a solution to reduce the number of back and forth between the client, broker and custodian by combining the steps? If implemented on an industry level, this solution has the potential to generate even more benefits on a wider scale.

The development of technologies such as machine learning and distributed ledger technologies (DLT) can replace certain current processes in the trade lifecycle. With DLT, business rules such as corporate actions entitlement can be embedded into smart contracts, removing the steps for manual calculation. Concurrent processes can be implemented to replace sequential ones for faster communication, although legality can be a new inhibitor to such parallel workflows. Other new technologies can also be used, such as artificial intelligence (AI) that can be trained with historical data to flag out potential trade errors at the point of execution, giving an additional layer of checks to prevent settlement fails.

This approach would require a longer time as it requires the right expertise to design and manage new workflows while retaining the same levels of operational risks controls in place. Firms will be required to invest in building new systems and technologies to support the faster settlement cycle in the near future.

2.3 Industry utility

The creation of a central utility by financial market infrastructures has the potential to introduce a more efficient industry wide workflow solution, allowing market participants to fully benefit from the economies of scale. The linear flow of data existing today still necessitates processes such as reconciliation, recreation, and dissemination to be performed between the parties involved. Having a central source where the market players can interact directly with removes the need for duplicated processes across the firms. This is illustrated in HKEX’s Synapse workflow where a central utility facilitates parallel communication between the various market participants, bringing about time and cost savings.2

While the benefits of a common utility are enormous, the magnitude of the task needs to be addressed. Such large-scale projects are best undertaken by FMIs to encourage the uptake by industry participants.

3. Evolving good market practices

As more markets accelerate their public securities settlement cycle, existing market best practices may need to evolve too. For example, currently, having prefunding requirements are viewed as inefficient as it increases funding costs and reduces liquidity for investors, causing market attractiveness to be diluted. However, it could be inevitable in the new environment; for example, after the move to a T+1 cycle in the US, asset managers in Asia may need to prefund if the following business day in the US is a public holiday in Asia. Hence, it is possible that prefunding may return as a market practice to meet the new settlement cut offs under certain conditions like holidays, despite inefficiencies that it brings.

As another example, in a shorter settlement cycle, the pressure on system and data recovery process would be significantly higher in the event of system outages because there is a higher possibility of systemic risks if core system recovery is delayed and transaction settlement snowballs. Consequently, firms will also need to reassess their recovery point objective (RPO) and the recovery time objective (RTO) of all systems involved. For example, having the RTO of χ hours for critical systems may be adequate in a T+2 cycle. However, if settlement cycles were to be compressed to a T+0 end-of-day batch run, disruptions to mission critical systems will have faster effects and more material impacts on the industry and the firm’s financials and reputation from snowballing transactions. Thus, a faster settlement cycle can require a reduced RPO and RTO to achieve new operational resilience, in turn possibly requiring more investment into technology infrastructure and staff training to respond more quickly to possible events. In this case, a false positive is safer than a false negative.

As such, the established “best” practices of today can benefit from reviews to establish an evolved market standard fitting this faster post-trade environment.

Careful planning is all

As the settlement cycle compresses further from T+2 to T+1 and even to T+0, the operational demands in the settlement space will increase significantly. More pressure will be added to an already operational intensive space, particularly when the market is facing a high trading volume such as during index rebalancing day. As both systems and people are stretched to their limits, it calls for a more sustainable solution to be in place.

Ultimately, a settlement acceleration should drive progress and efficiency. While savings in margin costs is real and visible, the new ways of settlement should not be translated into significantly increased operational costs and risks. To ensure a smooth transition, collaboration among market participants, financial market infrastructures (FMIs) and regulators is of the essence. Early consultations that include cross-border investors and intermediaries will help identify and address potential concerns and hurdles, giving investors more confidence in the market. Furthermore, the establishment of a centralised utility would standardise industry wide processes to achieve economies of scale.