13 December 2023

At The Network Forum (TNF) Asia 2023 meeting, delegates were reminded about India’s position as a leading foreign investment destination, the growing appetite for further settlement compression, the rise of digital assets, and the impact of ESG on investment styles. flow reports on the key discussion points

MINUTES min read

After last year’s TNF Asia Meeting in Singapore, which focused understandably on digital assets in the wake of the FTX bankruptcy, post-trade leaders gathered in Mumbai for the 2023 event.

Home to more than 21 million people, India’s most populous city is also its undisputed financial services capital and hosted the 2023 TNF Asia Meeting. Attended by more than 100 industry experts from leading custodians, buy-side firms and technology companies, along with international and local financial market infrastructures (FMIs), the event took place from 6-7 November 2023. This article shares the main talking points from the conference.

Investors flock to India

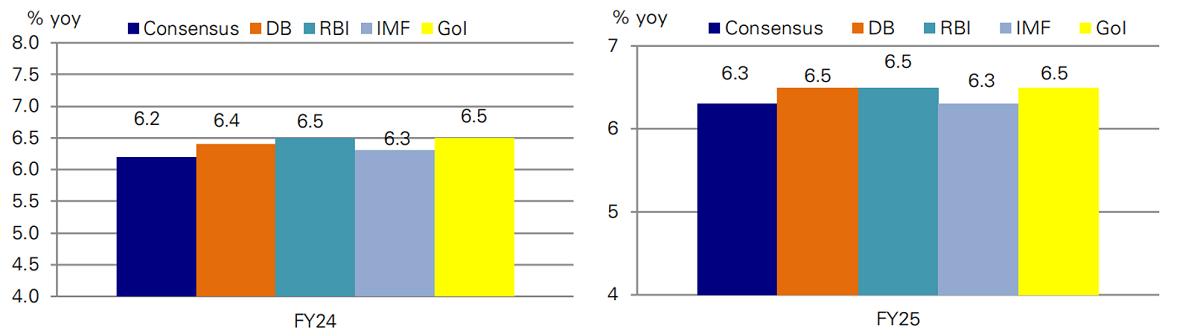

With growth largely subdued in most major markets, India is one of the few leading economies bucking the trend. According to Deutsche Bank Research, “India Macro Update: Wait and Watch” published in August 2023, India’s Gross Domestic Product (GDP) is projected to rise by 7.2% in 2023, before moderating to 6% - 6.5% in 2024, and then edging back up to 6.5% in 2025.1

A Deutsche Bank Chief Investment Office briefing forecasts that India’s economy will have doubled by 2030 from US$3.5trn to US7trn. This bullish projection has been underpinned by the country’s strong fundamentals, i.e. the government’s disinvestment and asset monetisation strategy, its demographic dividend , and growing financial inclusion, all of which were summarised in flow’s article, ‘India’s gateway to growth’.

Figure 1: Real GDP growth forecast for FY24 and FY 25

Source: RBI and Deutsche Bank Research (India Economics Weekly 16 November 2023 by Kaushik Das, Deutsche Bank Research)

“Inflows from FPIs into India’s equity market will grow”

After a period of sustained outflows in 2022, sparked by fears about global recession, inflation risk, and rising interest rates, foreign investors are once again doubling down on emerging markets. In India, foreign portfolio investors (FPIs) accumulated US$17.2bn worth of domestic equities through September 2023, driving the country’s stock market capitalisation up to a record US$3.75trn.2

Anand Rengarajan, Global Head of Sales & Head of Asia-Pacific, Securities Services at Deutsche Bank predicts growth in FPI flows into India’s equity market

Experts at TNF were bullish that India could potentially become a leading listing destination in Asia-Pacific. During his keynote address on day one at TNF, Anand Rengarajan, Global Head of Sales & Head of Asia-Pacific, Securities Services at Deutsche Bank, predicted that issuers will increasingly list in jurisdictions which are not their home markets; a trend that potentially benefits stock exchanges in countries such as India. “Today, many companies will typically want to list in New York, but it is expected firms will start to diversify to other stock exchanges in different markets. One analyst predicts that 44% of the listings on Indian exchanges could eventually be foreign,” noted Rengarajan. Should these forecasts prove correct, then inflows from FPIs into India’s equity market will only grow as the global GDP axis shifts to Asia.

