05 October 2023

Settlement compression, market harmonisation and digital readiness were among some of the main themes that were developed at Sibos Toronto 2023. flow’s Clarissa Dann looks at how these changes are impacting post-trade

MINUTES min read

At Sibos Amsterdam 2022, the themes of managing settlement fail rates, preparing for a T+1 post-trade world and digital asset custody readiness underpinned most conversations. Twelve months later at Sibos Toronto, those themes had returned, with an intensity nuanced by the US move to T+1 in May 2024, cost pressures on the buy side from higher interest rates and how new technologies such as artificial intelligence (AI) is changing the competitive landscape.

The handy Sibos 2023 app reveals no less than 15 sessions from a search on the word ‘securities’, that between them grappled with universal problems, suggested solutions and looked forward to how opportunities from cloud migration can deliver faster, cheaper and more accurate services all round.

Future of securities

The future of securities panel session. From left to right: Barnaby Nelson, CEO the ValueExchange; Stephanie Eckermann, CEO Clearstream Bank AG Frankfurt; Valerie Urbain, Chief Business Officer, Euroclear; and Matthew Bax, Global Head Securities, Citi

One of the early sessions to set the scene was alluringly entitled ‘The future of securities’ moderated by Barnaby Nelson of The ValueExchange with guests Stephanie Eckermann (Clearstream Bank); Valerie Urbain (Euroclear) and Mattew Bax (Citi). This lived up to its promise to “discuss the evolving landscape of securities services and explore the potential advancements and challenges that lie ahead”. Key points made by this panel included:

- The economic backdrop of higher inflation, a ‘normal’ interest rate environment, deglobalisation and shifting demographics has create a “very high level of disruption” – providing opportunities and threats to market participants and changing the competitive landscape.

- The industry is at a tipping point in digital transformation – accelerated by higher interest rates creating cost pressures on the buy side after a comparatively benign period. This is driving market consolidation and continuing the push onto the securities services industry for transformation.

- The ‘crypto winter’ has injected a necessary degree of reality into the crypto currency landscape. “Now there is reality with digital natives that we should tokenise the regulated world first,” said one panelist.

- There is as readiness for cloud migration in terms of infrastructure, data services and data governance – with digital transformation set to scale up over the next five years.

- The industry needs to be cater for new pools of liquidity, asset classes and financial market infrastructures (FMIs).

- More needs to be done translate all of this into more tangible benefits for the end client – ie “faster, more accurate and at lower cost”.

Shortening the settlement cycle

Kamalita Abdool Head of Securities Services Americas and Global Custodian Coverage at Deutsche Bank explains that having a global approach to preparation is key to being ready for the May 2024 U.S. market implementation of T+1. Her team has been taking advantage of all the 21 testing cycles available, with the first in August of 2023. “These market testing cycles simulate a live environment and allow our team to engage other market participants to identify and remediate any challenges that arise along the journey to May 2024,” she says.

“A shorter time frame during which trades are pending … frees up space for all market actors to have better capital deployment”

Unsurprisingly, settlement compression was a core theme at Sibos, and perspectives varied according to region. As Euroclear CEO Lieve Mostrey put it in "T+1 – the impact of one – and only one – day to settle securities” panel, advantages include, “a shorter time frame during which trades are pending – this frees up space for all market actors to have better capital deployment, to have more transactions and have more business for the same resources committed”. She also pointed out that central securities depositary regulation (CSDR) is focussing on settlement efficiency having introduced penalties around it. Mandating T+1 to CSDs, however, is not the way forward, she cautioned, and holistic view needs to be taken with some product lines, clients and business models having space to do their rethinking. “Awareness is still a bit low in Europe and we have to work on this,” she reflected.

