24 September 2021

One of the problems with securities settlement happening up to two days following the execution of the trade is the potential for operational and counterparty risk during that window. flow hears from Deutsche Bank’s Mike Clarke and Emma Johnson on the industry and regulatory cooperation, as well as the collaboration needed for instantaneous settlement

MINUTES min read

Despite the ongoing global transition towards a harmonised T+2 settlement cycle, a number of market participants believe improvements are still needed. Following the unprecedented market volatility in 2020 and 2021, there are growing calls in certain quarters for a further compression of the existing T+2 settlement cycle to either T+1 (one day) or T+0 (the same day). However, such a shift will not be a straightforward

exercise.

T+2: An industry best practice that could be better

“The direction of travel among many of the major markets has been towards a T+2 settlement cycle,” says Emma Johnson, Head of Securities Services Market Advocacy at Deutsche Bank.1 “In the European Union (EU), the Giovannini Barriers were first published at the turn of the century outlining some of the impediments inhibiting seamless cross-border clearing and settlement. This ultimately paved the way for the passage of Target2-Securities and the Central Securities Depositories Regulation [CSDR], a landmark piece of regulation which introduced a T+2 settlement cycle across the EU.”

Shortly afterwards in 2017, the US Securities and Exchange Commission [SEC] announced it would reduce the securities settlement cycle from T+3 to T+2. Leading APAC markets – including Australia, India, Indonesia, Japan, Hong Kong, Korea, New Zealand, Singapore and Taiwan – have also migrated to T+2.2

“The principal benefit of leveraging T+2 – as opposed to say T+3 – is that the former has a shorter settlement duration, meaning there is significantly reduced operational and counterparty risk between different trading counterparties. This can enable firms to lower their CCP (central counterparty clearing house) margin requirements leading to meaningful capital and collateral savings,” comments Mike Clarke, Global Product Manager at Deutsche Bank.

As T+2 is so ubiquitous among the leading markets, it also facilitates easier and more cost-efficient cross-border investment and operational support. This is vital, given some of the cost challenges now facing investors. Although T+2 is the market norm, it does have some limitations. While T+2 is a much better settlement model to adopt than T+3/4, on-exchange trading counterparties are still exposed to each other for two days after the trade date, a point made by Clarke. In the context of the recent market volatility, two days is a long period of exposure, meaning counterparties incur a lot of risk. A shorter settlement cycle could help firms offset this duration risk.

Moving towards a T+1 model: Is it a realistic prospect?

Amid growing scrutiny of the current T+2 model, some within the industry – most notably the Depository Trust & Clearing Corporation (DTCC) – have pushed for the introduction of a T+1 settlement system. In its paper – Advancing Together: Leading the Industry to Accelerated Settlement – the DTCC argued a T+1 settlement model would bring about major cost savings; reduce market risk; and lower margin requirements.3