India’s bond market is also expected to experience significant inflows following the decision by J.P. Morgan to add the country to its Government Bond Index-Emerging Markets benchmark from June 2024. This was highlighted by Margaux Blumenfeld, Head of Sales, Securities Services, South Asia at Deutsche Bank during her keynote address on day two at TNF. Reports suggest inclusion on the J.P. Morgan index could result in US$25bn–US$26bn of inflows heading towards India’s government bond market.3

Continuing regulatory journey

Inflows have been facilitated by India’s positive market reforms, which have made it easier for foreign investors to access the local market, a point made on a panel session titled “The Elephant in the Room: How to improve market access”, moderated by Mathew Kathayanat, Head of Securities Services Product Management, APAC at Deutsche Bank, and also featuring experts from BNY Mellon, Standard Chartered, and State Street.

A TNF survey during the session found 90% of the audience agreed that accessing India’s market had become easier over the last five years. “India has improved significantly in terms of market access,” said a network manager. “The FPI registration and approval process has been delegated (from the Securities and Exchange Board of India [SEBI] to global custodians), and this has expedited the approval turnaround times.”

Other positive initiatives by SEBI have included reducing the number of different foreign portfolio investment (FPI) categories from three to two, and simplifying and digitalising the Know-your-Client (KYC) documentation requirements for FPIs.

Despite this, KYC is one area about India that continues to frustrate network managers. A survey at TNF found that 58% of attendees believe the FPI registration and KYC processes are the areas most in need of improvement, when accessing the domestic market. Although SEBI now allows FPIs to use e-signatures on their application forms when opening up accounts, a network manager complained that the documentation requirements are still extensive.

Recent market events have also prompted SEBI to introduce tough new disclosure rules for FPIs with sizeable stakes in Indian companies. Under the provisions, FPIs with more than 50% of their Indian assets under management (AUM) in a single company/corporate group, or those with more than US$3 billion invested in Indian equities will be impacted.4 However, one expert at the event said that while the disclosure rules are quite onerous, there are plenty of exemptions, meaning very few institutions would actually be caught out by the changes.

Financial services hub status

Through the Gujarat International Finance-Tec (GIFT) City,5 India is seeking to position itself as a leading financial services and technology hub in Asia-Pacific, said Dipesh Shah, Executive Director (Development) at the International Financial Services Centre Authority. Shah presented on the panel session Onshoring the offshore: Insights into GIFT IFSC: India’s Maiden International Financial Centre.

An offshore financial centre located in Gujarat, GIFT City is attracting several financial institutions, including banks, insurance companies and asset managers, through its generous tax incentives and competitive pricing. “The operating costs of GIFT City are in Indian rupees (INR), making it much lower cost than other regional markets,” said Shah.

According to his presentation, there are currently 25 banks located in GIFT City, up from 14 in 2020, and 78 fund management groups, with a combined AUM of US$19.06bn.

While previously, Indian centric funds domiciled themselves in offshore centres, such as Mauritius, Singapore, Cayman Islands, and Luxembourg, Shah said many new funds are now setting up in GIFT City, thanks to its attractive taxation regime and globally aligned regulations.

Towards T+0?

Having gradually phased in T+1 settlement for equities , a process that only completed in January 2023, SEBI is already talking about introducing a voluntary T+0 settlement cycle in March 2024 and possibly instant settlements from 2025.6

An expert told TNF that SEBI’s plans for T+0 are still in the early stages of development. However, it is believed the regulator will allow T+1 and T+0 to run side by side, with the latter being entirely voluntary and nothing being introduced without extensive industry consultation. It is likely, they said, to be launched for the retail market first in 2024 and will be optional for all others. In other words, assuming the plan comes to fruition investors will be able to choose whether to settle their trades on a same day basis (i.e. T+0) or T+1.

Although India’s transition to T+1 went smoothly and trade fails are now back to their normal levels, some question whether the local financial market infrastructures (FMIs) have adequate technology to support T+0, let-alone instant settlements.

Participants at TNF agree that SEBI has an excellent track record of engaging with the industry and onboarding their recommendations, especially during the adoption of T+1. During the “Elephant in the Room” session, a speaker observed that India’s final T+1 rules were very different from what was initially proposed, the challenges of which were outlined in flow back in 2021.

India does appear to be the exception on T+1 in Asia-Pacific rather than the rule, according to a TNF panel session on Day One titled T+1 update: Accelerated settlement and settlement finality: What are the new challenges for the APAC markets and what can we learn from India?, which was moderated by Janak Dalal, Co-Head of CB, India, Head of India & Sri Lanka, Securities Services at Deutsche Bank. It featured Daniel Smith, Vice President, Network Management, Asia-Pacific, at J.P. Morgan, Lukas Conrad, Regional Head, Securities Services, APAC at SIX; Prashant Vagal, Executive Vice President at NSDL, and Kiran Shetty, CEO & Regional Head, India and South-East Asia at Swift.

