8 February 2024

Amid market challenges and regulatory pressures, global custodians are beginning to manage their network much more strategically. With contributions from three securities services providers, flow’s Clarissa Dann explores the changing dynamic between global custodians and their sub-custodian/agent bank partners

MINUTES min read

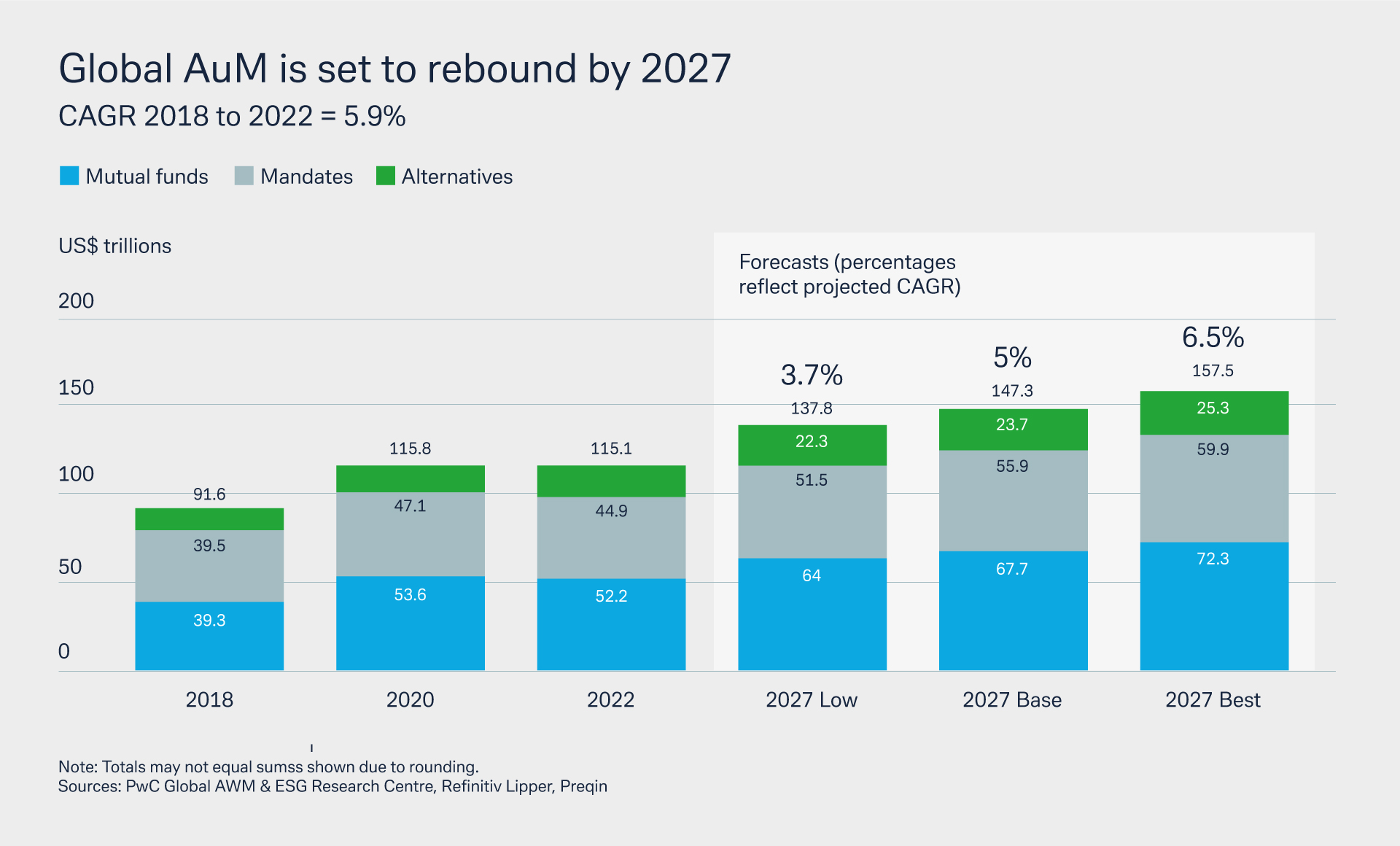

Some US$115.1trn is held in global assets under management (in exchange for fees) – a number that has been steadily rising since 2003 (see Figure 1), with a few bumps along the way. In their July 2023 Global Asset and Wealth Management Survey1 PwC notes that assets under management (AuM) dropped almost 10% below the 2021 high of US$127trn, but that they expect a rebound by 2027 to US$147.3trn (see Figure 1).