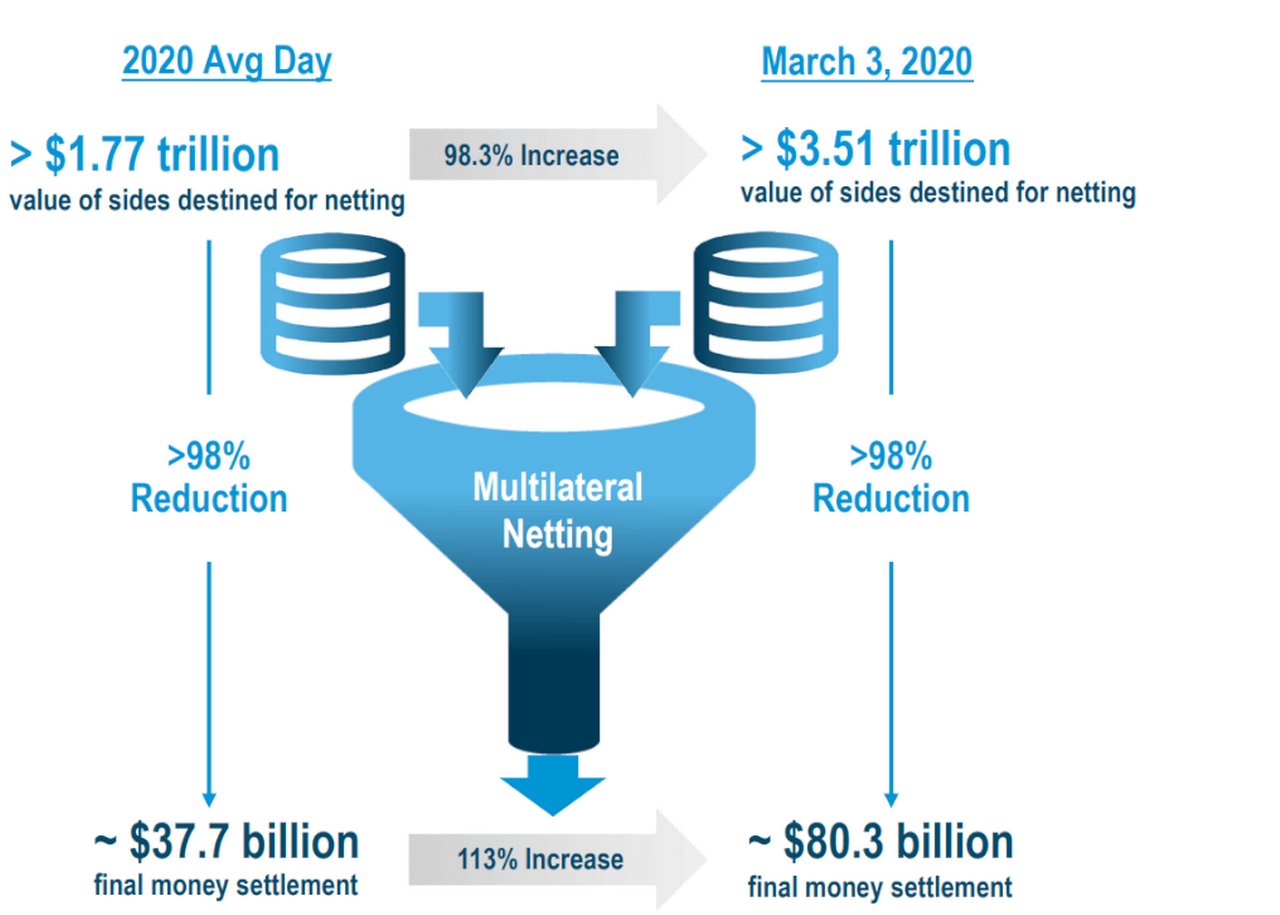

The paper makes the point that 3 March 2020, was “one of largest transaction value days on record for DTCC’s equities clearing subsidiary, National Securities Clearing Corporation (NSCC)”. It adds, “On that day, the value of shares moving through the system exceeded US$3.51trn; however, the actual dollar value requiring final money settlement was reduced over 98%, to just US$80.3bn” (see Figure 1).

Figure 1: DTCC on 3 March 2020

All of this will help provide a useful boost to market liquidity. According to its own calculations, the DTCC estimated a shift towards T+1 could result in a 41% reduction in the volatility component of the National Securities Clearing Corporation’s [NSCC] margin.

The cost benefits, especially during bouts of volatility – would be significant. Fuelled by the meme trading in January 2021, transactional volumes on the NSCC reached unprecedented heights – exceeding the activity witnessed during March 2020 – leading to the NSCC increasing its industry-wide margin demands from US$26bn to US$33.5bn.4 A shorter settlement cycle would have resulted in far fewer margin calls. In response, the DTCC has recommended the US settlement cycle move to T+1 by 2023. The DTCC is not the only institution recommending a wholesale shift towards a T+1 cycle in the US. A number of high-profile market makers and industry bodies have also called for a review into the current T+2 settlement model in the US, following some of the volatility seen earlier in the year.

However, a market-wide shift in the US to T+1 is not without its challenges, and these need to be overcome first. Most significantly, a market that chooses to adopt T+1 risks causing huge logistical problems, especially for investors operating across different time zones. This could create inefficiencies around trade matching and end of day reconciliations. A recent proposal by India’s regulators to introduce T+1 incurred heavy criticism from the Asia Securities Industry and Financial Markets Association [ASIFMA], which warned that the different time-zones between Europe/US and Asia-Pacific would create operational complexities for investors, particularly around FX management.5 This is because the two day settlement window helps global investors manage their FX, a point made by ASIFMA. However, a pivot to T+1 would force FX to be booked on the same day/T+1 meaning all parties in the settlement chain will need to confirm the trades on trade date.6 ASIFMA noted this may create issues around pre-funding − an outcome that would not be well-received by global investors.

“A transition to T+1 could also lead to added market fragmentation”

“A transition to T+1 could also lead to added market fragmentation. While fragmentation is not a new phenomenon or necessarily problematic (e.g. the US and EU both introduced T+2 at alternate times without significant issues), the differences between T+1 and T+2 – relative to T+2 and T+3 – are more acute,” comments Johnson. Implementation of T+1 carries more risk too, particularly from a regulatory perspective.

“Although T+1 theoretically reduces counterparty risk, it can increase settlement risk. A shorter settlement cycle might result in more trade settlement fails, which will incur either fines or mandatory buy-ins under regulations such as the EU’s CSDR SDR [Settlement Discipline Regime],” she adds. Meanwhile, Clarke warns that the cost of implementing T+1 could be disproportionately high, especially as providers will need to invest heavily into their operations and technology. At a time when margins and fees are being squeezed, this will be a challenge. To maximise the benefit of any shortened settlement cycle, the industry should also be reviewing the end to end front to back value chain to remove inherent inefficiencies.

