International investors can’t get enough of China, and Hong Kong Exchanges and Clearing has been at the innovation coalface, facilitating access by upgrading its post-trade systems and using new technologies to accelerate the settlement of securities traded through the Stock Connect links between China and Hong Kong

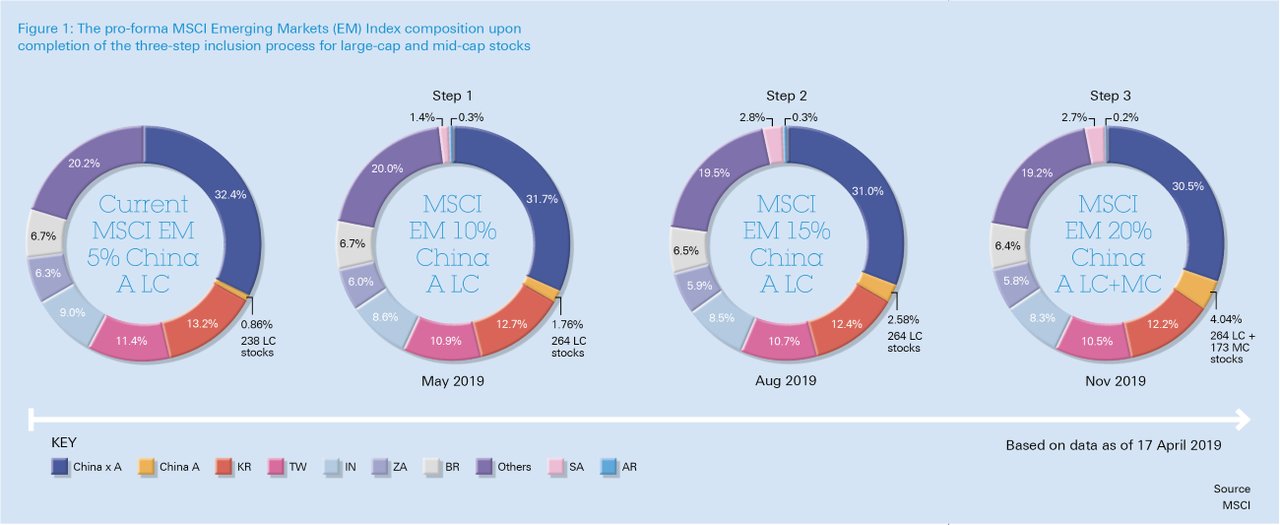

China’s capital markets have never had it so good. With the inclusion of the country’s A-shares in the MSCI indexes1 and Chinese bonds in the Bloomberg Barclays Global Aggregate Bond Index, China’s A-share market is expected to embrace a record high foreign investment in 2019, totalling in a range between US$70bn and US$125bn2 (see Figure 1).

Facts like these, coupled with the ongoing internationalisation of the renminbi (RMB) currency, could not make Charles Li happier. As Chief Executive of Hong Kong Exchanges and Clearing (HKEX), he has made it his mission to facilitate capital flows between Hong Kong and mainland China through the Stock Connect trading links,3 thus connecting global capital with Chinese issuers on the Hong Kong Stock Exchange. Now, given the expected capital inflows, he is keen to push those links towards an even grander vision: connecting China with the world.

His bold three-year plan for HKEX is designed to transform its predominantly equity-based exchange and futures exchange into a global market leader in the Asian time zone.

China-anchored

With a key part of this plan being anchored by China, HKEX is looking to increase the international portfolio diversification of Chinese mainland investors and to facilitate further internationalisation of the domestic capital markets through infrastructures across asset classes such as exchange-traded funds. These aims follow hotly on the heels of its updated listing regime,4 and the expansion of Stock Connect to bring international capital into Chinese companies’ shares within the country and to attract international companies to list in Hong Kong so that Chinese investors can invest in them.

Li’s plan will also see HKEX leveraging the growth of China’s fast-growing bond market5 amid government attempts to boost its currency by allowing its wider use in Belt and Road Initiative countries and by more foreign banks as RMB-clearers.6 “We believe that with China stepping out and meeting the world, we have an opportunity to create a post-trade ecosystem to connect that market with the world,” notes Li.

Perhaps the most important thread of Li’s plan to bring China closer to the globally connected community is technology. With this in mind, HKEX is exploring whether technology can help it to: expand its range of products and services; improve the client experience in trading, clearing and settlement; solve operational challenges and improve efficiency. This exploration has already borne fruit.

With the continued growth of Stock Connect, which is the main reason for MSCI including the China A-share market in its indexes, HKEX is expanding its role and upgrading its systems so that it can cope with the increased flow of cross-border transactions – as the weight of that market in the MSCI indexes7 increases (see Figure 1) – and intermediate further outflows from Chinese investors as well.

Driving these upgrades is HKEX’s self-awareness of its critical function: as central agent it’s about using technology to do things faster and more efficiently, without market participants having to refresh the bells and whistles and ancillary systems. “Our industry is faced with the critical choice of whether or not to refresh and maintain its technology, and whether the exchange could potentially consolidate those investments so that the clients continue to receive the service, but the delivery is actually all shared, consolidated and run by the exchange,” observes Li.