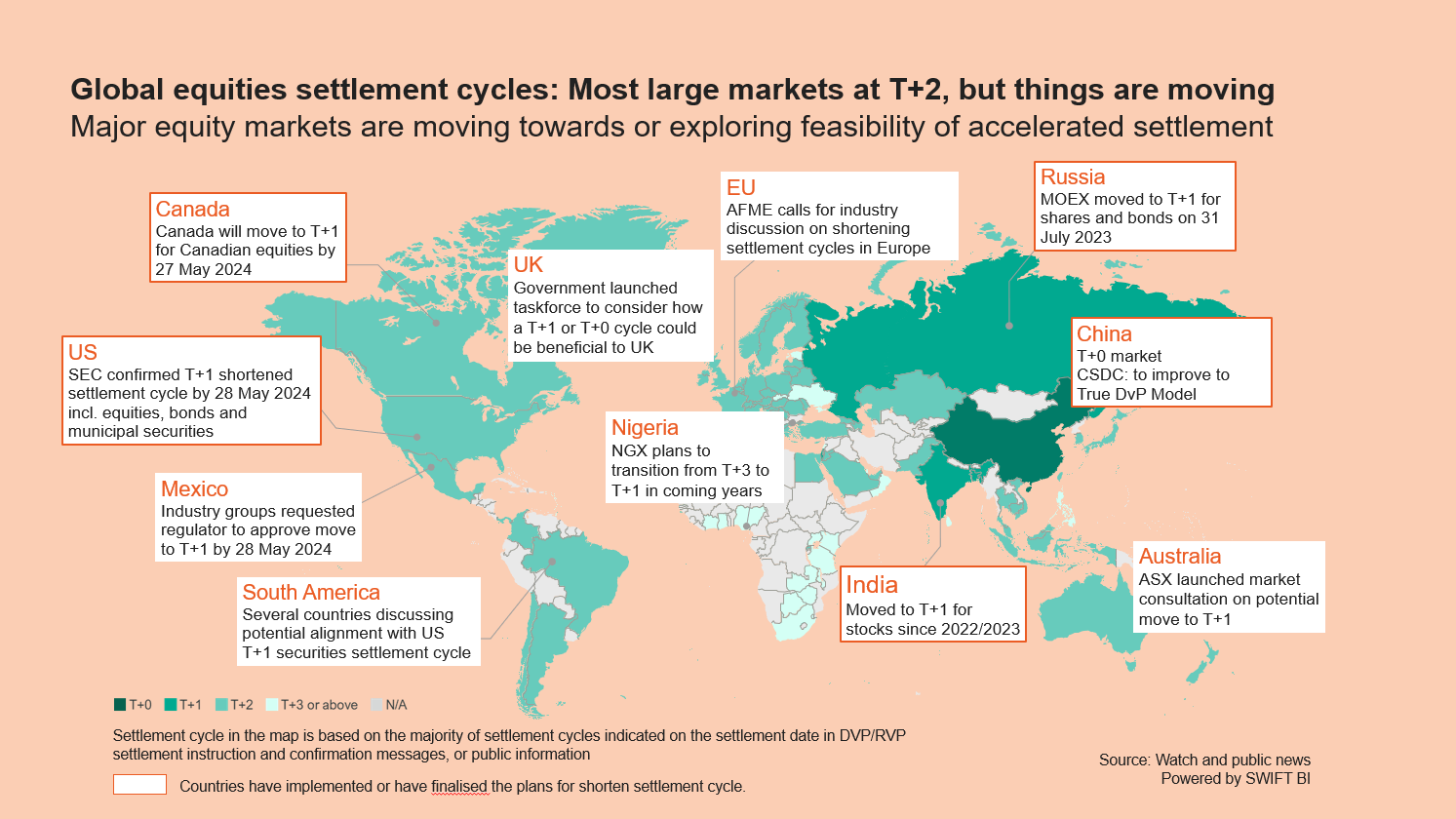

Figure 1: Global equities settlement cycles

Source: Swift BI

“T+1 is not insurmountable, nor is it as threatening as what has come before”

“Shortening the settlement cycle will help us de-risk our markets and make them more efficient, and this is probably a no regret move,” said Paul Maley, Managing Director, Head of Securities Services, Deutsche Bank, speaking on a Sibos Standards Forum panel –Shorter securities settlement cycles: How standards can turn challenges into Triumph, alongside Colin Parry, CEO of the International Securities Services Association (ISSA). Maley added T+1 could unlock a number of new commercial opportunities for providers. “One of those things I believe could be having FX liquidity spread over a greater number of time-zones rather than centred in Europe.”

Panel session: Shorter settlement cycles: How standards can turn challenges into triumphs. Left to right: Colin Parry (CEO, ISSA); Paul Maley, Head of Securities Services, Deutsche Bank

The audience heard that having dealt with extensive post-financial crisis regulation, T+1 implementation should be relatively straightforward for the industry. “If you think about what our industry has been through since the financial crisis with the introduction of Dodd-Frank, the Markets in Financial Instruments Directive II (MiFID II) and the Central Securities Depositories Regulation (CSDR), then T+1 is not insurmountable, nor is it as threatening as what has come before,” said Maley.