T+0: The future beckons

While there is scepticism about the merits of introducing a T+1 settlement cycle without impacting the value chain, market practitioners are also open to the concept of T+0, otherwise known as instantaneous or atomic settlement. Again, the benefits of shorter settlement cycles (e.g. less counterparty risk, capital and liquidity savings) ring true for T+0 just as they do for T+1. It is also clear that many of the barriers inhibiting T+1 will likely be the same obstacles hampering the future adoption of T+0. “New technologies could help the industry overcome these underlying problems,” suggests Clarke. “Rather than accelerating the settlement cycle to T+1 using existing technology and processes, forward-thinking post-trade providers believe that the industry should leverage innovative technologies such as DLT (distributed ledger technology) and smart contracts to achieve T+1 or directly to T+0.” So how can this be done?

“Another driver behind the potential adoption of T+0 is the growing appetite for digital assets such as tokenised securities”

Whereas DLT provides a real-time, single source of truth, smart contracts can be utilised to facilitate securities and cash settlement in what would create an ecosystem supporting atomic settlement, namely the simultaneous transfer of cash and securities. This could help market users procure massive operational and cost savings, especially as instantaneous settlement would remove the need for CCPs. Similarly, the emergence of central bank digital currencies (CBDCs) could play a role in bringing about T+0. CBDCs – namely digital iterations of fiat currencies issued by central banks,7 which are stored on a DLT – engineer efficiencies in securities settlement by using central bank money. As investment into these technologies increases, the possibility of delivering on T+0 will grow.

Another driver behind the potential adoption of T+0 is the growing appetite for native digital assets or forms of tokenised securities, continues Clarke.8 While there are reservations about the virtues of tokenising existing assets such as equities and bonds – mainly because it could result in a splitting up of the underlying liquidity – Clarke says there is a compelling case for potentially tokenising illiquid instruments such as real estate. Through tokenisation, once illiquid instruments could become more accessible as collateral, which in turn will help generate much-needed liquidity.

“The priority for the securities industry should be on identifying ways in which these new digitally native assets can be transacted and settled on a T+0 basis from the outset” explains Clarke. In fact, the settlement of digital assets is something in which regulators – such as the European Commission – are taking an interest. Among one of the objectives of the EU’s proposed Markets in Crypto-assets Regulation (MICA)9 is the establishment of a sandbox for market infrastructures to support trading and settlement of regulated digital assets using DLT. This could pave the way for new technologies to be integrated into the trade settlement process − in what could precipitate an eventual roll-out of T+0.

However, there are stumbling blocks which need addressing. Today, technologies such as DLT, digital assets and smart contracts are not subject to uniform industry standards or common regulation. Without some degree of basic harmonisation, the ability for market participants to interoperate with each other in post-trade processes such as trade settlement risks being undermined. More fundamentally, T+0 will never be achievable unless other activities in the investment value chain become real-time or instant as well. For example, if payment settlement systems and FX processing continues to rely on antiquated or legacy technologies, then T+0 will be harder to achieve. Only unless there is meaningful digitalisation across the entire transactional life-cycle will T+0 become a reality.

Next steps towards T+0

“If T+0 is to materialise, providers of post-trade – together with market regulators and industry associations such as AFME [Association for Financial Markets in Europe] and SIFMA (Securities Industry and Financial Markets Association] – will need to collaborate closely,” says Johnson. At the same time, the industry must embrace new technologies and members engage with each other in development so it can overcome the operational challenges synonymous with short settlement cycles.

Sources

1 See CSDR: Settlement discipline regime client toolkit at corporates.db.com

2 See https://bit.ly/3ztawEL at sec.gov

3 See https://bit.ly/3krxRSQ at dtcc.com

4 Financial Times (17 August 2021) “US banks and brokers set stage for shift to one day equities settlement”

5 Business Standard (6 November 2020) “T+1 settlement not aligned to global standards, ASIFMA tells SEBI”

6 See note 5

7 See CBDCs and the impact on cross-border payments at flow.db.com (4 August 2021)

8 See Token power at flow.db.com (25 June 2021)

9 See https://bit.ly/3lKp3ad at europarl.europa.eu

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SECURITIES SERVICES

Automating assets Automating assets

Deutsche Bank’s Boon Hiong Chan and Celina Chua assess how digital tools are being employed in post-trade to deliver new benefits to clients services at the front end of the securities lifecycle

TECHNOLOGY, SECURITIES SERVICES, CASH MANAGEMENT

Digital assets in 2021 Digital assets in 2021

With more companies using digital assets, flow’s Janet Du Chenne hears from Deutsche Bank’s Regulatory and Securities Services experts on the game-changing initiatives that are driving their adoption in financial services

WHITE PAPERS & GUIDES

DLT and digital asset’s path to smart custody DLT and digital asset’s path to smart custody

In the face of declining fee levels and increasing regulatory and market requirements for asset protection and market stability, the securities post-trade industry seeks a sustainable future. Distributed Ledger Technology (DLT) may provide part of the answer by realigning the roles of its participants