24 September 2020

Deutsche Bank’s Boon Hiong Chan and Celina Chua assess how digital tools are being employed in post-trade to deliver new benefits to clients at the front end of the securities lifecycle

We live in extraordinary times. The COVID-19 pandemic and the resulting lockdowns came as a major shock to many companies. With market uncertainties and volatility expected to further increase in the foreseeable future, digital transformation is no longer a choice, but a necessity.

As digital penetration accelerates, Deutsche Bank Securities Services (SES) is committed to using advanced digital techniques such as Distributed Ledger Technology (DLT), application programming interfaces (API), artificial intelligence (AI), data analytics and machine learning. These will deliver client-centric securities services, and transform our custody and clearing, domestic fund services and agency securities lending product suite.

This strategy reflects Deutsche Bank’s strength, as a leading German bank with strong European roots and a global network, backed by 150 years’ experience of enabling clients to conduct business all over the world. We are confident that by successfully navigating these technologies disrupting the Securities Services industry, we can reduce data latency, improve transparency and improve overall client experience.

What does blockchain/DLT disruption look like?

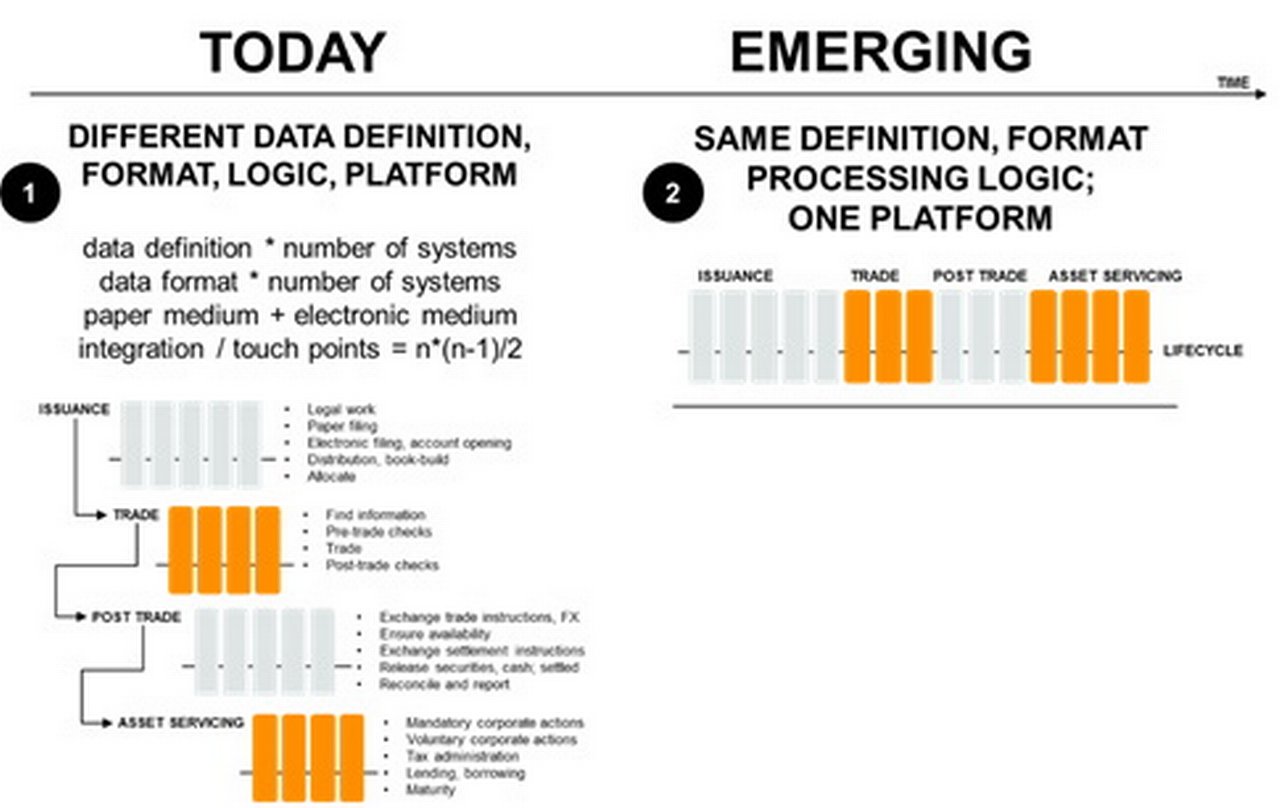

DLT follows a set of common data definitions, formats and business logic for its participants. In this way, it creates a virtual common platform for all participants to exchange trusted information without different message format mapping, systems integration or manual workarounds (see figure 1), while allowing for new workflow process efficiencies and productivity to be realised.