Circling back to the point made in The future of securities, the impact of higher interest combined with the move to T+1 leave little room for error. “If you are in a T+1 market and not sorted yourself out by T+0 you are in trouble. It will allow you to invest more if you are looking for a business case for investment in automation because the cost of failure is higher,” concluded ISSA’s Parry.

For many, T+1 will help mitigate market risk, especially during periods of volatility, as settlement duration will be shorter, meaning problems can be fixed more quickly and there will be fewer securities to deal with. Less risk translates into potential collateral synergies. As trading counterparties will have reduced exposure to each other during T+1, the Depository Trust & Clearing Corporation (DTCC) argues firms will no longer need to post as much margin, leading to substantial capital efficiency gains.1

According to the DTCC, there could be a 41% reduction in the volatility component of the National Securities Clearing Corporation’s margin requirements, corresponding into billions of dollars of savings for member firms.2 Whether these margin reduction rates will be the same at non-US central clearing counterparties (CCPs) is a question that remains unanswered for many at Sibos.

Potential obstacles and risks

AFME research suggests T+1 will result in the industry having 83% less post-trade processing time, which is likely to put enormous pressure on financial firms during the trade confirmation and affirmation process, possibly leading to a significant increase in trade fails, resulting in cash penalties under CSDR.

The impact of shorter settlements will be most pronounced in distant time-zones, with Asia likely to be the most impacted region. In some markets, this could mean that FX trades may need to be pre-funded creating additional costs and potential risk.

In the case of securities lending transactions, compressed settlement cycles will reduce the amount of time which people have to identify and recall on-loan securities, leading to breaks, and a possible increase in fails and fines.3 Due to the global nature of their underlying holdings, Exchange Traded Funds (ETFs) and Global Depository Receipts (GDRs) could face issues too.

Another possible obstacle, which has been flagged by the UK Government’s T+1 Taskforce, is the effect that T+1 will have on the fund subscription and redemption process, as EU domiciled UCITS typically settle on a T+2 or T+3 basis, a point made by Emma Johnson, Executive Director, Global Custody Industry & Regulatory Developments at J.P. Morgan, on her panel “All for T+1 and T+1 for all.”

Johnson also added T+1 might lead to complications during cross-border settlements involving instruments settling at multiple central securities depositaries (CSD)s. “If you were to purchase a security on a T+2 basis in say, Euroclear, but deliver it on a T+1 basis in DTCC, then you are going to have a one day fail. Now that one day fail will maintain the counterparty and market risk which we are fighting to eliminate and it will increase settlement risk,” she said.

Should the EU make T+1 mandatory, the situation could get messy for firms purchasing securities T+2 from a third country CSD and delivering them on a T+1 basis from an EU CSD, as it would lead to a one-day fail, resulting in cash penalties under the CSDR’s Settlement Discipline Regime.

Panel session: T+1 – the impact of one – and only one – day to settle securities, featuring Frank La Salla, CEO DTCC (centre) and Lieve Mostrey, CEO, Euroclear (right)

Preparing for T+0

While North America and Europe prepare for T+1, reports are emerging that the Securities Board of India (SEBI) is now considering a move to T+0 in 2024, despite having only just phased in T+1 at the beginning of this year. Although many at Sibos believe that T+0 is a natural next step for the industry, there is a broad consensus that financial institutions are not quite ready yet.

“The technology to support T+0 exists, but the issue lies with the market structure and market regulations. Regulations have to be looked at and rewritten for us to even consider a T+0 environment,” said DTCC CEO Frank La Salla, speaking during the T+1 – the impact of one – and only one – day to settle securities panel.

The industry also needs to navigate some of the logistical challenges highlighted by T+1, before it can think about T+0. “One element which is very important are the time zone differences. Already, we are hearing of firms moving to night shifts and moving people to other sides of the world to manage T+1, but these are temporary solutions. If we cannot manage the issues around time-zones under T+1, then T+0 will be a long way away,” according to Euroclear’s Mostrey.

Moving towards a world of improved settlement efficiency

With more markets adopting T+1/talking about adopting T+0 and toughening up on poor settlement discipline, or at least threatening to do so (i.e. CSDR Refit and the omnipresent threat of mandatory buy-ins), the industry is having to identify solutions to automate their post-trade operating models.

