19 August 2024

Now that the US, Canada, Mexico and Argentina have joined India in the transition to T+1, settlement compression, an expanding investor community and the integration of digital assets into business as usual have changed the post-trade landscape. flow’s Clarissa Dann reports on how its participants are responding

MINUTES min read

Approximately US$115.1trn is held in global assets under management (AuM) – a number that has been steadily rising since 2003, with a few bumps along the way. In their July 2023 Global Asset and Wealth Management Survey, PwC noted that AuM dropped almost 10% below the 2021 high of US$127trn, but that they expect a rebound by 2027 to US$147.3trn.

Growth has been propelled by the burgeoning wealth of high-net-worth individuals and the mass affluent, as well as a pronounced shift to defined contribution retirement savings. In addition, regional accelerations are playing a part – “Asia-Pacific, along with frontier and emerging markets in Africa and the Middle East, will set the pace of growth in AuM,” notes the survey.

The meme stock rally in 2021, which prompted the initial shortening of the custody cycle (most recently seen in North and South America’s shift to a T+1 post-trade settlement cycle), underscores the increasing need for adaptive service providers as the investor community continues to grow rapidly. Drawing on insights from market infrastructure participants and coinciding with the industry’s half-century milestone, this article provides a summary of the custody landscape.

Role of the custodian

Providers of global custody services are typically large banks or financial institutions, but what are the core responsibilities of the global custodian? Broadly, they can be grouped as follows:

• Safekeeping of assets. This involves maintaining proper records of ownership, valuation, accounting and reporting of assets owned by a plan/fund sponsor or an institutional investor throughout the trade lifecycle.

• Trade processing. Tracking, settling and reconciling assets that are acquired and disposed of by the investor – either directly or indirectly – through delegated authority with an asset manager.

• Asset servicing. Maintaining all economic benefits of ownership such as income collection, corporate actions and proxy voting.

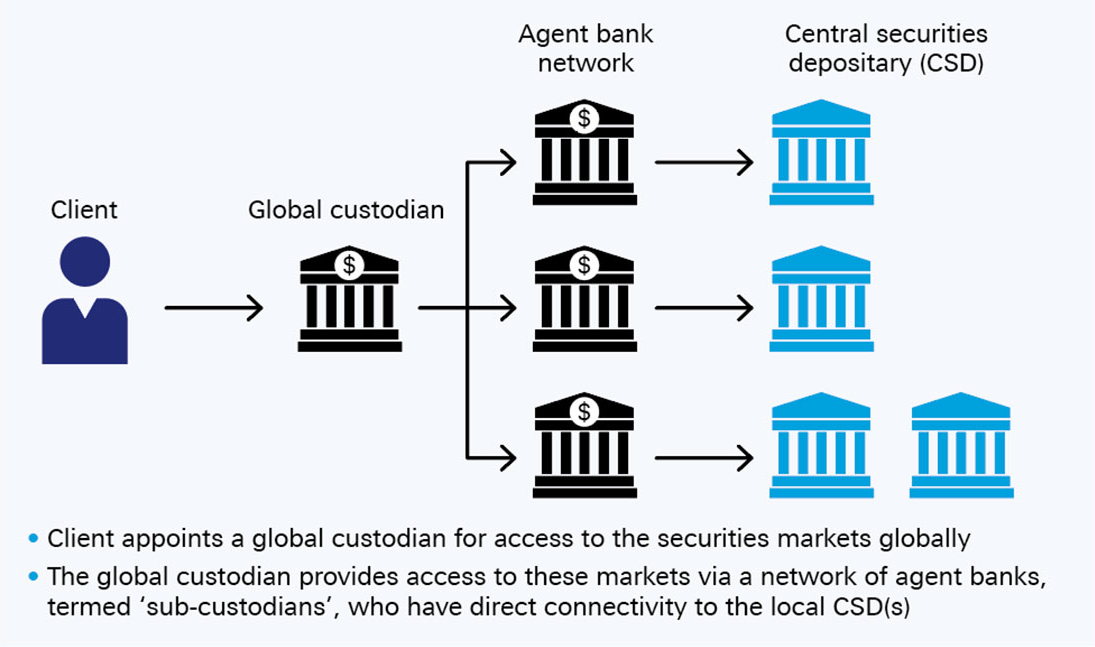

Figure 1: Summary of global and agent bank relationships

Therefore, as an asset servicer, a global custodian is responsible for administering investment-related activities, such as clearing and trade settlement, collection of income, proxy processing, corporate actions and cash movement activities. They provide these services on a global scale, both within the jurisdiction(s) in which the custodian is directly located and in other jurisdictions, ensuring assets are held securely and transactions are executed efficiently and accurately.

To facilitate access for investors into the securities markets worldwide, a global custodian works with agent banks (also known as ‘sub-custodians’) on the ground, to handle tasks in foreign markets that it is not directly located in such as safekeeping of assets, settlement, record-keeping, market access and advocacy. Agent banks therefore perform a variety of roles for their global custodian partners and are an important participant in the end-to-end custody lifecycle, providing direct market access and expertise to ensure compliance with local regulations (see Figure 1).

“Anything from digital assets to tokenisation is all about collaboration”

Strategic partners

Dan Hickey, Global Head of Network Management at State Street, reflected how, 10 years ago, one of the biggest factors when appointing an agent bank was price – but now it’s the capacity to work as a long-term partner. At the Global Custodian panel session, ‘The Future of Custody: Has the transition really taken place?’ held in London on 30 May 2024, just after the US T+1 migration two days earlier,1 he said, “Coming out of T+1, anything from digital assets to tokenisation is all about collaboration. You really must pick your custodians carefully as they really are an extension of yourself. When something happens at the central securities depositary (CSD), regardless of which market it is, we want that information to be back with our end client as soon as possible in real time – and the only way we can do that is with our sub-custodians.”