With key securities transaction participants all on the same platform, DLT provides seamless concurrent multi-party communication as a shared ledger capable of enforcing transaction confidentiality. Information can be accessed more directly by concerned parties than with sequential steps that have traditionally been necessary.

In the capital markets industry, these aspects can be used to mitigate time pressure on activities with tight timeframes, such as preventing settlement fails or offering optimal collateral management, when operational risks are amplified by a lack of time. Some examples of how this technology is used to achieve these benefits are offered below.

Figure 1: Existing multi-platform processes, and emerging single platform processes

Source: Deutsche Bank Securities Services

1. Project Synapse1 – Delivering faster, trusted information to participants to manage northbound stock connect settlement risks

In the Hong Kong Exchange’s (HKEX) Project Synapse, a blockchain based prototype for Stock Connect. The prototype, completed at the end of 2018, sees DLT combine with other technologies to address cross-boundary investment channel Northbound Stock Connect’s settlement challenges arising from the same day four-hour settlement time window for all parties – asset managers, brokers, clearing members, custodians – some of whom may be based in different time zones. By avoiding the exchange of multiple differing data formats between participants, this reduces reconciliation times and means less time pressure for trading participants. Once completed, this project will facilitate cross-border investments into Mainland China’s equities markets.

2. Thailand DLT one-Baht bond2 – creating financial inclusion, and savings opportunities for the rural population

In June 2020, the Thai Ministry of Finance fully sold its THB200 million 1.7% 3-year government savings bonds issue through DLT to local retail investors using a bank-provided e-wallet. The unique features of this digital DLT bond include a face value that was as low as THB1 (~CNY0.23), which could potentially helped to promote financial inclusion by enabling the less affluent to participate in the savings markets.

Through this initiative, DLT facilitated cost-effective and reliable distribution of digital financial assets – and coupon payments – to new segments of investors.

3. Deutsche Bank’s Ethereum experiment

Reflecting the industry’s progress, Deutsche Bank SES has been assessing DLT applications in digital assets, safety and soundness, market infrastructure and value-chain processes.

In 2019, we completed an internal Ethereum-based experiment that mimicked an OTC bond lifecycle with digital “money” through allocation, primary issuance to secondary market trading and post-trade activities. In the experiment, we identified how existing roles could evolve when using DLT. Depending on the market structure there is, for example, potential for industry fixed costs to be better managed.

We also published a white paper3 sharing our insights on DLT and process re-engineering or tokenisation of other asset classes.

In another example, SES also launched a pilot that explores using DLT to enable beneficial ownership transparency in Europe, thereby simplifying compliance with regulatory requirements.

In addition to DLT, our strategic product portfolio includes practical applications of other technology such as APIs, artificial intelligence and data analytics.