Our historical inability to track the lifecycle of a trade is a major reason why fails have remained so stubbornly high. Speaking the Unlocking the potential of the Unique Transaction Identifier (UTI) in Securities panel, Hannah Elson, Global Head of Custody at J.P. Morgan, said that while people can track their Amazon deliveries in real-time, such transparency has yet to filter into securities transactions.

Better visibility into the trading lifecycle will ultimately help firms achieve automation.

One solution would be for the industry to embrace Swift’s UTI, an alphanumeric code comprised of 52 characters that is assigned to a securities trade, allowing for trades to be tracked from end to end in the settlement lifecycle.4

Mike Clarke at the Pioneering Securities Tracking with the UTI session

The transparency benefits offered by the UTI are hard to dispute, according to Mike Clarke, Managing Director, Global Head of Product Management and Head of UK and Ireland Securities Services at Deutsche Bank, who was speaking on the Pioneering Securities Tracking with the UTI panel. Not only can the UTI provide assurances to trading counterparties that a transaction will match and settle as planned, but Clarke added it notifies firms earlier if there are problems during the settlement life-cycle, allowing them to resolve any issues before it is too late.

For the UTI to work, it needs to be adopted by as many intermediaries in the chain as possible, a point made by Clarke during his panel. “Having a common reference throughout the settlement chain makes matching much easier. Having a unique reference will only help if people use that reference. The industry can make its life easier by using the UTI, so please let’s all use it,” he said.

“The industry can make its life easier by using the UTI, so please let’s all use it”

However, speaking to flow at the Deutsche Bank Sibos stand, Clarke said there was a “chicken and the egg situation” within the industry about adopting the UTI. This raises the question as to whether the UTI should be made mandatory for the industry through regulation, with a Sibos poll revealing 76% of people are in favour of this idea, versus 24% against.

Market harmonisation and digitalisation

Panel session: ISO 2022 and securities markets: to be or not to be? From left to right: Giles Elliott, Head of Strategic Business Development, Capital Markets, TCS (Moderator); Juliette Kennel, Head of Standards, Swift; Emma Johnson, Executive Director, Global Custody Industry & Regulatory Developments, J.P. Morgan

Harmonisation and digitalisation in securities markets have been recurrent themes at Sibos conferences for decades now, and 2023 was no exception.

In the cross-border payments space, the industry has aligned and set a date for migration to ISO 20022 by 2025. In the securities space, although ISO 20022 is already used in many areas, no industry wide date has yet been set. J.P. Morgan’s Johnson, speaking on the IS0 20022 and Securities Markets – to be or not to be panel highlighted that the European Central Securities Depositories Association (ECSDA), an industry group, had published a discussion paper5, which talked about retiring the ISO 15022 message in general meetings from 2026 and replacing it with ISO 20022, and doing the exact same thing for corporate actions and market claims from 2030. Swift’s Global Head of Standards Juliette Kennel underlined the importance of ensuring that, before any migration dates are set, there is “a compelling business case and a clear mandate from the industry”. She added that “rather than moving from one syntax to another, the industry should focus on further harmonising underlying processes, particularly in the area of corporate events, and adopting standardised messages in areas where automation is lacking, because that will drive real efficiency and cost reduction”.

Regarding innovation there was a degree of caution at Sibos about too much hype in a particular direction of travel, with speakers taking a more nuanced view on topics like tokenisation. On a panel titled “Blazing the trail towards an interconnected tokenised world”, Stephanie Lheureux, Head of Digital Assets Excellence at Euroclear, said that despite the industry conducting experiments focused on tokenising funds, bonds and equities on Distributed Ledger Technology (DLT) infrastructure, liquidity is limited as these initiatives have largely been conducted in silos.

But readiness is key. Although institutional investors are not trading regulated digital assets in large numbers today, this has not deterred custodians from future proofing their operating models, a point made by John Sweeney, Head of Digital at State Street, speaking on the Evolution of traditional and digital custody in an integrated marketplace panel.

“If you look at State Street’s core businesses, they are custody, fund administration and transfer agency. We are taking a look at those processes to see how we can digitalise them for the benefit of our customers and ultimately the end investors,” said Sweeney.

Sibos 2023 Toronto took place at the Metro Toronto Convention Centre 18–21 September 2022, and a number of sessions featured in this article are available virtually to Sibos registrants on demand