30 January 2024

In the second of our two articles on India’s growth story (it has just become the world’s fourth largest stock market at US$4.33trn), flow’s Clarissa Dann re-examines its capital markets landscape and changes in the country’s securities regulatory space, technology advancement and investor protection

MINUTES min read

As highlighted in the flow article, ‘India’s new growth frontiers’, India is one of the fastest-growing economies in the world. On 9 December 2023, the Reserve Bank of India (RBI) revised its forecast for India’s GDP, projecting a growth rate of 7% for FY24, with Q3 and Q4 expected to show expansion at 6.5% and 6% respectively. After hikes earlier in 2023, in recent months the RBI’s Monetary Policy Committee (MPC) has left lending rates unchanged at 6.5%.1

Capital markets drivers

Strong consumption demand, a robust capex push by the government, rapid digitisation and favourable policies are the basic drivers of the success story. India’s capital market is one of the most dynamic and extensively regulated, the landscape dynamics are influenced by multiple factors such as global economic conditions, geopolitical events, and rapid technological changes. India’s stock market is now the world’s fourth largest with a market capitalisation of US$4.33trn.2

In September 2023, the JP Morgan Global Bond Index (GBI) team announced that India will be included in the GBI-Emerging Markets (EM) Global Series from June. The addition, says Deutsche Bank Research’s Chief Economist India Kaushik Das, “will bring about US$25bn inflows into the Indian fixed income markets in a staggered manner through FY25 or by the end of March 2025”.3

Commenting on the announcement, the government’s Chief Economic Advisor, V. Anantha Nageswaran said, “It attests to the confidence that financial market participants and financial markets, in general, have in India's potential and growth prospects and its macroeconomic and fiscal policies."4

“Inflows from FPIs into India’s equity market will only grow as the global GDP axis shifts to Asia”

Although JP Morgan’s move is just one example of foreign investor appetite, it helped to set the tone for the 2023 meeting of The Network Forum Asia (TNF), held two months later. At the Mumbai event Anand Rengarajan, Global Head of Sales & Head of Asia-Pacific, Securities Services at Deutsche Bank, predicted that issuers will increasingly list in jurisdictions outside their home markets; a trend that potentially benefits stock exchanges in countries such as India. “Today, many companies will typically want to list in New York, but it is expected firms will start to diversify to other stock exchanges in different markets. One analyst predicts that 44% of the listings on Indian exchanges could eventually be foreign,” he said. Should these forecasts prove correct, then inflows from foreign portfolio investors (FPIs) into India’s equity market will only grow as the global GDP axis shifts to Asia.

While there has been consistent increase in FPIs investing in Indian markets, a survey at TNF found that 58% of attendees believe the FPI registration and Know Your Customer (KYC) processes are the areas most in need of improvement. Deutsche Bank, is part of various working groups and along with other industry participants such as global and local custodians, clearing corporations and FPIs is working towards easing out the norms of FPI registration and KYC processes to help investors registering in India.

In other words, increased investor activity means that market infrastructures and regulation have been responding in parallel to ensure that improved ease of doing business in India’s capital markets does not compromise the safety and security of investor funds.

Market infrastructure developments

Investors seeking to own securities such as stocks, bonds and mutual funds in India are required to open a dematerialised – abbreviated to ‘demat’ – account. These are digital records tracking ownership of tradeable assets and help manage risks such as theft and forgery. They reduce the delay in registration of the shares. However, a mechanism providing further controls was needed to protect the misuse of securities being used for proprietary trading or on behalf of other clients by members.

After consultations with depositories, clearing corporations and stock exchanges, in 2021 the Securities and Exchange Board of India (SEBI) introduced a guideline to provide a block mechanism in the demat account of clients undertaking sale transactions to increase the safety of their assets and make the market transactions more secure. This addressed the issue of when clients gave Early Pay-In (EPI) for sale trades yet to be executed.

Furthermore, the client unpaid securities pledgee account (CUSPA) mechanism has been introduced for handling of clients’ securities by members, where any unpaid securities are transferred to the respective client’s demat account followed by creation of an auto-pledge.5 Looking more widely at developments, technology-driven innovations – such as algorithmic trading and blockchain applications – continue to shape the capital market landscapes.

Blockchain-based platforms are also being implemented for monitoring of security and covenants of debentures. Furthermore, stock market initiatives such as the recently introduced Social Stock Exchange (SSE) segment on the National Stock Exchange provides social enterprises engaged in eligible activities with a unique opportunity to raise funds on a recognised exchange platform, akin to a normal initial public offering (IPO).