Real time data and client connectivity via API

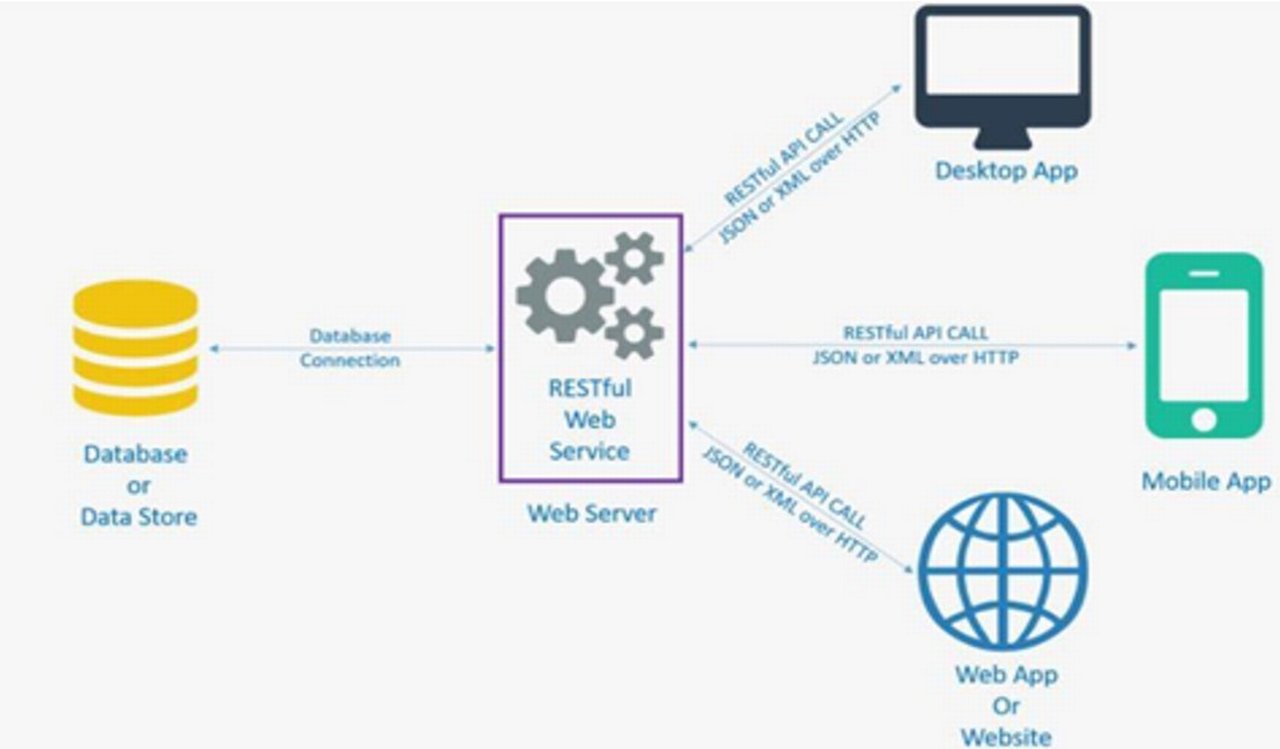

APIs allow one piece of software to interact with another, enabling authorised third-party developers to build products and services on top of software applications to access data or process transactions (see figure 2). APIs are already used on smartphones for weather apps, timetables, restaurant and theatre bookings for example. In China, payment services have become more closely connected with social media and retail platforms, such as WeChat Pay and Alipay, becoming an inextricable element of the user experience.

Figure 2: APIs foster real time data and client connectivity

Source: Deutsche Bank Securities Services

API use case 1: Enabling real time cash notifications

SES is currently building a unified API ecosystem, which will provide a flexible platform to support the Open Bank business models, in turn allowing our clients to integrate with Deutsche Bank in a seamless and more secure way.

SES has already enabled an asset management company to enhance its liquidity management with real-time cash notification APIs. The solution is also beneficial to corporate treasurers for cash positions forecasting subsequently eliminating the risk of unnecessary overdrafts or uncompleted transactions due to a lack of balance visibility. It also reduces the volume of liquidity reserves required. This ultimately leads to lower borrowing costs and higher investment returns.

API use case 2: Real time trade settlement status updates

We are also expanding the use of APIs with partners such as Symphony to increase the efficiency of multi-party communications, with the help of “bots” that can run semi-autonomously.