T+1 update: Accelerated settlement and settlement finality: What are the new challenges for the APAC markets and what can we learn from India? Panellists left to right: (Daniel Smith, J.P. Morgan, Janak Dalal, Deutsche Bank; Kiran Shetty, Swift; Prashant Vagal, NSDL, and Lukas Conrad, SIX)

Network managers and tokenisation

The rise of Digital assets (i.e. tokens, etc.) is a topic which has been covered extensively by flow, but what does their growing prominence mean for network managers, and their due diligence processes?

During a TNF panel session “How should network managers cover due diligences of digital asset custodians?” featuring industry experts from HSBC, Standard Chartered and SEB, one speaker said network teams are more comfortable with institutional grade banks offering digital asset custody as opposed to fintechs. “As a network manager, you want assurances that your provider understands requirements like the UK Financial Conduct Authority’s CASS rules,” said a network manager.

“Many network managers do not want to oversee yet another third-party provider”

The discussion comes 12 months after the collapse of FTX, a topic which was discussed at length at TNF in 2022. “Clients do not want the credit risk, vendor risk or operational risk of working with a standalone digital asset custodian” said Maley.

He added that at a time when costs are steadily rising, network managers are also looking to extract operational efficiencies, and many are doing so by streamlining counterparty relationships “clients want providers to deliver digital asset custody as part of an integrated package alongside their traditional custody services. Many network managers do not want to oversee yet another third-party provider.”

Deutsche Bank, along with several of its peers, is the process of developing digital asset custody solutions for customers, which will be offered alongside their traditional products.

Turning to due diligences, 77% of attendees surveyed at TNF expect the assessment process for digital asset custodians will be different to what is carried out on traditional providers, while 94% said technology and cyber-risk need to be the main areas of focus. Maley told flow that network teams will need to refine their due diligences by incorporating additional questions tackling issues like key issuance, key management, storage and retirement.

Even so, a network manager remarked that there is much overlap in the questions (i.e. cyber-risk, business continuity planning, cash flows, etc) being sent to both digital asset custodians and traditional providers. Although network teams are talking more about digital assets, only 12% of attendees at TNF believe that network managers are adequately equipped to assess digital asset custodians.

Sustainable investing

ESG – how are the varying levels of development and implementation across Asia playing out? A focus on sustainable investing. Panellists left to right: Luc Vantomme (Euroclear); Inderjeet Singh (Deloitte): Rajeev Agarwal (SEBI); Boon-Hiong Chan (Deutsche Bank)

Financial services has a vital role to play in promoting ESG and sustainability, a topic that was covered in the panel session ESG – how are the varying levels of development and implementation across Asia playing out? A focus on sustainable investing. Speakers included Inderjeet Singh, Partner & ESG & Carbon Markets at Deloitte, Rajeev Agarwal, Former Whole Time Member at SEBI, Luc Vantomme, MD, Business Development, APAC at Euroclear, and Boon-Hiong Chan, Head of Fund Services and Head of Securities Market & Technology Advocacy at Deutsche Bank.

Vandome said an estimated US$4trn will be required annually if developing markets are to meet their UN Sustainable Development Goals, something that needs to be facilitated by private sector investment, as well as the public purse.

One of the impediments facing ESG investing is that the data underpinning it is not standardised, which causes inconsistencies in reporting and increases the risk of greenwashing.

However, global efforts to harmonise ESG disclosure standards are in train, according to Chan. “Under the leadership of the International Sustainability Standards Board (ISSB), the new standards ISSB S1 and ISSB S2 are being released and which are linked to financial reporting covering sustainability and climate related disclosures respectively,” he said. Endorsed by the International Organisation of Securities Commissions (IOSCO), the aim of the ISSB standards is to consolidate all of the pre-existing voluntary standards into a single common framework, a move that it hopes will reduce confusion around ESG for issuers and investors.

Speaking to flow, one network manager said ESG is factored into due diligences and is referenced sporadically in network managers’ proprietary questionnaires and the Association for Financial Markets in Europe (AFME) due diligence questionnaire.7

Growth continues

Asia-Pacific markets have undergone seismic changes, and none more so than India. “Over the last few decades, India has opened up its capital markets and its reform zeal is as strong as ever, evidenced by its drive to adopt T+1, and more recently T+0,” said Andrew Barman, Founder, TNF. “As ever, the TNF Asia Meeting brought together industry experts from across the region and beyond to engage with each other on some of the most pressing issues facing the market today.”

The Network Forum Asia Meeting was held on 6-7 November 2023 in Mumbai, India.

Note all photographs in this article (apart from the header picture) are © The Network Forum

Sources

1 See Deutsche Bank Research – August 29, 2023 – India Macro Update: Wait and Watch

2 See business-standard.com

3 See ft.com

4 See ft.com

5 See giftsez.com

6 See livemint.com

7 See afme.eu