Choosing technology wisely

For HKEX to accomplish these efficiencies through technology, Li believes that it should employ new technology that allows it to make small improvements, instead of making large investments in systems and hiring new staff. “We’re interested in using new technology that helps us to do all these new things that we don’t do today that have revenue potential.”

Such new technologies are those that enable HKEX to improve efficiency and reduce costs. According to Li, HKEX is exploring the application of artificial intelligence (AI) and machine learning technologies in its business. “It’s about using those technologies to do our jobs better and quicker and servicing our members and clients more efficiently.”

US$7.6trn

China A-share market cap

The aggregation, sharing and monetisation of data are also presenting the market with a way of trading where the underlying assets are no longer real assets in companies and commodities, but the real assets are actual data. “There is a role for central market players to organise the industry and provide the most basic common infrastructure for trading and monetising data as a new asset class,” asserts Li.

Other technologies that are popular are those that address fundamental differences in market structure between East and West. Li is convinced that distributed ledger technology (DLT) has the ability to address nuances between the intermediated structures in the West, where there is a “convoluted” web of relationships between the exchange, broker dealers, custodians, and buyers and sellers. “DLT works well on a centrally operated market like an exchange. It can become a big enabler to do things differently, and means we can better connect all key participants, automate the cross-border post-trade process and make the environment a lot cheaper for participants to operate in.”

Upgrades in progress

By advancing its technology capabilities, HKEX is doing three things: upgrading its systems, improving internal productivity to introduce some incremental efficiencies and using new innovations to facilitate market access.

Firstly, the firm is revitalising its post-trade infrastructure across all business processes and systems, including clearing, securities settlement, and collateral management and nominee functions. Setting out HKEX’s technology agenda, Head of Group Strategy James Fok says: “The technology used over the past 20 or 30 years needs a bit of a reboot, so a big element of this change is cultural. It’s about introducing new processes in a multi-phased programme.”

"It’s about using technologies to service our members and clients more efficiently"

The programme, which is called Next Generation Post-Trade, contains multiple phases. In the first phase, HKEX will strengthen and simplify the risk management framework of all the clearing houses on to a single risk-based model. This structural enhancement will improve the safety and integrity of the securities market and place HKEX at the forefront of international best practice for risk management. The first phase also includes Client Connect, a new web-based interface which gives trading and clearing clients direct access to HKEX services and digitises the majority of paper-based services and duplicative processes. “We have taken out around 30,000 manual processes a year and compressed down the number of paper forms from 60 to 43 online or electronic form requests, which means we have removed a lot of risks of error from the system,” explains Fok.

Secondly, HKEX’s Innovation Lab is looking at technology that can help its various businesses introduce newer processes and weed out redundant ones to improve speed, efficiency and productivity in the business. This includes advanced data analytics, AI and machine learning to improve the efficiency and accuracy of data. It is also using AI to pick up the key fields in unstructured corporate actions notifications in order to replace the manual process in corporate actions messaging.

Thirdly, HKEX is using new technologies to innovate externally, improve process efficiency and reduce the risks for international investors who are accessing the Chinese market.

Attracting China inc. to Hong Kong is one of HKEX's key aims

At the innovation coalface with DLT

Using these new technologies, HKEX is running one of the highest-profile blockchain projects in the securities industry to address the differences in market structures between mainland China and international investors and their agents when accessing A-shares through the Stock Connect gateway.

The China A-share market settles on a T+1 basis. Securities are exchanged on trade date, and cash settled on T+1, through the China Securities Depository and Clearing Corporation (CSDC), while many international markets settle securities on T+2. The China Interbank Bond Market settles on a variable settlement basis between the buyer and seller of the bonds, and the settlement cycle can range from T+0 to T+2 through either the CSDC or the Shanghai Clearing House. This creates a misalignment in settlement practices and is the biggest issue facing international investors, who are used to operating on true delivery versus payment of securities in T+2.

Charles Li, Chief Executive, HKEX

The DLT proof of concept aims to resolve operational challenges for these international investors executing Stock Connect trades that settle to a T+0 timetable, getting post-trade processes in shape for faster settlement as well as better buy-in processes and prevention of failed trades. The compressed settlement timetable necessitates a rapid upstream sharing of information prior to settlement to avoid the risk of international investors trading A-shares on Stock Connect, incurring the cost of a buy-in for trades not settling on time.

US$14trn

Stock Connect Northbound net buy as of 28 June 2019

Typically, these international asset managers and their broker, their global custodian and the sub-custodian rely on the T+2 cycle for time to complete a sequence of reconciliations in which the price of the trade and the fees and commissions are agreed sequentially and bilaterally, and the cash and securities are put in position for settlement. This would necessitate compressing two days of work on post-trade allocations and settlement initiations into four hours between 15:00 and 19:00 Hong Kong time when transacting in China to meet the settlement cut-off times. Time zone differences mean that it is very difficult for investors based in Europe or the Americas to perform to that timetable, and there is a compulsory buy-in regime for securities that do not settle on time.