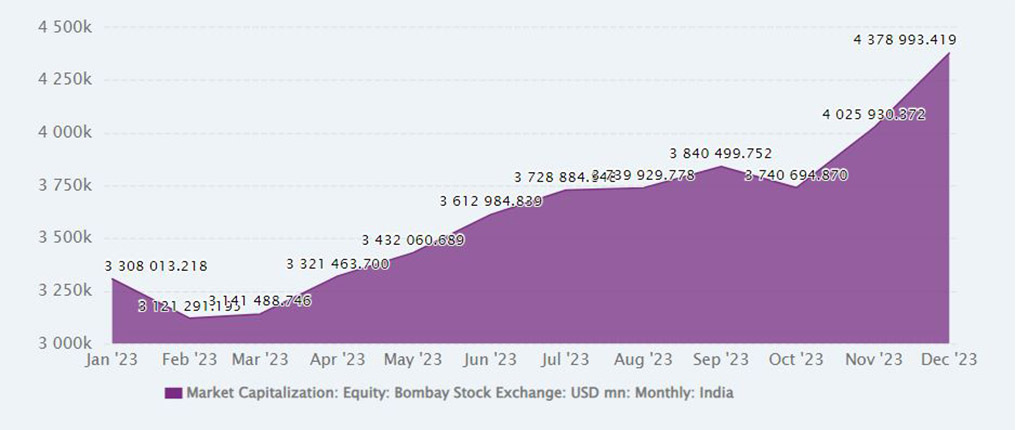

Such changes are leading to increased incorporation of Indian companies, with rises in new demat accounts. According to the Ministry of Government Affairs Corporate Bulletin, the number of Indian companies that incorporated are on the rise – December 2023 stood at 1,652,249.6 CEIC Data puts the total market market capitalisation as having grown by US$1bn from January to December 2023 (see Figure 1)

Figure 1: India’s market capitalisation January to December 2023

Source: www.ceicdata.com | CEIC Data

On 23 January 2024, Bloomberg reported the combined value of shares listed on Indian exchanges reached US$4.33trn compared with US$4.23trn for Hong Kong and overtaking it as the world’s fourth largest stock market. India had crossed the US$4trn threshold on 5 December 2023 with half of that rise occurring during the past four years.7

“T+1… has given investors quicker access to their funds following trade execution and settlement”

Governance and investor protection

Custody trends in financial markets generally reflect changes in the regulatory space, technology advancement and investor protection. The latest trends include digital solutions for custody and enhancement of cybersecurity norms.

A key change in the regulatory space is the equity markets movement from a trade date plus two days, or T+2, to T+1 settlement cycle, implemented on 27 January 2023.The move has given investors quicker access to their funds following trade execution and settlement, freeing up liquidity and making it possible for capital to be deployed more efficiently.8

In addition, SEBI is also working on the potential introduction of an optional T+0 settlement cycle by first half of 2024 and possibly optional instant/atomic settlements from 2025. Moreover, SEBI reforms helped in the strengthening of governance mechanisms in market infrastructure institutions, enhancements in sustainability reporting by listed entities, and streamlining the onboarding process of FPIs. In April 2022, cyber security body The Indian Computer Emergency Response Team (CERT-In) issued new directions containing, as explained by law firm Linklaters, “a broad range of new obligations including an obligation to notify security breaches within six hours and to keep detailed logs of network activity”.9

In a useful guide to the Indian securities market, SEBI explains that the regulator’s mandate is “to protect the interests of investors in securities and to promote the development of, and to regulate the securities market”.10 Protecting the interests of investors is of paramount importance for the intermediaries, stock exchanges and the regulators associated with the markets and “margins/collaterals” constitute as one of the key elements. By way of background the ‘margin’ is the collateral that an investor has to deposit with their broker or exchange to cover the credit risk the holder brings to the broker or the exchange. In India, end client margin/collaterals are bankruptcy remote from the default of member and clearing corporations along with elimination of misuse of such collaterals.

To strengthen this regime further the existing dispute resolution mechanism is being streamlined by establishing a common Online Dispute Resolution Portal (ODR Portal) that harnesses online conciliation and online arbitration for resolution of disputes arising in the Indian Securities Market.11

Working with regulation

Commenting on Deutsche Bank’s work with the Indian regulator, Janak Dalal, Head of Securities Services India concludes, “Deutsche Bank also successfully completed the regulatory activity on identification and verification of Beneficial Owner (BO) of Foreign Portfolio Investors (FPIs) by Designated Depository Participants (DDPs), in compliance with directions issued by SEBI well within the timelines.” He adds, “SEBI recently devised Standard Operating Procedure on seeking of ‘Additional Granular Disclosures from FPIs’12 along with the industry and Deutsche Bank was one of the contributors for providing its inputs.”

Given the pace of change in India with digital asset development, its continued attraction to foreign investors looks set to keep custodians and regulators busy for years to come.

Deutsche Bank reports referenced

India macro outlook for FY25 and beyond, by Kaushik Das, Chief Economist, India, Deutsche Bank Research (4 December 2023)

Namaste India by Deutsche Bank’s Securities Services team. This captures key securities market and regulatory updates in an annual publication

Sources

1 See economictimes.indiatimes.com

2 See bloomberg.com

3 See India macro outlook for FY25 and beyond, by Kaushik Das, Deutsche Bank Research, 4 December 2023

4 See reuters.com

5 See sebi.gov.in

6 See mca.gov.in

7 See indiatoday.in

8 See India trumpets T+1 settlement at flow.db.com

9 See linklaters.com

10 See investor.sebi.gov.in

11 See sebi.gov.in

12 See sebi.gov.in

Image credit: The Securities Exchange Board of India – photo by By Jimmy vikas https://commons.wikimedia.org/w/index.php?curid=4796761