Growth has been propelled by the burgeoning wealth of high-net worth individuals and the mass affluent, as well as a pronounced shift to defined contribution retirement saving. In addition, regional accelerations are playing a part – “Asia-Pacific, along with frontier and emerging markets in Africa and the Middle East, will set the pace of growth in AuM,” notes the survey.

Institutional investors, money managers and broker dealers depend on custodians and other market participants for the efficient handling of their securities portfolios around the world.

But what does this actually involve? And how has the custody role changed in response to seismic technological shifts in the form of cloud technology, artificial intelligence, in a world where data underpins all?

As helpfully observed by Clive Bellows, Head of Global Fund Services EMEA at Northern Trust, “The custodian of the future – Custodian 3.0 – cannot be all things to all people. Clients will expect access to the best technology at any given point of time – enabling them to take advantage of new platforms and strategies to help maximise returns and minimise risk. While these custodians should provide services through technology, they shouldn’t attempt to reinvent themselves and transition into a pure technology company. Rather, they must continue to focus on maintaining the core principles of protecting assets and supporting clients’ investment strategies.”2

To hear more about the “custodian of the future”, flow held interviews at Sibos Toronto 2023 with experts from three of the world’s largest global custodians – BNY Mellon, Northern Trust and State Street – on how the approaches to their sub-custody (or agent bank) networks are changing.

Key roles and responsibilities

Figure 1: Assets rebounding by 2027

Source: Asset and wealth management revolution 2023: The new context (pwc.com)

Providers of global custody services are typically large banks or financial institutions, but what are the core responsibilities of the global custodian? Broadly they can be grouped as follows:

- Safekeeping of assets. This involves maintaining proper records of ownership, valuation, accounting, and reporting of assets owned by a plan/fund sponsor or an institutional investor throughout the trade lifecycle.

- Trade processing. Tracking, settling, and reconciling assets that are acquired and disposed by the investor—either directly or indirectly—through delegated authority with an asset manager.

- Asset servicing. Maintaining all economic benefits of ownership such as income collection, corporate actions, and proxy voting.

Therefore, as an asset servicer, a global custodian is responsible for administering investment-related activities, such as clearing and trade settlement, collection of income, proxy processing, corporate actions, and cash movement activities. They provide these services on a global scale, both within the jurisdiction(s) in which the custodian is directly located and in other jurisdictions as well, ensuring assets are held securely and transactions are executed efficiently and accurately.

To facilitate access for investors into the securities markets worldwide, a global custodian works with agent banks (termed ‘sub-custodians’) on the ground to handle tasks in foreign markets such as safekeeping of assets, settlement, record-keeping, market access and advocacy. Agent banks therefore perform a variety of roles for their global custodian partners and are an important participant in the end-to-end custody lifecycle, providing direct market access and expertise to ensure compliance with local regulations.

In today’s rapidly changing custody landscape, global custodians are seeking proactive partnerships with agent banks that focus not only on asset safety, but also long-term strategy with the potential to build mutually beneficial products and services together. This is fundamentally changing the dynamic between global custodians and their agent banks– moving from a purely transactional relationship to one that is based on an agent bank’s ability to invest in new technologies and integrate existing services. In summary, selection criteria are:

- Evidence of resilience and track record of asset safeguarding.

- Transparency so that clients always know the status of requests and enquiries.

- Immediacy – so that clients have access to new markets, improved straight through processing and settlement statistics.

- Responsiveness – so that clients know who to contact when they need help and get the support they need.

- Insight – so clients have access to market experts who have market influence to advocate on their behalf.

- Local, on-the-ground expertise (eyes and ears).

- Capability of building new products and services in partnership.