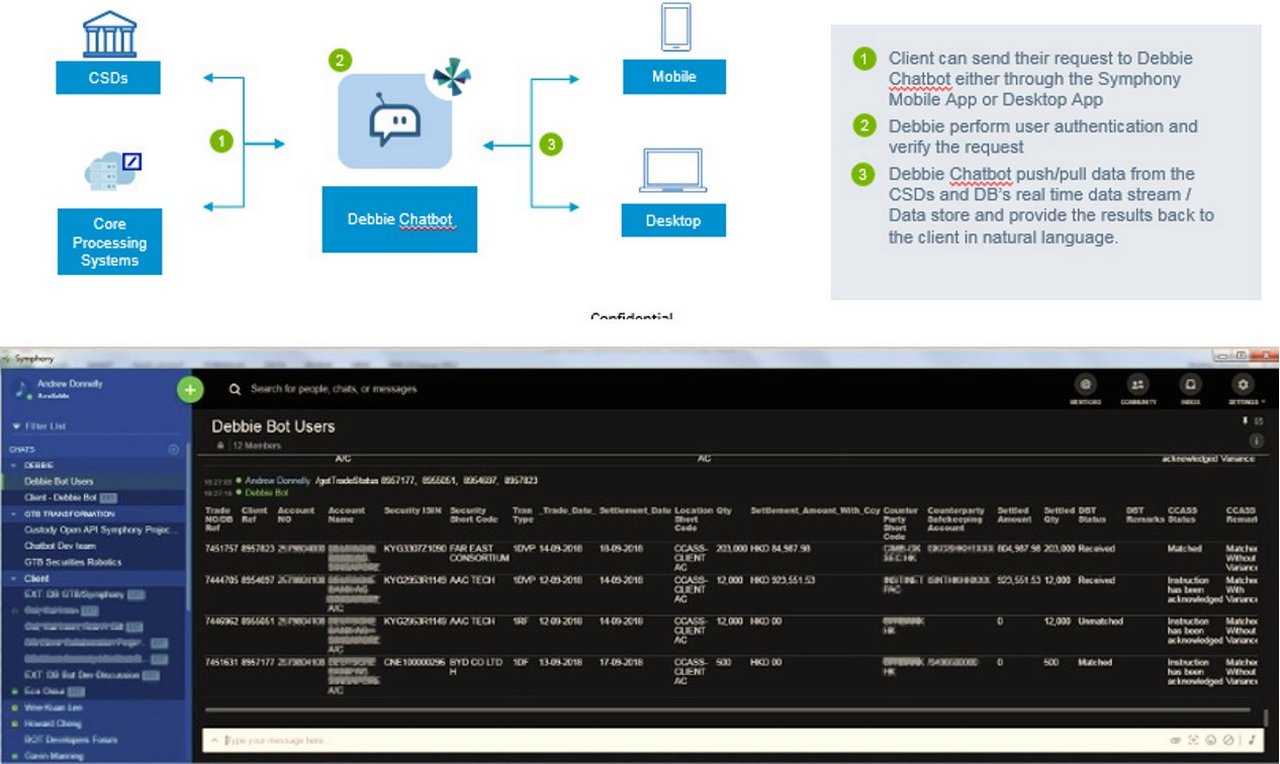

Debbie, a chatbot-to-chatbot or user-to-bot which directly interacts with our clients, was designed and built to automate settlement queries within a secure messaging platform (see figure 3). This solution created an ecosystem that facilitates automated queries on trade settlement status from:

“the end user→ our Client → Deutsche Bank → the Central Securities Depository”

Debbie is live on the Symphony platform and is able to fulfil client requests and provide clients with direct control on post-trade processes. The chatbot provides near instantaneous reply to trade settlement enquiries and allows trade settlement on demand.

This work paves the way for addressing other post-trade operational risks such as potential settlement failures.

Figure 3: Deutsche Bank’s Chatbot Debbie automates settlement queries

Source: Deutsche Bank Securities Services

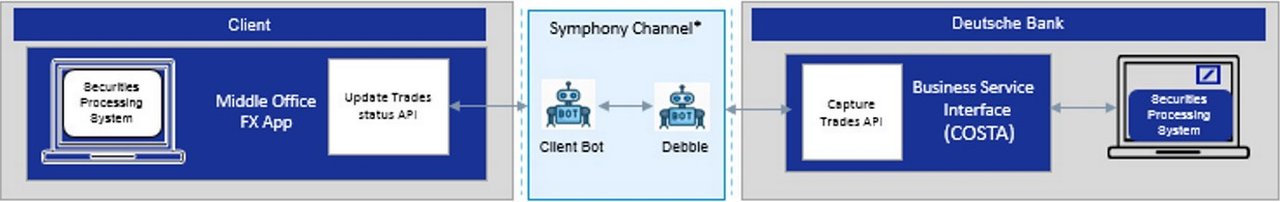

API use Case 3: Real time processing of FX requests

In the first half of 2020, SES collaborated with a global custodian bank to establish API connectivity from our core systems into the client’s applications to enable the real-time processing of FX requests linked to the underlying custody transactions from its own customers (see figure 4). The solution provides automated responses back to clients on the FX requests approval via rule-based processing. The chatbot was also deployed to enable instantaneous communication between SES and its client in order to eliminate any market friction. This innovative solution saw many benefits being delivered, including the ability for real-time FX request approvals, real-time cash balance checks to ensure there are sufficient balances for FX execution, automated routing of unapproved FX requests for immediate remediation by the global custodian bank as well as quicker market execution and client pricing.