Future of Custody panel, left to right: Hannah Elson (J.P.Morgan); Justin Chapman (Northern Trust); Philippe Laurensy (Euroclear); Dan Hickey (State Street); Kamalita Abdool (Deutsche Bank); Jonathan Watkins (Global Custodian)

He went on to explain that such a partnership is “about having a really meaningful relationship where they [the agent bank] are investing in their product and they integrate it into our platform so that it is presented as a seamless extension of State Street, rather than a completely separate and standalone service provider to asset managers”.

Hannah Elson, Global Head of Custody at J.P. Morgan, agreed, saying, “All of our models are very similar. From a network management perspective, it was all about best-in-class sub-custodians. Now, it’s about a combination of staying power, the ability to invest and resilience in respect to concentration risk. Overlay that with geopolitics and the selection process becomes way more complicated.” She added, “We rely heavily on our sub-custodians for their market expertise, connectivity and resilience.”

Clients can benefit from a strong interconnected partnership with their agent banks, says Kamalita Abdool, Head of Securities Services Americas and Global Custodian Coverage, Deutsche Bank. She continues, “Agent banks are embedded into the workflow, and bringing your agent into future strategic decisions allows them to challenge the custodian with creative approaches to problem solving. The agent bank has the benefit of seeing how others approach complex problems, they can leverage best practices and help the entire market drive consistency, scale, and straight through processing. This is a continuous feedback loop, with better scale and margins it ensures adequate margin for ongoing investment.” She adds that, “Tax and FX are good examples of how we can streamline and deliver a solution to multiple clients across multiple jurisdictions.”

Digital asset capability

The digital asset and decentralised finance landscape is changing all the time, along with evolving regulatory frameworks ensuring the appropriate guardrails are in place, and this requires a degree of agility from custodians and agent banks. In the Deutsche Bank/Northern Trust white paper, The road to institutional DeFi (June 2024), the authors explain how the application of decentralised finance (DeFi) for institutional use cases has the potential to create a new financial paradigm – one based on the principles of cooperation, composability and open-source code, and underpinned by open, transparent networks.

Justin Chapman, Global Head of Digital Assets and Financial Markets at Northern Trust, points out, “There are compelling use cases which promise to bring new asset classes and products to market.” But he went on to explain at the May Global Custodian panel how providing global custody services for those assets means he still has to demonstrate to the regulator how he is able to retain control over assets while the technology “sits in some other firm” and “my code has to work in their shop”.

From the CSD perspective, Philippe Laurensy, Head of Product Strategy and Innovation at Euroclear, underlined the importance of alignment with regulatory frameworks and working with regulators to develop the new ecosystem.

On 29 May 2024, three of the largest financial market infrastructures (FMIs) – DTCC, Clearstream and Euroclear – announced a blueprint for establishing an industry-wide digital asset ecosystem to drive acceptance of tokenised assets. In their report Building the digital asset ecosystem,2 they set out the six principles that facilitate successful adoption:

- Legal certainty – ensuring operations comply with law.

- Regulatory compliance – encouraging alignment with regulatory frameworks.

- Resilience and security – developing robust infrastructure capable of resisting disruptions while protecting sensitive data.

- Safeguarding customer assets – implementing governance via smart contracts to manage assets securely.

- Connectivity and interoperability – facilitating transactions and flexible settlements across diverse networks.

- Operational scalability – striving for efficiency and cost-effectiveness through standardisation.

Commenting on the paper at the time, Laurensy said, “Our objective is to create innovative solutions that will address the evolving needs of our customers and drive industry advancements, which includes clients having the flexibility to create space on their balance sheets through tokenisation, therefore leading to new business opportunities.” He developed this further at the May Global Custodian panel, saying, “We need to focus on the pain points.” A huge amount of legal work will be necessary, Laurensy said. “We could argue that this [a digital asset] is just a form of asset that is different; but because of crypto underlying it, some barriers are associated with digital assets and you might be hit with big capital requirements,” he reflected.

Platform resilience

Be it traditional finance or DeFi, technology is at the heart of the post-trade plumbing between global custodians and agent banks, the filament of trust straddling the buy-side community and financial market infrastructure. Global custody aggregators are driven by the tenets of providing their end-clients with richer real-time data using interoperable channels, integrated across the 100-plus capital markets to which they provide access. They must accomplish this at scale and, in parallel, adapt to changes driven by regulations, new client demands and an inherent need to digitalise the custody chain. “This is all in pursuit of faster account opening together with trade status transparency, rules-based corporate actions processing, multi-currency forecasting, query reduction and instantaneous asset availability,” explains Mathew Kathayanat, Head of Securities Services Product Management, APAC at Deutsche Bank.

“The agent bank of tomorrow should be willing to engage in digital connectivity”

This shift is best seen in the ever-increasing collaboration with fintech firms, an imperative as core processing platforms are not best suited for constant retrofitting. Adding these fintech layers that combine critical data elements with cutting-edge digital tools, together with the cyber-resilience and scalability of centralised computational systems, is fundamental to the front-to-back operating model demanded by decision-makers in the front office to oversee risk, construct portfolios, attribute performance and view investment books of records – all in near real time.

Application programming interfaces (APIs) and the Cloud are two critical enablers pivotal to the creation of end-to-end ecosystem connectivity, continues Kathayanat. The former integrates disparate programs to deliver datasets where they are required in real time, and the latter facilitates this by organising the panoply of data required by investors, accelerating its portability.

“Going forward, it will be de rigueur for agent banks to invest in the integrated ecosystem – the agent bank of tomorrow should be willing to engage in digital connectivity at a scale far beyond what’s implemented today, as the stakes are more than just commercial,” he concludes.