Resilience

Safeguarding assets

A core function of the sub-custodian (or agent bank) is to safeguard the assets held in custody. As a result, when appointing an agent bank, global custodians have traditionally focused their efforts on ensuring the partner has the appropriate security measures, risk management procedures, and insurance schemes in place to protect the assets from theft, fraud, or other forms of loss. This is, however, starting to change, with recent market events bringing other priorities into sharp focus.

“Asset safety has always been the cornerstone of global custody”

For example, the collapse of Silicon Valley Bank, Signature Bank and Credit Suisse in early 2023 demonstrated the need for strong due diligence around a provider’s resiliency and contingency planning measures – with financial strength to withstand market fluctuations and operational challenges.

“Asset safety has always been the cornerstone of global custody and we continually look for ways to further enhance the resiliency of our network,” says Michael Buzza, Global Head of Network Management and Market Strategy, Northern Trust. “We look at all levels of resiliency within the network, including the contingency measures within the core operations of who we appoint as a primary provider while also maintaining the same view with alternative agent banks. We also evaluate different access models for each market together with assessing all possible options regarding how we can recover assets in the event of a default of the account provider.”

Fiona McNally, Global Head of Network Management, BNY Mellon develops this point further, “We do a due diligence review on all our local sub-custodians in every market. A key part of that due diligence review is the resiliency of the contingency arrangements. And if there were any failings – this would be an issue”.

Digital assets and safety

Outside of traditional custody, the turmoil of cryptocurrency exchanges – such as the high profile collapse of FTX a year ago – has also raised questions around how digital assets can be safely held in custody. Investors who focus on digital assets are turning to traditional regulated companies and banks for these services, as opposed to crypto exchanges that have typically also doubled up as crypto custodians. Paul Maley, Deutsche Bank’s Global Head of Securities Services reflects on how client asset protection is an intrinsic part of all the securities services a global bank such as Deutsche Bank offers. “Following the demise of FTX and the huge fines levelled on Binance last month,3 the momentum in the development of digital assets will only continue towards well-governed, regulated and on-shore financial providers.”

In tandem, market-level events, such as the ongoing conflicts in Europe and the Middle East, are also a factor, with global custodians looking closely at a provider’s exposure to riskier markets. Effective communication during times of market turbulence is a must – and it is increasingly important that the agent bank has a clear communication plan in place to ensure global custodians are promptly informed about any developments that may affect their assets.

“Effective communication from sub-custodian to global custodian…is a key differentiator”

“Everyone experiences these kinds of contingencies, but effective communication from sub-custodian to global custodian – to update them on what the issue is, how they think they want to resolve it, what kind of timeline, etc. – is a key differentiator,” says BNY Mellon’s McNally.

Local expertise

Figure 2: Summary of global and agent bank relationships

Source: Deutsche Bank

One enduring component of the agent bank model is local market navigation. “We are their trusted partner in the local market” explains Kamalita Abdool, Head of Securities Services Americas, Deutsche Bank. Global custodians rely on their agent bank for critical sub-custody support, adding geographical coverage they deliver to the end client. Agent banks add value by navigating for the global custodian, information flow, and regulatory changes in local markets.

“It always comes back to the same key areas, which are: access to market for account opening, tax and asset servicing; and advisory and advocacy within the market,” adds Daniel Hickey, Global Head of Network Management, State Street.

Market advocacy

‘Market Advocacy-as-a-Service’ is an important part of service for global custodians. Agent banks maintain deep relationships in the regions in which they operate, often due to well-established teams and operations – and use this position to not only to provide access to local markets and exchanges, but to influence trends and policy in the local market. Global custodians rely on their agent banks to represent their interests in the local market, alongside other clients, as maintaining an expansive network themselves of in-house custody operations to the same level in each market, would be costly and resource intensive.

For example, in markets such as India, which moved to T+1 settlement cycle last year (see India trumpets T+1 settlement), Deutsche Bank – in its agent bank role – facilitated discussions between clients and regulators to address challenges and provide transparency across the whole process.

“We like to work with various regulatory and industry bodies in India, – and with Deutsche Bank accompanying us to our meetings – so that we can advocate how foreign portfolio investors handle some of the nuances of that market. This way, we can look for ways to potentially make the market more open and reduce some of these friction points,” says State Street’s Hickey.