Figure 4: Real-time processing of FX request via API and rule-based workflows

Source: Deutsche Bank Securities Services

Data analytics and machine learning

Data is fundamentally transforming the way people do business, how the world communicates and how we make decisions. Deutsche Bank is seeing significant changes in the way financial services information is curated and delivered. Our clients are also looking for more efficient ways to acquire insights from the increasing amount of data. To this end, we have developed a Data Analytics platform that ingests securities and cash management data, and organises them for better business decisions by our clients.

In China, SES is working with the bank’s Innovation team who have created an Artificial Intelligent (AI) Agent, named Blue Bot ‘Yi’, with “role-based access rights” that can autonomously navigate through different operating environments to perform operational tasks that would otherwise require different human operators. The launch of this ‘digital worker’ complements our work on AI, ethics and controls in 2019, where we collaborated with Microsoft and a few bank participants, with the guidance of Singapore’s Personal Data Privacy Commission (PDPC) and Monetary Authority of Singapore’s (MAS) data analytics department, to identify how the responsible and ethical use of AI can be operationalised4 .

Data analytics and ML use case 1: Using data to analyse intraday liquidity

Treasurers need visibility into their company’s cash positions globally to optimise their available liquidity, reduce funding costs and maximise return on cash. Deutsche Bank’s SES has partnered with the bank’s Data Labs to develop a data analytics model on the Enterprise Analytics Platform that graphically shows clients’ cash liquidity usage and how this corresponds to Deutsche Bank’s funding provision in the market (see figure 5). As a result, SES is able to provide more detailed liquidity insights at the client level and review its market funding allocations to ensure they are appropriate to cover these needs.

This data transparency enables clients to better understand when in the day their peak liquidity usage occurs, empowering them with the opportunity to modify their cash account funding behaviour and ensure adequate capital is reserved.

Figure 5: Intraday liquidity usage explained through data analytics

Source: Deutsche Bank Securities Services

Data analytics and ML use case 2: – Achieving settlement efficiency through real time dashboards

A settlement efficiency dashboard has also been built to provide Deutsche Bank clients and operations with performance, volume and operating metrics. The analytics platform brings client data together from all aspects of the custodial relationship, providing transparency and insight.

We also leveraged facets of advanced machine learning such as clustering and anomaly detection alongside predictive analytics to mine insights and relate variables to form meaningful information. The capability utilises a big data repository, which contains data related to the holdings and movements of cash and securities in client accounts globally and market data such as those related to financial instruments and FX.

This analytics capability has been used with great success to provide enhanced risk and control views, and to deliver information and trends to our clients’ managers and operations teams to support their market and business engagements with quantitative information. Clients benefit from the insights provided to help them make better-informed decisions, improve on their internal operational efficiencies and enhance their end client’s experience.

Moving forward

Looking ahead, digital techniques such as DLT, API, AI, data analytics and ML will continue to be a key focus for Deutsche Bank to create significant value and better experience for our clients and markets.

Sources

1 See Connecting capital at flow.db.com

2 See https://bit.ly/32VP522 at bot.or.th

3 See DLT and digital asset’s path to smart custody at corporates.db.com

4 See https://bit.ly/2EqUMf5 at db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SECURITIES SERVICES

Automating FX custody processes Automating FX custody processes

Deutsche Bank and BNY Mellon have collaborated on an API-enabled FX custody solution which reduces confirmation times for trades in restricted emerging market currencies

Trust and securities services

Securities services embrace the virtues of virtual Securities services embrace the virtues of virtual

With Covid-19 related restrictions still in place, the summer meeting of the Network Forum (TNF) went virtual for the first time. Deutsche Bank’s flow reports on the biggest talking points to emerge from the event

SECURITIES SERVICES

Capital markets transformation in Asia Capital markets transformation in Asia

Three separate Deutsche Bank Securities Services-hosted webinars looked at the developments that are reshaping the securities services landscapes across Vietnam, Malaysia and Singapore. flow reports on the key takeaways