In the absence of a T+2 margin for error, or window to operate in when an investor or broker in the US provides a settlement instruction after matching a trade, Fok says HKEX is working with participants in the chain, including Deutsche Bank as sub-custodian, “to apply blockchain technology to tie the settlement instruction to the trade and allow for an automated step-by-step functioning of the post-trade processes to take place, without someone having to give fresh instruction once a trade has been matched”.

Network effect

The blockchain-powered post-trade processing network will operate upstream into the Hong Kong central securities depository (CSD), enabling all parties to get the information they need to process in parallel so that the transaction can reach the CSD for settlement finality quicker. Such a transformation of the post-trade workflow is achieved by introducing a private permissioned network based on DLT.

The DLT network will be deployed in the Stock Connect settlement process and allow all participants linked to it – the asset manager, global custodian, broker, clearing participant and sub-custodian – to access the necessary information (for example, the balances of cash and stock in their accounts and settlement details) and status of the trade in near real-time simultaneously, so they can complete their share of the process in time to settle. “The HKEX DLT initiative will change today’s sequential processes to being concurrent, reducing certain costs and creating new potential,” notes Anand Rengarajan, Head of Securities Services, Asia Pacific at Deutsche Bank. “This will evolve Hong Kong’s cross-border capital market services into a new paradigm that can also change the industry structure. We will be at the forefront of this new future with HKEX and our key clients.”

HKEX data centre: the hub of the real assets in companies and commodities

Given that it is a private network, it only allows participants to access the information they need to see. For example, the global custodian sees the settlement details, but does not see the commission paid to the broker. The prototype demonstrates near real-time synchronisation of post-trade status between asset managers, brokers, custodians and the Hong Kong Securities Clearing Company Limited, the HKEX clearing house. This enables these financial institutions to complete their compliance checking and internal processes simultaneously, instead of the chain having to wait for one link to complete its part of the settlement process, before passing the information along to the next link.

"We will be at the forefront of this new future with HKEX and our key clients"

HKEX is also looking to shorten the initial public offering (IPO) settlement cycle – the five-day period between the end of an IPO and the start of trading – by digitising the process of pricing and trading shares so that banks and brokers can grant retail investors credit if they choose to subscribe for those IPOs. In the case of any oversubscription, that cash can be immediately returned to those investors. “This effectively takes out the process of retail investors writing cheques or sending deposits ahead of time, and puts in its place a solution that will allow us to settle on a similar timeline to other major markets,” notes Fok.

HKEX sees in the Year of the Pig with the Lunar New Year's First Day of Trading

Relationships that matter

In the meantime, the concept of custody via Hong Kong using a nominee structure and HKEX’s post-trade infrastructure to hold securities on behalf of the international investor in the Chinese CSDC is enabling international investors to access the Chinese market. “Given China’s unique T+0 settlement timeframe A-share market is a no-fail market, we work with partners such as Deutsche Bank to put in place the pre-trade controls to enable us to meet Chinese requirements,” explains Fok.

This also leverages existing solid relationships with the Securities and Futures Commission of Hong Kong and the China Securities Regulatory Commission, which Fok says takes a proactive approach to identifying problems that need to be solved, and coming up with solutions. It is relationships like these that will guide HKEX’s plan to be more globally relevant and to connect China with the world using new technologies.

With these relationships in mind, Fok confidently concludes: “We feel we are well placed to advise Chinese policymakers and regulators – like we did with Stock Connect – on what international investors need in order to participate in the Chinese market and to play an advocacy role on behalf of the international investment community, which is looking for even more efficient ways of tapping into the Chinese market.”

The Deutsche Bank view

Through various initiatives and a collaborative approach with industry partners, HKEX is enabling opportunities for growth in the capital markets. Deutsche Bank is proud to be associated with this important market infrastructure, given its strong role in championing innovation

Michaela Ludbrook

Global Head of Securities Services

Deutsche Bank

Sources

1 See https://bit.ly/2YxAjJx at hkex.com

2 See https://bit.ly/2T1iEsF at xinhuanet.com/english

3 See https://bit.ly/2ZhTs3m at hkexgroup.com

4 See https://bit.ly/2OoMJmX at hkexgroup.com

5 See https://bit.ly/2YgKAyk at chinadaily.com.cn

6 See https://bit.ly/2LONJPn at brinknews.com

7 See https://bit.ly/2OtqjBg at chinadaily.com.cn

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SECURITIES SERVICES {icon-book}

Planning for the people Planning for the people

India´s government aims to make the country a US$5trn economy by 2024. Janet Du Chenne talks to Sundeep Sikka about Nippon Life India Asset Management’s plans to harness the growth story through long-term savings plans and leveraging education and new technologies

SECURITIES SERVICES

Asia’s growth: pause or detour? Asia’s growth: pause or detour?

The second event in the series “The future of Asset Servicing Leadership”, organised by The Asset magazine in collaboration with Deutsche Bank, considered whether growth in Asia is experiencing a pause or a detour

SECURITIES SERVICES {icon-book}

Connecting capital Connecting capital

International investors can’t get enough of China, and Hong Kong Exchanges and Clearing has been at the innovation coalface, facilitating access by upgrading its post-trade systems and using new technologies to accelerate the settlement of securities