“Our sub-custodians advocate on our behalf with local market stakeholders, such as central security depositories and regulators. This is important and allows us to deliver our ‘local everywhere’ service to clients,” adds McNally. “They also play a key role when it comes to market advocacy. Acting as our sub-custodian, Deutsche Bank has, for example, been instrumental in interpreting some of the regulatory nuances to ease roadblocks to foreign investment in the market.”

Digital marketplaces

As traditional financial and digital ecosystems converge, this tests the custody relationship, explains Northern Trust’s Buzza. As he puts it, “Its vitally important that we understand how to govern, manage, and have the requisite oversight for digital marketplaces. We won’t all wake up on Monday morning and all markets have converted to digital, so digital and traditional assets will coexist for at least the next 10 to 15 years.”

The strategic use of data is already having a profound impact globally, across all sectors – and the full benefits are likely not yet unlocked. A McKinsey report found that the broad adoption of open-data ecosystems could range from about 1% to 1.5% of GDP in 2030 in the European Union, the United Kingdom, and the United States, to as much as 4% to 5% in India.4

Buzza is a firm believer that “technology will enable direct access to data”. He explains, “Right now we all maintain our own islands of data, we all maintain our version of the truth, and we all buy and sell data to each other. If I look forward to the next 10-15 years, there will be a single source of data through digital ecosystems that I will access directly.” What does this mean for current agent bank/local custody relationships? “They will change, continues Buzza. “However, even if I can get access to real-time data through direct market access to a digital infrastructure, agent banks will still need to service those assets”. His point is the same piece of data is used in different ways. “I’ll be using data to settle trades, while agent banks will be using it manage lifecycle events, corporate action, taxation purposes and income”. “It’s about how my asset service provider uses the data to provide services to me,” he concludes.

“The seamless transmission of data points – such as trade status, and corporate action data points – allows us to provide this data to our clients, which helps us to provide them with full transparency around their investment operations and further strategic insights,” agrees McNally.

In short, for global custodians, being able to leverage data from agent banks/sub-custodians as if it were their own is a significant value-add and expands the data pool available, which, in turn, improves the quality of insights for clients.

To achieve this, it is becoming increasingly important for agent banks to be integrated with their global custody partners from a data perspective. “Getting sub-custodian data back to your end client as quickly as possible requires a common data model both within your organisation and at the sub-custodian you use – and this requires investment from both sides,” adds Hickey.

Cloud technologies are one such technological development which could improve data sharing between custodians and their clients, improving data transparency across the end-to-end custody lifecycle. As explored in a recent flow article (see Cloud of Transparency), Cloud technologies can overcome current challenges and delays experienced in multi-party workflows, by enabling custodians to share data with their clients in real-time and provide additional insights through deep-dive analytics (including the use of Artificial Intelligence) and self-service tools.

“We look for a partner who will invest into a future that aligns with our strategy and ambition.”

Strategic partners

Looking back a decade, one of the biggest differentiators a sub-custodian (or agent bank) could offer would have been price; now it is more about creating a long-term partnership.

State Street, for instance, views its local custody/agent bank network as an extension of its own offering. “We look for a partner who will invest into a future that aligns with our strategy and ambition, and at the same time understand our client base and is willing to go the extra mile to ensure that client needs are serviced," says Hickey.

When considering who to partner with, State Street is not thinking short term – it is basing its assessments on long-term strategic decisions, based on a five-to-ten-year outlook. According to Hickey, State Street is moving away from transactional cost saving decisions and instead having conversations about investment. This changes the narrative – focusing to a lesser extent on fees, and to a larger extent on the ability to foster a two-way investment between global custodians and sub-custodians (or agent banks) and ultimately, providing the best possible service to the end client.

Enabling the paradigm shift

Reflecting on the feedback from Buzza, McNally and Hickey, agent banks such as Deutsche Bank continually ask themselves if they can move with the required speed to make the paradigm shift happen in the fullest sense.

“This means not only being exceptional at the day to day, but also delivering strategic initiatives that are mutually beneficial such as enhanced technological capabilities, raising skill levels among staff, and building resilience into settlement chains,” concludes Deutsche Bank’s Abdool.